Document 13499819

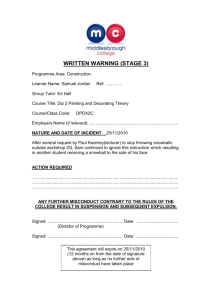

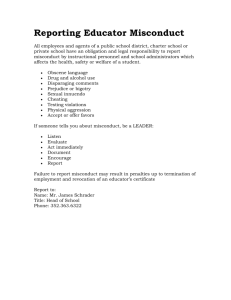

advertisement