Does the Tail Wag the Dog?

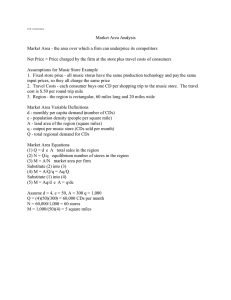

advertisement