Document 13493543

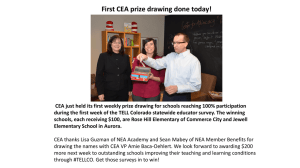

advertisement