CONSUMER AWARENESS AND INTEREST IN CAMELINA OIL

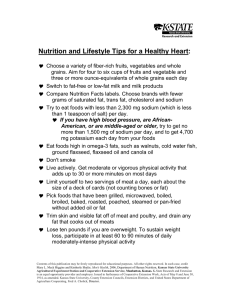

advertisement