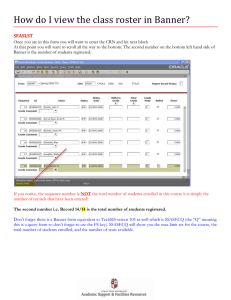

Banner Finance Chart of Accounts Training Workbook HIGHER EDUCATION

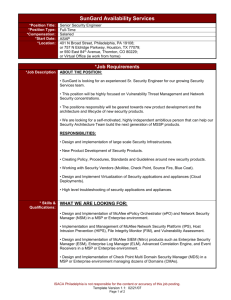

advertisement