K&L Gates Allocating Risk in Today’s Marketplace

advertisement

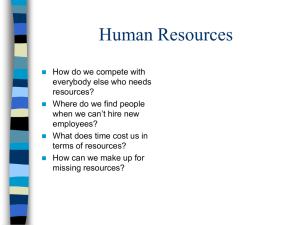

K&L Gates Allocating Risk in Today’s Marketplace Session E14 December 13, 2007 1 Anchorage London Beijing Hong Kong Seattle Portland Spokane/ Coeur d’Alene Newark Pittsburgh Washington, D.C. Taipei San Francisco Palo Alto Los Angeles Boston New York Harrisburg Orange County Dallas Miami 2 Berlin MODERATOR Brian R. Davidson – K&L Gates Partner, with K&L Gates since 1994. Represents domestic and foreign corporations in international (ICC, UNCITRAL and AD HOC) arbitration proceedings, and federal and state court proceedings. Involved in several multi-million dollar industrial projects, including steel, offshore oil and gas, and power facilities. 4 PANELIST Eileen G. Akerson – KBR, Inc. Joined KBR’s Law Department in 1999; previously a lawyer with Spriggs & Hollingsworth in Washington D.C. Current VP, Legal and Chief Counsel of KBR’s Energy & Chemicals Division. Responsible for managing the legal functions for KBR’s Energy & Chemicals Division. 5 PANELIST Bart Turner – KBR, Inc. Director of KBR’s Legal Department. Manages KBR’s lawyers located in the Americas offices and provides counsel to KBR on a variety of legal issues related to KBR’s activities around the globe. Involved in the development, acquisition and execution of several multi-billion dollar international projects for the development of oil and gas facilities. Counseled KBR on a variety of multi-million dollar claims. 6 PANELIST R. Suzen Shaw – Microsoft Corporation Senior Risk Manager for Microsoft’s Worldwide Operations. This position places her on the core team for every construction project undertaken globally by Microsoft. 25 years experience in the risk management and commercial insurance industry, including risk consulting, brokerage, safety and loss control, underwriting, claims adjusting and operational risk management. 7 OVERVIEW This session focuses on two primary questions: 1. How have current market forces impacted the construction industry? 2. Given the current market conditions, how can owners and contractors minimize and allocate risk on any given project? 8 THE CONSTRUCTION MARKET Has demand for large scale (nonresidential) construction projects increased over the past decade? Does demand for construction services vary depending upon the industry being analyzed? Data Centers Manufacturing Oil & Gas Power Plants Transportation Other 9 THE CONSTRUCTION MARKET Does demand for construction services vary depending on whether the project is domestic or international? What other variables impact the construction marketplace? Demand for Materials Demand for Labor Contractors Acquisitions and Consolidation 10 ALLOCATION OF RISK Step 1: Owners and contractors identify risk What procedures do owners and contractors use to identify risk? Outline the role of: o sales department o management o in-house lawyers o outside lawyers o risk managers o others 11 ALLOCATION OF RISK Step 2: Once risks are identified, how do contractors and owners minimize and allocate risk given current marketplace conditions? Bidding / Contracting Owners - maximize the number of bidders. Contractors - decide whether or not to bid. Lenders Requirements. 12 ALLOCATION OF RISK Securities for Payment Letters of Credit Guarantees Credit Analysis / Payment Risks Up-front Payments 13 ALLOCATION OF RISK Contract Structures Lump Sum Contract Cost Plus Incentives Open-book Estimates Reimbursable EPC Conversion from lump sum to reimbursable pricing structures Price escalations clauses Mixed hybrid lump sum / reimbursable 14 ALLOCATION OF RISK Contract Provisions Limitation of Liability Clauses Termination for Convenience and Default Clauses Liquidated Damages Waiver of Consequential Damages Indemnity Clauses Different Site Condition Clause Change Orders 15 ALLOCATION OF RISK Insurance/Bonding How can owners and contractors use third-parties to protect themselves against potential future risks? Bonds o Bid Bonds o Payment Bonds o Performance Bonds 16 ALLOCATION OF RISK Insurance Products o o o o o o o o CGL Builder’s Risk Property Professional Liability Default (“Subguard”) Efficacy Force Majeure Professional Protective Letters of Credit in Lieu of Bonds / Retainage 17 ALLOCATION OF RISK Owner / Contractor Relationships “Partnering” Concepts Public Private Partnerships (P3s) Alliancing Agreements (Australia) 18 LESSONS LEARNED Market trend favors contractors for large non-residential construction projects. Contractors should take advantage of market forces and carefully review all options to allocate risk to owner or third-parties. 19 K&L Gates Allocating Risk in Today’s Marketplace Session E14 December 13, 2007 20