Formula Sheets: FINA 5500 Valuation Model

advertisement

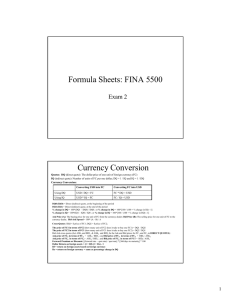

Formula Sheets: FINA 5500 Exam 1 Valuation Model Valuation model for MNC: m E CFj , t E ER j , t n j 1 Value = t =1 1 k t where E (CFj,t ) = expected cash flows denominated in currency j to be received by the U S parentt att th U.S. the end d off period i dt E (ERj,t ) = expected exchange rate at which currency j can be converted to dollars at the end of period t k = the weighted average cost of capital of the U.S. parent company 1 Opportunity Cost Analysis • The opportunity cost of product X (in terms of product Y) = How many units of product Y does it take to make one unit of product X = number of units of pproduct Y pper one unit of product X = cost of Y / cost of X BOP Accounting ACCOUNT CREDITS DEBITS Merchandise: A. Export of Goods B. Import of Goods Service: C. Export of Service D. Import of Service Net Investment Income: Unilateral Transfers: Capital Flows: E. Income from Foreign Investments G. Transfers to US from Overseas I. Increase in Foreign Investments in US / Decrease in US investments overseas Official Reserve: K. Decrease in Official Holding of FX & Gold F. Income paid to Foreign Investors H. Transfers to Overseas from US J. Decrease in Foreign Investments in US / Increase in US investments overseas L. Increase in Official Holding of FX & Gold 2 BOP Accounting (contd.) Balance of Trade (BOT) = (A - B) + (C-D) Current Account Balance = (A-B) + (C-D) + (E-F) + (G-H) Capital Account Balance = (I-J) Official Reserve Balance = (K-L) Current Account + Capital Account + Official Reserve = 0 Currency Conversion Quotes: DQ (direct quote): The dollar price of one unit of foreign currency (FC) IQ (indirect quote): Number of units of FC per one dollar; DQ = 1 / IQ and IQ = 1 / DQ Currency Conversion: Converting USD into FC Converting FC into USD Using DQ USD / DQ = FC FC * DQ = USD Using IQ USD * IQ = FC FC / IQ = USD DQ0 (IQO) = Direct (indirect) quote, at the beginning of the period DQ1 (IQ1) = Direct (indirect) quote, at the end of the period % change in DQ = 100*(DQ1 – DQ0) / DQ0 ; or % change in DQ = 100*[100 / (100 + % change in IQ) - 1] % change in IQ = 100*(IQ1 – IQ0) / IQ0 ; or % change in IQ = 100*[100 / (100 + % change in DQ) - 1] Ask Price (A): The buying price for one unit of FC from the currency dealer; Bid Price (B): The selling price for one unit of FC to the currency dealer; Bid-Ask Spread = 100* (A – B) / A Cross-Quotes: DQ1= $ price of FC1; DQ2 = $ price of FC2; The price of FC1 in terms of FC2 (how many unit of FC2 does it take to buy one FC1) = DQ1 / DQ2 The price of FC2 in terms of FC1 (how many unit of FC1 does it take to buy one FC2) = DQ2 / DQ1 Bid-Ask cross quotes (Let ASK1 and BID1 & ASK2 and BID2 be the Ask and Bid prices for FC1 and FC2 in DIRECT QUOTES) : Ask price of FC1 in terms of FC2 = ASK1 / BID2 ; and Bid price of FC1 in terms of FC2 = BID1 / ASK2 Ask price of FC2 in terms of FC1= ASK2 / BID1 ; and Bid price of FC2 in terms of FC1 = BID2 / ASK1 Forward Premium or Discount: [(forward rate – spot rate) / spot rate] * [360/days to maturity] * 100 Dollar Return on foreign assets = (1 + Rf) (1 + Rx) - 1 Rf = return on foreign assets based on foreign currency Rx = return on foreign currency = same as percentage change in DQ 3