Eastern Michigan University Board of Regents Quarter ending December 31, 2014

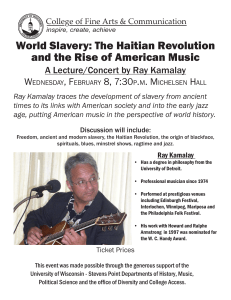

advertisement

Eastern Michigan University Board of Regents Quarter ending December 31, 2014 Investment Performance Analysis -DPHV5HLFKHUW&)$3DUWQHU *DU\:\QLHPNR&)$&RQVXOWDQW 0LFKDHO*DXJKDQ$QDO\VW Table of Contents Page Transition Review 4 Performance Review 6 Context for Capital Market Assumptions 22 NEPC 2015 Observations & Actions 27 Asset Allocation Review 32 Observations & Actions – Detail 38 Appendix 43 2 NEPC UPDATES Fourth Quarter 2014 Highlights of Fourth Quarter Happenings at NEPC NEPC Research Recent/Upcoming Events Recent White Papers Posted x Improving Asset Allocation with Factor Analysis (November 2014) - Mark Cintolo, CAIA, Research Consultant 2015 Market Outlook Webinar—January 22, 2015 at 3:00 PM EST x NEPC’s 20th Annual Client Conference—May 19-20, 2015 in Boston at the Boston Convention & Exhibition Center (BCEC) x x x Improving Governance Under an OCIO Structure (October 2014) - Steven Charlton, CFA, Director of Consulting Services NEPC Gives Back A team of NEPC employees participated in Movember once again this year. Movember is a global men’s health charity requiring each ‘Mo Bro’ to sport a well-groomed mustache during the entire month of November to raise funds and awareness for men’s prostate cancer, testicular cancer, and mental health. The team raised about $20,000 this year and ranked #49 nationally! Additionally, NEPC employees participated in Lee National Denim Day once again this year and raised $1,745. Lee National Denim Day is a fundraiser that takes place in October and was created by Lee Jeans to support the American Cancer Society’s breast cancer programs. NEPC 2014 Defined Contribution Plan & Fee Survey: What Plan Sponsors Are Doing Now (October 2014) - Ross Bremen, CFA, Partner; Dan Beaton, Senior Analyst Professional Staff Updates x New Partner: Sean Ruhmann, Partner, Director of Real Assets Research x New Principals: Jeffrey Mitchell, CFA, CAIA, Principal, Senior Consultant; Terri Sacramone, SPHR, Principal, Senior Human Resources Manager; and Michael Sullivan, Principal, Senior Consultant x We are also please to announch that Daniel Hennessy has joined NEPC as a Senior Consultant located in our Redwood City, CA office. Daniel will be focusing on Ta-Hartley and Public Funds in the West. NEPC Client Recognitions Several of NEPC’s clients were recognized by CIO Magazine recently. First, the October 2014 issue of CIO Magazine ranked the Power 100 CIOs, which included Tim Barre, CIO of Texas Tech University System (#59), and Don Pierce, CIO of San Bernardino County Employees’ Retirement Association (#61). Next, several NEPC clients were nominated for the CIO 2014 Industry Innovation Awards. Additionally, NEPC’s client SBCERA was nominated for an Investor Intelligence Award in ‘Portfolio Design’. 3 Transition Review 4 6XPPDU\RI$VVHW7UDQVLWLRQ ,QWHUPHGLDWH7HUP ,QYHVWPHQW0DQDJHUV )XQGHG September 2014 $SSURYDORI,36DQG /RQJ7HUP$VVHW $OORFDWLRQ October 2014 ,QLWLDO6XEVFULSWLRQVWR QHZO\DSSURYHG PDQDJHUVLQWKH/RQJ 7HUP,QYHVWPHQW3RRO September November 2014 )LUVW4XDUWHU PDUNVWKHILUVWIXOO TXDUWHURI SHUIRUPDQFH 5 Performance Review 6 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG3HUIRUPDQFH6XPPDU\ 0DUNHW9DOXH 0R 5DQN <U 5DQN <UV 5DQN <UV 5DQN B 7RWDO&RPSRVLWH $OORFDWLRQ,QGH[ ;;;;; 0DUNHW9DOXH 0R 5DQN <U 5DQN <UV 5DQN <UV 5DQN B /RQJ7HUP,QYHVWPHQW3RRO /RQJ7HUP$OORFDWLRQ,QGH[ /RQJ7HUP%DODQFHG,QGH[ ;;;;; <HDUWR'DWH $QO]G 5HW 5DQN $QO]G 6KDUSH 5DQN 5DQN 6WG'HY 5DWLR 6RUWLQR 5DWLR 5DQN 5) B 7RWDO&RPSRVLWH $OORFDWLRQ,QGH[ Composite Performance - The portfolio returned 0.2% for the 4th Quarter. The portfolio lagged the Allocation Index by 40 basis points. Fourth Quarter Transition - Performance of prior managers and partial month performance of newly funded managers is reflected at the composite level. Recommendations / Recent Decisions - The newly approved Asset Allocation and manager lineup was implemented during the 4th Quarter. - The Long Term Investment Pool transition is complete. 'HFHPEHU 7 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV /RQJ7HUP,QYHVWPHQW3RRO$VVHW$OORFDWLRQYV3ROLF\7DUJHWV $VVHW$OORFDWLRQYV7DUJHW &XUUHQW 3ROLF\ &XUUHQW 'LIIHUHQFH 3ROLF\5DQJH :LWKLQ 5DQJH <HV <HV <HV <HV <HV <HV <HV <HV <HV <HV <HV B 'RPHVWLF(TXLW\ ,QWHUQDWLRQDO(TXLW\ (PHUJLQJ0DUNHWV(TXLW\ *OREDO(TXLW\ &RUH)L[HG,QFRPH 0XOWLVHFWRU)L[HG,QFRPH (PHUJLQJ0DUNHW'HEW *$$5LVN3DULW\ +HGJH)XQGV $EVROXWH5HWXUQ 5HDO$VVHWV 7RWDO ;;;;; 'LIIHUHQFHEHWZHHQ3ROLF\DQG&XUUHQW$OORFDWLRQ 'HFHPEHU 8 'XH'LOLJHQFH0RQLWRU Investment Options Artisan Partners Limited Partnership Artisan Global Opportunities Manager Changes/ Announcements (Recent Quarter) &KDQJHVWR*URZWK(TXLW\ 3ODWIRUP NEPC Due Diligence Committee Recommendations &XUUHQW6WDWXV'RHV1RW&KDQJH NEPC Due Diligence Status Key No Action ,QIRUPDWLRQDO LWHPV KDYH VXUIDFHG QR DFWLRQ LV UHFRPPHQGHG Watch ,VVXHVKDYHVXUIDFHGWREHFRQFHUQHGRYHUPDQDJHUFDQSDUWLFLSDWHLQIXWXUHVHDUFKHVEXWFXUUHQWDQGSURVSHFWLYH FOLHQWVPXVWEHPDGHDZDUHRIWKHLVVXHV Hold 6HULRXVLVVXHVKDYHVXUIDFHGWREHFRQFHUQHGRYHUPDQDJHUFDQQRWEHLQIXWXUHVHDUFKHVXQOHVVDFOLHQWVSHFLILFDOO\ UHTXHVWVEXWFXUUHQWDQGSURVSHFWLYHFOLHQWVPXVWEHPDGHDZDUHRIWKHLVVXHV Client Review Terminate 9HU\VHULRXVLVVXHVKDYHVXUIDFHGZLWKDPDQDJHUPDQDJHUFDQQRWEHLQIXWXUHVHDUFKHVXQOHVVDFOLHQWVSHFLILFDOO\ UHTXHVWV&XUUHQWFOLHQWVPXVWEHDGYLVHGWRUHYLHZWKHPDQDJHU :HKDYHORVWDOOFRQILGHQFHLQWKHSURGXFWPDQDJHUZRXOGQRWEHUHFRPPHQGHGIRUVHDUFKHVDQGFOLHQWVZRXOGEH GLVFRXUDJHGIURPXVLQJ7KHPDQDJHUFDQQRWEHLQIXWXUHVHDUFKHVXQOHVVDFOLHQWVSHFLILFDOO\UHTXHVWV&XUUHQWFOLHQWV PXVWEHDGYLVHGWRUHSODFHWKHPDQDJHU 9 'XH'LOLJHQFH8SGDWHV Investment Option Artisan Partners Limited Partnership Artisan Global Opportunities Commentary NEPC Status $UWLVDQDQQRXQFHGRQ6HSWHPEHUWKDW$QG\6WHSKHQVZLOOQRORQJHUKDYHKLV QDPHGLUHFWO\WLHGWRDQ\FDSLWDOLQYHVWHGLQWKH*OREDO2SSRUWXQLWLHVIXQG+LVIXQFWLRQ JRLQJIRUZDUGZLOOEHDFRPELQDWLRQRIWKHIROORZLQJUROHV0DQDJLQJ'LUHFWRU$GYLVRU\ DQG5HVHDUFK+HZLOOUHPDLQDFWLYHLQWKHLGHQWLILFDWLRQRIVHFXODUWKHPHVDQGLQWKH UHVHDUFKSURFHVVZLWKWKHDQDO\VWV1(3&UHFRPPHQGV1R$FWLRQRQWKLVQHZV Preferred NEPC Due Diligence Rating Key Preferred $ KLJK FRQYLFWLRQ LQYHVWPHQW SURGXFW 3URGXFW KDV D FOHDU DQG HFRQRPLFDOO\JURXQGHG LQYHVWPHQW WKHVLV DQG LV PDQDJHG E\ DQ LQYHVWPHQW WHDP WKDW LV VXIILFLHQWO\ UHVRXUFHG DQG LQFHQWHG WR H[HFXWH RQ WKH WKHVLV Preferred Conditional $VWUDWHJ\WKDWPHHWVWKHGHILQLWLRQRI3UHIHUUHGDVGHVFULEHGDERYHEXWPD\RQO\EHVXLWDEOHIRUFHUWDLQFOLHQWVGXHWR XQLTXHFKDUDFWHULVWLFVRIWKHVWUDWHJ\HJKLJKHUULVNDWWULEXWHVVXFKDVFRQFHQWUDWLRQWUDQVSDUHQF\HWF Neutral $VDWLVIDFWRU\LQYHVWPHQWSURGXFW1RPDMRUIODZVEXWPD\EHODFNLQJDFRPSHOOLQJLQYHVWPHQWWKHVLVRU1(3&¶V FRQYLFWLRQUHJDUGLQJWKHLQYHVWPHQWWHDP¶VDELOLW\WRH[HFXWHRQWKHWKHVLVPD\EHOHVVWKDQWKDWRI3UHIHUUHGSURGXFWV Not Recommended Not Rated 6HULRXVLVVXHVKDYHEHHQLGHQWLILHGZLWKDQLQYHVWPHQWPDQDJHURUSURGXFW7KLVUDWLQJLVVLPLODUWRWKH&OLHQW5HYLHZRU 7HUPLQDWHUDWLQJIRUFOLHQWRZQHGSURGXFWV 'XHGLOLJHQFHKDVQRWEHHQFRPSOHWHGRQWKHSURGXFWRUPDQDJHU 10 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG$VVHW$OORFDWLRQ+LVWRU\ 'HFHPEHU 11 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG$VVHW*URZWK6XPPDU\ /DVW7KUHH 0RQWKV 2QH<HDU 7KUHH<HDUV B %HJLQQLQJ0DUNHW9DOXH :LWKGUDZDOV &RQWULEXWLRQV 1HW&DVK)ORZ 1HW,QYHVWPHQW&KDQJH (QGLQJ0DUNHW9DOXH B 'HFHPEHU 12 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG3HUIRUPDQFH1HWRI)HHV 0DUNHW9DOXH 0R )LVFDO <7' <U <UV <UV 5HWXUQ 6LQFH $SU $SU $SU $SU $SU $SU $SU $SU 1RY 1RY 1RY 1RY $SU $SU $SU $SU 2FW 2FW 2FW 2FW B 7RWDO&RPSRVLWH $OORFDWLRQ,QGH[ 6KRUW7HUP,QYHVWPHQW3RRO 'D\7%LOOV 'UH\IXV,QVWLWXWLRQDO3UHIHUUHG 'D\7%LOOV 9DQJXDUG3ULPH00.7,QVW 'D\7%LOOV 1RUWKHUQ,QVW*RYW6HOHFW00.7 'D\7%LOOV %DQNRI$QQ$UERU7UXVW&DVK 'D\7%LOOV ,QWHUPHGLDWH7HUP,QYHVWPHQW3RRO ,QWHUPHGLDWH7HUP$OORFDWLRQ,QGH[ ,QWHUPHGLDWH7HUP%DODQFHG,QGH[ %RI$0HUULOO/\QFK*RY<UV %DLUG&RUH%RQG %DUFOD\V$JJUHJDWH 'RXEOH/LQH/RZ'XUDWLRQ %RI$0HUULOO/\QFK867UHDVXULHV<UV ůůŽĐĂƚŝŽŶ/ŶĚĞdž͗hƐĞĚƚŽŵĞĂƐƵƌĞƚŚĞǀĂůƵĞĂĚĚĨƌŽŵĂĐƚŝǀĞŵĂŶĂŐĞŵĞŶƚ͘ĂůĐƵůĂƚĞĚĂƐƚŚĞĂƐƐĞƚǁĞŝŐŚƚĨƌŽŵƚŚĞƉƌŝŽƌŵŽŶƚŚĞŶĚŵƵůŝƚŝƉůŝĞĚďLJƚŚĞƐƉĞĐŝĨŝĞĚŵĂƌŬĞƚŝŶĚĞdž͘ /ŶƚĞƌŵĞĚŝĂƚĞdĞƌŵĂůĂŶĐĞĚ/ŶĚĞdžĐŽŵƉƌŝƐĞĚŽĨϱϬ͘ϬйĂƌĐůĂLJƐ/ŶƚĞƌŵĞĚŝĂƚĞh͘^͘'sͬZ/ŶĚĞdžĂŶĚϱϬ͘ϬйŽĨD>ϭͲϯzĞĂƌdƌĞĂƐƵƌLJ/ŶĚĞdž 'HFHPEHU 13 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG3HUIRUPDQFH1HWRI)HHV 0DUNHW9DOXH RI 3RUWIROLR 3ROLF\ 0R )LVFDO <7' <U <UV <UV 5HWXUQ 6LQFH $SU $SU $SU -DQ -DQ 'HF 'HF 'HF 'HF 2FW 2FW 'HF 'HF 'HF 'HF -DQ -DQ 2FW 2FW 2FW 2FW 'HF 'HF 1RY 1RY $SU $SU B /RQJ7HUP,QYHVWPHQW3RRO /RQJ7HUP$OORFDWLRQ,QGH[ /RQJ7HUP%DODQFHG,QGH[ 7RWDO(TXLW\ 06&,$&:, 66J$5XVVHOO,QGH[(7) 5XVVHOO &RSSHU5RFN,QWHUQDWLRQDO6PDOO&DS 06&,($)(6PDOO&DS $FDGLDQ(PHUJLQJ0DUNHWV(TXLW\ 06&,(PHUJLQJ0DUNHWV $UWLVDQ*OREDO2SSRUWXQLWLHV 06&,$&:, +H[DYHVW*( 06&,$&:, 7RWDO)L[HG %DUFOD\V$JJUHJDWH )UDQNOLQ7HPSOHWRQ*OREDO0XOWL6HFWRU3OXV %DUFOD\V0XOWLYHUVH %ODFN5RFN6,2 %DUFOD\V$JJUHJDWH %DLUG&RUH%RQG %DUFOD\V$JJUHJDWH $VKPRUH(0%OHQGHG'HEW6WUDWHJ\ -30(0%,*'-30(/0,-30*%,(0*' 7UHDVXU\6WULSV %DUFOD\V867UHDVXU\/RQJ7586' 'HFHPEHU 14 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG3HUIRUPDQFH1HWRI)HHV 0DUNHW9DOXH RI 3RUWIROLR 3ROLF\ 0R )LVFDO <7' <U <UV <UV 5HWXUQ 6LQFH 'HF 'HF 'HF 'HF 'HF 'HF 'HF 'HF 'HF 'HF 'HF 'HF 'HF B *$$5LVN3DULW\ $45*53(/ 06&,:RUOG*URVV&,7,:*%, 6WDQGDUG/LIH*$56 06&,:RUOG*URVV&,7,:*%, 5HDO$VVHWV 3,0&2$OO$VVHW 3,0&2$OO$VVHW,QGH[ +HGJH)XQGV 3HUPDO)L[HG,QFRPH+ROGLQJV +)5,)XQGRI)XQGV&RPSRVLWH,QGH[ 3ULVPD6SHFWUXP)XQG/WG +)5,)XQGRI)XQGV&RPSRVLWH,QGH[ ;;;;; 'HFHPEHU 15 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV /RQJ7HUP,QYHVWPHQW3RRO5LVN5HWXUQ <HDUV(QGLQJ'HFHPEHU $QO]G6WG $QO]G5HW 5DQN 5DQN 'HY 6KDUSH 5DWLR 5DQN <HDUV(QGLQJ'HFHPEHU $QO]G6WG $QO]G5HW 5DQN 5DQN 'HY B /RQJ7HUP,QYHVWPHQW3RRO /RQJ7HUP$OORFDWLRQ,QGH[ /RQJ7HUP%DODQFHG,QGH[ 6KDUSH 5DWLR 5DQN B /RQJ7HUP,QYHVWPHQW3RRO /RQJ7HUP$OORFDWLRQ,QGH[ /RQJ7HUP%DODQFHG,QGH[ 'HFHPEHU 16 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV /RQJ7HUP,QYHVWPHQW3RRO5HWXUQ6XPPDU\YV3HHU8QLYHUVH 'HFHPEHU 17 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV /RQJ7HUP,QYHVWPHQW3RRO5HWXUQ6XPPDU\YV3HHU8QLYHUVH 'HFHPEHU 18 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV /RQJ7HUP,QYHVWPHQW3RRO 7RWDO(TXLW\ 7RWDO)L[HG *$$5LVN3DULW\ 5HDO$VVHWV +HGJH)XQGV 7RWDO $WWULEXWLRQ6XPPDU\ 0RQWKV(QGLQJ'HFHPEHU :WG :WG,QGH[ ([FHVV 6HOHFWLRQ $OORFDWLRQ ,QWHUDFWLRQ $FWXDO 5HWXUQ 5HWXUQ (IIHFW (IIHFW (IIHFWV 5HWXUQ 7RWDO (IIHFWV 1RWH)XQGDWWULEXWLRQLVDVWDWLFUHWXUQEDVHGRQFDOFXODWLRQDQGWKH UHVXOWVUHIOHFWWKHFRPSRVLWHVVKRZQ$VDUHVXOWWKHWRWDOUHWXUQVVKRZQ PD\YDU\IURPWKHFDOFXODWHGUHWXUQVVKRZQRQWKHSHUIRUPDQFHVXPPDU\ 'HFHPEHU 19 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG$VVHW*URZWK6XPPDU\E\0DQDJHU 4XDUWHU(QGLQJ'HFHPEHU %HJLQQLQJ 0DUNHW9DOXH :LWKGUDZDOV &RQWULEXWLRQV 1HW&DVK)ORZ 1HW,QYHVWPHQW &KDQJH (QGLQJ 0DUNHW9DOXH B $FDGLDQ(PHUJLQJ0DUNHWV(TXLW\ $45*53(/ $UWLVDQ*OREDO2SSRUWXQLWLHV $VKPRUH(0%OHQGHG'HEW6WUDWHJ\ %DLUG&RUH%RQG %DLUG&RUH%RQG 'RXEOH/LQH/RZ'XUDWLRQ 'UH\IXV,QVWLWXWLRQDO3UHIHUUHG )UDQNOLQ7HPSOHWRQ*OREDO0XOWL6HFWRU3OXV %DQNRI$QQ$UERU7UXVW&DVK %ODFN5RFN6,2 &RSSHU5RFN,QWHUQDWLRQDO6PDOO&DS +H[DYHVW*( 1RUWKHUQ,QVW*RYW6HOHFW00.7 3HUPDO)L[HG,QFRPH+ROGLQJV 3,0&2$OO$VVHW 3ULVPD6SHFWUXP)XQG/WG 66J$5XVVHOO,QGH[(7) 6WDQGDUG/LIH*$56 7UHDVXU\6WULSV 9DQJXDUG3ULPH00.7,QVW 'HFHPEHU 20 (DVWHUQ0LFKLJDQ8QLYHUVLW\%RDUGRI5HJHQWV 7RWDO)XQG$VVHW*URZWK6XPPDU\E\0DQDJHU 4XDUWHU(QGLQJ'HFHPEHU %HJLQQLQJ 0DUNHW9DOXH :LWKGUDZDOV &RQWULEXWLRQV 1HW&DVK)ORZ 1HW,QYHVWPHQW &KDQJH (QGLQJ 0DUNHW9DOXH =7HUPLQDWHG-30RUJDQ&RUH%RQG =7HUPLQDWHG/RRPLV6D\OHV%RQG)XQG =7HUPLQDWHG3,0&27RWDO5HWXUQ =7HUPLQDWHG9DQJXDUG6&,QGH[6LJQDO =7HUPLQDWHG:HVWHUQ$VVHW,QIODWLRQ3URWHFWHG,QGH[ B =7HUPLQDWHG9DQJXDUG'HYHORSHG0NWV,QGH[ =7HUPLQDWHG9DQJXDUG,QVWLWXWLRQDO,QGH[ 7RWDO ;;;;; 'HFHPEHU 21 Context for Capital Market Assumptions 22 ([WUHPH2XWSHUIRUPDQFH6LQFH&ULVLV8QGHUVWDQG/RQJ7HUP,PSOLFDWLRQV • Returns have been exceptional since the global financial crisis – 5HVXOWVGUDPDWLFDOO\RXWSDFHGH[SHFWDWLRQVGXULQJDSHULRGRIHOHYDWHGXQFHUWDLQW\ – 9RODWLOLW\VSLNHGDWWLPHVEXWRYHUDOOH[SHULHQFHZHOOEHORZH[SHFWDWLRQV • Low realized volatility fuels shortsighted view for long-term investors – %HQHILWVRIGLYHUVLILFDWLRQDUHTXHVWLRQHGEXWVKRXOGEHDFRUQHUVWRQHRIVXFFHVV • NEPC’s capital market forecasts cover a 5-7 year horizon which is unlikely to look like most recent trailing periods – (QGSRLQWVHQVLWLYLW\LVYHU\SURQRXQFHG – /DVWWKUHH\HDUV¶UHVXOWVXQOLNHO\WRFRQWLQXHIRUWKHQH[W\HDUV • Easy monetary policy supports near-term returns beyond what fundamentals may otherwise indicate – (XURSHDQG-DSDQPD\SURYLGHIXUWKHUVWLPXOXVEXWHIIHFWLYHQHVVRIH[WHQGHGHDV\ PRQHWDU\SROLF\ZDQHVLQWRGD\¶VORZ\LHOGHQYLURQPHQW – 86VWUHQJWKFDQVSXUFRQVXPSWLRQDQGEXR\JOREDOJURZWKEXWSURILWPDUJLQVPD\ FRPSUHVVLPSDFWLQJYDOXDWLRQV – 7LPLQJLVNH\EXWGLIILFXOWWRSLQSRLQWULVNEDODQFHLVHQFRXUDJHG • 30 year forecasts are lower, challenging feasibility of success – ([WHQVLRQRIHDV\PRQHWDU\SROLF\KDVVW\PLHGH[SHFWDWLRQVRIKLJKHU\LHOGV – /RZORQJWHUPUDWHVGULYHUHWXUQH[SHFWDWLRQVEDFNWRZDUGVOHYHOVVHHQSULRUWR – &RQYHQWLRQDODSSURDFKHVPD\IDOOVKRUWJRLQJIRUZDUG 23 5HPHPEHU+RZ)DU:H¶YH&RPH«%XW+RZ0XFK)XUWKHU&DQ:H*R" Source: Bloomberg and NEPC as of 11/30 • NEPC’s 2009 5-7 assumptions were eye-popping relative to previous years – • 5HVXOWRIVLJQLILFDQWVHOORIILQWKHPLGVWRIWKHJOREDOILQDQFLDOFULVLV Most fundamental forecasting models suggested even higher returns – :HGLVFRXQWHGRULJLQDOH[SHFWDWLRQVKHDYLO\JLYHQWUHPHQGRXVSDWKXQFHUWDLQW\DWWKDWWLPH • – • ,IZHFRXOGKDYHRIIHUHGFHUWDLQW\RIRXUH[SHFWDWLRQVPRVWZRXOGKDYHVHL]HGLW Patient, long-term investors have been rewarded beyond our expectations – – 7UHPHQGRXVO\EHQHILFLDOLQKHDOLQJEDODQFHVKHHWVIXQGHGSRVLWLRQVJUDQWPDNLQJVWDELOLW\HWF %XWLPSRUWDQWWRUHFDOOWKHUDQJHRIRXWFRPHVWKDWKDYHEHHQLQSOD\DORQJWKHZD\ • • 6WLOOLQWKHPLGVWRIGUDZGRZQVIUR]HQFUHGLWPDUNHWVXQSUHFHGHQWHGPRQHWDU\SROLF\ 4XDQWLWDWLYH(DVLQJ(XUR]RQHVWDELOLW\HWF Low yields and core fundamentals suggest muted returns looking forward 24 .H\7KHPHVIRU • Balance potential for short term strength with an acknowledgement of lofty recent returns relative to global growth – 5HDOORFDWHULVNDVDSSURSULDWHZKLOHPDLQWDLQLQJGRZQVLGHSURWHFWLRQDVDFRXQWHUZHLJKW • US equity and credit similarly valued vs. history; near-term favors stocks – &UHGLW VOLPLWHGXSVLGHIURPSRWHQWLDO,*VSUHDGFRPSUHVVLRQRYHUDOOUHGXFWLRQLQOLTXLGLW\ DQGSUROLIHUDWLRQRI(7)VFRQWULEXWHWRDV\PPHWU\ – 5HDOHVWDWHDQGGLUHFWOHQGLQJWKRXJKOHVVOLTXLGFDQEHDVXEVWLWXWHIRUKLJK\LHOG – 0DQDJHSULYDWHFRPPLWPHQWVDQGPDLQWDLQOLTXLGLW\WRH[SORLWGRZQWXUQV • Non-US equity markets have not experienced the same rally as US – 9DOXDWLRQVDQGPRQHWDU\HDVLQJVXSSRUWRYHUZHLJKWGRZQVLGHULVNVSRLQWWRFDXWLRQ • 0XWHGUHWXUQH[SHFWDWLRQVDUHVHQVLWLYHWRELQDU\SROLF\GHFLVLRQVXSVLGHDQGGRZQVLGH – (PHUJLQJJURZWKH[SHFWDWLRQVKDYHFRPSUHVVHG • • &RPPRGLW\GULYHQFRXQWULHVIDFHSUHVVXUHVEXW86VWUHQJWKVXSSRUWVH[SRUWHUV )XQGDPHQWDOVWUHQJWKYVGHYHORSHGOLNHO\WRZLQLQWKHORQJUXQ – %HJOREDOO\GLYHUVLILHGKHGJHGHYHORSHGFXUUHQF\ULVNVDQGGRQ WIOHH(0 • We are one year closer to rate hikes by the Federal Reserve – &XUYHKDVVKLIWHGLQDQWLFLSDWLRQPDNLQJERWKFDVKVKRUWGXUDWLRQDQGORQJERQGVUHODWLYHO\ PRUHDWWUDFWLYHWKDQFRUHGXUDWLRQ – /RQJUDWHVOLNHO\UDQJHERXQGGXHWRG\QDPLFVRIVXSSO\VKULQNLQJGHILFLWVDQGGHPDQG LQFUHDVLQJ/',KHGJHUVJOREDOLQYHVWRUVDJLQJSRSXODWLRQRIVDYHUV – %DUEHOORIORQJWUHDVXULHVDQGFDVKFDQRIIHUVLPLODUFRUHERQGGXUDWLRQYRODWLOLW\\LHOGDQG DKLJKHUVHQVLWLYLW\WRUHFHVVLRQSURWHFWLRQFRXQWHUZHLJKW 25 ,PSRUWDQFHRI5HDO<LHOGVRQ*OREDO0DUNHW5HWXUQV&DXWLRQWRRXU2SWLPLVP • Many investors surprised by market impact of Bernanke’s taper comments in Spring 2013 – – – – 7KH3ULPDU\GULYHUZDVDFKDQJHLQ XQGHUO\LQJJOREDOUHDO\LHOGV 0DUNHWGLVFRXQWUDWHVLQFUHDVHG GULYLQJGRZQSUHVHQWYDOXHV $QGWKHVXUSULVHFKDQJHLQ H[SHFWDWLRQVRIWLJKWHUSROLF\ VSRRNHGVHQWLPHQW 86PDUNHWVWUHQJWKPD\QRWSHUVLVW ZLWKDUHSHDWRFFXUUHQFH Source: Bloomberg as of 11/30 • Real yields in 2014 reversed the normalization trend of 2013 and are a key component of lower 5-7 year expected returns in 2015 – – 86JDYHXSIDUOHVVWKDQRWKHU GHYHORSHGPDUNHWV *UDYLW\RIORZLQWHUHVWUDWHVLQ *HUPDQ\DQG-DSDQPD\GUDZ86 UDWHVORZHU Source: Bloomberg as of 11/30 26 1(3&2EVHUYDWLRQVDQG$FWLRQV 27 1(3&&DSLWDO0DUNHW2EVHUYDWLRQV • Protracted bull market, slow growth, and low interest rates persist – &DXWLRXVRSWLPLVPIRU86HFRQRP\EXWOHQJWKDQGVWUHQJWKRIUDOO\ZDUUDQWVLQTXLU\ – 1HJDWLYHUHDOLQWHUHVWUDWHVKDYHVXSSRUWHGHOHYDWHGYDOXDWLRQVDQGORZYRODWLOLW\ – ,QYHVWRUFRPSODFHQF\FRXSOHGZLWKORZHUOLTXLGLW\PD\OHDYHPDUNHWPRUHYXOQHUDEOH • Global monetary policies and capital markets continue to diverge – 7KH86VXFFHVVIXOO\QDYLJDWHGWKHHQGRITXDQWLWDWLYHHDVLQJLQZKLOH(XURSH SRQGHUHGDQG-DSDQSXUVXHGIXUWKHUDJJUHVVLYHPRQHWDU\SROLF\ – 5HJLRQDOHTXLW\PDUNHWYDOXDWLRQGLYHUJHQFHJUHZDV863(UDWLRVH[SDQGHG • The US economy shows strength relative to other developed markets – ,PSURYLQJODERUPDUNHWVLQFUHDVLQJFRQILGHQFHDQGH[SHFWHGULVHLQLQWHUHVWUDWHVDUH VXSSRUWLYHRIDVWURQJHUGROODUZKLFKKDVEHHQDKHDGZLQGIRUIRUHLJQH[SRVXUHV – 0HDQLQJIXOVWUXFWXUDOUHIRUPDQGFRQWLQXHGDJJUHVVLYHPRQHWDU\SROLF\DUHUHTXLUHGLQ (XURSH-DSDQWRSURSHODVVHWVKLJKHU • Fed rate hikes are on the horizon but markets expect a slow pace – +LJK86JURZWKPD\VSXUDFFHOHUDWHGKLNHGHFRXSOLQJUDWHVIURPPDUNHWH[SHFWDWLRQV – )HGWLJKWHQLQJLVDILUVWVWHSLQDPXOWL\HDUSROLF\QRUPDOL]DWLRQSURFHVV • Emerging Market fatigue tangible; low valuations cannot be ignored – 6KRUW DQGPHGLXPWHUPFKDOOHQJHVFDPRXIODJHORQJWHUPHFRQRPLFJURZWKSURVSHFWV – 3OXPPHWLQJHQHUJ\SULFHVKDYHSRWHQWLDOWRFUHDWHFKDOOHQJHVIRUFHUWDLQHFRQRPLHV 28 1(3&*HQHUDO$FWLRQVIRU&OLHQWV • Confirm alignment of portfolio positioning with long-term objectives – 5HFRJQL]HLQYHVWPHQWSURJUDP¶VWROHUDQFHWRZLWKVWDQGVKRUWWHUPYRODWLOLW\ – 6RPHWUDGLWLRQDODSSURDFKHVVXFKDVFRUHERQGVVXERSWLPDOLQFXUUHQWHQYLURQPHQW • Balance desire for increased return with recognition of downside risks – %DUEHOOSRUWIROLRULVNZLWKGHIHQVLYHDOORFDWLRQVWRZLWKVWDQGUDQJHRIRXWFRPHV – 6KLIWMXGLFLRXVO\DFURVVDQGZLWKLQDVVHWFODVVHV • • 6WUHWFKHGOLTXLGFUHGLWPDUNHWVPDNHHTXLWLHVUHODWLYHO\PRUHDWWUDFWLYH 5HFRJQL]HSRWHQWLDOIRUQRQ86GHYHORSHGPDUNHWVWRUHDFWWR4(SURJUDPVERWKFRQWLQXHG %DQNRI-DSDQDQGSRWHQWLDO(XURSHDQ&HQWUDO%DQN • Evaluate impact of expected US dollar strength on non-US allocations – &RQVLGHUVWUDWHJLFGHYHORSHGPDUNHWFXUUHQF\KHGJLQJSURJUDPWRPLWLJDWHULVN – 6FUXWLQL]HDOORFDWLRQWRDQGLPSOHPHQWDWLRQZLWKLQHPHUJLQJPDUNHWV • • $WWUDFWLYHIXQGDPHQWDOVDQGVHFXODUWUHQGVZDUUDQWPDUNHWZHLJKWDWDPLQLPXP &KDOOHQJLQJFRXQWU\VSHFLILFFRQGLWLRQVVXSSRUWSXUVXLWRIEROGDFWLYHPDQDJHPHQW • Remain committed to high conviction active manager exposures – 3DVVLYHWUHQGVDQGPDUNHWFRPSODFHQF\PD\LJQLWHGRUPDQWDOSKDRSSRUWXQLWLHV – 8VHQRQWUDGLWLRQDOVWUDWHJLHVZLWKUHGXFHGFRQVWUDLQWVDFURVVPDUNHWVWRFDSLWDOL]H • *OREDOHTXLW\WDFWLFDOFUHGLWVWUDWHJLHV*$$OLTXLGDOWHUQDWLYHEHWDJOREDOPDFUR • Seek niche private strategies to mitigate challenge of high valuations – (QHUJ\(XURSHDQ5HDO(VWDWHVHFWRUIRFXVHGJURZWKHTXLW\$VLDIRFXVHGPDQDJHUV DQGVHOHFWGLUHFWOHQGLQJPDUNHWVDOOSURYLGHFRPSHOOLQJRSSRUWXQLWLHV 29 1(3&$FWLRQVIRU(QGRZPHQW)RXQGDWLRQ&OLHQWV • Strike the appropriate balance between offense and defense – 1LFKHDUHDVOLNHHQHUJ\(XURSHDQUHDOHVWDWHVHFWRUIRFXVHGJURZWKHTXLW\$VLDIRFXVHG PDQDJHUVDQGVHOHFWGLUHFWOHQGLQJPDUNHWVDOOSURYLGHFRPSHOOLQJRSSRUWXQLWLHV – 2QWKHPDUJLQFRQVLGHUUHGXFLQJOLTXLGFUHGLWIRURWKHUUHWXUQVHHNLQJDVVHWV – 3ULYDWHHTXLW\DQGGHEWLQYHVWPHQWVDOORZIRUWDFWLFDOGHSOR\PHQWRIFDSLWDO • Review inflation hedging allocations in light of recent market action – 6RPHDUHDVKDYHOLNHO\VROGRIIPRUHWKDQLVZDUUDQWHG – 3ULYDWHUHDOHVWDWHDQGUHDODVVHWLQYHVWPHQWVRIIHUDWWUDFWLYHRSSRUWXQLWLHV • Fixed income allocation should remain low and focused on high quality, liquid exposures – %DUEHOOSRUWIROLRULVNZLWKGHIHQVLYHDOORFDWLRQVWRZLWKVWDQGUDQJHRIRXWFRPHV – 5LVNSDULW\DQGXQFRQVWUDLQHGVWUDWHJLHVFDQDOVRVDWLVI\WKHKLJKTXDOLW\DOORFDWLRQ • Focus on global macro ideas within hedge fund portfolio – 'LYHUJLQJFHQWUDOEDQNSROLFLHVSUHVHQWRSSRUWXQLW\IRURXWVL]HGUHWXUQV – %URDGOLTXLGRSSRUWXQLW\VHW • Remain committed to high conviction active manager exposures, especially in emerging markets – 3DVVLYHWUHQGVDQGPDUNHWFRPSODFHQF\PD\LJQLWHGRUPDQWDOSKDRSSRUWXQLWLHV • Weigh the pros and cons of currency hedging in select areas – &DQPLWLJDWHULVNEXWPD\EHDORZHUSULRULW\LWHPIRUVRPHSURJUDPVEDVHGRQHDVHRI LPSOHPHQWDWLRQ 30 'HYHORSPHQWRI$VVHW&ODVV$VVXPSWLRQV • Combination of historical data and forward-looking analysis – ([SHFWHGUHWXUQVEDVHGRQFXUUHQWPDUNHWSULFLQJDQGIRUZDUGORRNLQJHVWLPDWHV – 9RODWLOLW\EDVHGRQKLVWRU\ZKLOHUHFRJQL]LQJFXUUHQWXQFHUWDLQW\ – &RUUHODWLRQVEDVHGRQDPL[RIKLVWRU\DQGFXUUHQWWUHQGV • Historical data is used to frame current market environment as well as to compare to similar historical periods – +LVWRULFDOLQGH[UHWXUQVYRODWLOLW\FRUUHODWLRQVYDOXDWLRQVDQG\LHOGV • Forward-looking analysis is based on current market pricing and a “building blocks” approach – 5HWXUQHTXDOV\LHOGFKDQJHVLQSULFHYDOXDWLRQGHIDXOWVHWF – 8VHRINH\HFRQRPLFREVHUYDWLRQVLQIODWLRQUHDOJURZWKGLYLGHQGVHWF – 6WUXFWXUDOWKHPHVVXSSO\DQGGHPDQGLPEDODQFHVFDSLWDOIORZVHWF • Assumptions prepared by NEPC’s Asset Allocation Committee – $VVHW$OORFDWLRQWHDPSOXVPHPEHUVRIYDULRXVFRQVXOWLQJSUDFWLFHJURXSVPHHW WKURXJKRXW4WRGHYHORSWKHPHVDQGDVVXPSWLRQV – 3XEOLFPDUNHWVKHGJHIXQGVDQGSULYDWHPDUNHWVWHDPVSURYLGHPDUNHWLQVLJKWV • Assumptions and Actions reviewed and approved by Partners Research Committee 31 Asset Allocation Review & 2015 Asset Class Assumptions 32 (DVWHUQ0LFKLJDQ8QLYHUVLW\$VVHW$OORFDWLRQ5HYLHZ 5 – 7 Year Outlook 2015 Long Term Change Assumptio Target from 2014 n 'RPHVWLF$OO&DS (TXLW\ ,QWHUQDWLRQDO(TXLWLHV (PHUJLQJ ,QWHUQDWLRQDO (TXLWLHV *OREDO (TXLW\ Total Equity 35% &RUH %RQGV (PHUJLQJ0DUNHW'HEW *OREDO0XOWL6HFWRU)L[HG ,QFRPH $EVROXWH5HWXUQ)L[HG ,QFRPH Total Fixed Income 25% 5HDO$VVHWV/LTXLG +HGJH)XQGV Total Alternatives 20% 6WDQGDUG/LIH*$56 $45*53(/ Total GAA / Risk Parity Expected Return (compound) 20% Expected Risk (volatility) Sharpe Ratio 2014 Expected Return (compound) 2014 Expected Risk (volatility) 2014 Sharpe Ratio • After exceptional capital market returns over the past three years, most future expectations are more muted – – • With real yields in 2014 reversing the normalization trend of 2013, fixed income return expectations are lower – • 6.2% 11.9% 0.38 6.1% 11.3% 0.41 33 $OORI1(3&¶V\HDUHTXLW\ DVVXPSWLRQVDUHORZHUDVFRPSDUHGWR 7KHH[SHFWHGUHWXUQIRUKHGJHIXQGVLV H[SHFWHGWRLQFUHDVHE\EDVLVSRLQWV /RZLQWHUHVWUDWHVLQ-DSDQDQG*HUPDQ\ PD\GUDZ86UDWHVORZ Even with the 2015 revisions, the portfolio still is attractive from a risk/return perspective (DVWHUQ0LFKLJDQ8QLYHUVLW\5LVN%XGJHWLQJ &RPPRG $EV5HW), *EO0XOWL6HFWRU), +) +) &UHGLW +) 0DFUR +) (PHUJ *OREDO (PHUJ ,QW O ,QW O 6P0LG&DS /J&DS 3XEOLF(TXLW\5LVN 6P0LG&DS /J&DS *$$5LVN3DULW\ (0' *ORE%RQGV +< (0' &RUH%RQGV $VVHW$OORFDWLRQ &UHGLW $VVHW5LVN 34 WR<HDU5HWXUQ)RUHFDVWV Geometric Expected Return Asset Class &DVK 7UHDVXULHV ,*&RUS&UHGLW 0%6 Core Bonds* 7,36 +LJK<LHOG%RQGV %DQN/RDQV *OREDO%RQGV8QKHGJHG *OREDO%RQGV+HGJHG (0'([WHUQDO (0'/RFDO&XUUHQF\ /DUJH&DS(TXLWLHV 6PDOO0LG&DS(TXLWLHV ,QW O(TXLWLHV8QKHGJHG ,QW O(TXLWLHV+HGJHG (PHUJLQJ,QW O(TXLWLHV 3ULYDWH(TXLW\ 3ULYDWH'HEW 3ULYDWH 5HDO$VVHWV 5HDO(VWDWH &RPPRGLWLHV +HGJH)XQGV 2014 2.53% 2015 2.30% 2015-2014 -0.23% &RUH%RQGVDVVXPSWLRQEDVHGRQPDUNHWZHLJKWHGEOHQGRIFRPSRQHQWVRI$JJUHJDWH,QGH[7UHDVXULHV,*&RUS&UHGLWDQG0%6 35 2015 Volatility Forecasts Volatility Asset Class Cash Treasuries IG Corp Credit MBS Core Bonds* TIPS High-Yield Bonds Bank Loans Global Bonds (Unhedged) Global Bonds (Hedged) EMD External EMD Local Currency Large Cap Equities Small/Mid Cap Equities Int'l Equities (Unhedged) Int'l Equities (Hedged) Emerging Int'l Equities Private Equity Private Debt Private Real Assets Real Estate Commodities Hedge Funds 2014 1.00% 6.00% 7.50% 7.00% 6.32% 7.50% 13.00% 8.00% 8.50% 5.00% 12.00% 15.00% 17.50% 21.00% 20.50% 18.50% 26.00% 27.00% 19.00% 23.00% 17.00% 18.00% 9.00% 2015 1.00% 5.50% 7.50% 7.00% 6.03% 7.50% 13.00% 8.00% 9.00% 5.00% 12.00% 15.00% 17.50% 21.00% 21.00% 17.50% 26.00% 27.00% 17.00% 23.00% 15.00% 18.00% 9.00% 2015-2014 -0.50% -0.29% 0.50% 0.50% -1.00% -2.00% -2.00% * Core Bonds assumption based on market weighted blend of components of Aggregate Index (Treasuries, IG Corp Credit, and MBS). 36 5HODWLYH$VVHW&ODVV$WWUDFWLYHQHVV 37 Observations and Actions – Detail 38 <HDU5HWXUQV&RPPHQVXUDWHZLWK*URZWK1HDU7HUP6WUHQJWK&DQ3HUVLVW • Global growth forecasts low but approaching pre-crisis levels with less reliance on China – – – • $EVROXWHILJXUHVSURMHFWHGWR LPSURYHIRUWKH86DQG:RUOG (XURSHMRLQV-DSDQDVDGUDJRQ JOREDOJURZWK &KLQDH[SHFWDWLRQVFRPSUHVVEXW UHPDLQTXLWHKLJK Source: Bloomberg as of 11/30 S&P rally unlikely to persist for another 5-7 years – – – /RZIRUORQJHULQWHUHVWUDWHVPD\ SURYLGHQHDUWHUPVXSSRUWIRU KLJKHUYDOXDWLRQV 7HSLGJURZWKOHYHOVFKDOOHQJHDELOLW\ WRH[WHQGRXWVL]HGUHWXUQVRYHUWKLV KRUL]RQDVVWLPXOXVZDQHV :KLOHSHUFHLYHGWDLOHQGVRIEXOO PDUNHWVFDQEHIDOVHVLJQVWKH FXUUHQWOHQJWKDQGPDJQLWXGHLV RQO\RXWSDFHGE\µµDQGµ µ Bubble Size = P-E at peak Source: Bloomberg and Shiller Data as of 9/30 39 3ROLF\DQG0DUNHW'LYHUJHQFHV&RQWLQXHWR'HYHORS • Central bank stimulus has been a key driver of market returns – – – 3RVWFULVLVPRQHWDU\SROLF\ZDVILUVW KLJKO\VWLPXODWLYHZDQHGLQ WKHQUHVXPHGXQHYHQO\ *UHDWHUVWLPXOXVOHGWRVWURQJlocal PDUNHWUHWXUQV &RQWLQXHGVWLPXOXVLQ-DSDQDQG (XURSHVKRXOGEHLQFRUSRUDWHGLQWR RXWORRNEXWKHGJLQJGHYHORSHG PDUNHWFXUUHQF\H[SRVXUHLV SUXGHQW Source: Bloomberg as of 11/30 • Policy responses have been key driver of capital market results – – 'LVWLQFWHFRQRPLFHQYLURQPHQWV DFURVVFRXQWULHVOHDGVWR GLIIHUHQWLDWLRQLQPDUNHWUHWXUQV (YROYLQJPRQHWDU\SROLFLHVFRQWLQXH WRGLYHUJHDQGOLNHO\OHDGWRPRUH LQGHSHQGHQWFDSLWDOPDUNHW RXWFRPHVDPRQJFRXQWULHV Source: Bloomberg as of 11/30 - Local indices consist of Australia, Europe, UK, Emerging Markets, Japan, New Zealand, US, and Canada 40 )HG5DWH+LNHV([SHFWHGLQ7LPLQJDQG3DFH$UH8QFHUWDLQ • Fed governors (blue dots) project higher rates over the next few years – – 0DUNHWH[SHFWDWLRQVJUHHQGRWV DUHOHVVDPELWLRXVZLWKUHDOLW\OLNHO\ LQEHWZHHQ 8SVLGHVXUSULVHWRSDFHRUOHYHORI LQWHUHVWUDWHVVXSSRUWLYHRIKLJKHU 86'QHJDWLYHIRU86ULVNDVVHWV /RQJ7HUP • Source: Bloomberg and Federal Open Market Committee as of 11/30 Low real rates suppressed by central banks, squeeze expectations for future returns – – – – 8.(XURSH-DSDQDOOZLWK QHJDWLYH\HDUUHDO\LHOGV 86ERQGVORRNUHODWLYHO\DWWUDFWLYH LQWKLVFRQWH[W 5HDOUDWHVPRYLQJORZHUWRZDUG SHHUVLVEXOOLVKIRUULVNDVVHWV /RQJWHUPQRUPDOL]HGPRQHWDU\ SROLF\FRXOGUHYHUVHWKHWUHQG Source: Bloomberg as of 11/30 41 6WUXFWXUDO/RQJ7HUP3RVLWLYHVRI(PHUJLQJ0DUNHWV5HPDLQ6R'R,GLRV\QFUDWLF5LVNV • Emerging markets have higher growth and lower debt levels vs. developed markets – – • • 1HDUWHUPULVNVDUHSUHVHQWDVERWK &KLQDDQGFRPPRGLW\F\FOHVORZV 6WURQJGROODUZLOOKXUWVRPH FXUUHQFLHVEXWZLOODOVRDLG H[SRUWHUVKHOSLQJ(0JURZWK Local currency debt offers a compelling yield but paired with heightened volatility Source: IMF as of 10/31 Both exogenous and internal factors can drive major shifts across countries – – 'URSLQHQHUJ\SULFHVLQLVD UHFHQWVWUXFWXUDOVKLIWWKDWZLOOKDYH DPDMRULPSDFWRQFHUWDLQFRXQWULHV 9HQH]XHOD1LJHULD5XVVLDDQG VHYHUDOIURQWLHUFRXQWULHV Source: Bloomberg as of 11/30 42 Appendix 43 ,QIRUPDWLRQ'LVFODLPHU • Past performance is no guarantee of future results. • The goal of this report is to provide a basis for substantiating asset allocation recommendations. The opinions presented herein represent the good faith views of NEPC as of the date of this report and are subject to change at any time. • Information on market indices was provided by sources external to NEPC. While NEPC has exercised reasonable professional care in preparing this report, we cannot guarantee the accuracy of all source information contained within. • All investments carry some level of risk. Diversification and other asset allocation techniques do not ensure profit or protect against losses. • This report is provided as a management aid for the client’s internal use only. This report may contain confidential or proprietary information and may not be copied or redistributed to any party not legally entitled to receive it. 44 $OWHUQDWLYH,QYHVWPHQW'LVFORVXUHV It is important that investors understand the following characteristics of nontraditional investment strategies including hedge funds and private equity: 1. Performance can be volatile and investors could lose all or a substantial portion of their investment 2. Leverage and other speculative practices may increase the risk of loss 3. Past performance may be revised due to the revaluation of investments 4. These investments can be illiquid, and investors may be subject to lock-ups or lengthy redemption terms 5. A secondary market may not be available for all funds, and any sales that occur may take place at a discount to value 6. These funds are not subject to the same regulatory requirements as registered investment vehicles 7. Managers may not be required to provide periodic pricing or valuation information to investors 8. These funds may have complex tax structures and delays in distributing important tax information 9. These funds often charge high fees 10.Investment agreements often give the manager authority to trade in securities, markets or currencies that are not within the manager’s realm of expertise or contemplated investment strategy 45