Richard O’Neill Chief Economic Advisor Federal Energy Regulation Commission

advertisement

Richard O’Neill

richard.oneill@ferc.gov

Chief Economic Advisor

Federal Energy Regulation Commission

NAS Resource Allocation: Economics and Equity

The Aspen Institute

Queenstown, MD

March 20, 2002

This does not necessarily reflect the view of the Commission.

Richard P. O’Neill

Federal Energy Regulatory Commission

Benjamin F. Hobbs

The Johns Hopkins University and Energieonderzoek Centrum

Nederland

Paul M. Sotkiewicz

University of Florida

William Stewart

College of William and Mary

Michael Rothkopf

Rutgers University

Udi Helman

Federal Energy Regulatory Commission and The Johns Hopkins

University

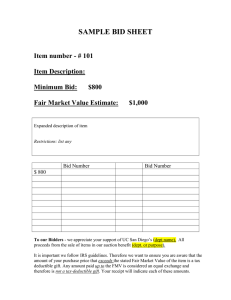

menu

gin

scotch

hot dog

burger

$4

$6

$3

$5

You must order

from the menu

value

gin

$5

scotch

$9

hot dog

$3

burger

$5

$5

Adam Smith on

network regulation

“The tolls for the maintenance of a high

road, cannot with any safety be made

the property of private persons. ... It is

proper, therefore, that the tolls for the

maintenance of such work should be

put under the management of

commissioners or trustees.” [Wealth of

Nations , Book V, Chap 1, p. 684]

If Adam Smith is not enough, why intervene?

To provide for reliability

To ensure revenue adequacy (no subsidies)

To facilitate entry

generation, transmission, consumption

To mitigate market power

To provide competitive price signals

To protect property rights

How to intervene?

nondiscriminatory

lower transactions costs

more not less options

control market power

highly efficient

“just” prices

will prices be too low?

Are low prices bad?

are market prices

unconstitutional?

All power corrupts, but we need the electricity.

Electric markets are

incomplete and complex

incomplete if not pricing all desired products

asymmetric markets: vertical demand curve

bidding nonconvexities

Supply: start-up and no-load

demand: for y continuous hours at < $x

intertemporal dependencies

reactive (imaginary/orthogonal) power

socialize transient stability/ voltage

socialize generation and load characteristics

can decentralized markets handle this?

Basics of market design

Contracts (not compacts)

Marginal/incremental cost bidding

Start-up and min run

Trading rules

Financially sound

Market clearing prices

Incentives

For doing “good” things

For not doing “bad” things(socal gas, no withholding)

With collars for political reasons

Information

Auction Design Principles

"Everything should be made as simple as

possible ... but not simpler." Einstein

Don'ts =22/7

Create gaming opportunities in the name of simplicity

Foreclose marginal (incremental) cost bids

Assume away non-convexities

increase risk

Allow bids that are not firm offers

favor large players

Do's = 4[1 -1/3 + 1/5 – 1/7 + …]

Allow marginal cost bidding

market clearing price (with scarcity rents)

make the process internally consistent

Create property rights and simple alternatives

Allow self scheduling

differences in auction vs.

COS based regulation

Issue

estimating short run marginal costs

estimating capacity

hold-up problem

estimating return on equity

estimating depreciation

estimating units of service

cost allocation

estimating proper discounts

measuring withholding

free-rider problem

Auction

yes

yes

yes

no

no

no

no

no

yes

yes

COS

yes

yes

yes

yes

yes

yes

yes

yes

yes

no

market design objectives

max bid efficiency within constraints

All RTO (centralized) markets are optional

self-scheduling and voluntary market bids

low transactions costs; no new risks

allow marginal costs bidding(multipart bids)

minimize incentives for market power abuse

don’t favor large participants/portfolio

max arbitrage/min averaging

simultaneous market clearing

lots of information

Coexistence of RTO and off-RTO markets

eliminate bias between off-RTO and RTO markets

RTO markets should not be severely constrained

to promote off-RTO markets

Allow clearing of mutually beneficial trades?

Why are there mutually beneficial trades?

Should off-RTO markets be subsidized? No

Should the RTO be in the insurance biz? No

bilateral physical markets: who pays for the

cleanup after the party?

Self supply

options

Self designed zonal configurations

balanced scheduling

self supply of ancillary services

self designed transmission rights

optional bidding in RTO/ISO markets

no bill from RTO/ISO

pay or get paid for imbalances

Pre-day-ahead markets

for transmission rights: CRT/TCC/TRCs/FGRs

for generation capacity/resevres (ICAP)

market power mitigation via options contracts

day-ahead market for reliability(valium substitute)

simultaneous nodal market-clearing auctions for energy,

ancillary services and congestion

allow multi-part bidding

higher of market or bid cost recovery

allow self scheduling

allow price limit bids on ancillary and congestion

Real-time balancing myopic market

markets are nodal-based LMP with fish protection

Pre-day-ahead markets

Annual, seasonal, monthly, weekly

Simultaneous clearing of all products

Demand side bidding or capacity options (physical?)

Capacity markets (two year ahead for entry)

Transmission contracts

energy forward contracts: FCCs, FTCs

energy options contracts: CRTs

flow gate options: FGRs

FTR options for reserves

Unbalanced contracts!

market power mitigation contracts

bid marginal costs including start up and no load

pay higher of market clearing price or costs

Day-ahead reliability

management

Optimize system topology over large areas

reserves, real and reactive power balanced

clear most congestion

reserves in place including tx capacity

set imports

clear mutually beneficial trades

interperiod interdependencies: start-up, ramp

rate and minimum load

Design principles for

day-ahead RTO market

Objective: max efficiency within reliability

allow marginal cost bids(start-up/min load)

self-scheduling with optional bidding

simultaneous clearing of all services at LMP

pay higher of bid costs or market clearing

price

financially binding/physically if needed

low risk and transactions costs

Can the real-time market

handle reliability by itself?

Is a real-time market enough? In theory yes

can too much real-time scheduling threaten

system stability?

Neighborhood reliability of the AC load flow

What if it was a DC load flow? Simple

should there be an incentive not to be more

than x% out of balance?

first, eliminate all bias to be in the RTM

Design principles for

real-time RTO market

No other markets need be in real-time balance

max efficiency within system balance

deviations from day-ahead priced at market

those operating as scheduled in day-ahead pay

nothing

physically binding

pay market clearing price

low risk and transactions costs

fast market info: prices and quantities

non-simultaneous auctions without

LMP and marginal cost bidding

Socialize not privatize cost

higher cost passthroughs: uplift

create incentives for market power to lower the

risks of the market design

higher transactions cost of bid preparation

market power mitigation is more difficult

constant redesign to correct flaws

problems in England, Columbia, California

Australia moving from zonal to nodal

Zonal markets (Cal, PJM, NE, UK)

Sequential markets for energy and anc services

One settlement systems

Infeasible markets (Cal PX and UK)

Ignore nonconvexities (start-up and no-load)

Ignore market power

As-bid pricing

all ended in administrative intervention

No property rights to market power or

poor market design

monopoly and scarcity rents

1

< withheld capacity >

demand

0.8

monopoly

price

$/unit

0.6

0.4

monopoly rents

lost

surplus

competitive

price

scarcity rents

0.2

variable costs

0

0

5

10

quantity

15

20

25

30

good market design allows

proper mitigation

Pre-day-ahead markets

Tx rights

Pre commitment of generators

Feasibility of capacity markets

Day-ahead market

Demand bidding

Marginal costs bid includes startup, noload and running

costs

Real-time balancing market

Bid running costs if you did not bid in DAM

Reliability by adjusting generators via bids

No fault market power mitigation

C

100 MW

2/3

A

150 MW

150 MW

100 MW

1/3

1/3

100 MW

B

Max bt + B(y)

βt

+ K(y) <= f

(μ)

Sequence of auctions; forward and real-time

40,000+ nodes

400, 000+ contingency constraints

Could be highly redundant constraints

K(y) can be non-convex (electromagnetic eqns)

Bids are non-convex mixed integer

Solvable? Bixby says not to worry: 6 orders

of magnitude in 10 years

A Four Node Network with Nomogram Flowgate

NW

NE

Nomogram Flowgate

SW

SE

Bidder

B1

B2

B3

B4

B5

B6

S1

Bid Type

FB option,

NE to NW.

Buy up to

100 MW

FB option,

NW to SW.

Buy up to

100 MW

PtP

forward,

NW to SW.

Buy up to

100 MW

PtP option,

NW to SW.

Buy up to

100 MW

PtP

forward,

NE to NW.

Buy up to

100 MW.

PAR

capacity.

Buy up to

100 MW.

Forward

generation

at SW.

Sell up to

200 MW.

Bid

($/MW)

10

30

20

25

25

25

-10

Quantity

awarded

100

100

0

100

40

20

200

Reduced

cost

10

5

-5

0

0

25

20

PTDFs:

Shadow Price:

NW to SW

0.0

1.0

0.8

0.8

0.6

0.0

0.0

25

NE to NW

1.0

0.0

-0.2

0.0

0.6

0.0

0.0

0

NE to SE

0.0

0.0

0.2

0.2

0.4

0.0

0.0

0

SE to SW

0.0

0.0

0.2

0.2

0.4

0.0

0.0

25

PAR

0.0

0.0

0.0

0.0

0.0

1.0

0.0

5

SF

nomogram

0.0

0.0

0.0

0.0

0.0

0.0

-1.0

30

Application: Electric Power Generator

Unit Commitment

fixed

su su

sd sd

(

C

g

S

z

S

z

S

Maximize:

i it i it i it i zit )

i

subject to:

t

git dt

i

git zit G

t,

0

i, t,

0

i, t,

zit zi ,t 1 zitsu 0

i, t,

zit zi ,t 1 z 0

i, t,

min

i

git zit G

max

i

sd

it

zitsu, zitsd {0,1}; all other variables 0; zit < 1

Problem 1: Single Period, 3 Plants

Plant

1

2

3

MIN Q

MAX Q

MC/unit

Fixed$/hr

StartUp$

ShutDown$

50

150

4

125

25

0

100

200

2

50

150

0

20

50

6

0

0

0

0 Load 400

Commodity Price

7

6

Price $/Unit

5

4

3

2

1

0

0

100

200

Quantity

300

400

Average Cost vs. Price

8

Average Cost

Price

7

6

$/Unit

5

4

3

2

1

0

0

100

200

Quantity

300

400

Startup Payments

200

Start P1

Start P2

Start P3

Dollars

150

100

50

0

0

100

200

300

400

Unit Commitment Extensions

1. Multi-Period Considerations: e.g., ramp rate limits

- Problem 2 (2 hours): Assume RR limit = 105 MW/hr,

demands = 180 MW and 395 MW

- Both plants start up in period 1 because of ramp rate

- Plant 1 gets paid $150 to start up in period 1 (commodity

price alone supports operation only in period 2); profit = $175

- Degeneracy/multiple duals a problem

2. Ancillary Services

3. Transmission Congestion Payments

4. Demand Bidding

Smokestack versus High Tech

(from Scarf, 1994)

Production

Characteristics

Capacity

Construction Cost

Marginal Cost

Average Cost at

Capacity

Total Cost at

Capacity

Smokestack

(Type 1 Unit)

16

53

3

6.3125

High Tech

(Type 2 Unit)

7

30

2

6.2857

101

44

Formulate and Solve MIP

(Simulates Bid Evaluation by

Auctioneer)

Let:

z1, z2 = construction decisions of types 1 & 2,

respectively

q1, q2 = output for types 1 & 2

MIP:

Max -i (53z1i + 3q1i) - Σi (30z2i + 2q2i)

i (q1i + q2i) = Q

-16z1i + q1i 0; z1i {0, 1}, q1i 0, i =1,2,…

-7z2i + q2i 0; z2i {0, 1}, q2i 0, i =1,2,…

Efficient Outcome

• To optimally satisfy a demand of, say, 61 units:

#Type 1 # Type 2 Type 1

Demand

Units

Units

Output Output

Type 2

Total

Cost

61

3

2

47

14

388

Note that one Type 1 does not operate at capacity

• The output price according to the LP solution is $3

– But both types make negative profits

not an equilibrium outcome

6.43

Average cost as a function of demand

6.42

for Scarf's problem

6.41

6.4

6.39

average cost

6.38

6.37

6.36

6.35

6.34

6.33

6.32

6.31

6.3

6.29

6.28

55

56

57

58

59

60

61

62 63

demand

64

65

66

67

68

69

70

optimal value as a function of demand

for Scarf's problem

450

440

430

optimal value

420

410

400

390

380

370

360

350

340

55

56

57

58

59

60

61

62 63

demand

64

65

66

67

68

69

70

450

440

optimal value as a function of demand

430

for Scarf's problem

420

optimal value

410

400

390

380

370

360

350

340

55

56

57

58

59

60

61

62

63

de mand

64

65

66

67

68

69

70

LP That Solves the MIP

Max -i (53z1i + 3q1i) -Σi (30z2i + 2q2i)

Duals

i (q1i + q2i) = Q

(y0**)

-16z1i + q1i 0 , i =1,2,..

(y1i)

z1i = z1i*

q1i 0

-7z2i + q2i 0 , i =1,2,..

z2i = z2i*

q2i 0,

(w1i**)

(y2i)

(w2i **)

** Used in payment scheme

Prices at an Output of 61

Unit type 1

(Smokestack)

(y)

(w1i)

(y1i)

Demand Commodity Price Start-up Capacity

61

3**

-53**

0

Unit type 2

(High Tech)

(w2i) (y2i)

Start-up Capacity

-23**

1

**Prices paid by unit to auctioneer

Thus, each unit is paid a start-up cost, ensuring nonnegative profit

(here, 0)

Dual Prices for Scarf's Problem

Unit 1 (Smokestack)

Dual Price Commodity

Set

Price

Unit 2 (High Tech)

Start-up

Price

Capacity

Price

Start-up

Price

Capacity

Price

3

53

0

23

-1

Set II

6.3125

0

-3.3125

-.1875

-4.3125

Set III

6.2857

.429

-3.2857

0

-4.2857

Set I

Non-Convexities in Markets

• While market models often assume away non-convexities (e.g.,

integral decisions and economies of scale),

… they exist!

• Electric utility industry:

– Still economies of scale in generation and especially transmission

– Unit commitment: start-up, shut-down costs; minimum run levels

• Why disregard non-convexities in market models?

… with convex profit maximization problems (concave

objective, convex feasible region), we can usually:

– define linear (“one-part”) market clearing prices

– establish existence, uniqueness properties for market equilibria

– create tests for entering activities

The Problem with Non-Convexities

• Linear prices can no longer clear the market …

an equilibrium cannot be guaranteed to exist

• E.g., electric power operations:

– At P < P*, inadequate supply

– At P > P*, a lump of additional supply enters that breaks

even (covers fixed costs), but supply exceeds demand. If

force any generator to back off, its profit < 0

– “Administrative” solution to reach the optimum:

• Adjust outputs to restore feasibility

• Side payments to ensure no one loses money

• As Scarf (1990, 1994) then points out, there is no

price test for Pareto improving entry of new

production processes

Why Address Non-Convexities in

Auctions Now?

1) New markets for electric power have non-convexities

2) A debate surrounding these power markets: the use of

prices to induce efficient, decentralized decisions a la

Walrasian auctions

3) Auction mechanisms in the NYISO and PJM attempt to

account for integer decisions

4) California said no to such an auction because of

complaints:

- these prices are not “equilibrium supporting” and

- administrative adjustments appear arbitrary

(e.g., Johnson, Oren, Svoboda 1998)

5) Our result: If integral decisions can be priced, a market

equilibrium can be supported

Some Related Literature

• Scarf (1990, 1994)

– Emphasized the divergence of math programming and economics

– Searched (unsuccessfully) for a way to find prices in the presence of

integral choices, and for pricing tests for improvements

• Gomory and Baumol (1960)

– The use of cutting plans that are combinations of existing constraints

to arrive at an integer solution

– Interpreted duals of those planes; stopped short of pricing individual

integer activities

• Wolsey (1981)

– Pure IP with integer constraint coefficients & RHSs

– Approaches to constructing price functions yielding dual problems

that satisfy weak and strong duality. Functions generally nonlinear

• Williams (1996)

– Examines possible duality for integer programs, but concludes no

“satisfactory” duals (Lagrange multipliers) exist

Pricing Integral Activities

• One can think of the traditional pricing approach as a

misspecification of the commodity space

– The commodity space could include integer decisions as an

“intermediate good”

• The pricing system derived here is similar to multi-part

pricing for utilities

– For example, an demand charge (fixed costs) and an energy

charge

• Buyers’ clubs with multipart contract

Our Approach

to Addressing Non-Convexities

1. Formulate the non-convex problem as a maximization MIP.

Bids include all costs and internal constraints.

2. Solve MIP

–

Take advantage of modern MIP technology

3. Take integer solutions z* and define equality constraints z=z*

in a LP -- “convexifying” the problem.

4. Solve LP

5. Duals on z=z* are prices on the integer variables

–

–

If market/auction participant pays those prices, together with the

duals on commodity and other coupling constraints…

…. then those prices support an equilibrium

For (0,1) variables, can use only negative prices for z*=1 and positive

prices for z* = 0

General Formulation: MIP

Let:

k = index for auction participants

xk, zk = activities

ck, dk = marginal benefits of activities (cost, if <0).

(ckxk + dkzk is the total benefit to participant k)

Ak1, Ak2, Bk1, Bk2 = constraint coefficients

b0 = commodities to be auctioned. In double auction, b0 =

0

bk = RHS of internal constraints of participant k

MIP:

max k (ckxk + dkzk)

subject to: k (Ak1xk + Ak2zk) b0

}

Bk1xk + Bk2zk bk

all k

An LP That Solves The MIP

LP(z*): Max k (ckxk + dkzk)

s.t.

k (Ak1xk + Ak2zk) b0

Bk1xk + Bk2zk bk

zk = zk *

xk 0

}

all k

where z* indicates an optimal value of z in MIP

Definition of Equilibrium

Definition 1. A “market clearing” set of contracts has the following

characteristics:

1. Each bidder is in equilibrium in the following sense. Given

•

•

prices {y0*, wk*} and payment function Pk(xk,zk) defined by the

contract

no restrictions on xk and zk other than k’s internal constraints

(Bk1xk + Bk2zk bk)

then no bidder k can find feasible xk’, zk’ for which:

(ckxk’ + dkzk’ - Pk(xk’,zk’)) > (ckxk* + dkzk* - Pk(xk*,zk*))

Thus, the prices support the equilibrium {xk*,zk*}.

2. Supply meets demand for the commodities. I.e.,

k (Ak1xk* + Ak2zk*) < b0

A Candidate Set of Market

Clearing Prices and Quantities

Definition 2. Consider the contract Tk with the following terms:

1. Bidder k sells zk=zk*, xk0=xk0* (where xk0 is the subset of xk

with nonzero Ak1)

2. Bidder k pays auctioneer:

Pk(xk,zk) = y0* (Ak1xk+Ak2zk) + wk* zk.

where * indicates an optimal solution to MIP / LP(z*)

Variant. Define:

wk*’ = Max(0, wk*) if zk* = 0

= Min(0, wk*) if zk* = 1

Pk(xk,zk) = y0* (Ak1xk+Ak2zk) + wk*’ zk

Existence of Market Clearing

Contracts for MIP Auction

Theorem. T { Tk} is a market clearing set of contracts.

• Proof exploits complementary slackness conditions from

auction LP to show that at the candidate equilibrium prices,

{zk*,xk0*} is optimal for each bidder’s own MIP:

Max [ckxk + dkzk] - [y0* (Ak1xk+Ak2zk) + wk* zk]

s.t.

Bk1xk + Bk2zk bk

xk 0, zk {0,1}

• There may be alternative optima for the bidder

• Profits nonnegative

• If wk* < 0 and zk* =1, interpretable as NYISO/PJM mechanism

for preventing winning bidders from losing money

• In this framework, there are payments directly for individual

capacity

A Welfare Result

Corollary. If each participant k bids truthfully (submits a bid

reflecting its true valuations (ckxk + dkzk) and true constraints

(Bk1xk + Bk2zk bk; xk 0; zk {0,1}),

... Then an auction defined as follows will:

(a) maximize net social benefits (k [ckxk + dkzk]) and

(b) clear the market

The auction includes the following steps:

1.

The auctioneer solves MIP, yielding primal {xk0*,zk*};

2.

The auctioneer solves LP(z*), obtaining prices {y0*, wk*}

3.

The auctioneer imposes contract T upon the bidders

Extensions

• Tests for Pareto improving entry of new activities

• How useful is this really likely to be?

– For small systems, where lumpiness looms large, market power is

important

– For large systems, the duality gap shrinks .. into irrelevancy?

• Strategic bidding over these integral activities.

– Comparisons to iterative single part bid auctions.

– Do more bidding degrees of freedom facilitate strategic behavior?

What are the impacts?

• Consequences for distribution of rents in the market

between consumers and producers, and among groups of

producers

• Tests on larger systems

Wholestic Market Design AGORAPHOBIA

You don’t

always get it

right the

first time.

Now you have

experience

Try

LMP

Are you a

Copernican or a

Ptolemain?

We had to destroy the market to save it