Investment Management Massachusetts Tax Law Changes on

advertisement

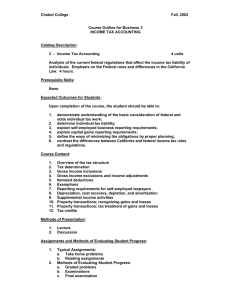

Investment Management FEBRUARY 2003 Massachusetts Tax Law Changes on Treatment of Capital Gains and Reporting Losses On January 1, 2003, the Department of Revenue of the Commonwealth of Massachusetts issued Technical Information Release 02-21, which alerted taxpayers to changes in the tax treatment of capital gains and losses under chapter 62 of the Massachusetts General Laws. In the endeavor to raise revenue for the Commonwealth of Massachusetts, the state legislature eliminated its reduced tax rate structure for the treatment of capital gains, which based its multiple-class tax rate structure (ranging from 5% to 0%) on the holding period of the capital asset sold. Under the prior law, capital gains distributions were included in Part C income, which included all Part C capital gains. Part C capital gains were defined as longterm gains from the sale or exchange of capital assets (except collectibles) which were divided into six classes carrying six different tax rates depending on the holding period of the capital asset. For tax years beginning on or after January 1, 2002, the legislature has replaced the multiple tax rates for Part C income with a single rate (5.3% for 2002) for transactions completed on or after May 1, 2002. Part C gross income is now defined as any gains from the sale or exchange of capital assets (except collectibles) that are held for more than one year before disposition. MULTIPLE RATE STRUCTURE UNDER PRIOR LAW Class Holding Period (in years) Class Tax Rate B More than one, not more than two 5% C More than two, not more than three 4% D More than three, not more than four 3% E More than four, not more than five 2% F More than five, not more than six 1% G More than six 0% Under the prior law, capital gain distributions to mutual fund shareholders were included in Part C income. Mutual funds could allocate the capital gain dividends attributable to each class and report this allocation to the taxpayer and the Commissioner on or before March 1 of the year following the year of distribution. If the mutual fund made this election, shareholders could report their distributions on their personal income tax returns in the same manner as the mutual fund. If the mutual fund did not elect to report the allocation to the shareholders, the entire capital gain distribution would be included in Part C, Class B gross income, carrying the highest tax rate (5% under prior law) for capital gains. Shareholders could not offset their Part C gross income with net capital losses incurred by their mutual funds. Kirkpatrick & Lockhart LLP PRIOR LAW EXAMPLE. The ABC Growth Fund (ABC) pays a $100 capital gain dividend to Shareholder X. ABC has a Class B (5%) net gain of $400,000 and a Class D (3%) net gain of $100,000 after offset by capital losses in all classes. ABC has total Part C capital gains of $500,000 ($400,000 + $100,000). Eighty percent of that amount ($400,000/$500,000) is designated as Class B capital gains (5%) while twenty percent of that amount ($100,000/$500,000) is designated as Class D capital gains (3%). ABC can report to Shareholder X that 80% (i.e., $80) of his capital gain dividend is included in Part C, Class B gross income and that 20% (i.e., $20) of his capital gain dividend is included in Part C, Class D gross income. For taxable year 2002, transactions that are completed on or after May 1, 2002 will not benefit from the multiple rate structure and resultant capital gains will be taxed at the rate of 5.3%. Transactions completed prior to that date will be treated under the old tax regime, so that fund shareholders will still be able to benefit from the multiple rate structures if their mutual fund elects to report their allocation to the Commissioner and to the shareholders. If the mutual fund fails to make that election, a shareholder’s entire capital gain distribution will be included in Part C gross income and taxed at the flat rate of 5.3%. Gain categories are determined not by the date of distribution to shareholders but rather by the date of realization by the fund. netted against long-term losses within each class (e.g., 4% long-term gains against 4% long-term losses), and then all net long-term gains were netted against all net long-term losses, irrespective of their holding periods. The netting started with the highest rate capital gain, and flowed down to the lowest rate capital losses. Under the new provisions dealing with capital losses, gains and losses from transactions completed before May 1, 2002 are offset in accordance with the ordering rules under prior law. However, if the fund has, as of April 30, 2002, an aggregate net capital loss, the net loss will be considered a loss from the sale or exchange of a capital asset held for more than one year and will offset capital gains realized during the last eight months of 2002. For tax year 2002, long-term capital gains resulting from transactions completed in the first four months of 2002 will be offset by any net long-term capital losses recognized on or after May 1, 2002, even if the long-term capital gain in the first four months falls within the 0% tax class. Carrying forward a net long-term capital loss in the last eight months to subsequent years is not an alternative to first offsetting gains (of any class) in the first four months. Any unused net capital loss for the entire year, however, will carry over for an indefinite number of years at the fund level. JOEL D. ALMQUIST 617.261.3104 jalmquist@kl.com WAL TER G. VAN DORN WALTER 617.951.9102 wvandorn@kl.com Although capital losses incurred by funds still do not flow through to their shareholders, mutual funds that are subject to taxation in Massachusetts will be affected by recent tax law changes at the fund level. Prior to the changes, capital losses, like long-term capital gains, were allocated into six classes based on the holding period of the underlying capital asset. Long-term gains were CHRISTINA H. LIM 617.261.3243 clim@kl.com ® Kirkpatrick & Lockhart LLP Challenge us. ® www.kl.com BOSTON ■ DALLAS ■ HARRISBURG ■ LOS ANGELES ■ MIAMI ■ NEWARK ■ NEW YORK ■ PITTSBURGH ■ SAN FRANCISCO ■ WASHINGTON ......................................................................................................................................................... 2 This bulletin is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. KIRKPATRICK & LOCKHART LLP INVESTMENT MANAGEMENT ALERT 2003 KIRKPATRICK & LOCKHART LLP. ALL RIGHTS RESERVED. © Kirkpatrick & Lockhart LLP maintains one of the leading investment management practices in the United States, with over 60 lawyers devoting all or a substantial portion of their practice to this area. According to the April 2002 American Lawyer, K&L is a mutual funds “powerhouse” that represents more of the largest 25 investment company complexes and their affiliates than any other law firm. We represent mutual funds, insurance companies, broker-dealers, investment advisers, retirement plans, banks and trust companies, private funds, offshore funds and other financial institutions. We also regularly represent mutual fund distributors, independent directors of investment companies, retirement plans and service providers to the investment management industry. In addition, we frequently serve as outside counsel to industry associations on a variety of projects, including legislative and policy matters. We work with clients in connection with the full range of investment company industry products and activities, including all types of open-end and closed-end investment companies, funds of hedge funds, variable insurance products, private and offshore investment funds and unit investment trusts. Our practice involves all aspects of the investment company business: from organizing and registering open-end and closed-end funds, both as series and individual portfolios, to providing ongoing advice and representation to the funds and their advisers, directors and distributors. We invite you to contact one of the members of our investment management practice, listed below, for additional assistance. You may also visit our website at www.kl.com for more information, or send general inquiries via email to investmentmanagement@kl.com. BOSTON Michael S. Caccese Philip J. Fina Mark P. Goshko Thomas Hickey III Nicholas Hodge 617.261.3133 617.261.3156 617.261.3163 617.261.3208 617.261.3210 mcaccese@kl.com pfina@kl.com mgoshko@kl.com thickey@kl.com nhodge@kl.com LOS ANGELES William P. Wade 310.552.5071 wwade@kl.com NEW YORK Beth R. Kramer Richard D. Marshall Robert M. McLaughlin Loren Schechter 212.536.4024 212.536.3941 212.536.3924 212.536.4008 bkramer@kl.com rmarshall@kl.com rmclaughlin@kl.com lschechter@kl.com SAN FRANCISCO Eilleen M. Clavere David Mishel Mark D. Perlow Richard M. Phillips 415.249.1047 415.249.1015 415.249.1070 415.249.1010 eclavere@kl.com dmishel@kl.com mperlow@kl.com rphillips@kl.com FEBRUARY 2003 WASHINGTON Clifford J. Alexander 202.778.9068 Diane E. Ambler 202.778.9886 Catherine S. Bardsley 202.778.9289 Arthur J. Brown 202.778.9046 Arthur C. Delibert 202.778.9042 Robert C. Hacker 202.778.9016 Benjamin J. Haskin 202.778.9369 Kathy Kresch Ingber 202.778.9015 Rebecca H. Laird 202.778.9038 Thomas M. Leahey 202.778.9082 Cary J. Meer 202.778.9107 R. Charles Miller 202.778.9372 Dean E. Miller 202.778.9371 R. Darrell Mounts 202.778.9298 C. Dirk Peterson 202.778.9324 Alan C. Porter 202.778.9186 Theodore L. Press 202.778.9025 Robert H. Rosenblum 202.778.9464 William A. Schmidt 202.778.9373 william.schmidt@kl.com Lynn A. Schweinfurth 202.778.9876 Donald W. Smith 202.778.9079 Robert A. Wittie 202.778.9066 Robert J. Zutz 202.778.9059 calexander@kl.com dambler@kl.com cbardsley@kl.com abrown@kl.com adelibert@kl.com rhacker@kl.com bhaskin@kl.com kingber@kl.com rlaird@kl.com tleahey@kl.com cmeer@kl.com cmiller@kl.com dmiller@kl.com dmounts@kl.com dpeterson@kl.com aporter@kl.com tpress@kl.com rrosenblum@kl.com lschweinfurth@kl.com dsmith@kl.com rwittie@kl.com rzutz@kl.com Kirkpatrick & Lockhart LLP 75 State Street Boston, Massachusetts 02109 TEL 617.261.3100 FAX 617.261.3175 2828 North Harwood Street Suite 1800 Dallas, Texas 75201 TEL 214.939.4900 FAX 214.939.4949 Payne Shoemaker Building 240 North Third Street Harrisburg, Pennsylvania 17101 TEL 717.231.4500 FAX 717.231.4501 10100 Santa Monica Boulevard Seventh Floor Los Angeles, California 90067 TEL 310.552.5000 FAX 310.552.5001 Miami Center - 20th Floor 201 South Biscayne Boulevard Miami, Florida 33131 TEL 305.539.3300 FAX 305.358.7095 The Legal Center One Riverfront Plaza, Seventh Floor Newark, New Jersey 07102 TEL 973.848.4000 FAX 973.848.4001 599 Lexington Avenue New York, New York 10022 TEL 212.536.3900 FAX 212.536.3901 Henry W. Oliver Building 535 Smithfield Street Pittsburgh, Pennsylvania 15222 TEL 412.355.6500 FAX 412.355.6501 Four Embarcadero Center, 10th Floor San Francisco, California 94111 TEL 415.249.1000 FAX 415.249.1001 1800 Massachusetts Avenue, N.W. Second Floor Washington, D.C. 20036 TEL 202.778.9000 FAX 202.778.9100 ® Kirkpatrick & Lockhart LLP Challenge us. ® 4 KIRKPATRICK & LOCKHART LLP INVESTMENT MANAGEMENT ALERT