AnnuAl report 2015 w

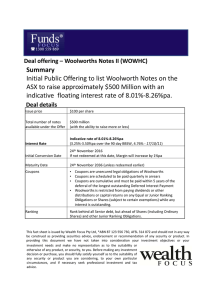

advertisement