Document 13376155

advertisement

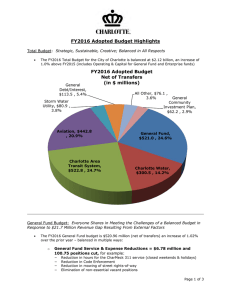

Economic Overview Regional Trends • • • • Steady population growth Construction is booming New and expanded businesses Unemployment near pre-recession levels M e c k l e n b u r g C o u n t y N C . g o v 17 Economic Overview Population Growth 2006 – 815,218 2015 – 1,055,791 M e c k l e n b u r g C o u n t y N C . g o v 18 Economic Overview • Total building permits issued for calendar year 2015 was 16,843 *2015 totals are thru third quarter M e c k l e n b u r g C o u n t y N C . g o v 19 Economic Overview Growth in the Tax Base • Property tax base growth reflects growth and consistency • The split between residential and commercial property has averaged 60% residential and 40% commercial M e c k l e n b u r g C o u n t y N C . g o v 20 Economic Overview Vacancy Rates *2015 totals are thru third quarter M e c k l e n b u r g C o u n t y N C . g o v 21 Economic Overview Home sales rebounding $260,003 M e c k l e n b u r g C o u n t y N C . g o v 22 Economic Overview New and Expanded Business in 2015 Summary of New and Expanded Business Year Firms Jobs Square Feet (millions) Investment (millions) *2015 722 6,406 4.2 $712.2 2014 1,156 11,105 3.1 $616.1 2013 1,138 11,530 5.7 $854.9 2012 1,180 9,595 6.9 $1,252.7 2011 1,089 8,850 6.2 2010 912 10,781 $669.4 6.4 $1,063.7 Source: Charlotte Chamber of Commerce *2015 numbers are for 9 months M e c k l e n b u r g C o u n t y N C . g o v 23 Economic Overview Unemployment Rate M e c k l e n b u r g C o u n t y N C . g o v 24 M e c k l e n b u r g C o u n t y N C . g o v 25 Expenditures by Core Service *2016 is Budget M e c k l e n b u r g C o u n t y N C . g o v 26 Revenue by Source • Property taxes continue to be stable, averaging 67% of total revenue ** includes revenue appropriated to debt service fund M e c k l e n b u r g C o u n t y N C . g o v *2016 is Budget only 27 Real Property Assessed Valuation (in Billions) • Total budgeted assessed valuation for FY2016 is $119.5 billion Assessed Valuation (as of 12/31/15) Budgeted Real Property Billed $97.1 $99.2 Personal Property 9.3 9.7 Vehicles 8.7 3.7 State Certified 4.4 4.7 $119.5 $117.3 Total M e c k l e n b u r g C o u n t y N C . g o v 28 Property Taxes (in Thousands) Property Taxes FY2015 As of 12/31/14 FY2016 As of 12/31/15 Total Levy Billed $920,944 $957,770 Tax Collections $689,515 $649,726 74.87% 67.84% Collections as a % of billed Levy Total Tax Levy for FY2015 $952,894 Total Tax Collections for FY2015 $947,070 FY2015 Collection Rate M e c k l e n b u r g C o u n t y N C . g o v 99.39% 29 Property Tax Collections (in Thousands) FY2015 Actual Current Year Tax Collections Prior Years Tax Collections FY2016 Budget FY2016 Projection $947,070 $956,425 $985,911 (47,019) 4,826 (16,429) M e c k l e n b u r g C o u n t y N C . g o v 30 Sales Taxes (in Thousands) Sales Taxes FY2015 FY2016 $189,410 $209,442 Sales Tax Revenue Through December 48,662 55,225 Sales Tax Revenue to date as a Percent of Total Sales Tax Budgeted 25.69% 26.37% Total Sales Tax Budgeted Total Sales Tax Revenue FY2015 M e c k l e n b u r g C o u n t y N C . g o v $205,860 31 Sales Tax 3,000,000,000 2,500,000,000 Collected Statewide 2,000,000,000 1,500,000,000 Distributed in Mecklenburg County 1,000,000,000 Distributed to Mecklenburg County 500,000,000 0 2011 2012 2013 2014 M e c k l e n b u r g C o u n t y N C . g o v 2015 32 Intergovernmental Revenue (in Thousands) Type Federal FY2015 Actual FY2016 Budget $120,036 $114,591 State 40,748 40,814 Local 7,182 6,141 $167,966 $161,546 Total • Intergovernmental revenue is 11% of County’s FY16 budget M e c k l e n b u r g C o u n t y N C . g o v 33 Charges for Services / Licenses & Permits (in Thousands) Type Charges for Services Licenses & Permits Total FY2015 Actual FY2016 Budget $54,329 25,038 $79,367 $59,135 25,474 $84,609 M e c k l e n b u r g C o u n t y N C . g o v 34 Other Revenue (in Thousands) FY2015 Actual Other Revenue FY2016 Budget $13,023 $9,664 Other Taxes 6,034 10,389 Investment Income 5,149 3,990 Administrative Charges 2,553 2,504 13,374 164 $40,133 $26,711 Transfers Total M e c k l e n b u r g C o u n t y N C . g o v 35 Revenues: General Fund (in Thousands) FY2015 Actual FY2016 Budget FY2016 Forecast $671,956 $729,172 $734,591 Sales Tax 159,106 162,414 165,829 Intergovernmental 155,551 149,140 150,632 Investment Income 4,127 3,360 4,125 Licenses & Permits 25,038 25,474 25,729 Charges for Services 54,329 56,066 56,627 Other (incl. transfers) 33,143 22,721 15,977 Revenue Source Property Tax (includes prior year & interest) Total $1,103,250 $1,148,347 $1,153,510 M e c k l e n b u r g C o u n t y N C . g o v 36 Expenditures: General Fund (in Thousands) Expenditures Business Partners Health & Human Services Detention & Court Support Services Other Transfers Expended Budget Expended as a Percent of Budget FY2015 Actual FY2016 Budget FY2016 Forecast $447,031 265,276 $465,165 281,657 $465,165 276,024 140,286 137,356 132,649 241,197 254,799 251,663 53,945 52,084 52,084 1,147,735 $1,191,061 1,177,585 $1,212,719 $1,191,061 94.6% M e c k l e n b u r g C o u n t y N C . g o v 98.8% 37 Revenues: Debt Service Fund (in Thousands) FY2015 Actual Revenue Source Property Taxes FY2016 Budget FY2016 Forecast $231,251 $234,079 $234,079 Sales Taxes 46,754 47,028 48,704 Intergovernmental 12,415 12,405 12,405 Interest Earned on Investments 1,022 630 630 Charges for Services 1,841 3,070 3,070 963 - - Other Financing Sources Total $294,246 $297,212 $298,888 M e c k l e n b u r g C o u n t y N C . g o v 38 Expenditures: Debt Service Fund (in Thousands) Expenditures Principal Interest Debt Service Reduction Capital Transfers Expended FY2015 Actual FY2016 Budget FY2016 Forecast $157,604 $170,778 $170,778 62,925 73,099 61,755 - 53,334 - 48,900 - 60,800 $269,429 $297,211 $293,333 M e c k l e n b u r g C o u n t y N C . g o v 39 Fund Balance Projection (in Millions) FY2016 Fund Balance Projection General Fund Debt Service Fund Budget Variance Positive / (Negative) - Revenues $5.2 $1.6 - Expenditures 13.5 18.7 3.9 5.5 (42.7) - (24.0) 474.1 5.5 181.6 $450.1 $187.1 Subtotal Appropriated Fund Balance Net Change in Fund Balance Fund Balance – Beginning Fund Balance – End M e c k l e n b u r g C o u n t y N C . g o v 40 Law Enforcement Service District Fund (in Thousands) FY2015 Actual - Revenues - Expenditures Subtotal FY2016 Budget FY2016 Forecast $ 13,384 $14,989 $14,699 (13,863) (14,989) (14,989) (479) - (290) Appropriated Fund Balance - 150 - Net Change in Fund Balance (479) (150) (290) Fund Balance – Beginning 2,138 1,659 1,659 $1,659 $1,509 $1,369 Fund Balance – End M e c k l e n b u r g C o u n t y N C . g o v 41 Fire Service Districts Fund (in Thousands) - Revenues - Expenditures Net Change in Fund Balance Fund Balance – Beginning Fund Balance – End FY2015 Actual FY2016 Budget $ 4,027 $4,364 $3,990 (3,524) (4,364) (4,099) 503 - (109) 1,101 1,604 1,604 $1,604 $1,604 $1,495 M e c k l e n b u r g C o u n t y N C . g o v FY2016 Forecast 42 Summary – Financial Update • Unless otherwise noted slides reflect General and Debt Service funds only. • Revenue projected to exceed budget by 0.5% • Expenditures estimated to be 1.2% below budget M e c k l e n b u r g C o u n t y N C . g o v 43