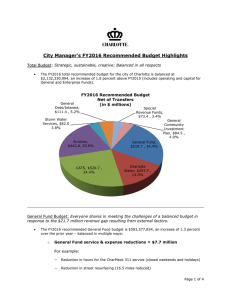

FY2016 Adopted Budget Highlights Strategic, Sustainable, Creative; Balanced in All Respects

advertisement

FY2016 Adopted Budget Highlights Total Budget: Strategic, Sustainable, Creative; Balanced in All Respects • The FY2016 Total Budget for the City of Charlotte is balanced at $2.12 billion, an increase of 1.0% above FY2015 (includes Operating & Capital for General Fund and Enterprise funds) General Debt/Interest, $113.5 , 5.4% FY2016 Adopted Budget Net of Transfers (in $ millions) Storm Water Utility, $80.9 , 3.8% Aviation, $442.8 , 20.9% Charlotte Area Transit System, $522.8 , 24.7% All Other, $76.1 , 3.6% General Community Investment Plan, $62.2 , 2.9% General Fund, $521.0 , 24.6% Charlotte Water, $300.5 , 14.2% General Fund Budget: Everyone Shares in Meeting the Challenges of a Balanced Budget in Response to $21.7 Million Revenue Gap Resulting From External Factors • The FY2016 General Fund budget is $520.96 million (net of transfers) an increase of 1.02% over the prior year – balanced in multiple ways: o General Fund Service & Expense Reductions = $6.78 million and 100.75 positions cut, for example: − − − − Reduction in hours for the CharMeck 311 service (closed weekends & holidays) Reduction in Code Enforcement Reduction in mowing of street rights-of-way Elimination of non-essential vacant positions Page 1 of 3 o Tax Rate Adjustments (tax rate change from 46.87¢ in FY2015 to 47.87¢ in FY2016); − Property tax rate increase of 1.00¢ per $100 of assessed valuation − Reduction of the $47 annual Single Family Residential Solid Waste Fee to $25, increase to the Multi-Family Solid Waste fee from $24 to $25, and implementation of a Solid Waste Small Business fee of $250 per year − Transfer 0.41¢ of Property Tax Rate from Debt Service Fund to the General Fund o Regulatory User Fee Rates Reduce General Fund Subsidy from 16.7% to 7.6% = $1.3 million additional revenue Community Investment Plan: Protects Today and Invests in Our Future • Capital Budgets continue to support all specifically identified projects and makes no changes to the Community Investment Plan adopted by the Council and partially funded by voterapproved bonds in 2014. • The FY2016-FY2020 five year General Community Investment Plan totals to $749.2 million, comprised of the following categories: o Housing and Neighborhood Development: $218.6 million o Transportation: $343.5 million o Economic Development: $60.5 million o Environmental Services: $16.5 million o Facility Investments: $110.1 million • The General Community Investment Plan is supported by the approved FY2014 bond referendum and two proposed bond referenda in 2016 and 2018. A fourth bond referendum in 2020 will be reflected in future five-year Community Investment Plans beginning in FY2017. Enterprise Funds’ Operating Budgets: Balanced With Self-Sustaining Revenues • Aviation = Additional 49 positions to keep up with service complexity and customer demand • CATS = Additional 5,000 revenue service hours; Adds 35 project positions for maintenance, acceptance start-up, and testing of the new rail cars for the Blue Line Extension • Storm Water Services = Revision to 4-tier rate methodology to continue addressing backlog o 61% of Storm Water residential customers will see no change to monthly bill • Charlotte Water = Rate methodology changes to eliminate the Tier 1 subsidy and respond to changing economic and regulatory conditions o Typical water and sewer bill increases by $1.55 per month Employee Compensation: Invests in Employees; Pay Plan Reduced Below Benchmark Average • Budget has been cut to include a reduced Pay Plan to assist in recruitment and retention; Benchmark average for FY2016 is 3.0%, but funded at lower rate: o 0.75% Public Safety market adjustment, o 2.5% or 5.0% Public Safety step adjustment based on rank and current step, o 1.5% Broadband merit budget (for all other general employees) o Adjust salaries of 88 employees who are below 60% of the Area Median Page 2 of 3 Total Tax & Fees Impact: Remains a Strong Value to the Community o A $10.71 annual increase (89¢ per month) for property owners at 50th percentile home value ($141,100); includes property tax adjustments, residential solid waste fee reduction, and changes to water & sewer and storm water rates. City of Charlotte taxes & fees – 50th percentile home value Property taxes on $141,100 home Solid Waste fee (Residential) Water & Sewer (Average user rate) Storm Water (Average user rate) Total Annual Total Monthly Prior Year FY2015 $661.34 $47.00 $682.80 $97.56 $1,488.70 $124.06 FY2016 Budget $675.45 $25.00 $701.40 $97.56 $1,499.41 $124.95 $ Change $14.11 ($22.00) $18.60 $0.00 $10.71 $0.89 % Change 2.1% (46.8%) 2.7% 0.0% 0.7% 0.7% How can I learn more? Information on the City budget can be found at: http://charmeck.org/city/charlotte/Budget Page 3 of 3