CHEI BA/Anthe m BCBS C Custom Plu

advertisement

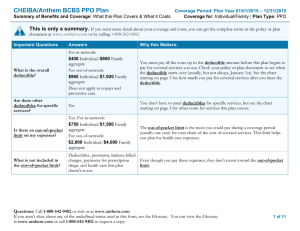

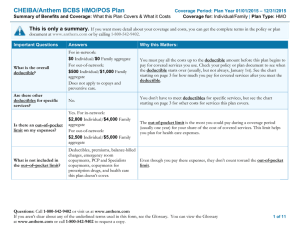

CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional This is only y a summarry. If you want more detail abouut your coveragee and costs, you can get the com mplete terms in th he policy or plan n document at ww ww.anthem.com m or by calling 1-800-542-9402. 1 Importa ant Questions s Answerrs Why W this Matters: What is the overall deductiible? Combineed in-network an nd out-ofnetwork: $600 Ind dividual/$1,200 0 Family aggregatee Does nott apply to preven ntive care. You Y must pay alll the costs up too the deductiblee amount beforee this plan beginss to pay p for covered services you usee. Check your po olicy or plan doccument to see wh hen the deductible starts over (usuaally, but not alwaays, January 1st).. See the chart starting on page 2 for how muchh you pay for co overed services affter you meet the deductible. Are therre other deductiibles for specific servicess? No. You Y don’t have to meet deducttibles for specifiic services, but seee the chart starting on page 2 for other costts for services th his plan covers. Is theree an out–of–poccket limit on n my expenses?? Combineed in-network an nd out-ofnetwork: $2,000 Individual/$4,0 I 000 Family aggregatee The T out-of-pocket limit is the m most you could pay during a covverage period (usually one yearr) for your sharee of the cost of ccovered services. This limit helpss you y plan for heaalth care expensees. What is not included in n the out––of–pocket limiit? Deductib bles, premiums, balance-billed b et Even though yo ou pay these expeenses, they don’tt count toward the out-of-pocke charges, copayments, c and d health care limit. l this plan doesn’t cover. Is theree an overall ann nual limit on n what the plan pays? Yes. Infeertility diagnosticc services have a liffetime maximum m of $2,000/m member in- and out-ofo network combined. Bariatric surgery has a peer occurrence maximum m benefit of $15,000 per member for services receeived from a designateed facility; total per p occurrence maximum benefit shall not exceeed $15,000 per member m inand out-o of-network comb bined. This T plan will paay for covered seervices only up tto this limit durin ng each coveragee ove period, p even if your y own need iss greater. You’re responsible for all expenses abo this limit. The chart c starting on page 2 describes specific coveragee limits, such as limits l on the num mber of office vvisits. Out-of-networkk maximum beneefit for bariatric ssurgery is $1,5000. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 1 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional Does th his plan use a network k of providers? Yes. See www.anthem.co om or call 1800-542-9402 for a list off participatting providers. Plans use the terrm in-network, p preferred, or parrticipating for prroviders in theirr network. See th he chart starting oon page 2 for ho ow this plan payss different kinds of providers. p Do I neeed a referral to see a speciaalist? No. You Y can see the specialist you cchoose without permission from m this plan. Are therre services this plan doesn’t cover? Yes. Some of the servvices this plan dooesn’t cover are listed on page 55. See your policyy or plan documen nt for additionall information abo out excluded seervices. Copaymennts are fixed dolllar amounts (for example, $15) you y pay for coverred health care, uusually when youu receive the serrvice. Coinsurance is your share of o the costs of a covered service,, calculated as a percent p of the alllowed amountt for the service. For example, if the plan’s allowed a amountt for an overnigh ht hospital stay iss $1,000, your co oinsurance paym ment of 20% wo ould be $200. Th his may change if i you haven’tt met your dedu uctible. The amounnt the plan pays for f covered serviices is based on the allowed am mount. If an out--of-network provvider charges m more than the allowed am mount, you may have to pay the difference. For example, if an out-of-network hhospital charges $$1,500 for an ovvernight stay and the allowed d amount is $1,0000, you may haave to pay the $500 difference. (T This is called ballance billing.) This plan may m encourage yo ou to use in-netw work providerss by charging youu lower deductib bles, copaymen nts and coinsurance amounts. Commo on Medica al Event Services You May Need Primary care viisit to treat an injury or illness Specialist visit If you vvisit a health care pro ovider’s office Other practitio oner office visit or clinicc If you h have a test Preventive caree/screening/ immunization Diagnostic testt (x-ray, blood work) w Imaging (CT/P PET scans, MRIs) Yo our Cost If Yo ou Use an In n-Network Provider Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er c 20% coinsurance 20% coinsuraance ––––––––––––––none–––––––––––––– 20% coinsurance c 20% coinsuraance 20% coinsurance c 20% coinsuraance No co opayment (100% % covered) 20% coinsurance c 20% coinsurance c No copaymennt (100% covereed) 20% coinsuraance 20% coinsuraance ––––––––––––––none–––––––––––––– p Chiropractic care is limitted to 12 visits per calendarr year, combinedd in- and out-ofnetworkk. Coveredd preventive caree services are nott subject tto deductible. ––––––––––––––none–––––––––––––– ––––––––––––––none–––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 2 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional Commo on Medica al Event Services You May Need If you n need drugs to treat your illness or conditio on Tier 1 prescripttion drugs Tier 2 prescripttion drugs Tier 3 prescripttion drugs Tier 4 prescripttion drugs If you h have outpatieent surgery Facility fee (e.gg., ambulatory suurgery center) Physician/surggeon fees If you h have a hospitall stay Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er 20% coinsuraance 20% coinsuraance 20% coinsuraance Retail in ncludes a 30-day supply. More infformation about prrescription drug co overage is availablee at www.antthem.com If you n need immediiate medical attentio on Yo our Cost If Yo ou Use an In n-Network Provider 20% coinsurance c 20% coinsurance c 20% coinsurance c 20% coinsurance c 20% coinsuraance c 20% coinsurance 20% coinsuraance ––––––––––––––none–––––––––––––– 20% coinsurance c 20% coinsuraance Emergency roo om services 20% coinsurance c 20% coinsuraance Emergency meedical transportattion 20% coinsurance c 20% coinsuraance Urgent care 20% coinsurance c 20% coinsuraance Facility fee (e.gg., hospital room m) 20% coinsurance c 20% coinsuraance Physician/surggeon fee 20% coinsurance c 20% coinsuraance ––––––––––––––none–––––––––––––– If admittted to the facilityy, failure to obtaain pre-auth horization (no latter than 24 hourrs after adm mission) may ressult in reduced or o no coverage. Maximuum benefit of $2,,000 for ground and $5,0000 for air per triip. ––––––––––––––none–––––––––––––– Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. ––––––––––––––none–––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 3 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional Commo on Medica al Event If you h have mental health, b behavioral health, or substance abuse n needs If you aare pregnant If you n need help recoveriing or have other sp pecial health needs If your cchild needs dental o or eye care Services You May Need Mental/Behaviioral health outp patient services Mental/Behaviioral health inpattient services Substance use disorder d outpatieent services Substance use disorder d inpatien nt services Prenatal and po ostnatal care Yo our Cost If Yo ou Use an In n-Network Provider Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er 20% coinsurance c 20% coinsuraance ––––––––––––––none–––––––––––––– c 20% coinsurance 20% coinsuraance Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. 20% coinsurance c 20% coinsuraance ––––––––––––––none–––––––––––––– 20% coinsurance c 20% coinsuraance 20% coinsurance c 20% coinsuraance Delivery and alll inpatient servicces 20% coinsurance c 20% coinsuraance Home health care 20% coinsurance c 20% coinsuraance Rehabilitation services s 20% coinsurance c 20% coinsuraance Habilitation serrvices 20% coinsurance c 20% coinsuraance Skilled nursing care Not covered Not covered Durable medical equipment 20% coinsurance c 20% coinsuraance Hospice service 20% coinsurance c 20% coinsuraance Eye exam Glasses Dental check-u up Not covered Not covered Not covered Not covered Not covered Not covered Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. ––––––––––––––none–––––––––––––– Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. ––––––––––––––none–––––––––––––– Outpatieent coverage of p physical, occupatiional and speech h therapies. All rehab bilitation and haabilitation visits mit. count to oward your rehab bilitation visit lim ––––––––––––––none–––––––––––––– Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. ––––––––––––––none–––––––––––––– ––––––––––––––none–––––––––––––– ––––––––––––––none–––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 4 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional Exclud ded Service es & Other Covered C Services: Service es Your Plan Does NOT Co over (This isn’tt a complete lisst. Check your policy p or plan d document for o other excluded sservices.) • Acup puncture • Infertility I treatm ment • Routine eyee care (Adult) • Cosm metic surgery • Long-term L care • Routine foo ot care • Den ntal care (Adult) • Weight losss programs Other C Covered Serv vices (This isn’’t a complete lisst. Check your policy or plan document d for oother covered seervices and you ur costs for thesse servicess.) • Bariaatric surgery (lim mits apply) • Hearing H aids (lim mits apply) • Chirropractic care (lim mits apply) • Most M coverage provided outside the United States. S See www..BCBS.com/blueecardworldwide • Private duty nursing (lim mits apply) Your R Rights to Co ontinue Cov verage: If you lo ose coverage und der the plan, then n, depending upo on the circumstaances, Federal an nd State laws maay provide protecctions that allow w you to keep heaalth coveragee. Any such righ hts may be limiteed in duration an nd will require yo ou to pay a prem mium, which maay be significantlyy higher than thee premium you pay p while co overed under the plan. Other lim mitations on yourr rights to contin nue coverage maay also apply. For morre information on o your rights to o continue coverrage, contact your Human Reso ources/Benefits Office. You maay also contact yyour state insuraance ment departm ment, the U.S. Deepartment of Lab bor, Employee Benefits B Securityy Administration n at 1-866-444-32272 or www.doll.gov/ebsa, or th he U.S. Departm of Healtth and Human Seervices at 1-877--267-2323 x615665 or www.cciio.cms.gov. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 5 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional Your G Grievance and a Appeals s Rights: If you haave a complaint or are dissatisfieed with a denial of o coverage for claims c under youur plan, you mayy be able to appeeal or file a grievvance. For question ns about your rigghts, this notice, or assistance, yo ou can contact: Anthem Blue Cross and Blue Shield Appeals Department 700 Broaadway, CAT CO O0104-0430 Denver, CO 80273 Addition nally, a consumer assistance proggram can help yo ou file your appeeal. Contact: Colorado Division of In nsurance ICARE Section 1560 Bro oadway, Suite 8550 Denver, CO 80202 Does this Covera age Provide Minimum Essential E Co overage? The Affo fordable Care Acct requires most people p to have health h care coverrage that qualifiees as “minimum essential coveragge.” This plan oor policy does providee minimum esseential coveragee. Does this Covera age Meet the e Minimum Value Stand dard? The Affo fordable Care Acct establishes a minimum m value sttandard of beneffits of a health plan. p The minimuum value standarrd is 60% (actuaarial value). This health ccoverage does meet m the minim mum value standard for the beenefits it provid des. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 6 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Summa ary of Benefitts and Covera age: What this Plan Covers & What it CosttsCoverage fo or: Individual/F Family | Plan T Type: Traditional Langu uage Access s Services: ––––––––––––––– –––––––––To seee examples of how this t plan might covver costs for a samplle medical situationn, see the next page.––––––––––––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 7 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Coverage fo for: Individual/Family | Plan T Type: Traditional Covera age Examples s Abou ut these Coverage C e Exam mples: These exxamples show ho ow this plan migght cover medical care in given situ uations. Use these examplees to see, in general, how much financial fi protectio on a sample patient might get if they are covered under different plans. This is not a co ost estimato or. Don’tt use these examples to estimaate your actual costs underr this plan. The actual a care yyou receive will be b differeent from these examp ples, and the cosst of that caare will also be differeent. See th he next page for imporrtant information n about these examples. Hav ving a baby Mana aging type 2 diabetes (no ormal delivery) ((routine mainten nance of aw well-controlled ccondition) Amount A owed d to providers s: $7,540 Plan P pays $5,560 Patient P pays $1,980 $ Amount o owed to proviiders: $5,400 Plan pays s $3,920 Patient pa ays $1,480 Sa ample care costs: Hospital H charges (mother) ( Ro outine obstetric care Hospital H charges (baby) ( An nesthesia Laaboratory tests Prrescriptions Raadiology Vaaccines, other prreventive Total $2,700 $2,100 $900 $900 $500 $200 $200 $40 $7,540 Sample carre costs: Prescriptionss Medical Equuipment and Sup pplies Office Visitss and Proceduress Education Laboratory ttests Vaccines, oth her preventive Total $2,900 $1,300 $700 $300 $100 $100 $5,400 Pa atient pays: Deductibles Co opays Co oinsurance Liimits or exclusions Total $600 $0 $1,380 $0 $1,980 Patient pay ys: Deductibles Copays Coinsurance Limits or excclusions Total $600 $0 $880 $0 $1,480 Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 8 of o 9 CHEIBA/Anthem BCBS Custom C Plu us Plan Covera age Examples s Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Coverage fo for: Individual/Family | Plan T Type: Traditional Ques stions an nd answers about the Cove erage Exa amples: What are some of the assum mptions beh hind the Coverrage Examp ples? Cossts don’t include premiums. Sam mple care costs are a based on national averages supplied by b the U.S. Dep partment of Heaalth and Human Servvices, and aren’t specific to a partticular geographic area or health plan. Thee patient’s condition was not an excluded condition.. All services and treaatments started and a endded in the same coverage c period. Theere are no other medical expensees for anyy member covereed under this plaan. Out-of-pocket expeenses are based only o on treating the cond dition in the example. Thee patient received d all care from in nnetw work providers.. If the patient had h receeived care from out-of-network pro oviders, costs wo ould have been higher. h What W does a Coverage Example E show? Can I us se Coverage e Examples to comp pare plans? Fo or each treatmen nt situation, the Coverage C Exxample helps yo ou see how dedu uctibles, co opayments, and d coinsurance can add up. It also helps you seee what expenses might m be left up p to you to pay because b the serviice or treeatment isn’t covvered or paymen nt is limited. Yes. W When you look at the Summary of Does D the Cov verage Example predict my own o care nee eds? No. Treatmennts shown are just examples. The care you would w receive forr this condition could d be different baased on your doctor’s advicee, your age, how serious your condition is, an nd many other faactors. Does D the Cov verage Example predict my fu uture expen nses? No. Coverage Examples are not n cost estimators. Youu can’t use the exxamples to estimate costs for f an actual con ndition. They are for comparrative purposes only. o Your own costs will be different dep pending on the care you receive, the prices your providers charrge, and the reim mbursement your health plaan allows. Benefits and Coverage ffor other plans, you’ll fin nd the same Covverage Examples. When yo ou compare plan ns, check the “Patientt Pays” box in eaach example. Thee smaller tthat number, thee more coverage the plan provides. Are therre other cos sts I should conside er when com mparing plans? m Yes. Ann important costt is the premium you pay. Generally, the lower your premium m, the more youu’ll pay in out-offpocket ccosts, such as cop payments, deductiibles, and coinsu urance. You should aalso consider con ntributions to accountss such as health savings accountss (HSAs), flexible spendin ng arrangements (FSAs) o or health reimbuursement accounts (HRAs) that help you paay out-of-pockett expensess. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 9 of o 9