CHEI BA/Anthe m BCBS H HMO/POS

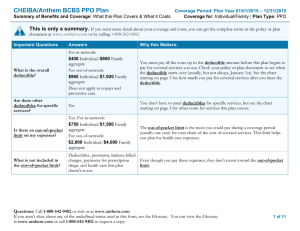

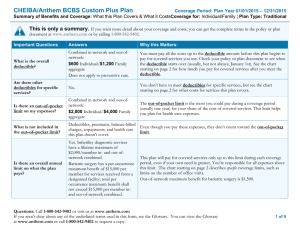

advertisement

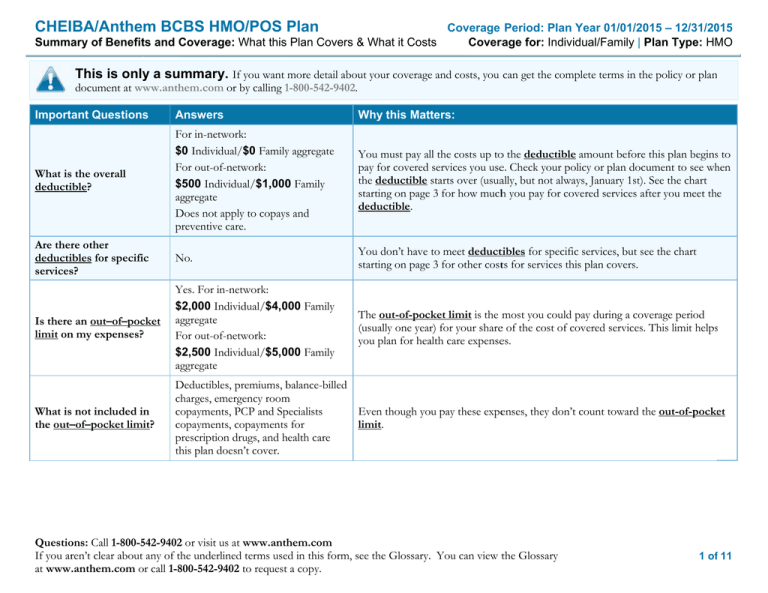

CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO This is only y a summarry. If you want more detail abouut your coveragee and costs, you can get the com mplete terms in th he policy or plan n document at ww ww.anthem.com m or by calling 1-800-542-9402. 1 Importa ant Questions s Answerrs Why W this Matters: What is the overall deductiible? For in-neetwork: $0 Indivvidual/$0 Familyy aggregate For out-o of-network: $500 Ind dividual/$1,000 0 Family aggregatee Does nott apply to copayss and preventivve care. You Y must pay alll the costs up too the deductiblee amount beforee this plan beginss to pay p for covered services you usee. Check your po olicy or plan doccument to see wh hen the deductible starts over (usuaally, but not alwaays, January 1st).. See the chart starting on page 3 for how muchh you pay for co overed services affter you meet the deductible. Are therre other deductiibles for specific servicess? No. You Y don’t have to meet deducttibles for specifiic services, but seee the chart starting on page 3 for other costts for services th his plan covers. Is theree an out–of–poccket limit on n my expenses?? Yes. For in-network: $2,000 Individual/$4,0 I 000 Family aggregatee For out-o of-network: $2,500 Individual/$5,0 I 000 Family aggregatee The T out-of-pocket limit is the m most you could pay during a covverage period (usually one yearr) for your sharee of the cost of ccovered services. This limit helpss you y plan for heaalth care expensees. What is not included in n the out––of–pocket limiit? Deductib bles, premiums, balance-billed b charges, emergency e room m et copayments, PCP and Sp pecialists Even though yo ou pay these expeenses, they don’tt count toward the out-of-pocke copayments, copaymentss for limit. l prescriptiion drugs, and health h care this plan doesn’t cover. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 1 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Is theree an overall ann nual limit on n what the plan pays? Yes. Infeertility diagnosticc services have a liffetime maximum m of $2,000/m member in- and out-ofo network combined. Bariatric surgery has a peer occurrence maximum m benefit of $15,000 per member for services receeived from a designateed facility; total per p occurrence maximum benefit shall not exceeed $15,000 per member m inand out-o of-network comb bined. This T plan will paay for covered seervices only up tto this limit durin ng each coveragee period, p even if your y own need iss greater. You’re responsible for all expenses abo ove this limit. The chart c starting on page 3 describes specific coveragee limits, such as limits l on the num mber of office vvisits. Out-of-networkk maximum beneefit for bariatric ssurgery is $1,5000. Does th his plan use a network k of providers? Yes. See www.anthem.co om or call 1800-542-9402 for a list off participatting providers. If you use an in--network doctorr or other health care provider, tthis plan will payy some or all of th he costs of coverred services. Be aaware, your in-n network doctor or o hospital h may usee an out-of-netw work provider fo or some services.. Plans use the term in-networkk, preferred, or pparticipating for providers in th heir network. Seee the chart startingg on page 3 for hhow this plan paays different kindds of providers. Do I neeed a referral to see a speciaalist? No. You Y can see the specialist you cchoose without permission from m this plan. Are therre services this plan doesn’t cover? Yes. Some of the servvices this plan dooesn’t cover are listed on page 77. See your policyy or plan documen nt for additionall information abo out excluded seervices. Copaymennts are fixed dolllar amounts (for example, $15) you y pay for coverred health care, uusually when youu receive the serrvice. Coinsurance is your share of o the costs of a covered service,, calculated as a percent p of the alllowed amountt for the service. For example, if the plan’s allowed a amountt for an overnigh ht hospital stay iss $1,000, your co oinsurance paym ment of 20% wo ould be $200. Th his may change if i you haven’tt met your dedu uctible. The amounnt the plan pays for f covered serviices is based on the allowed am mount. If an out--of-network provvider charges m more than the allowed am mount, you may have to pay the difference. For example, if an out-of-network hhospital charges $$1,500 for an ovvernight stay and the allowed d amount is $1,0000, you may haave to pay the $500 difference. (T This is called ballance billing.) This plan may m encourage yo ou to use in-netw work providerss by charging youu lower deductib bles, copaymen nts and coinsurance amounts. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 2 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Commo on Medica al Event Services You May Need Primary care viisit to treat an injury or illness Specialist visit If you vvisit a health Other practitio oner office visit care pro ovider’s office or clinicc Preventive caree/screening/ immunization Diagnostic testt (x-ray, blood work) w If you h have a test Imaging (CT/P PET scans, MRIs) If you n need drugs to treat your illness or conditio on Tier 1 prescripttion drugs Tier 2 prescripttion drugs More infformation about prrescription drug co overage is availablee at www.antthem.com Tier 3 prescripttion drugs Yo our Cost If Yo ou Use an In n-Network Provider Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er $20/vvisit 30% coinsuraance ––––––––––––––none–––––––––––––– $20/vvisit 30% coinsuraance $20/vvisit 30% coinsuraance ––––––––––––––none–––––––––––––– Chiropractic care, acupuuncture, massagee therapy limited to a com mbined maximum m of 30 vissits per calendar year, combined inand out--of-network. No co opayment (100% % covered) $30/visit; $500 copaymeent for covered colonoscopy facility servicees Out-of-n network coveredd preventive caree services are not subject tto out-of-networrk deductib ble. 30% coinsuraance ––––––––––––––none–––––––––––––– 30% coinsuraance ––––––––––––––none–––––––––––––– No co opayment (100% % covered) Non-h hospital based facilityy: $80/p procedure Hospiital based facilityy: $100/ /procedure $15/p prescription (Retaill/Mail order) $30/p prescription (Retaill) $60/p prescription (Mail order) $45/p prescription (Retaill) $90/p prescription (Mail order) Not covered Not covered Not covered d Asthma//Diabetic prescrription drugs and Diabeticc supplies from a retail or mail order ph harmacy at 100% % der Retail in ncludes a 30-day supply; Mail ord includess a 90-day supplyy. Certain specialty drugs m must be ordered Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 3 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Commo on Medica al Event Services You May Need Tier 4 prescripttion drugs If you h have outpatieent surgery Facility fee (e.gg., ambulatory suurgery center) Physician/surggeon fees If you n need immediiate medical attentio on If you h have a hospitall stay Yo our Cost If Yo ou Use an In n-Network Provider 30% copayment c with a maxximum payment of $1225/prescription (Retaill), or Maxim mum payment of $2550/prescription (Mail Order) Hospital based Non-H facilityy: $60/visit, or Hospiital based facilityy: $85/visit No co opayment (100% % covered) Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er through a specialty pharrmacy; see the contractt plan for details.. Not covered Specialtyy drugs are not eeligible for the 90 0 day maill order program.. 30% coinsuraance ––––––––––––––none–––––––––––––– 30% coinsuraance ––––––––––––––none–––––––––––––– Emergency roo om services $100/ /visit $100/visit Emergency meedical transportattion $100/ /trip $100/trip Urgent care $50/vvisit $50/visit Facility fee (e.gg., hospital room m) $400/ /admission 30% coinsuraance Physician/surggeon fee No co opayment (100% % covered) 30% coinsuraance Copaym ment is waived if admitted. If admittedd to the facility, ffailure to obtain pre-auth horization (no latter than 24 hourrs after adm mission) may ressult in reduced or o no coverage. Copaym ment is waived if admitted to the facility. ––––––––––––––none–––––––––––––– Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. ––––––––––––––none–––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 4 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Commo on Medica al Event Services You May Need Mental/Behaviioral health outp patient services If you h have mental health, b behavioral health, or substance abuse n needs Yo our Cost If Yo ou Use an In n-Network Provider $20/o office visit, or no cop payment (100% covereed) for outpattient facility Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er 30% coinsuraance In-network: copay applies to office visits and proffessional servicees; coinsurance charged for facility serviices. Mental/Behaviioral health inpattient services /admission $400/ 30% coinsuraance Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. Substance use disorder d outpatieent services $20/o office visit, or no cop payment (100% covereed) for outpattient facility 30% coinsuraance In-network: copay applies to office visits and proffessional servicees; coinsurance charged for facility serviices. Substance use disorder d inpatien nt services $400/ /admission 30% coinsuraance Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. Prenatal and po ostnatal care $20/p pregnancy 30% coinsuraance ––––––––––––––none–––––––––––––– Delivery and alll inpatient servicces $400/ /admission 30% coinsuraance Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. If you aare pregnant Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 5 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Commo on Medica al Event Services You May Need Home health care If you n need help recoveriing or have other sp pecial health needs Your Cos st If You Use an Limitattions & Excep ptions Out-of-Netw work Provide er 30% coinsuraance Rehabilitation services s $20/vvisit 30% coinsuraance Habilitation serrvices $20/vvisit 30% coinsuraance Skilled nursing care No co opayment (100% % covered) 30% coinsuraance Durable medical equipment Hospice service If your cchild needs dental o or eye care Yo our Cost If Yo ou Use an In n-Network Provider No co opayment (100% % covered) Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Eye exam Glasses Dental check-u up No co opayment (100% % covered) No co opayment (100% % covered) Not covered Not covered Not covered 30% coinsuraance 30% coinsuraance Not covered Not covered Not covered ––––––––––––––none–––––––––––––– Outpatieent coverage of p physical, occupatiional and speech h therapies is limited tto 30 visits each per year, combin ned in- and o out-of-network. All rehab bilitation and haabilitation visits count to oward your rehab bilitation visit lim mit. Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. Coverss up to 600 days per year co ombined in- and d out-of-n network. Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. Failure tto obtain pre-autthorization may result in n reduced or no ccoverage. ––––––––––––––none–––––––––––––– ––––––––––––––none–––––––––––––– ––––––––––––––none–––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 6 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Exclud ded Service es & Other Covered C Services: Service es Your Plan Does NOT Co over (This isn’tt a complete lisst. Check your policy p or plan d document for o other excluded sservices.) • Cosm metic surgery • Long-term L care • Routine foo ot care • Den ntal care (Adult) • Routine R eye caree (Adult) • Weight losss programs • Inferrtility treatment Other C Covered Serv vices (This isn’’t a complete lisst. Check your policy or plan document d for oother covered seervices and you ur costs for thesse servicess.) • Acup puncture (limits apply) • Hearing H aids (lim mits apply) • Bariaatric surgery (lim mits apply) • • Chirropractic care (lim mits apply) Most M coverage provided outside the United States. S See www..BCBS.com/blueecardworldwide • Private dutyy nursing (limits apply) Your R Rights to Co ontinue Cov verage: If you lo ose coverage und der the plan, then n, depending upo on the circumstaances, Federal an nd State laws maay provide protecctions that allow w you to keep heaalth coveragee. Any such righ hts may be limiteed in duration an nd will require yo ou to pay a prem mium, which maay be significantlyy higher than thee premium you pay p while co overed under the plan. Other lim mitations on yourr rights to contin nue coverage maay also apply. For morre information on o your rights to o continue coveerage, contact yo our Human Reso ource/Benefits O Office. You maay also contact yyour state insuraance ment departm ment, the U.S. Deepartment of Lab bor, Employee Benefits B Securityy Administration n at 1-866-444-32272 or www.doll.gov/ebsa, or th he U.S. Departm of Healtth and Human Seervices at 1-877--267-2323 x615665 or www.cciio.cms.gov. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 7 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Your G Grievance and a Appeals s Rights: If you haave a complaint or are dissatisfieed with a denial of o coverage for claims c under youur plan, you mayy be able to appeeal or file a grievvance. For question ns about your rigghts, this notice, or assistance, yo ou can contact: Anthem Blue Cross and Blue Shield Appeals Department 700 Broaadway, CAT CO O0104-0430 Denver, CO 80273 Addition nally, a consumer assistance proggram can help yo ou file your appeeal. Contact: Colorado Division of In nsurance ICARE Section 1560 Bro oadway, Suite 8550 Denver, CO 80202 Does this Covera age Provide Minimum Essential E Co overage? The Affo fordable Care Acct requires most people p to have health h care coverrage that qualifiees as “minimum essential coveragge.” This plan oor policy does providee minimum esseential coveragee. Does this Covera age Meet the e Minimum Value Stand dard? The Affo fordable Care Acct establishes a minimum m value sttandard of beneffits of a health plan. p The minimuum value standarrd is 60% (actuaarial value). This health ccoverage does meet m the minim mum value standard for the beenefits it provid des. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 8 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Summa ary of Benefitts and Covera age: What this Plan Covers & What it Costts Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Langu uage Access s Services: ––––––––––––––– –––––––––To seee examples of how this t plan might covver costs for a samplle medical situationn, see the next page.––––––––––––––––––––––– Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 9 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Covera age Examples s Abou ut these Coverage C e Exam mples: These exxamples show ho ow this plan migght cover medical care in given situ uations. Use these examplees to see, in general, how much financial fi protectio on a sample patient might get if they are covered under different plans. This is not a co ost estimato or. Don’tt use these examples to estimaate your actual costs underr this plan. The actual a care yyou receive will be b differeent from these examp ples, and the cosst of that caare will also be differeent. See th he next page for imporrtant information n about these examples. Hav ving a baby Mana aging type 2 diabetes (no ormal delivery) ((routine mainten nance of aw well-controlled ccondition) Amount A owed d to providers s: $7,540 Plan P pays $7,090 Patient P pays $450 $ Amount o owed to proviiders: $5,400 Plan pays s $5,180 Patient pa ays $220 Sa ample care costs: Hospital H charges (mother) ( Ro outine obstetric care Hospital H charges (baby) ( An nesthesia Laaboratory tests Prrescriptions Raadiology Vaaccines, other prreventive Total Sample carre costs: Prescriptionss Medical Equuipment and Sup pplies Office Visitss and Proceduress Education Laboratory ttests Vaccines, oth her preventive Total Pa atient pays: Deductibles Co opays Co oinsurance Liimits or exclusions Total $2,700 $2,100 $900 $900 $500 $200 $200 $40 $7,540 $0 $450 $0 $0 $450 Patient pay ys: Deductibles Copays Coinsurance Limits or excclusions Total Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. $2,900 $1,300 $700 $300 $100 $100 $5,400 $0 $220 $0 $0 $220 10 off 11 CHEIBA/Anthem BCBS HMO/POS H Plan Covera age Examples s Coverage Period: Plan Year 01/01/20 015 – 12/31/20 015 Covera rage for: Indiviidual/Family | P Plan Type: HM MO Ques stions an nd answers about the Cove erage Exa amples: What are some of the assum mptions beh hind the Coverrage Examp ples? Cossts don’t include premiums. Sam mple care costs are a based on national averages supplied by b the U.S. Dep partment of Heaalth and Human Servvices, and aren’t specific to a partticular geographic area or health plan. Thee patient’s condition was not an excluded condition.. All services and treaatments started and a endded in the same coverage c period. Theere are no other medical expensees for anyy member covereed under this plaan. Out-of-pocket expeenses are based only o on treating the cond dition in the example. Thee patient received d all care from in nnetw work providers.. If the patient had h receeived care from out-of-network pro oviders, costs wo ould have been higher. h What W does a Coverage Example E show? Can I us se Coverage e Examples to comp pare plans? Fo or each treatmen nt situation, the Coverage C Exxample helps yo ou see how dedu uctibles, co opayments, and d coinsurance can add up. It also helps you seee what expenses might m be left up p to you to pay because b the serviice or treeatment isn’t covvered or paymen nt is limited. Yes. W When you look at the Summary of Does D the Cov verage Example predict my own o care nee eds? No. Treatmennts shown are just examples. The care you would w receive forr this condition could d be different baased on your doctor’s advicee, your age, how serious your condition is, an nd many other faactors. Does D the Cov verage Example predict my fu uture expen nses? No. Coverage Examples are not n cost estimators. Youu can’t use the exxamples to estimate costs for f an actual con ndition. They are for comparrative purposes only. o Your own costs will be different dep pending on the care you receive, the prices your providers charrge, and the reim mbursement your health plaan allows. Benefits and Coverage ffor other plans, you’ll fin nd the same Covverage Examples. When yo ou compare plan ns, check the “Patientt Pays” box in eaach example. Thee smaller tthat number, thee more coverage the plan provides. Are therre other cos sts I should conside er when com mparing plans? m Yes. Ann important costt is the premium you pay. Generally, the lower your premium m, the more youu’ll pay in out-offpocket ccosts, such as cop payments, deductiibles, and coinsu urance. You should aalso consider con ntributions to accountss such as health savings accountss (HSAs), flexible spendin ng arrangements (FSAs) o or health reimbuursement accounts (HRAs) that help you paay out-of-pockett expensess. Questio ons: Call 1-800-5542-9402 or visitt us at www.anth hem.com If you arren’t clear about any of the undeerlined terms useed in this form, see s the Glossary.. You can view tthe Glossary at www..anthem.com or o call 1-800-542--9402 to requestt a copy. 11 off 11