Mar 12 2015 Natalie Boyd

advertisement

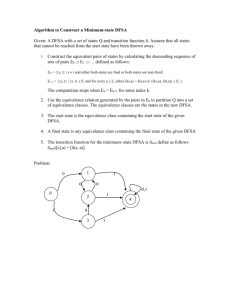

DFSA TO MAKE SUBSTANTIAL CHANGES TO ITS CURRENT CLIENT CLASSIFICATION PROVISIONS First published by Thomson Reuters Accelus Regulatory Intelligence/Compliance Complete Mar 12 2015 Natalie Boyd Following on from the implementation of the manager-friendly qualified investor fund (QIF) fund regime in August 2014, the Dubai Financial Services Authority (DFSA) continues to make strides in attracting international investment firms to the UAE's leading financial free zone, the Dubai International Financial Centre (DIFC). Committed to the continuous development of the DIFC's regulatory regime in line with international best practices, the DFSA has recently announced proposals to make substantial changes to its current client classification provisions with effect from April 1, 2015. (Subject to one exception: the increase of the net asset test from "assessed" Professional Clients will come into effect on April 1, 2016 in order to give firms sufficient time to re-assess clients who currently exist in this category.) The proposals stem from continuing issues identified by the regulator in its dealings with authorised firms grappling with practical difficulties in complying with the existing client classification regime and their own business structures and client base. As is common to most international financial services regulatory regimes, in order to ensure that clients are provided with adequate regulatory protection, the DFSA's existing client classification regime requires authorised firms to determine whether a client is a retail client or non-retail client prior to the provision of any financial services. This distinction is derived from the general consideration that non-retail clients are more likely to have a greater appreciation of inherent investment risk in certain financial products and services and sufficient resources to negotiate related terms and to pursue and enforce available legal remedies. The DFSA has however acknowledged that, since its introduction in 2007, certain parts of the regime have become unwieldy, as evidenced by an increasing number of requests from authorised firms for waivers and modifications. Following an extensive consultation process which culminated in the final quarter of 2014, market feedback has given rise to a number of significant enhancements to, and restructuring of, the existing regulations. While still respecting IOSCO standards, the DFSA has taken care to align its new regulations with the EU regime for investment business. This will be a welcome move for locally regulated branches or members of international firms who have previously been impeded from conducting business in or from the DIFC as a result of unwarranted differences between DIFC and EU client classification requirements. While the current regime of having three types of clients — retail clients, professional clients and market counterparties — will not change, it will be extended to provide for three distinct categories of professional clients. These are: "Deemed" professional clients — wholesale or institutional clients with sufficient expertise and resources to forego the need for the firm to undertake a detailed assessment of the clients' assets or expertise. This category has also been extended to include large undertakings and single family office licencees; "Assessed" professional clients — clients to whom professional client status may be confirmed following satisfaction of a two-fold net asset and knowledge and experience 1 assessment. In order to reflect the effects of inflation, the net asset threshold will be doubled from its current threshold to $1 million and certain additional enhancements have been made to existing look through arrangements and distinctions between individuals and corporate undertakings. "Service -based" professional clients — clients who would be considered to be professional clients based upon the nature of the financial services and associated risks involved. The financial services identified by the DFSA for the purpose of this new categorisation are providing credit to undertaking for business purposes and advising and arranging services for corporate structuring and financing. The first two client categories already exist under the current client classification regime but have been remodelled in order to address firms' concerns as to interpretation and flexibility. The third category is a new addition to the regime and is consistent with the DFSA's risk based approach to its regulations. While firms will not be required to undertake a detailed assessment of service-based clients' expertise or net assets, they will be required to demonstrate to the DFSA that they have a reasonable basis for electing this category of classification. Under the new regime, only servicebased and assessed professional clients will be entitled to opt in as retail clients. Subject to limited conditions, additional flexibility has been built into the regulations in order to allow firms to bundle financial services provided to clients with similar services provided by other group members and, more significantly, to rely on client classifications made by their head offices or other group members, no doubt a welcome relief to firms who experience practical complexities in applying the current classification regime to intricate group wide structures. Such extensive changes to the client classification requirements will inevitably impact on firms' existing client agreements, particularly for those who rely on client agreements entered into by their head office or other group members. The DFSA has cautioned that there will be limited scope for an authorised firm to rely on this type of client agreement and as a consequence will restrict the ability for a firm to do so except in limited circumstances. Importantly, the new regime will not have retrospective effect and as such firms will not be required to unwind existing transactions. The DFSA has been mindful to implement grandfathering provisions into the client classification requirements in order to assist firms with the transition of existing clients and client agreements into the new regime. Natalie Boyd is a finance and regulatory partner at K&L Gates. Based in Dubai, she focuses her practice on conventional and Islamic structured finance, secured bank lending, debt capital markets, derivatives and GCC wide financial services regulation. The views expressed are her own. 2