Proceedings of 8th Annual London Business Research Conference

advertisement

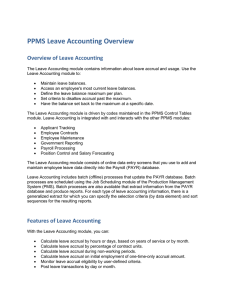

Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 Accrual Accounting in Italian Local Governments in the Context of Public Sector Managerial Changes Claudia Salvatore† and Carla Del Gesso** This article focuses on the main reforms of accounting in Italian local governments within the context of international public management change. It traces the progressive introduction of accrual bookkeeping as a means of improving the decision-making process with the ultimate aim of improving efficiency, accountability and transparency. In Italy, local governments were the precursors of managerial changes in the public sector, and accounting innovations (starting in 1990) are still ongoing. A legislative decree of 1995 introduced accrual reporting in the traditional cash accounting as well as managerial control systems, whereas double-entry bookkeeping will be mandatory in 2014. Currently, budgetary accounting is still prepared on a cash and commitment basis, and the budget continues to play its central authorizing function in the accounting cycle in which accrual reporting has a marginal role. Accrual accounting is often considered a mere formal requirement; consequently, implementation of management by objectives is still largely elusive. Field of Research: Accounting JEL Code: M 41 1. Introduction The aim of this study was to analyse the process of modernization of accounting in Italian local governments (LGs) within the context of significant management changes made in the public sector in the wake of the New Public Management (NPM) movement (Hood 1991, 1995, 2000; Pollitt & Bouckaert, 2000; Barzelay, 2001), which has been widely adopted internationally (Lapsley, 2009). In Italy, the trajectory of public management reforms started with law 142/1990 (Ongaro & Vallotti, 2008, p. 181) that was devoted to the reorganization of LGs. This law introduced accrual principles also in public sector accounting with the aim of reducing costs and optimising allocation of resources. The most significant change for LGs was legislative decree 77/1995 that introduced accrual reporting and managerial control systems. More than 10 years later, law 42/2009 and legislative decree 118/2011 introduced harmonization of the accounting process in LGs. Claudia Salvatore, Associate Professor of Accounting and Business Administration, Department of Economics, Management, Society and Institutions, University of Molise, Campobasso, Italy. Email: claudiasalvatore@unimol.it **Carla Del Gesso, Contract Professor of Public Administration, Department of Economics, Management, Society and Institutions, University of Molise, Campobasso, Italy. Email: carla.delgesso@unimol.it. † Although this article results from a collaboration between the authors, Claudia Salvatore produced sections 4, 4.2, 4.3, 5 and 6, whereas Carla Del Gesso produced sections 2, 3 and 4.1; section 1 was produced by both authors. 1 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 The overall aim of this modernization process was to better meet the users‟ needs; in fact, the integration of the traditional accounting system (cash accounting-based) with accrual data provides economic information about the performance of LGs that can be used for rational decision-making. Thus, in this optics, the implementation of accrual accounting should be viewed as an important opportunity to improve the quality of information, and not merely a legal requirement. However, LGs are still having difficulty in adopting the new accounting model. This paper reports the main reforms introduced into LG accounting and maps the progressive implementation of accrual-based accounting in Italy. 2. Literature Review 2.1 Changes in the Public Sector: New Public Management Reforms During the last two decades, the public sector in many countries has undergone a general process of change as a result of NPM-related reforms (Hood, 1991, 1995). The aim of these reforms was to improve the efficiency of resource use and to enhance transparency and accountability (Lapsley, 2008). Central to these reforms, which introduced managerial and market-based principles in public organizations, has been the transformation of accounting-based techniques (Olson et al., 1998, p. 18; Guthrie, 1998; Lapsley, 1999). Many international studies show that within the global phenomenon of financial NPM reforms, public sector institutions have changed, or are in the process of changing, their financial statements and reports in order to integrate accrual accounting principles (see for example, Guthrie et al, 1999; Olson et al., 2000) by introducing more informative and business-oriented accounting systems. In accordance with this international trend, LGs have undergone a process of reform involving the accounting system information that can be viewed as part of a wider set of public sector reforms (Lapsley & Pallot, 2000, p. 215). The most relevant of these reforms concern accounting tools and performance measurement (Nasi & Steccolini, 2008, p. 181). In particular, the accrual accounting developments related to NPM initiatives have led to radical changes in accounting models (Borgonovi & Anessi Pessina, 2000), but these changes have had a limited impact on the potential users of information (Arnaboldi & Lapsley, 2009). 2.2 Heterogeneity of the Application of Accrual Accounting The evolution from a cash-based budgetary accounting system to an accrual-based financial system and thus to a cost accounting system in LGs has been well documented worldwide (see for example, Lapsley & Pallot, 2000 for Scotland and New Zealand; Yamamoto, 1999 for Japan; Barton, 2009 for Australia; Pina et al., 2009 for a comparative view of EU local governments; da Costa Carvalho et al., 2007 for Portugal; Christiaens, 2001 for Flemish local governments; ter Bogt 2008 for the Dutch public sector; Caccia & Steccolini, 2006, Anessi-Pessina & Steccolini, 2007, Anessi-Pessina et al., 2008 and Nasi & Steccolini, 2008 for Italy; Ridder et al., 2005 for Germany; Goddard, 2005 and Ball, 2005 for the UK; Adam et al., 2011 for a comparative view of the situation in Germany, Italy and 2 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 UK). In particular, Adam et al. (2011) describe the complexity and diversity of accounting practices in two cities in Germany, two in Italy and two in the UK. They also confirm the tensions between the institutional environments of continental European accounting and the Anglo-Saxon world of accounting (see also Caperchione & Lapsley, 2011, p. 104). A main feature of the current situation of LG accounting systems in Europe is heterogeneity in terms of the different patterns and aims of the reforms in the individual politicoadministrative environments (see also Vela & Fuertes, 2000, p. 87). Moreover, international studies reveal that there are various degrees of accrual accounting implementation and legal compliance (see for example Pina et al., 2009). Accounting systems vary widely among countries and between different levels of governments: in some of these systems accrual accounting completely replaces traditional budgetary accounting, in others accrual reporting is adopted in conjunction with cash or commitment-based budgeting (Anessi Pessina et al., 2008, p. 321). In general, many intermediate systems between the extremes of pure cash and full accrual accounting have been adopted in the public sector, and there is no single accrual accounting model (Pina & Torres, 2009, p. 336), but a wide diversity of bookkeeping systems. On the whole, three main situations emerge: (i) countries that have a higher degree of implementation of accrual accounting in both their budgetary and accounting systems (Anglo-American countries); (ii) countries that have implemented accrual accounting but budgeting is still based on cash accounting (many Continental European countries); and (iii) countries whose accounting is predominantly cash-based (Pina & Torres, 2009, pp. 343-345). 2.3 Advantages and Problems of the Adoption of Accrual Accounting The “new accounting models” have various advantages, for instance, they identify the costs of services and of political programmes; enable cost control and efficiency measurement; ensure accountability for the use of resources; and focus on the long-term impact of decisions (Anessi Pessina & Steccolini, 2007, p. 114). In fact, accrual accounting provides complete information about the assets of public organisations and enhances the quantity and the quality of information generated by the accounting system. Moreover, the accrual accounting model provides information about the results obtained (revenue and costs), which can be used to enhance communication with stakeholders, to better evaluate performance and to measure the impact of public policies. Thus, this model allows management to make more rational and efficient choices. However, the implementation of accrual accounting is, on the whole, problematic (see Carlin & Guthrie, 2003 and Lapsley et al., 2009 for an overview of accrual accounting in the public sector) and its actual effects are still limited. In this optics, Pallot (2001) observes that the real success of accrual accounting in the public sector depends on its long-term effect. Thus, the gaps between the formal purposes of accounting reforms and their actual effects persist, and the usefulness of accrual accounting for public sector decision-making is still questioned (see for example, Kober et al., 2010; Carlin, 2005; ter Bogt & van Helden, 2000). 3 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 3. The Methodology The methodology we used is based on a deductive analysis of accounting reforms in Italian LGs, and on doctrinal research related to this topic. 4. Implementation of Accrual Accounting Reforms in Italy Accounting reforms of the Italian LG sector over the last two decades were inspired by managerial principles (Mussari, 1997; Meneguzzo, 1997). The aims were to increase financial autonomy, to privatise activities (Caccia & Steccolini, 2006, p. 155), and lastly to ensure transparent information in order to improve expenditure control, internal decision making and external accountability. 4.1 Law 142/90 - “A Law of Principle” Law 142/1990 was the first attempt to introduce accrual accounting in Italian LGs. The law encouraged reporting of economic information about performance but did not make it compulsory. Although accrual transactions had to be shown (law 142/1990, art. 55, c. 6), the reporting documents (the year-end financial report and the balance sheet) remained exclusively financial-based. Therefore, this first reform was only a “law of principle” because did not allow LGs to implement accrual accounting and did not change their traditional accounting system. 4.2 Legislative Decree 77/1995 and Accrual Accounting in the Reporting Stage Five years later, legislative degree 77/1995 marked a step forward in accrual accounting implementation in Italian LGs. This decree introduced two important innovations: “accrual reporting” and “managerial control systems” (Nasi & Steccolini, 2008, p. 176) in order to enhance accountability, transparency and managerial control. However, the introduction of accrual accounting still did not replace the traditional accounting system (Anessi Pessina & Steccolini, 2007 p. 116). In fact, “accrual reporting” required LGs to produce an operating statement in the reporting phase of their accounting cycle. However, because double-entry bookkeeping was not mandatory, LGs could choose the type of accounting to use to produce this statement. Consequently, three types of accounting systems have emerged: 1) extensive financial accounting; 2) an integrated system; 3) a parallel accounting system (see Anessi Pessina, 2000, pp. 156-158). The extensive financial accounting model is based on a single-entry budgetary accounting method that does not introduce accrual accounting. Local governments elaborate accrual documents in the reporting phase using a “reconciliation statement” that reconverts their cash and commitment data into accrual-based information at the end of the year. The integrated system model consists of financial and accrual accounting in a common database that enables LGs to elaborate all the year-end reporting documents (the yearend financial report, operating statement, and balance sheet). In this configuration of accounting, LGs record their transactions using both single-entry budgetary accounting and double-entry bookkeeping (Anessi-Pessina et al., 2008, p. 322). With this model, they also elaborate a “reconciliation statement” to reconcile ex-post the values of the two 4 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 bookkeeping systems, but only in order to identify discrepancies. Thus, the function of this statement is less important in the integrated accounting model than in the extensive financial accounting model. Lastly, in the parallel accounting system financial and accrual accounting coexist, but they are divided into two independent sub-systems of accounting that are not formally connected. Legislative decree 77/1995 also introduced the executive budget, which enables the Executive body to assign objectives and resources, both financial (on a cash and obligation basis) and non financial, to administrative/technical managers. Therefore, it required LGs to adopt “managerial control systems” (Caperchione & Pezzani, 2000). Subsequently, legislative decree 286/1999, which reorganised public sector control systems, introduced the principle of separation between compliance controls, managerial and strategic controls, and personnel performance evaluation (Caccia & Steccolini, 2006, p. 157). In summary, as shown in Table 1, after the reform of 1995, LGs in Italy maintained the traditional cash and commitment-based system in all phases of their accounting cycle (budgeting, accounting and reporting) and implemented accrual-based reporting although it remained marginal. In fact, budgets still have a merely formal “authorizing” function and retain their key role in LG accounting. In particular, during the budgeting phase, LGs elaborate a triennial strategic plan and a budget structured according to the commitment basis of accounting that must be approved by the Town and/or Provincial Council (Caccia & Steccolini, 2006, p. 156). They also elaborate the executive budget based on the budget approved by the Executive body. In the accounting phase, some LGs have implemented accrual accounting, but most continue to use single-entry bookkeeping. Therefore, in the reporting phase they use the “reconciliation statement” in which their operating statement and balance sheet are derived from modified cash and commitment-based accounting statements through a complex system of adjustments (Mussari, 2005; Anessi-Pessina & Steccolini, 2007, p. 117; Nasi & Steccolini, 2008, p. 182; Adam et al., 2011, p. 118). As shown in Table 1, the accounting system of Italian LGs is, at present, mandatorily accrualbased only in the reporting phase (Anessi Pessina et al., 2008, p. 321). 5 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 Table 1: Evolution of the Implementation of Accrual Principles in the Three Phases of the Accounting Cycle in Italy Phases of accounting cycle BUDGETING ACCOUNTING REPORTING Before Legislative decree 77/1995* Triennial Strategic Plan, Financial budget. Financial accounting Year-end financial report, Balance sheet. Legislative decree 77/1995 Triennial Strategic Plan, Financial budget, Executive budget. Three types of LGs accounting systems emerged: Extensive financial accounting, Integrated accounting, Parallel accounting. Year-end financial report, Balance sheet, Operating statement, (Reconciliation statement). Legislative decree 118/2011 Triennial Strategic Plan, Financial budget, Executive budget. New financial budget templates become available (Decree of the President of the Council of Ministers 28.12.2011) Integrated accounting system. Year-end financial report, Balance sheet, Operating statement, (Reconciliation statement). New accounting document templates become available (Decree of the President of the Council of Ministers 28.12.2011) * Before legislative decree 77/1995, law 142/1990 introduced accrual accounting principles but did not allow LGs to change their traditional accounting documents. 6 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 4.3 Accounting Harmonization and IPSAS In 2009, the Italian Parliament passed a law (42/2009) to introduce fiscal federalism, which includes the principles of harmonization of accounting processes at municipal, provincial and regional level. To meet the accounting harmonization objectives of this law, central Government issued a legislative decree (118/2011) that requires LGs to complement their financial accounting with accrual accounting to ensure disclosure. Subsequently, the President of the Council of Ministers issued a decree on 28 December 2011 that introduced, for some Italian entities, selected based on geographic and demographic criteria, a two-year experimentation phase of accrual accounting starting in 2012. New accounting document templates were also provided. In 2014, all LGs must adopt an integrated accounting system (like the integrated system configuration described above). The purpose of fiscal federalism, which will result in consolidated financial statements (Adam et al., 2011, p. 122), is to uniform the information provided by public accounting in order to make it comparable thereby enhancing transparency in public finances. Accounting harmonization was also introduced to foster a convergence in the final configuration and informative dimension of different countries. Therefore, the aim of the harmonization process is to synchronize the accounting differences existing between countries and between the various public entities and levels of government within each country (see Caperchione, 2012) by introducing accrual principles in all phases of the public accounting cycle. The importance of accrual information within the context of accounting harmonization is also generally viewed by academics and practitioners as an opportunity to develop the International Public Sector Accounting Standards (IPSAS) (Rossi & Trequattrini, 2011; Farneti & Pozzoli, 2005). In fact, in Italy, in which the budgets are still cash-based, the present accounting heterogeneity at regional and municipal level (Grandis & Mattei, 2012, p. 33), is a barrier to the implementation of IPSAS. Although the recent harmonization reforms (from 2009) do not mention IPSAS principles, the convergence of local and central entities to the new accounting principles and to a homogeneous balance scheme in 2014 should foster the implementation of IPSAS. 5. Discussion Implementation of accrual accounting by Italian LGs occurs within the context of public management reforms based largely on NPM principles, which introduced a managerial vision in the public sector in the attempt to overcome bureaucratic obstacles to cost control and efficiency measurement. NPM-related reforms have transformed the significance of accountancy (Lapsley, 1999, p. 202). In fact, they enable the evaluation of the assets of public organizations, foster the adoption of managerial techniques typical of the private sector and consolidate performance management (Rossi & Trequattrini, 2011, p. 137). In this new cultural context, the adoption of accrual accounting revealed that public entities need to use their limited resources better and with economic criteria. Thus, by providing relevant information for political decision-makers and administrative/technical managers, accrual accounting also plays a key role in strategic performance management (Kloot & Martin, 2000). Moreover, by evaluating performance (service costs, efficiency and results obtained) and providing an estimate of the public value created, accrual accounting also 7 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 helps to improve assessment of managerial decisions. In fact, accrual accounting is often recognised to be better than traditional budgetary accounting in providing relevant information to external and internal users (politicians, managers and citizens) about the management of public assets (for a discussion, see Anessi-Pessina & Steccolini, 2007). However, empirical studies demonstrate that these advantages of accrual accounting have not had a significant impact on the public sector. In fact, accrual accounting information is rarely used by public organizations for internal management control purposes, and moreover public managers are usually not familiar with managerial techniques (Paullson, 2006, p. 60). Italian LGs may be considered the first public entities in Italy to include economic surveys in their financial accounting. Despite a long process of accounting reforms, the usefulness of the integrated accounting systems for their decision-making is influenced by such cultural variables as the perceptions of Chief Financial Officers and geographic location (Anessi Pessina et al. 2008, p. 337). As emerges from an empirical study (see Nasi & Steccolini 2008, p. 186), in Italy, the integrated configuration of accounting is often chosen merely to meet the legal requirements; rarely is it chosen to improve cost-accounting and management control. In this scenario, it is difficult to implement management by objectives in Italy (Pavan & Reginato, 2012, p. 362) because budgetary accounting is still financial-based, and accrual implementation is still generally considered merely a formal requirement. In fact, although an executive budget, in which the Executive body assigns objectives and resources to administrative/technical managers was implemented in 1995, it derives from a budget that is not yet economic-based. Moreover, although accrual accounting has been implemented by many LGs, most politicians, who are the internal users of the accrual accounting systems, are reluctant to use them to improve strategic and management control. The latest accounting reform in Italy (legislative decree 118/2011) confirms the formal “authorizing” function of budgets and the fundamental role of financial accounting to reach LG objectives. However, it makes accrual accounting mandatory in order to determine revenue, to manage costs and to obtain information about economic resources (acquired and used). At the end of the ongoing experimentation phase, Italian LGs should reach a homogeneous level of accounting in which each entity adopts the integrated system. As long as budgets continue to have a central “authorizing” function in the accounting cycle, financial accounting will prevail because decisions will continue to be made from cash-and commitment-based data, while accrual accounting will be implemented only to comply with the law. This incongruity could be addressed by training human resources to implement the advantages of accrual accounting. Politicians and administrative/technical managers should be aware that accrual accounting can support decision-making and help to devolve management responsibilities. In fact, as reported by Anessi Pessina (2000) and Caperchione (2000), traditional budgetary accounting in LGs does not provide reliable information on the medium and long-term impacts of government policies; has incomplete information about the transactions recorded; provides limited economic information about 8 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 the effects of management on assets, liabilities and economic results; does not allow expenditure control; and finally, it contributes little to decision-making. In an era of declining financial resources, LGs should, more than ever, reinforce the link between strategic goal-setting and performance management in order to increase accountability and disclosure to citizens and stakeholders. 6. Conclusions In the wake of public management reforms, LG accounting in Italy has been undergoing a process of change since 1990. However, the complexity of the informative accounting system resulting from the various reforms together with cultural resistance will probably delay the implementation of authentic managerial innovation. Double-entry bookkeeping will be mandatory for all public bodies starting from 2014. Thus, serious efforts should be made to overcome the opposition to accrual implementation in public accounting. Politicians and managers should accept the change as an opportunity to implement a new cultural way of responsive management based on a rational modus operandi. This implies that politicians and administrative/technical managers must understand that accounting is not a mere formality, and recognize that it provides crucial information for management control. In fact, the integrated configuration of accounting (cash and accrual) completes the set of information required in the decision-making process to enhance the planning of objectives and the results of performance in an efficient cycle of plan-do-check-act. However, in Italian LGs only financial information continues to be used for managerial decision-making. Consequently, the process of managerial changes, which entails the transition from bureaucracy to responsive management, is well underway, but not yet complete. References Adam B., Mussari R., Jones R. (2011), The diversity of accrual policies in local government financial reporting: an examination of infrastructure, art and heritage assets in Germany, Italy and the UK, Financial Accountability & Management, Vol. 27, No. 2, pp. 107-133. Anessi Pessina E. (2000), La contabilità delle aziende pubbliche. Contabilità finanziaria e contabilità generale negli enti locali, Egea, Milano. Anessi Pessina E., Nasi G., Steccolini I. (2008), Accounting reforms: determinants of local governments‟ choices, Financial Accountability & Management, Vol.24, No. 3, pp. 321342. Anessi-Pessina E. & Steccolini I. (2007), Effects of budgetary and accruals accounting coexistence: evidence from Italian local governments, Financial Accountability & Management, Vol.23, No. 2, pp. 113-131. Arnaboldi M. & Lapsley I. (2009), On the implementation of accrual accounting: A study of conflict and ambiguity, European Accounting Review, Vol.18, No. 4, pp. 809-836. Ball A., (2005) Environmental accounting and change in UK local government, Accounting, Auditing & Accountability Journal, Vol. 18, No. 3, pp.346 – 373. 9 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 Barton A. (2009), The Use and Abuse of Accounting in the Public Sector Financial Management Reform Program in Australia, ABACUS (Journal of Accounting, Finance and Business Studies), Vol. 45, No. 2, pp. 221-248. Barzelay M. (2001), The new public management: improving research and policy dialogue, University of California Press, Berkeley. Borgonovi E. & Anessi Pessina E. (2000), „Accounting and Accountability in Local Government: A Framework‟, In: Caperchione E. & Mussari R. (eds) (2000), Comparative issues in local government accounting, Kluwer Academic Publishers, USA, pp. 1-9. Caccia L. & Steccolini I. (2006), Accounting change in Italian local governments: What‟s beyond managerial fashion?, Critical Perspectives on Accounting, Vol. 17, No. 2-3, pp.154–174. Caperchione E. (2000), „Trends and Open Issues in Governmental Accounting Systems: Some Elements of Comparison‟, In: Caperchione E. & Mussari R. (eds) (2000), Comparative issues in local government accounting, Kluwer Academic Publishers, USA, pp. 69-85. Caperchione E. (2012), L‟armonizzazione contabile nella prospettiva internazionale, Azienda Pubblica, No. 1, pp. 83-99. Caperchione E. & Lapsley I. (2011), Foreword. Making comparisons in government accounting, Financial Accountability & Management, Vol.27, No. 2, pp. 103-106. Caperchione E. & Pezzani F. (eds) (2000), Responsabilità e trasparenza nella gestione dell’ente locale, Egea, Milano. Carlin T.M. (2005), Debating the impact of accrual accounting and reporting in the public sector, Financial Accountability & Management, Vol.21, No. 3, pp. 309-336. Carlin T. & Guthrie J. (2003), Accrual Output Based Budgeting Systems in Australia: The Rhetoric-reality Gap, Public Management Review, Vol. 5, No. 2, pp. 145–62. Christiaens J. (2001), Converging New Public Management Reforms and Diverging Accounting Practices in Flemish Local Governments, Financial Accountability & Management, Vol. 17, No. 2 pp. 153-170. da Costa Carvalho J.B., Camões P.J., Jorge S.M., Fernandes M.J. (2007), Conformity and Diversity of Accounting and Financial Reporting Practices in Portuguese Local Government, Canadian Journal of Administrative Sciences, Vol. 24, No. 1, pp. 2-14. Farneti G. & Pozzoli S. (eds) (2005), Principi e sistemi contabili negli enti locali. Il panorama internazionale, le prospettive in Italia, FrancoAngeli, Milano. Goddard A. (2005), Accounting and NPM in UK local government – contributions towards governance and accountability, Financial Accountability & Management, Vol.21, No. 2, pp. 191-218. Grandis F.G. & Mattei G. (2012), Is There a Specific Accrual Basis Standard for the Public Sector? Theoretical Analysis and Harmonization of Italian Government Accounting, Open Journal of Accounting, No. 1, pp. 27-37. Guthrie J. (1998), Application of Accrual Accounting in the Australian Public Sector: Rhetoric or Reality?, Financial Accountability & Management, Vol. 14, No. 1, pp. 1–19. Guthrie J., Olson O., Humphrey C. (1999), Debating developments in new public financial management: The limits of global theorizing and some new ways forward, Financial Accountability and Management, Vol. 15, No. 3 & 4, pp. 209-228. Hood C. (1991), A public management for all seasons?, Public Administration, Vol. 69, pp. 3-19. 10 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 Hood C. (1995), The “new public management” in the 1980s: variations on a theme, Accounting, Organizations and Society, Vol. 20, No. 2-3, pp. 93-109. Hood C. (2000), The art of the state. Culture, rhetoric, and public management, Oxford University Press, Oxford. Kloot L. & Martin J. (2000), Strategic performance management: A balanced approach to performance management issues in local government, Management Accounting Research, No. 11, pp. 231–251. Kober R., Lee J., Ng J. (2010), Mind your accruals: perceived usefulness of financial information in the australian public sector under different accounting systems, Financial Accountability & Management, Vol.26, No. 3, pp. 267-298. Lapsley I. (1999), Accounting and the New Public Management: Instruments of Substantive Efficiency or a Rationalising Modernity?, Financial Accountability & Management, Vol. 15, No. 3 & 4, pp. 201–207. Lapsley I. (2008), The NPM agenda: back to the future, Financial Accountability & Management, Vol. 24, No. 1, pp. 77–96. Lapsley I. (2009), New Public Management: The Cruellest Invention of the Human Spirit?, ABACUS (Journal of Accounting, Finance and Business Studies), Vol. 45, No. 1, pp. 1-21. Lapsley I., Mussari R., Paulsson G. (2009), On the Adoption of Accrual Accounting in the Public Sector: A Self-Evident and Problematic Reform, European Accounting Review, Vol.18, No. 4, pp. 719–723. Lapsley I. & Pallot J. (2000), Accounting, management and organizational change: A comparative study of local government, Management Accounting Research, No. 11, pp.213-229. Meneguzzo M. (1997), Ripensare la modernizzazione amministrativa e il New Public Management. L‟esperienza italiana: innovazione dal basso e sviluppo della governance locale, Azienda Pubblica, No. 6, pp. 587-606. Mussari R. (1997), „Autonomy responsibility and new public management‟, In: Jones L.R. & Schedler K. (eds), International perspectives on the new public management, Jai Press, London. Mussari R. (2005), „Public Sector Financial Reform in Italy‟, In: Guthrie J., Humphrey C., Jones L.R., Olson O. (eds.), International Public Financial Management Reform, IAP, Greenwich, pp. 139–68. Nasi G. & Steccolini I. (2008), Implementation of accounting reforms. An empirical investigation into Italian local governments, Public Management Review, Vol. 10, No. 2, pp. 175-196. Olson O., Guthrie J., Humphrey C. (eds) (1998), Global warning: debating international developments in new public financial management, Capelen Akademisk Forlag As, Oslo. Olson O., Humphrey C., Guthrie J. (2000), Caught in an evaluatory trap: The dilemma of “public services” under NPFM, ElASM International Conference on Accounting, Auditing and Management in Public Sector Reforms, Zaragoza, Spain. Ongaro E. & Valotti G. (2008), Public management reform in Italy: explaining the implementation gap, International Journal of Public Sector Management, Vol. 21 No. 2, pp. 174-204. 11 Proceedings of 8th Annual London Business Research Conference Imperial College, London, UK, 8 - 9 July, 2013, ISBN: 978-1-922069-28-3 Pallot J. (2001), A Decade in Review: New Zealand‟s Experience with Resource Accounting and Budgeting, Financial Accountability & Management, Vol. 17, No. 4, pp. 383–400. Paulsson G. (2006), Accrual Accounting in the Public Sector: Experiences From the Central Government in Sweden, Financial Accountability & Management, Vol.22, No. 1, pp. 47-62. Pavan A. & Reginato E. (2012), Programmazione e controllo nelle amministrazioni pubbliche. Gestione per obiettivi e contabilità integrata, Giuffrè, Milano. Pina V. & Torres L. (2009), Reshaping Public Sector Accounting: An International Comparative View, Canadian Journal of Administrative Sciences, Vol. 20, No. 4, pp. 334-350. Pina V., Torres L., Yetano A. (2009), Accrual Accounting in EU Local Governments: One Method, Several Approaches, European Accounting Review, Vol.18, No. 4, pp. 765807. Pollitt C. & Bouckaert G. (2000), Public management reform. A comparative analysis, Oxford University Press, Oxford. Ridder H.G., Bruns H.J., Spier F. (2005), Analysis of public management change processes: the case of local government accounting reforms in Germany, Public Administration, Vol. 83, No. 2, pp. 443-471. Rossi N. & Trequattrini R. (2011), IPSAS and Accounting Systems in the Italian Public Administrations: Expected Changes and Implementation Scenarios, Journal of Modern Accounting and Auditing, Vol. 7, No. 2, 134-147. ter Bogt H.J. (2008), Management accounting change and new public management in local government: a reassessment of ambitions and results – an institutionalist approach to accounting change in the Dutch public sector, Financial Accountability & Management, Vol.24, No. 3, pp. 209-241. ter Bogt H.J. & van Helden G.J. (2000), Accounting Change in Dutch Government: Exploring the Gap Between Expectations and Realizations, Management Accounting Research, Vol. 11, No. 2, pp. 263–79. Vela J. M. & Fuertes I. (2000), „Local Government Accounting in Europe: A Comparative Approach‟, In: Caperchione E. & Mussari R. (eds) (2000), Comparative issues in local government accounting, Kluwer Academic Publishers, USA, pp. 87-102. Yamamoto K. (1999), Accounting System Reform in Japanese Local Governments, Financial Accountability & Management, Vol.15, No. 3-4, pp. 291-307. 12