Winning Strategy 1: Strategy Deployment Plan

advertisement

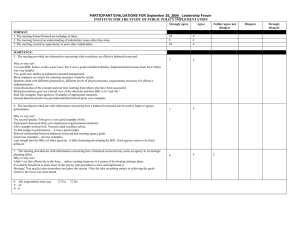

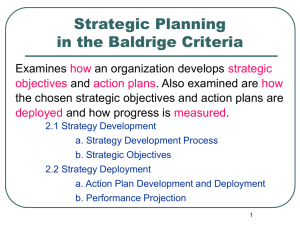

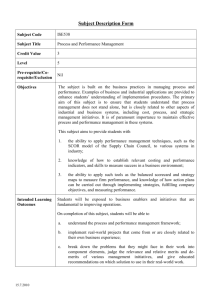

Winning Strategy 1: Strategy Deployment Plan Overview of BSC Comparison of BSC ,Policy Deployment (Hoshin Kanri) & Business Process ReEngineering Overview of organizational Strategy Recommended Deployment of Strategy using BSC Summary Conclusion References Created in 1992 by Kaplan and Norton A holistic method of measuring organizational performance Complements traditional financial assessment methods Balances short term activities with long term plans Functions as a strategy deployment tool BSC is based on four (4) premises: Finance Clients Internal Processes; and Learning and Growth FINANCIAL PERSPECTIVE Analysis of financial performance (Reports & Ratios) Determining company financial health Addresses issues such as profitability, ROCE, sales figures, liquidity, debt figures, etc. CLIENTS PERSPECTIVE Focuses on customers needs Assesses how well products/services fulfill consumers requirements Market Segmentation & Customer Surveys INTERNAL PROCESSES Concerned with operational activities within the organization Analyzes how efficiently and effectively they function Aims to ensure they work towards attaining organizational goals LEARNING AND GROWTH PERSPECTIVE Examines how much organizational learning occurs within the company Concerned with employees growth and skills development Analysis is done on each perspective The requirements for each are defined The cause & effect relationship between them is expressed in a strategic map Here, organizational goals and objectives, defined action plans and performance indicators selected are reflected. The BSC may be used alongside other strategic development methodologies. Pro’s Clarifies and translates vision and strategy. Communicates and link strategic objectives and measures. Helps plan, set targets and align initiatives. Enhances strategy feedback and learning in division Con’s Overly abstract Balanced Scorecard goals are easy to reach but hard to quantify Implementation of the balanced scorecard is time consuming Balanced Scorecard does not include direct financial analysis of risk management COMPARISON OF BSC, HOSHIN KNARI (POLICY DEPLOYMENT) AND BPR BSC HOSHIN KANRI BPR Performance measurement system & strategy deployment tool Strategy deployment tool A tool for the introduction of radical change Focuses on cause & effect relationships between strategic objectives Way of deployment, communication, & execution of strategy Aims to re-design business processes to improve efficiency and effectiveness Describes the perspectives to focus upon Organizational objectives are developed by employees through the ‘catchball’ process Encourages organizational communication through brainstorming sessions Describes the perspectives to focus upon All endeavours are aligned to the same vision and goal Involves analysis of risk assessment BSC disadvantages can be mitigated in the following ways; Combining BSC with a complimentary deployment tool e.g Hoshin Kanri Ensuring that strategic objectives are S.M.A.R.T Making effort to avoid measure bias. i.e using the same measurement for different objectives Carrying out analysis of Risk Management i.e opportunity cost should be considered Increase market share in Europe Actions and costs Research European market pricing structure, discounts, distribution, competition, product and safety specifications etc. Identify a distributor who could take on the European sales and handle any future expansion of the market. Need new computerized finance package for Euros and to reduce Finance workload (estimated cost £25,000) Identify successful European promotional campaigns and put together a winning promotions strategy. Increase marketing spend to £250k. Increase price of both products by approximately 2.5% (in line with inflation). Reorganize the Leisure sales team to three external sales representatives and three internal sales people to handle client follow-up by taking on two new salespeople and take on a European sales representative in the Rescue/Military sales team. Continue to invest in new technology costing an estimated £150k on capital expenditure. Reorganize Finance and HR departments by moving wages and salaries manager into the Finance department. Reduce the remaining clerical staff in HR to a total of one To be the second largest inflatable boat Production Company in Europe in 5 years and start to expand in the U.S. market. FINANCE CLIENTS INTERNAL PROCESS LEARNING OBJECTIVE OBJECTIVE • Increase Production Capacity by 40% OBJECTIVE • Increase customer satisfaction to 85% OBJECTIVE • • Increase the number of training/skill development programs for employee. • Increase market share to 30% of the European market • • Reduce overhead costs By 20%. • • Reduce Bureaucracy To get information regarding the target areas, taste and best market opportunities of U.S. market. Increase R.O.C.E. from 27.05% to 35% MEASURES Increased profit figures. o Increase in sales in Europe market o Reduction in inventories. o TARGETS Increase R.O.C.E. to 30% in first 2 years Increases R.O.C.E. by 33% in 4 years INITIATIVES Identify distributor for European market MEASURES Increasing marketing spending to £250 k. MEASURES Customer retention Customer complaints. Sales in European Market Reduction in time taken to approve discounts. Production figure Reduction in non-value added activities. o Analyzing surveys TARGETS • Increase European market share to 20% at the end of 3 years. • TARGETS Increase production by 30% at the end of 3 years. Reduce overhead costs Get at least 75% of survey by 10% at the end of 3 forms back from the pool years. Reduce time taken to of our customers. approve discounts by 75% at he end of 5 years. INITIATIVES • Development European marketing campaigns • • Re-organize sales team to handle client service Increase market spends to £250k. INITIATIVES Restructure organizations departments. Purchasing financial computer information systems to reduce workload Invest in new technology MEASURES Employee efficiency Employee productivity Knowledge base regarding the U.S. market TARGETS • Increase employee efficiency by 50% • Increase employee productivity by 50% • Identify potential distributors in the U.S. market. INITIATIVES • Increase investment in research activities • Invest in new technology. • Form a team of people to research about the U.S. market. The Organizational objectives have been clearly outlined for each perspective Specific targets were defined Performance Measures are suggested The action steps stated in the strategy were highlighted as initiatives The BSC can be efficiently used in the deployment of this selected organizational strategy It will allow for the clarification and translation of the company vision As well as provide feedback to enhance the organizational learning process Asan, S.S & Tanyas, M (2007) Integrating Hoshin Kanri and the Balanced Scorecard for Strategic Management: The Case of Higher Education. Total Quality Management, 18(9)Pp. 999 –1014 Pettus, M.L (2006) Utilizing Capabilities to Increase Stakeholder Wealth: A Balanced Scorecard Approach. Competition Forum, 4(1) pp. 15 Brewer, P., (2003) Putting Strategy Into The Balanced Scorecard. Articles Of Merit 2003 Competition. Pp.1-11 Salterio, S. & Webb, A., (2003)The balanced scorecard. CA Magazine, 136 (6) Pp. 3 Kaplan, R.S., & Norton, D.P., (1996) Using the balanced scorecard as a strategic management system. Harvard Business Review. Pp. 75-85 White, T. (2012) Balanced Scorecard - Advantages and Disadvantage. [Online] http://tamarawilhite.hubpages.com/hub/Balanced-ScorecardPros-and-Cons. Access Date: 1st February, 2012. Shin, M & Jamella, D.F (2002) Business process re-Engineering and performance Improvement: The case of chase Manhattan bank, Business Process Management, 8(4). Pp. 351-363