Proceedings of Eurasia Business Research Conference

advertisement

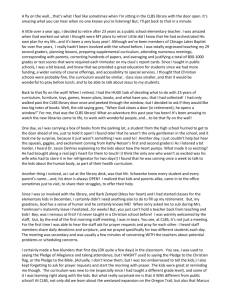

Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Factors Influencing the Success of Cash Loan Businesses in Maun (Botswana) in 2014 George Mukwapuna* and Reinford Khumalo** Bank of Botswana‟s mission is to contribute towards the financial well being of the financial sector so that Botswana attains orderly, balanced and sustainable economic development (Bank of Botswana Annual Report, 2013). This, among other objectives, is directly intended to lead to the creation of many and varied financial enterprises in order to achieve total financial inclusivity of the entire population. Sadly, most of the Cash Loan Businesses (CLBs) are performing below expectations; teetering on the brink of collapse; and most do not even seem to grow and develop into large entities. This paper seeks to identify factors contributing to the success of CLBs owned by private individuals and, ultimately, determine a model for their success. A sample of 99 respondents comprising of CLBs owners/managers and clients were identified in Maun and interviewed using predesigned interview guideline questions which sought to identify factors influencing their success. Results were summarized and common themes were identified. A qualitative prediction model was then developed to identify what contributes towards the success of CLBs. Groups of factors comprising of entrepreneur‟s personality traits and skills, project idea attributes, managerial skills and training, organizational characteristics and the external environment were identified as critical elements defining success or failure of a CLB. Keywords: Cash Loan Businesses, entrepreneur, personality traits and skills, project idea attributes, managerial skills and training, organizational characteristics, external environment JEL Codes: G23, M13 and M10 1. Introduction Botswana is widely known to be one of those rare underdeveloped countries that have successfully morphed into a relatively prosperous middle income country. Further, it has a fairly resilient financial sector that is supported by a vibrant central bank. Botswana‟s central bank, Bank of Botswana, has adopted the mission that seeks to contribute towards the well being of the financial sector in order to achieve an orderly, balanced and sustainable economic development (Bank of Botswana Annual Report, 2013). _____________________________________________ * Senior Lecturer Botho University, Botswana and PhD Student at National University of Science and Technology, Zimbabwe. Email: gmukwapuna@yahoo.co.uk **Director of Graduate School, National University of Science and Technology, Zimbabwe. Email: reinford.khumalo@gmail.com Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Despite all its efforts Botswana is estimated to be dogged by financial exclusivity that hovers around 33 percent (Bank of Botswana Annual Report, 2011). Consequently, to reduce this financial exclusivity many and varied financial enterprises are being encouraged to grow and develop. This enables financial deepening and increasing the breadth of the financial sector. The new institutions and the products offered cater for the needs of the previously marginalized groups (Serrano-Cinca and Gutierrez-Nieto, 2013). Thus financial institutions that we now find in Botswana comprise of not only the traditional institutions (like banks, insurance firms and finance houses) but also a new form of financial enterprise called the Cash Loan Business (CLB) or Micro-Lender (ML). Most of these CLBs are sole proprietorships or partnerships or small private limited firms that are owned by individual entrepreneurs or partnerships. Sadly, most of these CLBs are collapsing; teetering on the brink of collapse; remain stagnant and do not seem to grow and develop into large entities. The research problem is explained in this paragraph. It is a fact that the benefits of CLBs both as financial enterprises and as business enterprises have been documented and appreciated in extant literature. Such benefits range from socio-political factors and economic considerations. However, the poor performance of the CLBs still remains a major concern. This paper seeks to identify why these CLBs are not performing as well as they are intended. Thus the purpose of the study was to identify factors influencing the success of CLBs in Botswana in 2014. It was a qualitative study whose design was to describe the situation affecting CLBs. In this study the objective sought was to identify any factors that affect the performance of the CLBs and a combination of both the deductive and inductive approaches were applied in order to develop a more convincing answer to the research questions. The significance of the research was that the study would benefit policy makers, researchers and potential as well as current CLBs‟ entrepreneurs by enabling them to better support the creation growth and development of the CLBs for the benefit of their economies. As is common in all research exercises salient terms would need to be described. Such descriptions applied in this research study are offered below; Cash Loan Business – refers to a business enterprise that is dedicated towards the provision of financial solutions in the form of short-term credit to private individuals. Such entities are registered under Section 2 of the Non-Bank Financial Institutions Regulatory Authority (NBFIRA) Act. Short-term credit – refers to the 30-day loans also known as „payday‟ loans because they need to be repaid on the day that one obtains his or her salary or wage. Success of financial enterprise – refers to the ability of an enterprise to survive for at least three years. This qualification is deliberately made more stringent in order to identify enterprises that are truly successful. Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 2. Literature Review The paper discusses a motley collection of factors that have been observed by various authors as influencing the success of enterprises in general as well as those factors that have also been linked to the success of financial enterprises. The first factor to be considered is the issue of gender of the entrepreneur. Conceptual research has been carried out by Marlow and McAdam (2013) to explore the concept of performance and underperformance in relation to gender. The results showed that linking women entrepreneurs‟ enterprises to poor performance is a notion emanating from gender bias and is not backed by empirical evidence. The other variable of interest is the entrepreneurial intent and personal skills and traits. Entrepreneurial intent has been identified as a critical factor determining the success of an enterprise (Gomezelj and Kusce, 2013; Prabbhu et al, 2012). Further, it has been noted that if an entrepreneur has a proactive personality then there is a robust correlation with entrepreneurial intent. Having a sound knowledge of the business has also been attributed to the success of an entrepreneur (Athur et al, 2012; Lean 2012; Varian, 2006). Further, Zimmerer and Scarborough (2005) corroborate by saying that successful entrepreneurs are like sponges that soak up as much knowledge as they can from a variety of sources. Learning becomes a constant ritual in their day-to-day operations. Audet and Couteret (2012) single out coaching as a prerequisite for successful entrepreneurships. They argue that this must be supported by the entrepreneur‟s attitude to change. This is so because learning and an avid desire for change correspond to the desire to change both ones‟ self as well as the environment as an active agenda for novel ideas. Mamoria et al (2008) assert that it is security needs that will tend to motivate and enhance productivity and thus (one can infer) success of the enterprise. Other authors have identified a range of traits and skills including sound health, a desire to succeed, passion for wealth accumulation, preference for moderate risk, a high energy level, a high degree of commitment, flexibility and tenacity. Ryals and Davies (2013) assert that key account management is the critical element defining the success of an organization. They assert that it is possible to have secure and steady key account relationships although there may be an imbalance of strategic interests or strategic intent in developing key account management relationships. However, Mainela (2013) says it is the personal interaction with customer that is important for the success of the business. Chen et al (2013) also assert that interorganisational and interfunctional coordination is one of the most important factors. They go on to state that these two will enable product development performance. Many management authors have also asserted that a well trained and skilled management team is the major determinant distinguishing successful performers. Management with the required qualifications and experience have been heralded as the cornerstone of success. Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 According to Lessem (1986) the enterprise itself is the dominant factor defining the success or failure of the enterprise. The organization is advocated for to be an “intraprise.” If an organization supports the growth and development of entrepreneurship within its employees then it becomes competitive and this leads to success of the organization. Urban and Naidoo (2012) point out that the underlying factor defining the success of an enterprise is operational skills. They argue that a key driver of growth and development is operational skills. Having motivated staff with high morale, adequately trained staff, sound employee empowerment schemes, a conducive location and succession-planning strategies have been single out as some determinants of the success of an enterprise. In particular Gomezelj and Kusce, (2013) made a significant finding that firm performance should not be confined to financial indicators but should also take into account the perceived performance. They posit that it is relevant to identify how entrepreneurs are pleased with their performance. The external environment has also been considered to be a determinant of business success. Battisti et al (2013); Zimmerman and Chu, (2013) considered such external variables as geographical location; a weak economy and foreign exchange limitations to have an influence on the success or failure of an enterprise (in Venezuela). They further asserted that entrepreneurial activity is also related to government programs and policies, opportunity and transaction costs, freedom (both fiscal-, and monetary-), as well as labor freedom. Benzing et al (2009) and Gartner (1988) assert that most studies on entrepreneurship have focused their attention on a few sets of factors that can be grouped into three categories of factors that define the success of an enterprise. These factors were grouped into; (1) psychological and personal traits of the entrepreneur; (2) management skills and training; and (3) the external environment. They further assert that from the contributions made by other authors it appears that there is no unanimous agreement on the variables determining the success or failure of the enterprise. A more complete model is, therefore, required. This is the gap that this study intends to cover by developing not only a more comprehensive model but also a customized model suitable for defining the success of a CLB. To conclude discussing on the available literature, it can be stated that there is a lot of work that has illuminated our understanding of the variables influencing the success of entrepreneurships. However, not much has been done on identifying factors that specifically addresses the determinants of the success of CLBs in Botswana. Thus, the questions to pose are; „Which factors influence the success of CLBs in Botswana?‟ „Are the same factors impacting on the performance of the CLB enterprises?‟ „How does the demise of the CLB occur?‟ Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 3. Research Methodology The study adopted a descriptive approach and sought to describe and explain the factors influencing the success of CLBs in Botswana. The dictates of ethical research methods were also complied with. The population understudy comprised of 9 successful CLBs situated in Maun. Unsuccessful enterprises were ignored in this study. The research sample was composed of the CLBs manager/entrepreneur as well as the first 10 clients randomly picked up through identifying the third client to visit the enterprise to conduct business. A total of 99 respondents were then identified. Interview guideline questions were created. One set of interview guideline was addressed to both the Owner/Manager and the CLBs clients. These interview guideline questions posed are as shown below; (a) How do you characterize entrepreneurs of successful CLBs? (b) Describe the attributes of a successful service offered by a CLB? (c) Which managerial skills and training define the success of an enterprise? (d) What organizational characteristics influence the success of CLBs? (e) Identify the external environmental factors that influence the success of CLBs? In order to analyze this data the responses from the respondents were condensed according to the research questions and common themes were identified. This interview research method was adopted because of its interactive nature (Saunders et al, 2011). Interview sessions were recorded as they were conducted. During night time intermittent analysis was carried out to determine the general direction of the study. 4. Research Results and Analysis All the identified 99 respondents (comprising of 9 owners/managers and 10 respondents per enterprise) were successfully interviewed. This constituted a 100% response rate. The study sought to identify the factors influencing the success of the CLBs. There was a marked concurrence among respondents to the question, “How do you characterize entrepreneurs of successful CLBs?” About 87% of the respondents (86 in number) ranked personal traits and skills to be decisive in determining the success or failure of the CLBs. In particular they singled out high energy levels, confidence, sound people management and having a decisive approach to business as important. Respondents were also asked to respond to the question, “Describe the attributes of a successful service offered by a CLB?” About 76% of the respondents (75 in number) concurred that the project idea was critical for the success of the CLBs. Project idea factors according to their importance were said to be adoption of technology, speed of service delivery, cost of credit offered and risk management. During the personal interview sessions the respondents were also asked, “Which managerial skills and training define the success of an enterprise?” Almost all the Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 respondents (94 in number or about 95%) agreed that management with appropriate skills and training was a definite advantage leading to the success of the CLBs. The other quality considered relevant for management was said to be realization of the need to motivate employees by providing fair remuneration. The response to the question, “Identify the organizational characteristics that influence the success of an CLBs?” was enthusiastically answered by almost all the respondents with all 99 agreeing that having adequate finance (to both start and provide working capital) was important for the success of the CLBs. The question generating a lot of passion was, “What external environmental factors influence the success of CLBs?” Of the 99 respondents 82 agreed that external factors do affect CLBs sustainability. In particular, 78 respondents asserted that if the economy performed poorly it was noted that the rate of default payments tended to increase. About 63 owner/managers expressed anger and angst over some operators who are not licensed. They asserted that these were taking all their customers away and giving them unfair competition as they were not duly registered. Lack of default risk protection was also cited by most owner/managers who complained that there was virtually no protection against the danger of debt non-repayments. They further pointed out that they were lending at their own risk. This proved worrisome particularly because clients wanted to borrow even if they did not always have the means to pay back. The sum total of all the respondents‟ answers clearly suggested that there are factors influencing the success of the CLBs. Further, these factors can be classified as; entrepreneur‟s personality traits and skills, project idea attributes, managerial skills and training, organizational characteristics and the external environment. 5. Summary, Conclusion and Recommendations Personal traits and skills were considered relevant by 87% of the respondents. A high energy level, confidence, people management and a decisive approach were considered critical for an entrepreneur. Indeed the impact of the entrepreneur on the business processes is unquestionable. This becomes clearer where there are no experts employed to assist. Project idea and the service offered were considered a relevant group of factors by 76% of the respondents. In particular it was the adoption of technology; cost of credit offered and risk management that was considered very important. Further implementation of a sound project and the offering of a viable service contribute towards the success of a CLB. Managerial skills and training was also pointed out as a critical group of factors by 95% of the respondents. Management that offered a fair reward was considered to be more successful than that which did not. Further, ability to recover loans lent out was also considered critical Organizational factors were also considered relevant for the success of the CLB by all respondents. It was clearly pointed out that only CLBs that enjoyed adequate funding had more chances of success. Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 The researcher concludes that there are indeed independent factors defining the success of the CLB and these factors can be grouped into; entrepreneur‟s personality traits and skills; project idea attributes; managerial skills and training; organizational characteristics and the external environment. Non-conformance to any group of these factors would lead to the collapse of the business. As one attempts to interpret the results of the study, it becomes obvious that there is a typology of factors that describes how CLBs are able to survive, succeed and sustain themselves. Thus the factors influencing the success of the CLB can be categorized into five groups as follows: Personal skills and traits; Type of project service offered; Managerial skills and training; Organizational characteristics; and External environment. The structure of the relationships between these groups of variables implies that a complete failure to satisfy any one of these variables will lead to the demise of the firm. So the relationship existing between these five groups of variables is multiplicative. This relationship can be diagrammatically represented as shown below; SB = (Pt + Ps) x (Pi + Ps) x (Ms + M t) x Oc x Ee Where, SB = Success of the Cash Loan Business Pt + Ps = Personal traits and skills Pi + Ps = Project idea and service Ms + M t = Managerial skills and training Oc = Organisational characteristics Ee = External environmental influence This relationship can be diagrammatically represented as shown in the diagram that follows; Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Figure 1: Factors Influencing Success/Failure of CLB Non-competent Personal skills and traits Competent Non-competent Project idea and service Competent Managerial skills and training Non-competent Competent Non-competent Appropriate organizational characteristics Competent Non-competent Adaptation to external environmental influence WindowCompetent Window- CLB SUCCESS CLB FAILURE The CLB should be competent on all factors from the top downwards (as shown by the arrows pointing downwards). If there is any non-competence (that is, zero competence) on any factor, then this signifies the collapse of the CLB (as shown by the arrows pointing to the right and then the big arrow pointing downwards). This means that a CLB needs to be competent in all areas. However, competence above zero in the lowest factor does not lead to the demise of the firm. Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Thus the diagrammatic representation shows that non-competence in any of the variables leads to the demise of the CLB. Before the final collapse of the firm a process occurs. This process follows non-competence on any of the five groups of factors identified. Then if no appropriate corrective action is taken, by addressing noncompetence in the concerned area, then “window-dressing” is undertaken. Windowdressing involves the process of covering up to give the impression that everything is as it ought to be. Some examples of window-dressing involve taking such action as borrowing from other CLBs to further on-lend to one‟s clients; failure to pay salaries and wages on time; deferring capital expenditure; and adopting an ostentatious lifestyle to impress onlookers. It is a false facade cast to pretend to the world that everything is normal and yet the organization is about to collapse. Usually this window-dressing creates inertia for further and continuous window-dressing efforts until the CLB finally collapses. The researcher recommends that training focusing on the five groups of factors needs to be offered to CLB operators and managers in order to reduce the rate of demise of these enterprises. Policy makers need to ensure that they provide support to the CLBs in all areas identified in this research exercise. Further research also needs to be carried out in this area to determine the specific contribution of each of the identified factors towards the success of the CLBs. A threshold limit of the influence of non-competence in each of the variables needs to be calculated in order to have a more precise success or failure predictive model. A logistic regression model could be developed as a tool for predicting success or failure of CLBs. Moreover, this research needs to be increased in expanse to get a more country representative picture of the influence of these factors towards the success of a CLB. References Arthur, S.J., Hisrich, R.D., and Cabrera, A. (2012), The Importance of Education in the Entrepreneurial Process: a World View, Journal of Small Business and Enterprise Development, Vol. 19 Iss: 3, pp 500 – 514 Audet, J. and Couteret, P. (2012) Coaching the Entrepreneur: Features and Success Factors, Journal of Small Business and Enterprise Development, Vol.19 Iss: 3, pp. 515 – 531 Bank of Botswana (2001) Annual Report 15-19 Battisti, M., Deakins, D.and Perry, M., (2013), The Sustainability of Small Businesses in Recessionary Times: Evidence from the Strategies of Urban and Rural Small Business in New Zealand, International Journal of Entrepreneurial Behaviour and Research, Vol.19, Iss: 1 Benzing, C., Hung, M. C. and Kara, O. (2009), Entrepreneurs in Turkey: A Factor Analysis of Motivations, Success Factors, and Problems Journal of Small Business Management, Vol 47, No. 1, pp. 58-91 Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Bordens, K. S. and Abbot, B.B. (2006), Research and Design Methods, (6th Edition), Tata McGraw-Hill, New Delhi Chen, Y., Li, P. and Lin, Y. (2013) How Inter-and Intraorganisational Coordination Affect Product Development Performance: The Role of Slack Resources, Journal of Business and Industrial Marketing, Vol. 28, Iss: 2 Cohen, L., Manion, L., and Morrison, K. (2008) Research Methods in Education, (6thEdition) Rutledge Cooper, D.R. and Schindler, P.S., (2000), Business Research Methods, 7thEdition, McGraw-Hill, UK Gomezelj, D. O. and Kusce, I. (2013), The influence of personal and environmental factors on entrepreneurs‟ performance, Emerald Group Publishing Ltd, vol. 42, No. 6, pp. 906-927 Government of Botswana (1999), “Policy on Small Medium and Micro-enterprises in Botswana”, Government Paper No. 1 of 1999 Gutierrez-Nieto, B. and Serrano-Cinca, C., (2010), Factors Influencing Funder Loyalty to Microfinance Institutions, Nonprofit and Voluntary Sector Quarterly, Ed Elsevier, 39 (2) pp 302-320 Jahan, S. and McDonald, B., A Bigger Slice of a Growing Pie, September (2011), Vol.48, No. 3, International Monetary Fund Publication Lean, J. (2012), Preparing for an uncertain future: the Enterprising PhD Student, Journal of Small Business and Enterprise Development, Vol. 19 Iss: 3 pp. 532 – 548 Lessem, R., (1986) Intrapreneurship: How to be an Enterprising Individual in a Successful Business, Wildwood House Mamoria, C.B., Gankar, S.V. and Pareek, U. (2008) Personnel Management, 28th Edition, Himalaya, New Delhi Marlow, S. and McAdam, M., Advancing debate: An epistemological critique of the relationship between gender, entrepreneurship and firm performance, International Journal of Entrepreneurial Behaviour and Research, Vol. 19, Iss:1 Mainela, T. and Ulkuniemi, P. (2013) Personal interaction and customer relationship management in project business, Journal of Business and Industrial Marketing, Vol. 28 Iss: 2 Moran, D., (2000) Introduction to Phenomenology, London: Routledge Non-Bank Financial Institutions Regulatory Authority, Annual Report (2011) Pansiri, J. Zelealem, T.T., (2010) Linking firm and managers‟ characteristics to perceived critical success factors for innovative entrepreneurial support, Journal of Small Business and Enterprise Development, Vol. 17 Iss: 1, pp.45-59 Prabbhu, V. P., Stephen J. McGuire, Ellen A. Drost, Kern K. Kwong, (2012) Proactive personality and entrepreneurial intent: Is entrepreneurial self-efficacy a mediator or moderator? International Journal of Entrepreneurial Behaviour & Research, Vol. 18 Iss: 5, pp.559 – 586 Ryals, L. J. Davies, I. A. (2013) Where‟s the strategic intent in key account relationships? Journal of Business & Industrial Marketing, Vol. 28 Iss: 2 Serrano-Cinca, C., and Gutierrez-Nieto, B., (2013), Microfinance, the long tail and mission drift, International Business Review, Elsevier Proceedings of Eurasia Business Research Conference 16 - 18 June 2014, Nippon Hotel, Istanbul, Turkey, ISBN: 978-1-922069-54-2 Temtime, Z.T., and Pansiri, J. (2004) Small Business Critical Success/Failure Factors in Developing Economies: Some Evidence from Botswana, American Journal of Applied Sciences, 1(1):18-25 Urban, B. and Naidoo, R. (2012), Business Sustainability: empirical evidence on operational skills in SMEs in South Africa, Journal of Small Business and Enterprise Development, Vol.19 Iss: 1.pp146-163 Varian, H.R. (2006) Microeconomics: A Modern Approach, 7th Edition, East-West Press, New Dehli Watson, J., & Everett, J. E. (1996) Do small businesses have high failure rates? Journal of Small Business Management, 34 (4), 45-63 Zimmerer, T. W., and Scarborough, N.M. (2005) Essentials of Entrepreneurship and Small Business Management, (4th Edition), Prentice Hall Zimmerman, M.A. and Chu, H.M. (2013) Motivation, Success and Problems of Entrepreneurs in Venezuela, Journal of Management Policy and Practice, Vol. 14, No. 2