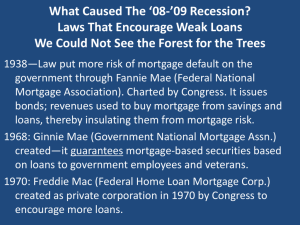

Fannie Mae/Freddie Mac Uniform Mortgage Instruments: The Forgotten Benefit to Homeowners I. I

advertisement