Proceedings of 30th International Business Research Conference

advertisement

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

Equity Valuation Meets the Sigmoid Growth Equation: The

Gordon Growth Model Revisited

Evelyn Madoroba1* and Jan Kruger1

The valuation of equity is a central topic in finance and accounting from many fronts. However,

equity valuation is still subjective as different analysts obtain target prices that are not similar

despite using the same publicly available information. Growth has a substantial influence on the

value of equities when using Gordon Growth Model. Nevertheless, initial high growth and a

constant growth to perpetuity assumption whereby a company continues to grow indefinitely is

considered to be naive and simplistic. Therefore, this study proposes the use of sigmoid growth

curve equation that is expected to better capture practicalities of firm growth. The sigmoid curve

consists of lag, exponential, stationary and decline phases. The aim of this study was to provide

evidence of sigmoid growth patterns of Johannesburg Securities Exchange listed companies and

to propose a model for valuing equities using principles behind the sigmoid growth curve. This has

implications for improving accuracy when approximating the value of equities, detecting mispriced

stocks and informing buy/ sell decisions. For this purpose, cumulative sustainable growth patterns

of 64 JSE listed companies were examined using data from 1994 to 2014, followed by curve fitting

to determine whether the profiles were sigmoid. Interestingly, 50% of the firms showed typical

sigmoid growth patterns. Ultimately, a model was developed for valuing equities by replacing

growth, g, in the Gordon Growth Model with equivalent parameters in the sigmoid equation. In

conclusion, the findings of this study accentuate that the Gordon Growth Model for equity valuation

must factor in the complex growth parameters of firms in order to circumvent mispricing shares.

Key Words: Equity Valuation; Sigmoid Growth Equation; Gordon Growth Model;

Sustainable Growth Rate; Johannesburg Securities Exchange Listed Companies

Field of Research: Finance; Stock markets, Financial modelling

1. Introduction

The valuation of equity is a central topic in finance and accounting (Schreiner, 2007).

Nevertheless, equity valuation is still subjective as different analysts obtain target prices

that are not similar despite using the same publicly available information. This could be

due to the analysts’ different forecasts or the use of various models where the inputs vary

because of different assumptions.

The growth dynamics of diverse populations follows a sigmoid shape, which consists of

lag, exponential, stationary and decline phases. A typical example is microbial growth

when bacteria are introduced into a closed environment with fresh nutrients under

laboratory conditions. The number of bacterial cells increases at a slow pace initially,

followed by rapid exponential growth, then the growth becomes stable for some time

_______________________________________________________________________

1

University School of Business Leadership, Cnr Janadel and Alexandra Avenues, Midrand, 1686, Gauteng,

South Africa*: Corresponding author, Evelyn Madoroba, University School of Business Leadership, Cnr

Janadel

and

Alexandra

Avenues,

Midrand,

1686,

Gauteng,

South

Africa,

Email:

evelyn.madoroba@gmail.com

1

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

before death of bacterial cells leads to a decline phase (Baranyi, 2010). During the lag

phase, it takes time for bacteria to adjust to the new environment. During the exponential

or logarithmic phase, bacteria divide and grow rapidly and exponentially. The exponential

bacterial growth leads to depletion of nutrients, accumulation of toxic metabolites and

waste, which leads to a stationary phase and subsequent decline phase if there is no

injection of fresh growth media.

There is scope in applying the principles behind the bacterial sigmoid growth curve

dynamics to the business environment. Almost all companies do not start by experiencing

high growth, but instead, they are anticipated to go through the ‘lag phase’ of adaptation,

followed by ‘exponential’, ‘stationary’ phase with or without value addition and a ‘decline

phase’ depending on whether management adjusts company strategy to avoid decline.

The lag phase may be equated to a phase when a business is being set-up or after a new

strategy is introduced. The exponential phase may be akin to the high growth period of

businesses. The stationary phase is reminiscent of stable growth in businesses. The

decline phase during bacterial growth can be equated to the phase when business growth

declines due to market saturation or stiff competition in the market.

Due to the pertinent role that growth rate plays in equity valuation, sufficient attention

should be awarded to the growth parameter, otherwise the resulting equity values might

be misleading. This study argues that equity valuation should be based on sigmoidal

growth depicted by the sigmoid growth equation (Gompertz, 1825). Therefore, the aim of

this study was to provide evidence for firm sigmoid growth and to develop a model for

valuing equities by capturing the complexities of firm growth dynamics through substituting

the growth rate, g, in the Gordon Growth Model (Gordon, 1962), with the growth rate

function in sigmoid equation using the Gompertz equation as an example.

The specific objectives of the study were:

i)

To examine cumulative sustainable growth patterns of 64 Johannesburg Stock

Exchange Listed Companies using data from 1994 to 2014, followed by

comparison with sigmoid curves;

ii)

To develop a model for valuing equities by substituting growth rate, g, in the

Gordon Growth Model with parameters of a sigmoid Gompertz equation.

1.1.

Investigation Approach

In the subsequent sections, we discuss each of the objectives of this study. Section 2

presents empirical evidence of sigmoid growth patterns for 64 JSE listed companies. In

section 3, we propose a ‘new’ model. Section 4 concludes the study findings.

2

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

2. Sigmoid growth in equity valuation

Despite the success of sigmoid curves in predicting future growth, there is very little

information regarding application of the principles behind the sigmoid growth curve in

equity valuation.

Herbst and Wu (2004)

Herbst and Wu determined the influence of earnings growth on cost of equity capital, and

the optimal time to sell stocks. The authors concluded that in the long run, companies

follow sigmoid growth patterns. Subsequently, the authors fitted a sigmoid curve to

earnings data of Microsoft and measured the magnitude to which investors presumably

miscalculate if they calculate share value based on Gordon formula instead of the method

that shows varying growth. Gap analysis: The study was not aimed at equity valuation,

which is the thrust of our study.

2.1.

Sample Selection and Description

In this section of the study, we sought to determine the cumulative sustainable growth

patterns of JSE listed firms with data for at least 15 consecutive years from 1994 to 2014.

Companies that did not have complete data for sustainable growth rate data for at least 15

consecutive years from 1994 to 2014 were excluded from this study resulting in 64 firms

being assessed. Cumulative sustainable growth was plotted on a time scale for each

company.

2.2.

Curve fitting and Statistical analysis

The cumulative sustainable growth patterns of all the 64 JSE firms were examined for

sigmoid patterns through curve fitting using the DMFit programme, which was developed

by Baranyi and Roberts (1994). Briefly, DMFit is an Excel add-in that uses regression

analysis to enable fitting of sigmoid curves, linear and biphasic functions to the data under

investigation. DMFit calculates the best fit parameters that comply with the input controls.

In addition, other statistical and computational indicators were calculated.

The four main parameters of DMFit are rate, lag, y0, yEnd and two curvature parameters

named mCurv and nCurv. The primary parameter is ‘rate’, which is the potential or

theoretical maximum rate of the model. The initial point of the sigmoid curve is denoted by

y0. The upper asymptote of the sigmoid curve is called yEnd. The curvature parameters at

the beginning and end of the linear phase are respectively described by nCurv and

mCurv.

3

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

2.3.

Empirical Findings

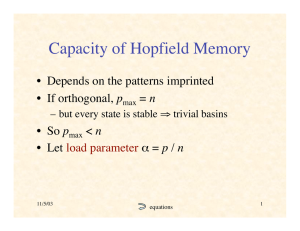

Figures 1 and 2 show examples of typical sigmoid growth patterns that were obtained from

cumulative sustainable growth of JSE companies. The number of firms that followed

sigmoid patterns after fitting the sustainable growth patterns of 64 JSE listed firms was

50% (n = 32). These firms had the lag, exponential and stationary phases. The values for

the different phases are shown in Table 1. The same proportion of firms that were

analysed in this study did not display sigmoid patterns.

Figure 1: Typical diversity of the sigmoid* curves of cumulative sustainable growth

patterns of JSE listed companies after curve fitting using DMFit software (Baranyi and

Roberts, 1994). The yValue represents cumulative sustainable growth, and Fit 1 shows

the line that was plotted through DMFit. TFG refers to The Foschini Group.

800

TFG

350

700

300

600

250

500

200

yVal

150

Fit 1

100

Cash Build

400

yVal

300

Fit 1

200

50

0

1990

-50

yVal

yVal

400

100

2000

2010

Time in years

2020

0

1990

2000

2010

Time in years

2020

4

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

2500

350

ARGENT

AFROX

300

2000

1500

yVal

1000

yVal

yVal

250

200

yVal

150

Fit 1

Fit 1

100

500

50

0

1990

2000

0

1990

2010

2020

Time in years

2000

2010

Time in years

2020

Figure 2: Typical diversity of the non-sigmoid curves of cumulative sustainable growth

patterns of JSE listed firms after curve fitting using DMFit software. The yValue represents

cumulative sustainable growth, and Fit 1 shows the line that was plotted through DMFit.

300

600

AVI

TRUWORTHS

500

250

400

300

150

yVal

Fit 1

100

200

yVal

100

0

1990

-100

50

0

1990

yVal

yVal

200

Fit 1

2000

2010

2020

-200

2000

2010

time

2020

-300

time

5

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

1000

800

GROUP 5

900

ELB

700

800

600

700

500

500

yVal

400

Fit 1

300

yVal

yVal

600

400

yVal

300

Fit 1

200

200

100

100

0

1990

2000

2010

2020

0

1990

-100

2000

2010

2020

time

time

Table 1: Summary of DMFit results obtained for some JSE listed firms

Firm

rate

Lag

y0

yEnd

se(fit)

R^2_stat

First Rand

33.2467959

3.90780356

9.2563109

395.36707

7.8777468

0.997204159

FPT

133.113293

9.66921833

0.6955976

319.36675

12.980232

0.992994219

INVLTD

23.8172473

7.63881008

28.06562

239.81864

14.594816

0.971531987

PUTPRO

44.6046753

13.013106

16.101247

257.22769

8.7533831

0.990085133

SANTAM

573.074136

8.88302787

54.430004

891.70679

34.852635

0.993030578

STANBANK

39.7999405

4.04288962

56.129875

518.44444

16.503533

0.991404856

SYCOM

59.4488134

45.741419

317.50165

14.19903

0.987061065

AVI

22.4241302

10.0312889

NL

29.520436

21.888975

0.926811061

Crookes

188.310358

14.3185733

122.58341

257.61634

NS

85.48716

0.935538069

Distell

9.89257591

NS

11.581869

0.94247422

19.7896402

6.12752689

NL

15.769882

Illovo

9.5437087

14.274991

0.979029474

Metair

24.6965455

NL

86.722165

294.83307

NS

44.799573

0.920948539

Nuworld

52.7654871

NL

14.267791

418.38905

148.73255

0.408677303

Oceana

82.6386885

NL

556.631

45.506318

0.943860241

SAB

10.7114586

NL

-25.31682

17.895316

NS

7.7522075

0.985243904

Sovfood

22.1751439

25.63889

82.041595

4.9391516

0.910026716

Tongaat

26.1549022

2.5797762

NL

-1.811203

98.489374

31.454805

0.445843563

41.915845

719.21337

13.109105

0.997808593

127.96754

22.889461

0.951738092

11.500592

0.97850978

Cash Build

Caxton

18.8996807

7.15570179

NL

City Lodge

12.5138312

NL

34.70026

434.65709

NS

163.30323

9.69794378

122.4789

563.59491

66.050554

0.910518575

Fam Brands

105.197269

9.04803135

66.322239

623.4228

35.619434

0.980221229

Italtile

8820.00244

7.07166601

215.92084

8314.3541

143.5494

0.998706107

CMH

77.62648

6

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

JD Group

26.9834998

NL

62.528293

348.23609

14.974797

0.977290366

Mass Mart

571.354978

102.59648

0.97290704

140.71862

776.87792

NS

33.420166

Mr Price

8.94633956

NL

127.44331

0.987518895

ND

NICTUS

23.6796836

10.7274789

14.477805

NS

9.6235741

0.983824942

Rex True

69.1866748

49.497367

483.67875

30.246013

0.973484611

Shoprite

31.9613279

9.85403082

NL

37.74414

606.84552

15.757928

0.992534241

SUNINT

91.2018918

4.01659056

1064.6712

77.937776

0.964396805

TFG

34.4347254

337.30651

11.39365

0.993153485

24.269745

5.209539

NL

10.257066

0.6264769

337.43803

40.869869

0.830409471

Truworths

41.8438726

4.06866277

49.1951

34.927766

464.47088

17.585371

0.987756418

Wollies

18.7198659

2.40887208

431.99889

540.17651

39.613749

0.277978416

Altron

689.071844

6.03053259

88.673581

903.06209

66.665892

0.970791224

Argent

569.753664

7.34320252

2104.0429

173.41658

0.964278506

Barworld

27.9914682

NL

204.9893

9.6006148

259.47696

26.821785

0.920417199

Bowcalf

Firm

61.2330325

rate

NL

Lag

188.56715

y0

1023.774

yEnd

55.305388

se(fit)

0.964300107

R^2_stat

Cargo

142.364893

7.44731133

85.708691

43.505243

0.990815812

ELB

76.0727155

11.0610733

47.264548

1135.0277

NS

41.778335

0.969019974

Grindrod

521.984022

5.82968332

55.934084

0.969357737

54.0429054

6.28845989

171.52936

2027.0182

NS

160.96155

Group 5

27.59099

0.988258391

ILIAD

1044.43963

589.20766

2.32449351

344.08922

5292.2536

NS

494.69899

Imperial

2.53807928

NL

123.98768

0.879137117

ND

Invicta

M&R

Holdings

1454.7947

0.91670998

674.28556

2579.4586

189.32256

0.795774257

14.2415614

NL

61.435421

NS

74.033462

0.52746959

Masnite

12.8150576

NL

32.495681

136.19323

11.077272

0.904731568

6.7913466

NL

0.6889697

4.1397115

0.960715439

Reunert

18.6524805

NL

137.86567

61.569576

NS

36.350301

0.909805878

Sasol

35.4958859

4.77170456

16.49745

439.59867

18.57781

0.981405762

AFROX

31.8059851

3.2970976

0.967644967

28.5294156

38.893939

302.52664

NS

21.842996

ANGLO

3.27559927

NL

78.74222

0.833443057

Anglo Gold

Anglo

Platinum

11.8570351

NL

4.9727895

NS

111.42937

0.232539699

50.6074545

NL

-63.99026

NS

153.64398

0.804952028

ARC Mittal

52.1437893

8.90335511

36.785947

327.58645

15.092221

0.986710595

BHP Billiton

265.572258

10.5072198

NL

192.22416

42.476126

0.988267495

Tsogo

PPC

18.49632

1011.8942

NS

44.877776

0.933316687

GFIELDS

54.6151743

NL

-30.23806

505.29389

39.187829

0.955868901

IMPLATS

35.8979724

6.34903177

315.09523

15.416075

0.985271594

LONMIN

235.157497

1.49472686

14.077197

78.376955

493.77951

218.80699

0.314681569

NOTHAM

10.7336415

9.22162961

14.910801

91.074813

4.1256078

0.983194113

Delta

27.106987

7

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

21.499758

NS

101.1161

0.939329756

20.919797

3.19684926

NL

17.949368

NS

33.840954

0.930179743

382.577218

8.49589761

89.32693

1961.4092

90.572302

0.989051576

OMNIA

71.7273253

SAPPI

Sentula

Key: Rate refers to the potential or theoretical maximum rate of the model. The 'lag'

represents the lag growth parameter as defined by Baranyi and Roberts (1994). The y0

represents initial point of the sigmoid curve. The yEnd refers to the upper asymptote of

the sigmoid curve. NL, NS and ND indicates that there was no lag phase, no stable phase

and no defined fit respectively; which implies that the growth pattern was not sigmoid.

R^2_stat refers to the Adjusted R-square statistics of the fitting, whereR2 is the coefficient

of determination, which shows the proportion of variability in the data set due to the

statistical model.

2.4.

Discussion of empirical findings

The fact that 50% of the 64 JSE listed firms in this study followed sigmoid growth patterns

may have implications on mispricing of equities during the period studied if the GGM was

used to value equities. This is because the findings clearly demonstrated sigmoid growth.

Similar findings were obtained by Herbst and Wu (2004) who illustrated how investors

would err if they applied constant growth models instead of using growth patterns that are

specific to the company.

The very high R2 values that were obtained in this study demonstrate that the estimates of

regression lines were very close to the actual data points. This implies that more accurate

share values would be obtained if the growth parameter in equity valuation models is

based on the sigmoid equations.

There are a plethora of reasons that give rise to non-sigmoidal growth patterns among

firms. Failure to follow sigmoid growth patterns by firms may be caused by growth

setbacks or high growth as a result of complicated industry, macroeconomic or firm

dynamics. We propose that companies follow sigmoid growth patterns as a simple way of

managing resources and predicting future growth.

3. Linking Gordon Growth Model and the

Development of An Equity Valuation Model

Gompertz

curve:

Due to the theoretical scope of substituting growth in the Gordon Growth Model with

parameters from the Gompertz equation, we developed the equity valuation model by

decomposing both the Gordon Growth formula and the Gompertz equations. The

substitution could also be based on Logistic, and Richards sigmoid equations or their

8

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

variations depending on the best determined model. This model selection could be done

using other software that specifically defines the type of sigmoid curve, but this was

outside the scope of this study. Nevertheless, model selection constitutes future work.

In the standard Gordon growth model, the constant growth rate is g and the model is

represented by:

Vj= D / (Ke - g) …………………………………………………………………………….....(1)

Where:

Vj = Value of stock j

Ke = The required rate of return on stock j, which is the cost of equity capital,

D = Dividend,

g = Expected long-term sustainable growth rate in cash flow to the investor

We then incorporated growth parameters of a Gompertz sigmoid growth equation in

Gordon growth formula (1). Although the substitution is not expected to fit completely due

to the differences between continuous and discrete values, the growth parameters are

comparable and it is estimated that the continuous growth function is a better

representative of the reality (Herbst and Wu, 2004). Unlike previous one, two and three

stage growth models that were characterized by discrete phases, our model assumes

continuous growth.

The Gompertz curve has diverse mathematical representations and some of the

expressions are shown below:

According to McKellar and Lu, (2004), the Gompertz Model can be represented as:

loge N (t)= A+C exp{exp[−B (t −M)]}………………………………………….................…(2)

where N(t) is the momentary number of cells in the population,

A: represents the logarithm of the initial number, that is, A ≈ logeN0,

C: is the asymptotic logarithmic growth ratio, that is, N(t)/N0 when t →∞ ,

B: is the relative growth rate, and

M: the time that corresponds to the maximum growth rate, that is, it marks the inflection

point location of the sigmoid growth curve.

In a study of mammalian growth curves by Zullinger and co-workers (1984), the Gompertz

equation is represented as:

………………………………………………….............................................................(3)

9

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

Where A = Asymptomatic mass

M(t) = mass (g) at age t

K = growth rate constant

I = age at inflection point

Using the Gompertz curve in (3), we developed the model as follows:

In order to make K the subject of formula, the following algebraic steps were taken:

Each side of the equation was divided by A resulting in the expression:

M(t)= e^-e^K*(t – I)…………………………………………………………….....................(4)

A

Then the natural logarithm of each side of the equation was considered, which gives the

expression:

Ln

A

M(t)

= ln M(t) – ln A, ……………………………………………………….....(5)

Therefore,

ln M(t) – lnA = -e^-K*(I–t)…………………………………………………………….........(6)

Taking an additional natural logarithm to each side of the equation yields:

ln (ln M(t)–ln A) = K*(t – I)……………………………………………………………........(7)

Dividing both sides by (t – I) gives the expression;

ln (ln M(t) – ln A) = K…………………………………………………………………….....(8)

(t – I)

We then substituted the constant and discreet growth function g in the Gordon Growth

formula with K, the natural growth rate function in the Gompertz growth equation. We

assign K in the Gompertz equation the designation Kappa to avoid confusion with Ke,

which is the cost of equity in the Gordon Growth formula. The assumption is that dividends

at time t, Dt follow the Gompertz growth equation and the firm will not ordinarily pay a

dividend that is greater than the earnings (Herbst and Wu, 2004).

Our proposed model for valuing equities is therefore:

Vj =D …………………………………………………………………………………(9)

Ke – Kappa

Where Kappa = ln (ln M(t) – ln A)

(t – I)

A represents the maximum expected dividends over a chosen time horizon

Mt = dividends at any time t within the chosen time horizon

t = any time within the chosen time horizon

Kappa is the natural growth rate

I = duration of growth at inflection point

10

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

4. Conclusion

This study has used cumulative sustainable growth data for 64 JSE listed companies over

a 20 year period to provide empirical evidence that the growth of many firms actually

follows sigmoid patterns. Indeed, empirical support for the proposed model was obtained

as 50% of the companies clearly illustrated sigmoid growth patterns with high coefficient of

determination values. The findings of this study can be used to reflect the intricacies of

company growth. Furthermore, managers of companies may use the findings of this study

to predict the optimal time to change company strategies.

A ‘new model’ for valuing equities was then proposed based on the principles behind the

Gordon Growth Model and the sigmoid growth equation. This model is expected to

circumvent the challenges of discrete constant growth rate to perpertuity that are

associated with the GGM. The ‘new model’ is expected improve equity valuation accuracy.

5. Future Work

The quintessential test of any model is the precision of its prediction (Modis, 2007). It is

our intention to use the ‘new’ model for predicting the value on stocks of publicly listed

firms on diverse securities counters.

6. References

Baranyi, J. 2010, Modelling and parameter estimation of bacterial growth with

distributed lag time, Doctoral Thesis. School of Informatics University of Szeged,

Hungary.

Baranyi, J. and Roberts, T.A. 1994. ‘A dynamic approach to predicting bacterial growth

in food;’ International Journal of Food Microbiology, vol. 23, pp. 277-294.

Bierman, H. Jr. 2001. ‘Valuation of stocks with extraordinary growth prospects’, The

Journal of Investing, vol. 10, issue 1, pp. 23-26.

Damodaran, A. 2006, Valuation approaches and metrics: A survey of the theory and

evidence, Stern School of Business.

Gompertz, B. 1825. ‘On the nature of the fucntion of the law of human mortality, and a

new mode of determining the value of live contingencies’, Philosophical

Transactions of the Royal Society, vol. 182, pp. 513-585.

11

Proceedings of 30th International Business Research Conference

20 - 22 April 2015, Flora Grand Hotel, Dubai, UAE, ISBN: 978-1-922069-74-0

.

Gordon, M. 1962, The investment financing and valuation of the corporation. Irwin:

Homewood, IL.

Haslem, J.A. 2002. ‘Valuation of stocks with prospects of dividend growth’, The Journal

of Investing, vol. 11, issue 1, pp. 64-68.

Herbst, A.F. and Wu, J.S.K. 2004. ‘Trajectory of earnings growth influences cost of

equity capital, and optimal time to sell’. Investment Management and Financial

Innovations, vol. 1, pp. 100-113.

McKellar, R.C. and Lu, X. 2004, Modelling microbial responses in foods. CRC Press,

Boca Raton, Fla.

Miller, D. 1990, The Icarus paradox. New York: Harper Business.

Modis, T. 2007. ‘Strengths and weaknesses of S-curves’, Technological Forecasting

and Social Change’, vol. 74, issue 6, pp. 866–872.

Schreiner, A. 2007, Equity valuation using multiples: An empirical investigation. PhD

Thesis.

Zullinger, E.M., Ricklefs, R.E., Redford, K.H. and Mace, G.M. 1984. ‘Fitting sigmoidal

equations to mammalian growth curves’, Journal of Mammalian Research, vol. 65,

pp. 607-636.

12