Proceedings of 5th European Business Research Conference

advertisement

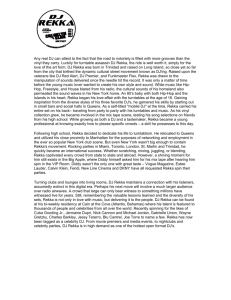

Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 Strategic Positioning For Re-Emergent Legacy Technologies: The Case of the Vinyl Record Natasha Vijay Munshi and Mirko Terrestre We explore the nascent phenomenon of legacy technology re-emergence in this paper. We specifically focus on unraveling the strategic dimensions of bringing back an obsolete legacy technology and gaining market share, after near extinction in the technology’s life cycle. To do so, we looked at the almost 70 year old vinyl (LP) record technological format in sound recording which, after having been displaced by several newer technologies over the decades, has seen a resurgence and gain in global market demand. We suggest that a strategy for technological re-emergence involves first, positioning the legacy technology based on performance attributes that differ from both the dominant design’s maturing technology as well as the newly emerging technological heir; we propose that this has implications for its competitive strategy. Finally, we find that one caveat to a legacy technology’s re-emergence strategy, is the need to acquire new competencies across value chain activities to survive format wars. We conclude with implications of our study for firm survival, especially in newly emergent product markets. (168) Field(s) of Research: Management (Strategic Management) 1. Introduction In this paper, we explore the strategic imperatives that drive ‘technological re-emergence’ (Raffaelli, 2013), which refers to nearly obsolete dominant technological designs rekindling market demand to enjoy a renewed renaissance period in a product market. Dominant designs are single product architectures around which a majority of users and producers converge (Anderson & Tushman, 1990, Utterback & Abernathy, 1978). Many studies on dominant designs and technology life cycles have shown that mature technologies fail in their home markets when a novel discontinuous technology is able to capture majority market share based on completely different set of product attributes from those offered by the dominant design (e.g., Adner & Levinthal, 2001; Anderson & Tushman, 1990; Christensen, 1997; Tripsas, 2008; Utterback & Abernathy, 1978 etc.). This is especially seen in analog product markets such as watches (Raffaelli, 2015), cameras (Benner & Tripsas, 2012), etc. Yet, a relatively recent phenomenon has been observed in some industries where dominant designs based on legacy technologies, have re-emerged to gain traction with new audiences (Bartmanski & Woodward, 2015; Raffaelli, 2013). In these instances, a legacy technology re-enters the current market, after a prolonged period of declining market share and dormancy. Studies on such a quiescent phase and re-emergence ______________________________________________________________________ Dr. Natasha Vijay Munshi, Associate Professor, Department of Management, Saint Mary’s College of California, 380 Moraga Rd, Moraga, CA, 94556, USA, Tel: +1-925-631-4514; Fax: +1-925-376-6521; Email: nvm2@stmarys-ca.edu Mr. Mirko Terrestre, Graduate Candidate, University of Lugano, USI, Via Buffi 13, Lugano, CH-6900 Switzerland, Tel: +41-763801053; Email: mirkoterrestre@hotmail.it 1 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 phenomenon are relatively unaccounted for in existing research on technology evolution and little is known about how formerly dominant designs based on legacy technologies that are virtually extinct, strategically re-establish themselves as a product category. While a few studies have focused on strategies for dominant designs that are in the mature phase of their technology life and under threat from a newly emerged discontinuous technology (Adner & Snow 2009, 2010), they do not address how legacy technologies that have almost exited out of the technology landscape can re-emerge, after leapfrogging over several newer technological designs’ S curves, to carve out new niches for themselves in the market. Our paper aims to address this gap in the strategic innovation literature while extending on the research done on re-emergence of legacy technologies. One aspect of what could be driving technological re-emergence is the heterogeneity of users in the diffusion and adoption of a legacy technology. A recent study conducted by Raffaelli on the Swiss watch industry (2013) looks at identity related issues to explicate why legacy technologies re-emerge. Raffaelli discusses one category of users that allow for the re-emergence of the legacy technology whom he terms as “institutional guardians” or the standard bearers for the old values and beliefs associated with the old ways of doing things in an industry; in the Swiss watch industry, these constituted the watch collectors who sustained the market demand for vintage mechanical watches. While this nostalgia driven user category (Raffaelli, 2015) is clearly important to re-emergence of a legacy technology, it does not fully account for how diffusion of re-emergent legacy technologies occurs. We believe that addressing the heterogeneity in demand categories for mature technologies (Tripsas, 2008) is an important aspect to understanding technological reemergence. It is beyond the scope of this paper to address demand heterogeneity in technological re-emergence, so we address it in a follow up study, while touching on some aspects of the former in the discussion. While much of the technology life cycle literature on dominant designs have focused on novel emergent discontinuous technologies that succeed in replacing dominant designs, we believe that studying newly re-emergent technologies and the strategies that can be undertaken to bring them to market, could be helpful in understanding firm survival in today’s turbulent markets. As not much is known about the strategic aspects of technological re-emergence, we use a single case study of the vinyl records industry in order to better understand this phenomenon. Similar to other studies on dominant designs (see Benner & Tripsas, 2012) we use a product market like vinyl records, which is within the broader industry of sound recording (Bartmanski & Woodward, 2015a), to study this under-researched phenomenon. Next, we survey the literature on technology life cycles and re-emergent technologies. 2. Literature Review A substantial literature (Kaplan & Tripsas, 2008; Utterback, 1994a; Tushman & Rosenkopf, 1992; Foster, 1986; Sahal, 1981; Abernathy & Utterback, 1978) argues that any product or technology evolves by following a predetermined path composed of four stages, called the “technology life cycle”. The starting point is often introduced by a disruption created by the introduction of new technologies that can be radically different from the existing technological reign (Utterback, 1974). This era of ferment, is characterized by experimentation and uncertainty where different new technologies compete in order to 2 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 become the new standard. The take-off phase begins when one technology becomes the dominant design, defined as “a single architecture that establishes dominance in a product class” (Abernathy, 1978; Sahal, 1981). Next is the maturity phase which is characterized by “a tightly linked system, with capabilities, routines, incentives and technological frames all working in a common direction” (Kaplan & Tripsas 2008, p. 22) that is toward the achievement of incremental changes that augment and strengthen the technology. The last stage involves a disruption in which a new technology has “so much more potential that ultimately surpasses the old” (Sood & Tellis 2005, p.154). The validity of the technology life cycle model has been well established (Tripsas, 2008), however there is evidence that old technologies “that are seemingly “dead” can re-emerge, thrive, and even co-exist with newer technologies” (Raffaelli, 2013, p.2). Raffaelli (2013) explains the phenomena of technology re-emergence by building on identity literature. He proves that the redefinition and interaction of three types of identities (product, organization and community) are associated with the re-emergence of market demand for a legacy technology (Raffaelli, 2013) in the Swiss watch industry. By building on the work of Raffaelli, we seek to extend the research on this field by proposing possible strategic implications that could lead to the process of re-emergence. The legacy technology cannot compete with the dominant or newly emerging formats with the same arsenal of strategic maneuvers used in its heyday. Thus, it becomes crucial to find new ways to compete with the new dominant design. It has to redefine its competitive set, adapt to the new conditions, reposition itself and so forth. Two different possible strategies suggested by Adner and Snow (2009), namely racing and retreat strategies, offer mature dominant technologies choices other than abandoning the old dominant design technology in favor of the new discontinuous technology. Adner and Snow (2009) suggest that sticking with the old technology, as a conscious and active strategic choice, can help incumbent firms that have competencies in the old technology avoid failure and find a new albeit less profitable niche in which to survive in existing or new markets. While these retreat strategies can be proactive choices for dominant technologies in the mature phase of their life cycle, what are the strategic choices available for technological reemergence? We take a deeper look into what a re-emergent strategy for legacy technologies would constitute below. 3. Data Collection and Methodology Our empirical setting, which is the re-emergence of the vinyl record (LP) format as a legacy technology, is an ideal context in which to address technological re-emergence. We study the vinyl LP format, in order to look at the strategic factors that contributed to vinyl record’s re-entry into the sound recording industry, following a steep period of decline and near exit from the market. Data was collected in the period from January to July 2015. Our data set comprises the entire historical period of vinyl Long Play technology from 1931 to 2015. It includes all global vinyl pressing firms’ existence, decline, and re-emergence from various archival data sources that cover a period of time from year 1900 to 2015 for the sound recording industry, as well as the various formats that emerged and were dominant during that time. The data was sourced from company websites, trade association materials, individual archival sources, and media sources. 3 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 4. Case Study: The Vinyl (LP) Record Format as a Re-Emergent Legacy Technology The sound recording industry itself was conceived with Thomas Edison’s original phonograph in 1877. The vinyl Long Play (LP) technology format was introduced and commercialized at the end of the 1940s when Columbia Records, RCA Victor and other companies introduced the new format as a replacement of the existing shellac record (or the 78 rpm), due to shellac shortages during World War II. The new technology made of vinylite1 was lighter, more resistant, with less surface noise, capable of holding between 224-300 grooves per inch against the previously 80-100 grooves per inch, and playing for more than 20 minutes (History of the LP Record n.d.). It soon became the dominant standard in the industry, favoring the proliferation of pressing plants all over the world from the 1940s to the 1970s. Both big music label companies (e.g. Columbia Records, RCA Victor, Capitol Records, Polygram Record) as well as small companies which were producing for music labels that did not invest in manufacturing facilities directly (e.g. Motown), made huge capital investments in the construction of pressing plants that could meet the increasing demand (Bartmanski & Woodward, 2015a). However, during the end of the 1960s and the beginning of the 1970s a new technological format emerged – the compact cassette. The new technology format introduced a new attribute that was appealing to customers - portability and increased storage, it allowed consumers to listen to the music not only at home but also outside through stereos and portable audiocassette players, and it had a bigger play capacity (30 or 45 minutes per side) that made compact cassettes more attractive. From 1970 to 1980, the industry witnessed a rise of cassettes in the market, with a decline of vinyl pressing plants (about 15% of all the plants in the world closed). The sound industry saw another era in the 1980s when a new radical technology was developed and brought up to market by Sony and Philips: the Compact Disc or CD, which led to the shift from analog to digital technology as the ‘cleaner’ sound of CDs, extra storage, and disposability were attributes that appealed to the mass market at the time (Bartmanski & Woodward, 2015a, b).. About 60% of all the pressing plants shut down their operations during the 1980s and the 1990s. In the mature phase, from mid 1960s to the end of the 1990s, 80% of pressing plants were closed (see Figure 1). 1 Synthetic resin consisting of polyvinyl chloride or a related polymer (Oxford dictionaries) 4 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 Figure 1: Vinyl Pressing Firm Closures - 1930 to 2015 Vinyl Pressing Firm Closures (1930-2015) 30 CD format emergence 1982 Number of Plants Closed 25 20 15 MP3 format emergence late 1990s Compact Cassette format emergence mid1960s 10 Vinyl LP format emergence 1948 Digital Streaming format emergence 2010 5 0 N° of Closures >1930 <1940 1 >1941 <1950 3 >1951 <1960 2 >1961 <1970 1 >1971 <1980 9 >1981 <1990 25 >1991 <2000 8 >2001 <2010 6 >2011 <2015 1 Sources: Adapted from http://www.totalsonic.net/vinylplants.htm and http://www.discogs.com/lists/Record-Pressing-Plants/213755 Despite being displaced by multiple newer dominant design technology eras, such as digital downloads, which supplanted the CD in the last decade, the vinyl LP format has reemerged from the brink of extinction. Vinyl records showed approximately the same growth rate of 54% as the newest emergent technology of digital streaming (IFPI, 2014) last year, though as a niche market that in the USA, accounts for 3.6 % of total album sales (Nielsen 2015). In 2014 the number of vinyl records sold was 9.2 million, which is meager if compared to the 106.5 million digital downloads or the 140.8 million CDs sold. Although still a niche product, the vinyl record business has become more profitable every year, with sales rising exponentially in the last 9 years, from 2006 to 2014 as seen in Figure 2 below (Statista, 2015). One major trigger event for this resurgence in market demand for the vinyl LP format, according to a recent Wall Street Journal article, is the founding of the Record Store Day in 2007 by approximately 700 US-based independent record stores (Barron, 2015). 5 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 Figure 2: Vinyl Record Sales Worldwide from 1997 to 2014 (in million U.S. dollars) 400 350 Revenues in million U.S. dollars 300 250 200 150 100 50 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: Statista 2015 But the increased demand and sales spurt of vinyl LP format was not only based on the trading of old and used vinyl records produced by extinct vinyl pressing firms. In fact, we found that the number of pressing plants opened in the last 15 years increased with fifteen new plants opened; however, of the 58 incumbent firms in existence during the dominant design phase of the 1950s to 1960s, only 22.4% of these firms are still pressing vinyl records today (Table 1). We observed that in our data, the majority of the incumbent vinyl pressing firms that are around in present time, were established only in the last 15 years. Most of the vinyl pressing plants in existence when the vinyl LP record format was the dominant technology, decided to abandon the vinyl LP format and either switch to the next S-curve or exited from the market, with very few firms staying on the vinyl format’s S curve. 6 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 Table 1: Global Vinyl Pressing Plants in Existence in Dominant Design (1950-late 1960s) and Re-Emergence (2007-2015) Phases Vinyl Pressing Plants Country of Origin Year of Founding GZ Vynil Czech Republic 1951 MPO Group France 1957 Pallas Group Tuff Cong Germany Jamaica 1948 1965 Toyokasei CO., LTD Record Industry Japan 1959 Netherlands 1958 Archer Record Pressing Musicol Recording United Record Pressing Rainbo Records USA 1965 USA USA 1964 1949 USA 1939 Disc Makers Pallas USA USA USA 1946 1955 Queen City Album (QCA) Record Pressing RCA Records Pressing Plants USA 1950 USA 1929 What has allowed the technological re-emergence of a legacy technology like Vinyl LP records in a highly competitive market? We address possible strategic factors in the next section. 5. Discussion The technology life cycle literature has a well-established theoretical basis to explicate how a technology evolves from an early ferment period to take-off and maturity, and then to a final phase of discontinuity in which the old dominant design has to make a strategic choice: it can either try to fend off the attack from an emergent threat, exit the market, or engage in a technological retreat into niche markets to extend its life (Adner and Snow, 2009; Tripsas, 2008; Utterback and Abernathy, 1978). While much attention has been paid to emergence of new technologies in a technological life cycle (Adner and Snow, 2009; Tripsas, 2008), what is less known is the relatively new phenomenon of technological reemergence, or resurgence of a legacy technology, and the strategic conditions for it. In this paper, we use the vinyl record’s resurgence into the global sound recording industry to address the nascent phenomenon of technological re-emergence; more specifically, we explore the strategic factors that trigger market demand for legacy technologies. While we earlier described the technological re-emergence of vinyl LP format, below we propose three possible factors that could contribute to a firm’s re-emergent strategy for a legacy 7 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 technology, namely the performance attribute on which the technology competes, the competitive strategy used to target key customer segments, and building new competencies across the value chain. Redefining the Performance Attribute – Christensen (1997) describes how a disruptive technology is able to enter the market by appealing to a fringe segment that values a performance attribute not offered by the sustaining dominant design technology. In the case of a legacy technology, it also has unique performance attributes that differentiate it from not only the maturing technology but also the newly emerging technological heir. The product attributes for vinyl LP’s resurgence as a legacy technology were one of “fat” sound and authenticity of audio listening experience rather than “clean” sound quality, portability, and greater storage that CDs, MP3 and digital stream have in common (Bartmanski & Woodward, 2015a, Hayes, 2006). Vinyl offers a sensory experience that is unable to be achieved by the digital media formats that lack “materialism” or a tactile quality (Hayes, 2006). Differentiation focus strategy in a blue ocean-like space - building on redefining the performance attribute, is the fact that for a re-emergent strategy to succeed, it requires a differentiation focus strategy rather than a cost focus strategy to target niche segments, which may differ widely in their customer preferences. For legacy technologies to successfully differentiate themselves from reigning technological formats in existing markets, the value proposition should be based on product attributes that appeals to a broad base of underserved market niches rather than a single niche market segment. Legacy technologies returning after a long period of quiescence may in fact, already have “institutional guardians” (Raffaelli, 2015), who protect the identity of the product long after its dominant design period. These individuals, in the case of vinyl records, were the disc jockeys or DJs, as well as the independent record store owners, who favored vinyl records as the only technology able to provide a richer, more natural and listening experience compared to the other technologies (Bartmanski and Woodward, 2015 a,b). Yet institutional guardians or the nostalgic category of users are only one type of consumers of vinyl records; for example, in the USA and UK, which are two of the top 10 global markets for vinyl records (International Federation for the Phonographic Industry (IFPI), 2014), the top ten selling records were in the music genres of rock, pop rock, and indie rock, and many were from contemporary music albums from 2013 and 2014 by artists like Artic Monkeys, Jack White, as well as older groups like the Beatles, Miles Davis, and Pink Floyd (Barnes, 2014; Nielsen report, 2014). This demonstrates that there is significant heterogeneity in customer preferences who are not all represented by a ‘retro’ niche segment. The younger indie-rock fans, for example, are not the stalwart guardians nor are they a “segment zero” category in the sense used by Christensen, as the younger consumers are willing to pay a higher price for vinyl than the current dominant design or the emergent discontinuous technology. In fact, vinyl appeals to youth, who use vinyl LP records as a complement to their other modes of listening experiences like digital streaming music, depending on their moods and settings (Hayes, 2006). Now a very mixed consumer niche that consist of nostalgic baby boomers, indie rock fans, DJs, as well as millennials who buy for the pleasure of collecting something that can be physically shown, 8 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 that is considered a luxury item, and for the richer sound compared to the CD (Weber, 2014). Thus, by competing based on product attributes that are different from both the maturing dominant design and the newly emerging discontinuous technology, which in this case are CDs, MP3 formats and digital downloads, vinyl does not engage in direct head to head competition with the prevailing formats. Rather than use retreat strategies, as proposed by Adner and Snow (2009), and taking a cost focus approach in less profitable niches, a reemergent strategy positions the legacy technology in a “blue ocean” like (Kim and Mauborgne, 2005) market space, that make other technology formats irrelevant. Acquisition of new competencies across the value chain: There are several external factors that have played a role in the re-emergence of the vinyl LP format. One of the most critical external factors has been the lack of suppliers such as the manufacturers of vinyl pressing machines and the crude vinyl itself (Shah, 2014), which has required vinyl pressing firms to acquire new competencies. Many of the vinyl pressing firms today, such as Gotta Groove Records Brooklyn Phono, and Quality Records to name a few, have had to acquire and fix the old vinyl pressing machines themselves (Kozinn, 2013, Oliphint, 2014). Although in one sense, the legacy technology is in very similar position as the dominant design technology in decline with the shortage of suppliers, it is different in that new entrants and incumbents into the legacy market already struggle to keep up production to market demand. To bring the legacy technology to market, organizations need to acquire new competencies in value chain activities upstream and downstream from their core activities to survive. A reemergent strategy with legacy technologies will require significant investment acquiring competencies in the upstream value chain activities initially, to accommodate the growing installed base of users while dealing with the dearth of suppliers and complements. Thus, one caveat for a technological re-emergence is the ecosystem in which a legacy technology is brought back, needs to be able to support the resurgence or the legacy technology could become a victim of its own success. 6. Conclusion In this paper, we describe the phenomenon of technological re-emergence and the strategic factors involved in a re-emergent strategy for legacy technologies. We specifically put forth three potential factors that could contribute to a firm’s re-emergent strategy for a legacy technology, namely the role of the performance attribute on which the technology competes, the competitive strategy used to target key customer segments in a blue ocean like market space, and the need to acquire new competencies across the value chain. While we have attempted to explore the strategic aspects of technological re-emergence, there are some limitations to what we were able to do in this study. Some future avenues for exploration include the consideration of demand heterogeneity for legacy technologies, other conditions that may be relevant to technological re-emergence, as well as whether these strategic factors are generalizable to other product markets and industry settings. However, this paper adds to the literature on technology life cycles by addressing an under-researched topic of technological re-emergence. From a practitioner’s perspective, it also has implications for firm survival as it sheds light on viable strategic choices available 9 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 to incumbent firms’ managers as to how to strategically position a legacy technology in the face of rapid technological change and turbulence in product markets brought in by newly emergent technologies. REFERENCES Abernathy, W. J., & Utterback, J. M., 1978. Patterns of industrial innovation. Technology review, 64, 254-228. Adner, R., & Snow, D., 2009. “Old” Technology Responses to “New” Technology Threats: Demand Heterogeneity and Graceful Technology Retreats. Industrial and Corporate Change, 19(5) 1655-1675. Aguilar, M., 2014. Why Vinyl is the Only Worthwhile Way to Own Music. GIZMODO. Available from <http://gizmodo.com/why-vinyl-is-the-only-worthwhile-way-to-ownmusic-1527750499>. [04/19/2014]. Anderson, P., & Tushman, M. L.,1990. Technological Discontinuities and Dominant Designs: A Cyclical Model of Technological Change. Administrative Science Quarterly, p. 604-633. Bartmanski, D., & Woodward, I., 2015a. Vinyl: The Analogue Record in the Digital Age. Bloomsbury Academic: London. - 2015b. The Vinyl: The Analogue Medium in the age of digital reproduction. Journal of Consumer Culture, 15(1) 3-27. Christensen, C., 1997. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Harvard Business School Press. Hayes, D. 2006. “Take those old records off the shelf”: youth and music consumption in the postmodern age. Popular Music and Society, 29(1) 51-68. History of the LP Record, 2013. Available from <http://lprecord.umwblogs.org/history/invention/>. [07/28/2015]. Foster, R., 1986. Innovation: The Attacker’s Advantage. New York: Summit Books. Kaplan, S., & Tripsas, M., 2008. Thinking About Technology: Applying a Cognitive Lens to Technical Change. Research Policy, 37(5), p. 790-805. Kim, W. C., & Mauborgne, R., 2005. Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant. Harvard Business School Publishing: Boston. Kozinn, A., 2013. Weaned on CDs, They’re Reaching for Vinyl. New York Times. Available from <http://www.nytimes.com/2013/06/10/arts/music/vinyl-records-are-making-acomeback.html?_r=2>. [07/23/2015]. Nielsen, 2015. 2014 Nielsen Music U.S: Report. Oliphint, J., 2014. Wax and Wane. The Tough Realities Behind Vinyl’s Comeback. Pitchfork Media Inc. Available from <http://pitchfork.com/features/articles/9467-waxand-wane-the-tough-realities-behind-vinyls-comeback/>. [07/23/2015]. Raffaelli, R. L., 2013. Identity and Institutional Change in a Mature Field: The Reemergence of the Swiss Watch making Industry, 1970-2008 (Doctoral dissertation, Boston College). Raffaelli, R., 2013. Mechanisms of Technology Re-Emergence an Identity Change in a Mature Field: Swiss Watchmaking, 1970 – 2008. Harvard Business School Working Paper, No.14-048. 10 Proceedings of 5th European Business Research Conference 10 - 11 September 2015, St. Regis Hotel, Rome, Italy, ISBN: 978-1-922069-83-2 Raffaelli, R., 2015. The Re-Emergence of an Institutional Field: Swiss Watchmaking. Harvard Business School Working Paper 16-003. Rogers, E.M., 1995. Diffusion of Innovation (4th Ed.). New York: Free Press. List of Record Pressing Plants. Discogs. Available from <http://www.discogs.com/lists/Record-Pressing-Plants/213755>. [08/01/2015]. Shah, N., 2014. The Biggest Music Comeback of 2014 – Vinyl Records. Wall Street Journal. Available from <http://www.wsj.com/articles/the-biggest-music-comeback-of2014-vinyl-records-1418323133>. [07/21/2015]. Sahal, D., 1981. Patterns of Technological Innovation. Reading, MA: Addison-Wesley. Sood, A., and Tellis, G. J., 2005. Technological Evolution and Radical Innovation. Journal of Marketing, 69(3), p. 152-168. Statista, 2015. Vinyl Record Sales Worldwide from 1997 to 2014 (in million U.S. dollars). Tushman, M. L., and Rosenkopf, L., 1992. Organizational Determinants of TechnologicalChange: Toward a Sociology of Technological Evolution. Research in Organizational Behavior, vol.14, p. 311-347. Tripsas, M., 2008. Customer preference discontinuities: a trigger for radical technological change. Managerial and Decision Economics, vol. 29, p. 79-97. Utterback, J. M., 1974. Innovation in industry and the diffusion of technology. Science, 183(4125), 620-626. Utterback, J., 1994. Mastering the Dynamics of Innovation: How Companies can Seize Opportunities in the Face of Technological Change. Harvard Business School Press. UK Top 10 Albums 2014. Source: <http://www.mirror.co.uk/news/uk-news/more-onemillion-vinyl-albums-4704121>. [08/05/2015] Vinyl Record Pressing Plants. Total Sonic Media. Available from <http://www.totalsonic.net/vinylplants.htm>. [08/01/2015]. Weber, P. (2014, January 10th). The Baffling Revival of the Vinyl LP. The Week. Available from <http://theweek.com/articles/453256/baffling-revival-vinyl-lp>. [07/21/2015] [4347 words] 11