Proceedings of 3rd Global Business and Finance Research Conference

advertisement

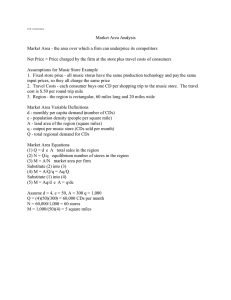

Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Analysis of Sovereign CDS and Government Bond Markets in the Euro Zone Crisis Takayasu Ito Sovereign CDS and government bond markets are integrated only in the Netherlands and not in Austria, Belgium, Finland, France, Germany, Greece, Italy, Ireland, Portugal, or Spain. Even though the CDS and government bond markets are separated, mutual influences between them are found in Greece, Italy, Ireland and Portugal with a one-way influence from the government bond to the CDS market in Spain. This means that CDS functions as insurance in Spain but not elsewhere. The intensified sovereign crisis delivered a shock to the CDS and government bond markets, resulting in the loss of market integration and the price discovery function. No evidence is found that CDS intensified the degree of the crisis because a unilateral influence from CDS to government bonds was not observed in any of the countries studied. JEL Classification: E43, G12 Keywords: CDS, Government Bond, Euro Zone, Sovereign Crisis 1. Introduction Government bond markets in several Eurozone countries started to experience severe stress in the first half of 2011. Massive sell-offs were observed, especially in Greek bonds, whose CDS (Credit Default Swaps) premium rose dramatically. This triggered a rise in government bond yields and CDS premiums in other countries such as Italy, Spain and Portugal. Originally, CDS served as a sort of insurance insofar as it is a financial swap agreement whereby the ____________________________________________________________ Takayasu Ito, School of Commerce, Meiji University, ito747@meiji.ac.jp 1 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 seller will compensate the buyer if there is a credit event. The buyer of the CDS makes a series of payments to the seller and, in exchange, receives a compensation payoff if there is a default, whereupon the seller retakes possession of the defaulting bond or loan. When the sovereign crisis in Europe intensified, however, speculation was rampant that hedge funds were buying CDS contracts and short selling government bonds. This arouse from two assumptions. Firstly, the worsening of the crisis would raise CDS premiums, and secondly that this would result in a decline in bond prices. These assumptions signify that CDS was no longer functioning as insurance for bond holders and had intensified the crisis. Insofar as a credit risk is priced, cash and synthetic market prices should reflect an equal valuation, in equilibrium. If, in the short term, they are affected by factors other than credit risk, such elements may partially obscure the co-movement between bond yield and CDS premiums. This paper focuses on the relationship between CDS and the underlying government bonds in the Eurozone sovereign crisis. It investigates this from two points of view. Firstly, we look at whether or not CDS and government bonds co-move. As Duffie (1999) and others point out, a theoretical no-arbitrage condition between the cash and synthetic price of credit risk should drive investment decisions and tie up the two markets in the long run. If this condition is applied to CDS and government bonds in sovereign crisis, co-movement between them can be confirmed. Secondly, this paper investigates whether CDS propels government bonds or the other way. If the former is confirmed, CDS do not function as insurance and if the letter, they do. There are some other papers which analyze the relationship between CDS and government bonds in the Euro zone. Fontana and Scheicher (2010) focus on Euro zone sovereign CDS and underlying government bonds using weekly CDS and bond spreads of ten Euro area countries for the period January 2006 to June 2010.They find that CDS spreads on average exceeded bond spreads. They also conclude that since September 2008, market integration for bonds and CDS has varied across countries. Palladini and Portes (2011) examine whether non-stationary CDS and bond spreads series are bound by a cointegration relationship over the period January2004 to March 2011 and find that the two prices should be equal to each 2 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 other and in equilibrium. They also conclude that the CDS market moves ahead of the bond market in terms of price discovery. The analyses conducted by Fontana and Scheicher (2010), and Palladini and Portes (2011) do not cover the period after April 2011 when the Eurozone sovereign crisis intensified. This paper covers the sample period January 29, 2009 to September 16, 2011, and therefore does include this period of intensification. This paper is the first to analyze the relationship between CDS and government bonds for 11 Euro zone countries in this period, and hence can be distinguished from related literatures. 2. Data CDS are liquid only in the maturity of five years. CDS and government bonds with a maturity of five years are used in this analysis. The sample period runs from January 29, 2009 to September 16, 2011. Eleven countries whose data are available are chosen from the Euro zone, namely Austria, Belgium, Finland, France, Germany, Greece, Italy, Ireland, Netherlands, Portugal and Spain. Data are provided by Bloomberg on a daily basis. CDS and government bonds are quoted by basis point and percentage in the market. The descriptive statistics of the dataset are shown in Table1. The movements of CDS and government bonds for Greece, Italy, and Germany are shown in Figures 1 and 2. About two weeks before the sample period began, on January 14, 2009. Standard and Poor (S&P) downgraded the rating of Greek government bonds to A− on the basis that the fiscal the country’s fiscal deficit would worsen within the downward trend of the global economy. Moody’s Investors Service also downgraded Greece's local- and foreign-currency bond ratings to Ca from Caa1 on 25 July 2011, about two months before the end of the sample period. According to Moody’s Investor Service (2013), obligations rated Ca are highly speculative and are likely to be in default or very close to it, with some prospect of recovering the principal and interest. Although the International Swaps and Derivatives Association (ISDA) announced that the Greek case was not a credit event on October 31, 2011, the last day when price information of CDS was updated on the information vendor was September 16, 20111. 1 For details, see the press release by ISDA on October 31, 2011. 3 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Table1 Figure1 Figure2 3. Methodology 3.1. Unit Root Test Because empirical analyses of the period from the mid-1980’s to the mid-1990’s show that data such as interest rates, foreign exchange and stocks are non-stationary, it is firstly necessary to check whether the data used in this paper contain unit roots. ADF (Augmented 2 Dickey/Fuller) and PP (Phillips /Perron) tests are conducted. Both the ADF and PP tests define the null hypothesis as ‘unit roots exist’ and the alternative hypothesis as ‘unit roots do not exist’. Fuller (1976) provides the tables for the ADF and PP tests. Firstly, the original data are checked to see whether they contain a unit root. Then, the data with first differences are analyzed to see whether they have a unit root in order to confirm that the data represent I (1) variables. 3.2 Cointegration Test A cointegration framework is presented to analyze the relationship between CDS and government bonds. Non-stationary time series vary widely with their own short-run dynamics, but a linear combination of these series can sometimes be stationary so that they show co-movement with long-run dynamics. This is called cointegration by Engle and Granger (1987). In the test of co-movement between CDS and government bonds by cointegration, equation (1) is estimated by Ordinary Least Squares (OLS) to find out whether the residual contains unit roots. CDSt GBt ut 2 (1) See Dickey and Fuller (1979), Dickey and Fuller (1981), and Phillips and Perron (1988) . 4 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 C D St = CDS GBt = Government Bonds When series CDSt and GBt are both non-stationary I (1), they are said to be in the relationship of cointegration if their linear combination is stationary I (0). The cointegration relationship between CDSt and GBt implies that government bonds and CDS move together in a long-run equilibrium. In addition to testing whether government bond and CDS are in a cointegration relationship, the cointegration vector (1,-1), β in the equation (1), is checked using the dynamic OLS method developed by Stock and Watson (1993). Equation (2) is used to test if β = 1 can be rejected. GBt i denotes the lead and lag variables of 3 government bonds . If β = 1 cannot be rejected, CDS changes to the same degree as government bonds. The test of the cointegration vector is only conducted on a pair of samples when they are in a cointegration relationship. p CDSt GBt bi GBt i ut (2) i p Firstly, analyses on the pair-wise relationship between CDS and government bonds of five years maturity are conducted. The co-movement of CDS with government bonds is then investigated using the cointegration test, and the cointegration vector test is used to determine whether they are in a one to one relationship. These results can be divided into three cases and interpreted as shown below. Case Cointegration Cointegration Vector Ⅰ No -- Ⅱ Yes β=1 cannot be denied Ⅲ Yes β=1 can be denied ⅠCDS does not co-move with government bonds and the CDS market is segmented from the government bond market. ⅡCDS co-moves with government bonds and their markets are integrated. ⅢCDS co-moves with government bonds and they are not in a relationship of one to one 3 As for the number of lead and lag terms, twelve is used. Hirayama and Kasuya (1996) provide empirical analysis using Rats procedure SWDYNAMIC.PRG. 5 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 relationship. 3.3 Granger Causality Test With regard to the variables CDSt and GBt , the Granger causality test checks whether CDSt affects GBt or GBt affects CDSt or CDSt and GBt mutually in a time series model. The original data are usually transformed into the change ratio to avoid the problem of spurious regression, but doing so also causes an error. Toda and Yamamoto (1995) develop the Granger causality test to use directly with non-stationary data. In the present study, the null hypothesis H 0 as to the influence of GBt on CDSt and of CDSt on GBt is tested. According to this method, trend term t and p + 1 (original lag plus one) are added for the estimation. Original lag length is decided by the Bayesian Information Criterion (BIC) standard. 𝑝+1 𝑝+1 𝐶𝐷𝑆𝑡 = 𝑢0 + 𝑢𝑡 + ∑ 𝛼𝑖 𝐶𝐷𝑆𝑡−𝑖 + ∑ 𝛽𝑖 𝐺𝐵𝑡−𝑖 + 𝑢𝑡 𝑖=1 (3) 𝑖=1 𝐻0 : 𝛽1 = 𝛽2 = ⋯ 𝛽𝑝 = 0 𝐻1 : 𝐸𝑖𝑡ℎ𝑒𝑟 𝛽𝑖 ≠ 0 (𝑖 = 1,2, ⋯ , 𝑝) 𝑝+1 𝑝+1 𝐺𝐵𝑡 = 𝑣0 + 𝑣𝑡 + ∑ 𝛾𝑖 𝐺𝐵𝑡−𝑖 + ∑ 𝛿𝑖 𝐶𝐷𝑆𝑡−𝑖 + 𝑢𝑡 𝑖=1 (4) 𝑖=1 𝐻0 : 𝛾1 = 𝛾2 = ⋯ 𝛾𝑝 = 0 𝐻1 : 𝐸𝑖𝑡ℎ𝑒𝑟 𝛾𝑖 ≠ 0 (𝑖 = 1,2, ⋯ , 𝑝) The F test is conducted by estimating equations (3) and (4) using OLS and summing the squared error. If the null hypothesis of H 0 in equation (3) is rejected, GBt is considered to explain CDSt . In other words, government bonds cause movement in CDS. If the null hypothesis of H 0 in the equation (4) is rejected, CDSt is considered to explain GBt . In other words, CDS causes movement in government bonds. Pair-wise analyses on CDS and GB over the five year maturity period are then conducted. These results can be divided into three cases and interpreted as shown below. 6 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Case Causlity From CDS to Government Bond Causality From Government Bond to CDS Ⅰ Yes Yes Ⅱ Yes No Ⅲ No Yes ⅠThe CDS and bond markets influence each other. No judgment can be made about the insurance function of CDS. ⅡThe CDS market influences the government bond market unilaterally. CDS does not function as insurance. ⅢThe government bond market influences the CDS market unilaterally. CDS functions as insurance. 4.Resutls 5.1 Unit Root Test Firstly, ADF and PP tests are conducted for the original series both with and without time trends. The BIC standard is used for the determination of lag length in the ADF test. The critical point of 5% for the t type of T = ∞ is –2.86(without trend) and –3.41(with trend) as reported in Fuller (1976). The results are shown in Tables 2and 3.It is apparent that all the variables are non-stationary. Table 2 Table3 Next, the data with first difference from the original data are analyzed using the ADF and PP tests. It is possible to conclude that all the variables are I (1) These results are shown in Tables 4 and 5. Table4 Table5 7 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 5.2 Cointegration Test Firstly, pair-wise analyses on CDS and government bonds in five-year maturities are conducted. The relationship of cointegration is confirmed only in the Netherlands and in no other country. Thus Dutch government bonds and CDS moved in long-term equilibrium during the Euro zone sovereign crisis. In other countries, government bonds and CDS moved separately. These results are reported in Table 6. Next, whether the size of β (the impact of government on CDS in Netherland) is 1 or not is investigated. The size of β is 0.018. This indicates that the impact of government bonds on CDS in the Netherlands is very small. These results are reported in Table 7. Table6 Table7 5.3 Granger Causality Test Pair-wise analyses on CDS bond and government in five-year maturities are conducted. Mutual causalities are found in Greece, Italy, Ireland and Portugal. Causality from government bonds to CDS is found in Spain. No causality between government bond and CDS is found in Austria, Belgium, Finland, France, Germany and the Netherlands. Table8 5. Conclusion This paper focuses on the relationship between sovereign CDS and underlying government bonds in the context of the Eurozone crisis. The countries analyzed in this paper are Austria, Belgium, Finland, France, Germany, Greece, Italy, Ireland, the Netherlands, Portugal and Spain. The investigations are conducted from two viewpoints. Firstly, whether CDS and government bond co-move is tested. Secondly, whether CDS propels government bond, or, 8 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 government bond propels CDS is tested. If the former is confirmed, CDS does not function as insurance tool and if the latter, they do. This paper concludes that CDS and government bond markets are integrated only in the Netherlands. But in other countries such as Austria, Belgium, Finland, France, Germany, Greece, Italy, Ireland, Portugal and Spain, CDS and government bond markets are not integrated because no co-movement is found. In Austria, Belgium, Finland, France, Germany and Netherland, CDS and government bond markets are totally segmented. On the other hand, CDS and government bond markets are separated in Greece, Italy, Ireland, Portugal, and Spain, but mutual influences are found in Greece, Italy, Ireland and Portugal. A one-sided influence from government bonds to CDS is found in Spain, indicating that in this country CDS functions as insurance. In the other countries, such an insurance function was not found. No evidence was found that CDS intensified the degree of the sovereign crisis unilaterally because such a one –way influence from CDS to government bonds was not observed in any of the countries studied. The results reported here are different from those of Fontana and Scheicher (2010) and Palladini and Portes (2011). Fontana and Scheicher (2010) conclude that since September 2008, market integration for bonds and CDS varies across countries. Palladini and Portes (2011) report that the CDS market moves ahead of the government bond market in terms of price discovery. This divergence arises mainly because of the difference in the sample period studied. The analyses conducted by Fontana and Scheicher (2010), and Palladini and Portes (2011) do not cover the period after April 2011 when the Eurozone sovereign crisis intensified. This paper covers the period from January 29, 2009 to September 16, 2011. Within this timeframe the intensified sovereign crisis delivered a shock to the government bonds and CDS markets, resulting in the loss of market integration and the price discovery function. References Dickey,D.A. and W.A. Fuller.,1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74(366), 427-431. Dickey,D.A. and W.A. Fuller.,1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49(4), 107-1072. 9 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Duffie,D. ,1999. Credit swap valuation. Financial Analysts Journal 55(1),73-87. Engle,R.F. and C.W.J. Granger., 1987.Co-integration and error correction: representation, estimation and testing. Econometrica 55(2), 251-276. Fontana, A. and M. Scheicher., 2010. An analysis of euro area sovereign CDS and their relation with government bonds European Central Bank. Working Paper Series: 1271. Fuller,W.A., 1976. Introduction to statistical time series. John Wiley & Sons,Inc. Johansen,S., 1988. Statistical analysis of cointegrated vectors. Journal of Economic Dynamics and Control 12 (2-3), 231-254. Moody’s Investor Service, 2013. Rating symbols and definitions. Palladini,G. and R. Portes., 2011. Sovereign CDS and bond pricing dynamics in the Euro-area. CEPR Discussion Papers: 8651. Stock,J.H. and Watson, M.W., 1993. A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 61(4), 783-820. Toda,H.Y. and Yamamoto, T., 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66(1-2), 225-250. 10 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 bp 6,000 5,000 4,000 3,000 Greece Italy 2,000 France 1,000 07/29/2011 05/29/2011 03/29/2011 01/29/2011 11/29/2010 09/29/2010 07/29/2010 05/29/2010 03/29/2010 01/29/2010 11/29/2009 09/29/2009 07/29/2009 05/29/2009 03/29/2009 01/29/2009 0 Figure 1 Movement of Five Year CDS Premium Note: Sample period is from January 29, 2009 to September 16, 2011. Data source is Bloomberg. % 30 25 20 15 Greece Italy 10 France 5 07/29/2011 05/29/2011 03/29/2011 01/29/2011 11/29/2010 09/29/2010 07/29/2010 05/29/2010 03/29/2010 01/29/2010 11/29/2009 09/29/2009 07/29/2009 05/29/2009 03/29/2009 01/29/2009 0 Figure 2 Movement of Five Year Government Bond Yield Note: Sample period is from January 29, 2009 to September 16, 2011. Data source is Bloomberg. 11 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Table 1 Descriptive statistics of data for analysis Variable Average SD Min Max Median Austria 2.59 0.45 1.66 3.47 2.67 Belgium 2.93 0.47 1.95 3.85 2.90 Finland 2.38 0.41 1.49 3.29 2.51 France 2.44 0.37 1.59 3.13 2.56 Germany 2.17 0.40 1.08 2.89 2.30 Greece 9.72 5.70 3.19 27.19 8.74 Italy 3.32 0.58 2.59 5.45 3.15 Ireland 5.87 3.08 3.20 17.12 4.35 Netherland 2.40 0.42 1.50 3.21 2.51 Portugal 5.42 3.37 2.70 17.51 3.89 Spain 3.55 0.75 2.64 5.68 3.24 Austria 89.05 36.92 47.59 268.98 80.53 Belgium 112.25 60.67 32.08 297.13 114.69 Finland 34.78 14.38 16.25 90.42 30.69 France 67.00 33.84 19.66 191.83 68.90 Germany 0.43 0.16 0.19 0.91 0.40 Greece 736.51 662.71 100.50 5034.45 720.66 Italy 159.39 76.07 57.72 504.00 154.89 Ireland 371.39 238.75 110.30 1180.50 257.30 Netherland 48.86 21.27 24.50 138.31 44.82 Portugal 327.28 280.62 43.13 1214.86 274.58 Spain 185.45 94.85 53.23 429.65 197.01 Government Bond 5Y CDS 5Y Notes: Sample period is from January 29, 2009 to September 16, 2011. Government Bond is expressed by percentage. CDS is expressed by basis point. One basis point is 0.01%. 12 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Table 2 ADF unit root test (original series) Variable Without Trend With Trend Variable Government Bond 5Y Without Trend With Trend CDS 5Y Austria -1.309 -1.512 Austria -0.919 -2.256 Belgium -0.328 -1.866 Belgium 0.271 -2.904 Finland -1.502 -1.688 Finaland -0.391 -1.583 France -1.141 -1.423 France 1.354 -1.389 Germany -1.109 -1.382 Germany -0.089 -2.208 Greece 2.389 -2.099 Greece 2.489 -0.219 Italy 0.284 -2.153 Italy 1.217 -1.209 Ireland -0.342 -2.346 Ireland 0.287 -3.018 Netherland -1.465 -1.340 Netherland 2.135 -2.096 Portugal 1.154 -1.830 Portugal 1.867 -1.937 Spain 0.111 -2.978 Spain 0.584 -3.113 * indicates significance at 5% level. 5% critical values are −2.86 (without trend) and −3.41 (with trend). Table 3 PP unit root test (original series) Variable Without Trend With Trend Government Bond 5Y Variable Without Trend With Trend CDS 5Y Austria -1.274 -1.582 Austria -1.676 -1.235 Belgium -1.511 -1.959 Belgium -0.089 -2.071 Finland -1.906 -2.072 Finland -0.681 -0.630 France -1.326 -1.533 France 0.393 -1.254 Germany -0.977 -1.400 Germany -0.615 -1.322 Greece 0.100 -2.970 Greece 0.903 -1.221 Italy -1.158 -2.287 Italy 0.184 -0.932 Ireland -0.806 -1.521 Ireland -0.216 -2.065 Netherland -1.207 -1.507 Netherland -3.676 -3.111 Portugal 0.488 -1.582 Portugal 0.767 -1.781 Spain -1.245 -3.033 Spain -0.904 -3.533 * indicates significance at 5% level. itical values are −2.86 (without trend) and −3.41 (with trend). 13 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Table 4 ADF unit root test (first differenced series) Variable Without Trend With Trend Variable Government Bond 5Y Without Trend With Trend CDS 5Y ⊿Austria -26.706* -26.420* ⊿Austria -18.856* -18.943* ⊿Belgium -23.231* -23.147* ⊿Belgium -19.193* -17.216* ⊿Finland -20.946* -21.323* ⊿Finland -13.967* -14.042* ⊿France -21.141* -21.045* ⊿France -16.386* -16.520* ⊿Germany -25.519* -25.545* ⊿Germany -19.740* -19.672* ⊿Greece -10.797* -11.206* ⊿Greece -10.798* -11.151* ⊿Italy -19.116* -19.043* ⊿Italy -20.698* -19.229* ⊿Ireland -11.124* -11.047* ⊿Ireland -18.271* -18.408* ⊿Netherland -26.541* -26.629* ⊿Netherland -23.850* -22.339* ⊿Portugal -8.833* -9.016* ⊿Portugal -11.588* -11.849* ⊿Spain -19.081* -18.988* ⊿Spain -18.135* -18.147* Without Trend With Trend * indicates significance at 5% level. 5% critical values are −2.86 (without trend) and −3.41 (with trend). Table 5 PP unit root test (first differenced series) Variable Without Trend With Trend Variable Government Bond 5Y CDS 5Y ⊿Austria -26.779* -26.779* ⊿Austria -18.869* -18.917* ⊿Belgium -23.248* -23.797* ⊿Belgium -19.947* -20.012* ⊿Finland -26.737* -26.737* ⊿Finland -23.109* -23.323* ⊿France -26.376* -26.382* ⊿France -23.204* -23.304* ⊿Germany -25.571* -25.595* ⊿Germany -19.761* -19.853* ⊿Greece -22.928* -22.972* ⊿Greece -13.320* -13.299* ⊿Italy -22.218* -22.268* ⊿Italy -20.916* -20.958* ⊿Ireland -18.958* -18.959* ⊿Ireland -18.313* -18.346* ⊿Netherland -26.625* -26.628* ⊿Netherland -23.885* -24.285* ⊿Portugal -19.375* -19.441* ⊿Portugal -18.577* -18.637* ⊿Spain -21.187* -21.199* ⊿Spain -23.043* -23.073* * indicates significance at 5% level. 5% critical values are −2.86 (without trend) and −3.41 (with trend). 14 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Table 6 Cointegration test Variable Test Statistics Government Bond 5Y, CDS 5Y Austria -2.169 Belgium -1.343 Finland -1.46 France -0.677 Germany -1.981 Greece 0.043 Italy -0.763 Ireland -2.446 Netherland -3.742* Portugal -2.867 Spain -2.237 Notes: * indicates significance at 5% level. ** indicates significance at 10% level. 5% critical value is −3.3377 from MacKinnon (1991). 10% critical value is −3.0462 from MacKinnon (1991). Table 7 Cointegration vector test Variable β Modified SE Modified t Value 0.01813 0.136 7.220 Government Bond 5Y, CDS 5Y Netherland Notes: β = 1 can be rejected because modified t value is smaller than 5% critical value (1.96). 15 Proceedings of 3rd Global Business and Finance Research Conference 9 - 10 October 2014, Howard Civil Service International House, Taipei, Taiwan, ISBN: 978-1-922069-61-0 Table 8 Granger causality test Test Statistics Test Statistics Government Bond 5Y to CDS5Y CDS 5Y to Government Bond 5Y Austria 1.247 0.415 Belgium 1.198 0.208 Finland 1.445 0.553 France 1.383 0.121 Germany 1.540 0.050 Greece 13.142* 15.626* Italy 44.674* 5.372* Ireland 60.991* 3.879* Netherland 0.783 1.500 Portugal 73.605* 5.595* Spain 13.455* 1.011 Notes: * indicates significance at 5 % level. As for the number of lags, one ia added to BIC selection. 16