Proceedings of Annual Spain Business Research Conference

advertisement

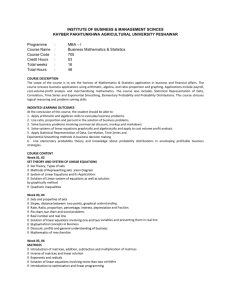

Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Would Investor Sentiment and Macroeconomic Factors Affect Exchange Market in Asian Country? Huang Mei-Hung1*, Jeng Yih 2 and Hsu So-De3 Kahneman and Tverskey(1979) established Prospect Theory studying the decisionmaking procedure of the investors from mental part, and the influence of the mental effects to the financial market. This theory brought in human irrational behavior, a tremendously new idea, to traditional Finance. Investor sentiment would affect the investor’s trading behaviors and investment strategy, and further would affect the market returns. To identify the changes in investor sentiment and macroeconomic factors, and to find out whether the asymmetric phenomenon exists in the foreign exchange market under the influences of these factors, this research studies the relations among the investor sentiment, macroeconomic factors, and foreign exchange market. Using the data from 01/1999 to 03/2011, we processed principal components analysis, general linear model, GARCH, and quantile regression analysis. The result shows that the investor sentiment factors and the macroeconomic factors have the different influences to the foreign exchange rates in each Asian country in different conditions. JEL Codes: C31, F31 and G02 1. Introduction With the development of technologies and internet, the international finance markets and trade liberalization made the investments more globalized. Therefore, to predict exchange rates more reasonably becomes an important topic. However, in Taiwan, most studies about investor sentiment are related to the general impacts to stock returns. There are not many studies about investor sentiment to the foreign exchange markets. From the documentations, we found that investor sentiment would affect the investment decisions in different finance markets. However, in foreign exchange market, how investor sentiment factors could be evaluated? And, what should be the indicators for evaluating the investor sentiment? The study object of this research is the foreign exchange markets in Asian countries. We took the investor sentiment factors studied in Baker and Wurgler(2006) as the reference. Beside stock turnover rate, index of consumer sentiment, and weather effect factors selected by Saunders(1993), trade remaining, industrial production index, inflation rate, money supply, discount rate, and base interest rate are used to study the relation of investor sentiment factors and exchange market returns. We expect to find out the precise relations among these factors and the exchange rates. Compared with economic indicators, investor sentiment factors are easier to interpret and provide more information. In different exchange market returns, the investor sentiment factors are easy to interpret as well, and could help to identify the market situations and investment decisions. Through the related researches from other countries, we found that the investors can be grouped by different emotion factors. Moreover, these factors could affect the cross-sectional stock 1 Miss. Huang Mei-Hung, Ph.D. Candidate of Financial Management, National Sun Yat-Sen University , Kaohsiung, Taiwan ; Lecturer of Dep. Of Business Administration, Overseas Chinese University, Taichung, Taiwan, Email: tiffanyhuang428@gmail.com 2 Dr. Jeng Yih, Department of Finance management, , National Sun Yat-Sen University, Kaohsiung, Taiwan, Email: yihjeng2@gmail.com 3 Dr. Shyu So-De, Department of Banking and Finance, Takming University of Science and Technology, Taipei, Taiwan, Email: dshyu@takming.edu.tw Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 market. This research is also expected to find out whether the investor sentiment factors and macroeconomic factors would impact exchange market. Mainly, we would like to research further about the influence of the investor sentiment factors to the exchange market returns in Asian countries. Most the researches are related to the influences of the investor sentiment to the stock market returns or to the speculative stocks‟ returns. Not many researches studied about the influence of the investor sentiment to the exchange market returns. Based on the points in Behavioral Finance, we would like to find out the correlation of the investor sentiment and macroeconomic factors to the fluctuation of foreign exchange rates. The purposes of this study are -1. to study the relations of the exchange market returns among 11 countries in Asia. 2. to study how the exchange market returns in each country are related to investor sentiment and macroeconomic factors through principal components analysis. 3. to study how the exchange returns in each country are related to investor sentiment factors and macroeconomic factors through multivariate analysis and quantile regression analysis. 2. Literature Review 2.1 Exchange Rates and Exchange Market With the data collected and integrated by International Commercial Bank of China and Taiwan Stock Exchange from 01/04/2001 to 12/30/2004, Yu(2005) processed unit root test, Granger causality test, error correction model, and cointegation to process the research. The result of Yu‟s study shows -- (1) Depending on the countries, the causality of stock price index and foreign exchange rates has the different lead-lag relationship. Moreover, different exchange rate objects come up with the different lead-lag relationships. (2) The stock markets of the countries with the larger capital markets affect the ones of the countries with the smaller capital markets. And, this causality is not reversible. Therefore, the U.S. stock price index is followed by the Japan stock price index and Taiwan stock price index. The stock price index of a small capital market, such as the one in Taiwan, is impacted by international stock markets. (3) U.S. S&P500 affects TAIEX for more days than Nikkei 225 index affects TAIEX. This inferred that Japan stock market affects Taiwan stock market directly and immediately because Japan is the country with the largest total trade volume for Taiwan. (4) No matter if stock price index or exchange rates fluctuate ahead, it comes up with the same conclusion that the investors transfer the capitals to stock market when the stock price rising, which causes currency depreciation because of the capital loss in exchange market. At this situation, investors would transfer the capitals to exchange market, which causes the stock price dropped. The currency value and the stock price of a country are in a negative correlation. Hsu (2010) studied the correlation between the fluctuations in international stock market and foreign exchange market. The methods used were ADF and PP unit root test. The samples were the data from 01/07/2000 to 03/05/2010. Because the stock market off days are different in each country, this study compared the stock market data from Thailand, Taiwan, Philippines (with the data for 525 weeks), Japan, Singapore, South Korea, and Indonesia after U.S. stock market re-opened. Because Indonesia started to operate the market based on floating rate of exchange at 07/2005, there is only data for 238 weeks for Indonesia. The data was retrieved from Global Financial Database. The results of the study demonstrated that the correlation coefficient estimated by DCC model Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 varies obviously and shifts back and forth with a specific range. If the data is only estimated by unconditioned fix correlation coefficient model, the fluctuation of correlation coefficient would be overlooked, which makes the investors cannot identify the correlation of the factors in the finance markets and get into the higher risk. The samples of the exchange rates were affected by the fluctuation of the stock market returns in each country. Except the result of Taiwan, the ones of all other seven countries demonstrated that the alteration of the exchange rates had the significant influence to the stock market returns. Furthermore, the more serious the alteration, the wider the fluctuation of the stock market returns, which makes the investment more risky. Except Taiwan and Singapore, the mean of θ derived from unconditioned fix correlation coefficient is less than the mean ofθ derived from dynamic conditional correlation coefficient . This means the influence of the exchange rate alteration to the stock market return fluctuation would be underestimated when estimated by unconditioned fix correlation coefficient. Therefore, when doing the estimate, dynamic conditional correlation coefficient is better than unconditioned fix correlation coefficient. Exchange rate alteration impacts stock market return fluctuation positively and obviously. Beside the investment returns and the investment portfolio, the investors should consider the relations among the finance markets, the fluctuation in exchange market, and the international finance situations to make the more reasonable and more correct decisions to get lower risks and higher benefits. 2.2 Investor Sentiment DSSW(1990) brought up the points about the influence of the investor sentiments to the risk-weighted assets (Lo and Lin, 2005). First, when noise traders are more optimistic at investment, they would carry more risk-weighted assets. Therefore, they carry more risk premium. However, eventually, the increase of the demand would cause the price of the risk-weighted assets rising. The investors need to pay the higher price for the riskweighted assets, which makes them get the lower returns in the investment. Second, when the noise traders have more different attitudes to the future stock market, they would get more uncertainty at the risk-weighted assets. The uncertainty would trigger the risk aversion causing that the arbitragers carry less risk-weighted assets and get less returns. That also means the decrease of arbitragers in the markets would increase the noise traders bringing up the prices far away from the fundamental values. Because of carrying the higher risk, the noise traders get higher returns. Third, noise traders would obtain the risk-weighted assets with the higher price but sell out with the lower prices. Thus, the more common the situations happen, the lower returns that the noise traders would get. Shleifer and Vishny(1997) stated that the investor sentiments brought the investment risk which might be very expensive. Brown and Cliff(2004) assumed that fundamental investors and speculators exist in the market in which the fundamental investors have the unbiased expectation and the speculators have the biased expectation to the asset values. When the speculators think the asset real value is higher or lower than the current price, they would tend to be optimistic or pessimistic. In other words, the extent of being optimistic or pessimistic could be taken as the range of the discount of the real value. The expectation deviation from the investors is what we take as the investor sentiment. Different scholars have the different ways to explain and to think about the investor sentiment. Thus, the results of the researches are different. Baker and Stain(2004) stated that turnover rate is like a liquidity variable which can be taken as a sentiment variable. Jones(2001) found that the return rate of future stock will be low when the turnover rate is high. Chen(2001) took odd lot Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 trading amount, turnover rate, the ratio of margin purchase and short sale, domestic institutional investors, foreign investor net buy and net sell, dealer, bond redemption price, investment trust holding ratio, the amount of initial public offering companies, and fund net asset value discount rate as the investor sentiment variables. The study found that investor‟s emotions and stock return are correlative. Brown and Cliff(2004) used principal components analysis to build up the sentiment index to study the relationship between sentiment index and short-term stock return. This study revealed that the historical stock returns could affect the sentiment index. Besides, the stock return and sentiment index are highly correlated. But, in the study, there was no obvious evidence provided to support that the sentiment factors could be used to predict stock returns. 2.3 Macroeconomic Factors Lee(1992) studied the connections of substantial stock returns, industrial production growth, inflation and real interest rate through Granger causality test and vector autoregression (VAR) model. In VAR model, substantial stock returns can only interpret a small part of the variation in inflation rate. Inflation can only interpret a small part of the variation in industrial production growth and real interest rate. Kwon and Shin (1999) studied whether Korean economic activities would impact Korea Stock Exchange (KSE) through vector error correction model, cointegration, and Granger causality test. In the study of Kwon and Shin (1999), the economic activity factors had exchange rates, trade remaining, money supply, and industrial production index. The result of this study indicated that KSE stock price index and economic factors have a stable and lasting relationship. However, KSE stock price is not a leading indicator. Choudhry(2001) studied the connections of the stock return rates for Chile, Argentina, Venezuela, and Mexico, the countries with the high inflation rate. The result of this study indicated that inflation rate and stock return rate are positively correlated. The historical inflation rate would impact the current stock return rate. And, some studies indicated that the correlation of substantial stock returns to inflation rate of the next term is negative. Tsouma (2009) studied the relationship between stock return and economic activities for developed countries through Granger causality test and vector autoregression with the index of consumer sentiment from 01/1991 to 12/2006, nominal rate of stock return, substantial stock return, and industrial production index. The results of the study indicated that no causal connection exists between economic activities and stock return. The fluctuation of stock return prediction and stock returns in emerging markets could interpret the finance development and risk. Chen (2001) used multiple regression analysis to analyze the relationship among the macroeconomic factors, the returns of the bond market, and the returns of the stock market. The factors were interest rate change, money supply change rate, inflation rate, and real gross production rate of change. The study shows that the real gross production rate of change and money supply change rate have the significant and positive correlation to the stock returns. And, these four factors have the significant negative correlation to the returns at bond market. Lee et al.(2006) picked industrial production index, 30-day commercial paper rate, and the difference of the prices as the macroeconomic factors. And, the investor sentiment factors were replaced by the balance of stock load, total amount, and stock index returns. Vector autoregression model and forecast error variance decomposition were used to analyze the relationship among the momentum strategy, macroeconomic factors and investor sentiment factors. The result of the research shows up that the investor sentiment and macroeconomic factors is in the causal correlation. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Besides, the investor sentiment, momentum strategy, and macroeconomic affect one another. 3. The Methodology and Model 3.1 Data This research studied the connection between investor sentiment and exchange market, and the connection of the exchange market and the investor sentiment. The study object is the exchange markets in Asia. Because of the difficulty of collecting the data in investor sentiment and macroeconomic factors, Vietnam is not covered in this study. The exchange market returns of Japan, South Korea, Hong Kong, Singapore, China, Indonesia, Malaysia, Philippines, Taiwan, and Thailand are the research objects. The collected data are from 01/1999 to 03/2011 (monthly). The data resources are TEJ, and Intelligence Winner. Beside turnover rate and index of consumer sentiment, industrial production index, substantial interest rate, exchange rates, and trade remaining are taken as the economic factors for studying the connection between investor sentiment and exchange market return. For the missing data, the previous entry would be used. 3.2 Research Methods With time series model, we used unit root test, cointegration, vector error correction model, causal relationship, vector autoregression, impulse response, and variance decomposition to build up the model of exchange market and stock price index for Asian countries. We clarify the definitions of the factors involved in this study. We studied the interaction and the connection of stock price index and exchange rates for Asian countries. After the analysis, the conclusion and suggestions are provided. 4. Empirical Results 4.1 Data The factors of exchange rates from 11 countries are selected to process a basic descriptive statistics (Table 4-1). The exchange return data of China, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, Philippines, Singapore, Taiwan, and Thailand from 01/1999 to 03/2011 were used to process a single differencing. The basic statistics data is listed in Table 4-1. 4.2 The Result of Unit Root Test Table 4-2 lists the result of unit root test for the exchange rates. During ADF and PP unit root test, before autoregression, the unit root test for time series of exchange rates from Asian countries cannot reject null hypothesis. The result shows the time series has the unit root phenomenon, which is called nonstationary time series. However, after first autoregression, the test results of all factors reject the unit root, which means the series is stable and the features of all the factors could be presented at first level. At KPSS test, before autoregression, all the factors reject null hypothesis, which means unit root phenomenon exists. That is nonstationary time series. However, after first autoregression, the series is stable. Therefore, we can conclude that the results of ADF, PP and KPSS unit root tests are matched. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 4.3 Principal Components Analysis For obtaining the most appropriate factors to represent the exchange rates in each country, we selected the common investor factors and macroeconomic factors.The principal components analysis of each country is similar. We took the principal components analysis for Japan as the example. Here is the result. When running regression analysis, if the factors are highly correlated (please see Table 3), other than the complexity of the model is increased, the interpretation of the factors would be possibly dispersed. Therefore, we used principal components analysis to solve collinearity problems. Generally, when Eigenvalue is less than 1 (Eigenvalues: (Sum = 8, Average = 1)), the interpretation of principal component is not acceptable for not better than the original variable. Based on the Eigenvalue at Table 1, we figured out that only factor 1, factor 2, and factor 3 could be selected as the principal components. Furthermore, the cumulative proportion reaches to 75%, which is with the highly interpretation. Chart 4-2 shows the interpretation of the eight factors by the principal components. Therefore, we can conclude that PC1 has the positive correlation with BA, CU, DI, IP, TE, and TU. PC1 has the negative correlation with CC and TR. PC2 has the positive correlation with CC, CU, DI, IP, TE, TR, and TU, and negative correlation with BA. These demonstrate that PC1 can fully interpret most the original factors. PC1 is highly correlated with BA(BASE_RATE), DI(DISCOUNT_RATE), and TU(TURNOVER_RATE), which means PC1 has the better interpretation to BA(BASE_RATE), DI(DISCOUNT_RATE), and TU(TURNOVER_RATE). PC2 has the better interpretation to IP(IPI). And, PC3 has the better interpretation to TE(TEMPERATURE). 4.4 Ordinary least squares Regression From the exchange market data at Table 4-5, we found that both basic interest rate and index of consumer sentiment have the negative correlation with exchange market return in Japan. But, both do not have the significant negative correlation with exchange market return in South Korea. For Hong Kong, the temperature to exchange market return has a significant negative correlation. The Constant is significant and keeps the positive correlation with the temperature. This means, other than basic interest rate, inflation rate, discount rate, industrial growth index, temperature, and turnover rate, there is some other factors affecting Hong Kong exchange market return. From Table 4-6, for Singapore, we found the turnover rate to exchange market return has the significant and negative correlation. For China, both index of consumer sentiment and industrial production index have the significant and negative correlation to exchange market return. For Indonesia, trade remaining to exchange market return is in a significant and negative correlation. From Table 4-7, for Malaysia, the inflation rate to exchange market return is in a significant and positive correlation. For Philippines, the discount rate to exchange market return is in a significant and positive correlation. For India, all are not significant. From Table 4-8, for Taiwan, the index of consumer sentiment to exchange market return is in significant and negative correlation. The temperature to exchange market return is in significant but positive correlation. Constant to exchange market return is in a significant and positive correlation. Therefore, other than basic interest rate, index of consumer sentiment, inflation rate, temperature, and turnover rate, there are other factors affecting Taiwan exchange market return. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 4.5 Quantile Regression The data at Table 4-9 shows that the basic interest rate, and the index of consumer sentiment both have significant and negative correlation with exchange market return. For getting the area of the points of significance, we processed Quantile Regression Analysis. For Japan, the result of the analysis shows that basic interest rate has the significant and negative correlation in the interval of 0.2, the index of consumer sentiment has the significant and negative correlation in the interval of 0.7. The results of both general regression and quantile regression of discount rate are not significant. The result of industrial production index has the significant and positive correlation in the interval of 0.7. And, the result of quantile regressions of the temperature, trade remaining, turnover rate are not significant. The data, for South Korea, at Table 4-10 shows that the results of quantile regression for basic interest rate, index of consumer sentiment, discount rate, industrial production index, trade remaining, and turnover rate are insignificant. The result of the whole inflation rate is insignificant. However, with quantile regression, the inflation rate is in significant and positive correlation in the interval of o.9.The data, for Hong Kong, at Table 4-11 shows that the exchange rate return to the whole basic interest rate, inflation rate, discount rate, industrial production index, and turnover rate are insignificant. But, through quantile regression, exchange market return to basic interest rate is in significant and negative correlation in the interval of 0.6, 0.7, 0.8, and 0.9, to inflation rate is in significant and positive correlation in the interval of 0.8, and 0.9, to discount rate is in significant and positive correlation in the interval of 0.6, 0.7, 0.8, and 0.9, and to industrial production index is in significant and negative correlation in the interval of 0.1, and 0.2, The exchange market returns to turnover rate is in significant and negative correlation in the interval of 0.1, which means insignificant to the whole system but significant to the interval. The exchange market return to temperature is in significant and negative correlation in the interval of 0.1. The data, for Singapore, at Table 4-12, shows that the exchange market return to the whole basic interest rate and temperate are both in insignificant correlation. Hence, the quantile regression result is insignificant. The exchange market return to inflation rate is insignificant, but is in significant and negative correlation in the interval of 0.1 and 0.2. The exchange market return to trade remaining is significant, and the quantile regression result is in significant and negative correlation in the interval of 0.4, 0.5, 0.6, 0.7, 0.8, and 0.9. The data, for China, at Table 4-13, shows that the general regression of index of consumer sentiment and temperature are insignificant. Thus, the result of quantile regression is insignificant. The general regression results for inflation rate, discount rate, and trade remaining are insignificant. The result after quantile regression shows that inflation rate is in significant and negative correlation when in the interval of 0.1, 0.2, and 0.3. The quantile regression for discount rate is in significant and negative correlation while in the interval of 0.2, 0.3, and 0.4. The quantile regression for trade remaining is in significant and negative correlation while in the interval of 0.1, and 0.2. The quantile regression for industrial production index is in significant and negative correlation while in the interval of 0.1, 0.3, 0.6, 0.7, and 0.8. The data, for Indonesia, at Table 4-14, shows that the results of general regression for inflation rate, and discount rate are insignificant. Thus, the result of quantile regression for discount rate is insignificant.The data, for Malaysia, at Table 4-15, shows that the general regression for basic interest rate, industrial production index, and trade remaining are Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 insignificant. But, the result of quantile regression for basic interest rate is in significant and negative correlation while in the interval of 0.2. The result of quantile regression for industrial production index is in significant and negative correlation while in the interval of 0.2 and 0.3. The result of quantile regression for trade remaining is in significant and negative correlation while in the interval of 0.1 and 0.9. The result of quantile regression for inflation rate is in significant and positive correlation while in the interval of 0.9. The result of general regression for temperature is insignificant, so the result of quantile regression for temperature is insignificant as well. The data, for Philippines, at Table 4-16, shows that the results of general regression for the whole basic interest rate, inflation rate, and trade remaining are insignificant. But, the result of quantile regression for basic interest rate is in significant and negative correlation while in the interval of 0.2, 0.4, 0.5, and 0.8. The result of quantile regression for inflation rate is in significant and negative correlation while in the interval of 0.1, 0.2, and 0.3. The result of quantile regression for trade remaining is in significant and negative correlation while in the interval of 0.1, and 0.9. The result of general regression for discount rate is in significant. The result of quantile regression for discount rate is in significant and positive correlation while in the interval of 0.2, 0.3, 0.4, 0.5, 0.7 and 0.8. The result of general regression for temperature is insignificant. Hence, the result of quantile regression for temperature is also insignificant. At Table 4-17, the data, for India, shows that the results of general regression for basic interest rate, inflation rate, discount rate, and industrial production index are insignificant. Therefore, the quantile regression results are insignificant. The result of general regression for temperature is insignificant, but the result of quantile regression result is in significant and positive correlation while in the interval of 0.8 and 0.9. At Table 4-18, the data, for Taiwan, shows that the general regression results for basic interest rate, money supply, and turnover rate are insignificant. However, the result of quantile regression for basic interest rate is in significant and negative correlation while in the interval of 0.1, 0.4, and 0.5. The result of quantile regression for money supply is in significant and negative correlation while in the interval of 0.4, 0.5, and 0.6. The result of quantile regression for turnover rate is in significant and negative correlation while in the interval of 0.9. The result of general regression for the index of consumer sentiment is in significant and negative correlation. The result quantile regression for the index of consumer sentiment is in significant and negative correlation while in the interval of 0.1, 0.2, 0.3, 0.4, 0.6, and 0.7. The result of general regression for the temperature is in significant and positive correlation. The result of quantile regression for the index of consumer sentiment is in significant and positive correlation while in the interval of 0.1, 0.2, 0.3, 0.4, 0.5, 0.6, and 0.9. The result of general regression for inflation rate is insignificant. The result of quantile regression for inflation rate is also insignificant.At Table 4-19, the data, for Thailand, shows that general regression results for basic interest rate, inflation rate, discount rate, and temperature are all insignificant. The result of quantile regression for basic interest rate is in significant and negative correlation while in the interval of 0.1. The result of quantile regression for inflation rate is in significant and positive correlation while in the interval of 0.7. The result of quantile regression for discount rate is in significant and negative correlation while in the interval of 0.2. The result of quantile regression for temperature is in significant and positive correlation while in the interval of 0.8. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 5. Conclusion and Suggestions Integrated with the ideas in Finance and Psychology, this research studied the factors affecting exchange markets in Asian countries. We used unit root test ADF and PP to check if exchange rates of the 11 Asian countries are in stationary series, and used KPSS for the confirmation. The result demonstrates that the level 1 difference would make the data a stationary series. Moreover, in Japan, exchange market return to basic interest rate is in significant and negative correlation, to index of consumer sentiment is in significant and negative correlation, and to industrial production index is significant and positive correlation. For South Korea, the exchange market return to inflation rate is in significant and positive correlation. For Hong Kong, the exchange market return to basic interest rate is in significant and negative correlation, to inflation rate is in significant and positive correlation, to discount rate is in significant and positive correlation, to industrial production index is in significant and positive correlation, to temperature is in significant and negative correlation, and to turnover rate is in significant and negative correlation. Other than these factors, there might be some other factors affecting Hong Kong exchange market. For Singapore, exchange return to inflation rate is in significant and negative correlation, and trade remaining is in significant and negative correlation. For China, inflation rate, discount rate, industrial production index and trade remaining are the factors affecting the exchange market. These factors are all in significant and negative correlation with the exchange market. There are other factors impacting the exchange market in China. For Indonesia, trade remaining to exchange market is in significant and positive correlation. For Malaysia, to exchange market, basic interest rate is in significant and positive correlation, inflation rate is in significant and positive correlation, industrial production index is in significant and negative correlation, and trade remaining is in significant and positive correlation. For Philippines, to exchange market, basic interest rate is in significant and negative correlation, inflation rate is in significant and negative correlation, discount rate is in significant and positive correlation, and trade remaining is in significant and negative correlation. For India, to exchange market, temperature is in significant and positive correlation. For Taiwan, basic interest rate is in significant and negative correlation, index of consumer sentiment is in significant and negative correlation, money supply is in significant and negative correlation, and temperature is in significant and positive correlation. For Thailand, basic interest rate is in significant and negative correlation, inflation rate is in significant and positive correlation, discount rate is in significant and negative correlation, and temperature is in significant and positive correlation, From this study, the controllable factors were found for the government of each country to control the exchange rates. Japanese government can drop the basic interest rate to make exchange rates risen and Japanese Yen appreciated. South Korean government can increase the money supply to make exchange rates going up. Hong Kong government can decrease basic interest rate and increase money supply to make exchange rates going up, and make HKD appreciated. Singapore government can decrease money supply to lower inflation rate (increase exportation and decrease import) to rise the exchange rates to make Singapore Dollar appreciated. Chinese government can decrease money supply to lower inflation rate, or lower trade remaining (increase exportation and decrease import) to make exchange rates going up (CNY appreciated). The government of Indonesia can rise trade remaining (increase exportation) to rise exchange rates (IDR appreciated). The government of Malaysia can rise basic interest rate, rise money supply or rise trade remaining (increase import and decrease exportation) to rise exchange rates (MYR appreciated). The government of Philippines can lower basic interest rate, lower money supply, or lower trade remaining (increase exportation and Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 decrease import) to rise exchange rates (PHP appreciated). The government of Taiwan can lower basic interest rate to rise exchange rates (TWD appreciated). The government of Thailand can lower basic interest rate, and rise money supply to rise exchange rates (THB appreciate). The index of consumer sentiment and temperature would affect investor sentiment, than to fluctuate exchange market in Japan, Hong Kong, India, Taiwan and Thailand. All the factors selected in this study would affect the exchange market in one or more countries, depending on the countries. However, there is no factor can affect all the countries at the same time. References Baker, Malcolm and Jeremy C. Stein, 2004, „Market Liquidity As a Sentiment Indictor‟, Journal of Financial Markets, Vol 7, pp 271-299. Biais, B., L. Glosten, and C. Spatt. 2005. “Market microstructure: A survey of microfoundations, empirical results, and policy implications,” Journal of Financial Markets, Vol 8: pp 217-264. Brown, Gregory W. and Michael T. Cliff, 2004, „Investor Sentiment and the Near-Term Stock Market, Journal of EmPSrical Finance, Vol 11, pp 1-27. Kwon, Chung S. and Tai S. Shin, 1999, “Cointegration and Causality between Macroeconomic Variables and Stock Market Returns,” Global Finance Journal Vol 10, pp 71-81. Lee, Bong-Soo 1992, “Causal Relations among Stock Returns, Interest Rates, Real Activity, and Inflation,” Journal of Finance Vol 47, pp 1591-1603. Lyons, R. K. 1995. “Tests of microstructure hypotheses in the foreign exchange market,” Journal of Financial Economics, Vol 39: pp 321-351. Lyons, R. K. 1997. “A simultaneous trade model of the foreign exchange hot potato,” Journal of International Economics, Vol 42: pp 275-298. Omitted some of the papers for space constraints Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Appendix CH HK ID IN JA KO MA PH SI TA TH Mean Median 7.341491 7.775543 44.68482 9521.453 103.7105 1075.393 3.470996 48.07893 1.486149 32.16679 35.116 7.1133 7.7719 44.64 9230 105.42 1030.1 3.47 47.52 1.4819 32.278 34.32 Table 4-1 Basic Statistics Max Min Standard Deviation 8.2767 6.561 0.585996 7.8246 7.7501 0.021719 51.065 39.27 2.842656 12350 8715 749.2965 123.52 80.76 12.71448 1534 900.7 142.6095 3.8 3.0225 0.227237 56.3 40.46 4.135247 1.6916 1.2609 0.117489 34.95 29.3 1.061078 41.7 29.98 3.179134 Skewness Kurtosis 0.283941 0.466864 -0.11002 2.059393 -0.28779 0.975468 -0.20756 0.356124 0.086186 -0.55054 0.477492 1.434403 1.964429 2.670889 7.041425 1.738657 3.537506 1.960307 2.299458 2.048059 3.402719 2.320816 Table 4-2 The ADF, PP, KPSS Unit Root Test Result of Exchange Rates for Asian Countries Method ADF PP KPSS Country Level 0 Level 1 Level 0 Level 1 Level 0 Level 1 -1.68907 -16.2325 *** -1.25408 NA 0.33108*** 0.00000322 CH ( 0.7513) (0) ( 0.8948) (0.5) (0) [0.052978] -3.5612** -11.8265*** 0.109558*** 0.00000099 -3.507** -64.7633*** HK (0.0368) (0) (0.0423) (0.0001) (0.007571) [0.033873] -2.42297 -12.8637*** -2.2443 -46.3198*** 0.114252 -0.00022 ID (0.3662) (0) (0.4613) (0.0001) (0.647871) [-0.11004] -3.27803 -11.5279*** -3.26917 -70.9886*** 0.069448* 0.309844 IN ( 0.074) (0) (0.0755) (0.0001) (0.000001) [0.262645] -1.69097 -15.1813*** -1.71997 -51.0627*** 0.23521*** 0.000933 JA (0.7506) (0) (0.7376) (0.0001) (0) [0.11088] -1.88194 -11.458*** -1.93674 NA 0.172314** -0.01271 KO (0.6589) (0) (0.6302) (0.5) (0.000607) [-0.10168] -2.7484 -7.12857*** -1.37817 NA 0.230681*** 0.00000508 MA (0.2192) (0) (0.8635) (0.5) (0) [-0.04909] -1.62945 -9.46257 *** -1.62945 NA 0.294717*** -0.00023 PH (0.7767) (0) (0.7767) (0.5) (0.650433) [-0.09279] -2.26915 -10.3596*** -2.28441 -113.126*** 0.298729 0.00000913 SI (0.4477) (0) (0.4394) (0.0001) (0) [0.143168] -2.39981 -13.9961*** -2.1438 -46.2358*** 0.1668** 0.0000355 TA (0.3781) (0) (0.5168) (0.0001) (0.000542) [-0.03353] -2.50992 -14.7176*** -2.52441 -82.9833*** 0.259469 *** 0.0000467 TH (0.323) (0) (0.3161) (0.0001) (0) [0.022284] Note: 1.CH is China. HK is Hong Kong. ID is India. IN is Indonesia. JA is Japan. KO is South Korea. MA is Malaysia. PH is Philippines. SI is Singapore. TA is Taiwan. TH is Thailand. 2.( ) is p value. [ ] is t value 3.For 10%, 5%, and 1% of ADF unit root test statistics, the significant critical values for level 0 are -4.02, 3.44, and -3.1. The significant critical values for level 1 are -4.02, -3.44, and -3.15. For 10%, 5%, and 1% of PP unit root test statistics, the significant critical values for level 0 are -4.02, -3.44, and -3.14. The significant critical values for level 1 are -4.02, -3.44, and -3.15. For 10%, 5%, and 1% of KPSS unit root test statistics, the significant critical values for level 0 are 0.22, 0.15, and 0.12. The significant critical values for level 1 are 0.22, 0.15, and 0.12. * means null hypothesis is rejected at 10% significance level. ** means null hypothesis is rejected at 5% significance level. *** means null hypothesis is rejected at 1% significance level. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table 4-3 The Codes of Sentiment Factors and Macroeconomic Factors country variable Japan Korea Hong Kong Singapore ★ ★ BA BASE RATE ★ ★ CC ★ ★ ★ ★ ★ DI CCI CURRENCY INFLATION DISCOUNT RATE ★ ★ ★ IP IPI ★ ★ ★ TE TEMPERATURE TRADE REMAINING ★ ★ ★ ★ ★ TU TURNOVER RATE ★ ★ MO MONEY SUPPLY CU TR China Indonesia Malaysia Philippines India Taiwan Thailand ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ Table 4-4 The Result of Principal Components Analysis for Japan 《Table 1》Principal Components Analysis- Japan Date: 11/09/11 Time: 12:32 Sample: 2005M12 2011M03 Included observations: 64 Computed using: Ordinary correlations Extracting 8 of 8 possible components Eigenvalues: (Sum = 8, Average = 1) Number Value Difference Proportion 1 2.984 1.008341 2 1.975659 0.907201 3 1.068458 0.180454 4 0.888004 0.404203 5 0.483801 0.196092 6 0.287709 0.068608 7 0.219101 0.125833 8 0.093268 --《Table 2》Eigenvectors (loadings): Variable PC 1 PC 2 BA 0.497681 -0.09731 CC -0.393806 0.405659 CU 0.42673 0.18951 DI 0.421299 0.296976 IP 0.133469 0.608737 TE 0.03329 0.137495 TR -0.189727 0.556557 TU 0.427458 0.051382 《Table 3》Ordinary correlations: BA CC BA 1 CC -0.719068 1 CU 0.375619 -0.26228 DI 0.688133 -0.233668 IP 0.045822 0.270443 TE 0.04659 0.139141 TR -0.246306 0.503414 TU 0.467019 -0.370315 0.373 0.247 0.1336 0.111 0.0605 0.036 0.0274 0.0117 Cumulative Value CumulativeProportion 2.984 4.95966 6.028118 6.916122 7.399923 7.687632 7.906732 8 0.373 0.62 0.7535 0.8645 0.925 0.961 0.9883 1 PC 3 0.11546 0.059879 -0.217789 0.143439 -0.284869 0.910524 0.057091 0.040161 PC 4 -0.434007 0.250796 0.433004 -0.378498 0.062751 0.223739 -0.371921 0.475041 PC 5 0.077531 -0.260894 -0.442428 -0.381217 0.100877 -0.06036 0.403361 0.639011 PC 6 0.04129 0.580611 -0.273608 0.432142 -0.354522 -0.297806 -0.129941 0.410267 PC 7 -0.2447 -0.155675 0.458618 0.071622 -0.611259 -0.08941 0.561416 0.060059 PC 8 0.688155 0.429493 0.257154 -0.482984 -0.130525 -0.023418 0.133756 -0.084269 CU DI IP TE TR TU 1 0.511936 0.430051 -0.005162 -0.205992 0.571799 1 0.393807 0.160625 0.13402 0.351912 1 -0.046362 0.511806 0.228609 1 0.102051 0.135067 1 -0.224247 1 Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Chart 4-1 (Scree Plot(Ordered Eigenvalue) Scree Plot (Ordered Eigenvalues) 3.0 2.5 2.0 1.5 1.0 0.5 0.0 1 2 3 4 5 6 7 8 From Table 2, principal components are shown as PC1= 0.497681-0.393806+0.42673+0.421299+0.133469+0.03329-0.189727+0.427458 PC2=-0.09731+0.405659+0.18951+0.296976+0.608737+0.137495+0.556557+0.051382 PC3=0.11546+0.059879-0.217789+0.143439-0.284869+0.910524+0.057091+0.040161 Chart 4-2 Orthonormal Loadings Biplot Orthonormal Loadings Biplot 8 IPI T RADE_REM AINING_SUM Component 2 (24.7%) 6 CCI 4 07M 03 DISCOUNT _RAT E 08M 03 CURRENCY_INFLAT ION T EM PERAT URE 2 T URNOVER_RAT E 08M 09 0 08M 10 BASE_RAT E -2 -4 09M 01 -6 -8 -8 -4 0 4 8 Com ponent 1 (37.3% ) Table 4-5 Regression Analysis for Exchange Markets in Japan, South Korea, and Hong Kong Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table 4-6 Regression Analysis for Exchange Markets in Singapore, China, and Indonesia Table 4-7 Regression Analysis for Exchange Markets in Malaysia, Philippines, and India Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table 4-8 Regression Analysis for Exchange Markets in Taiwan and Thailand Table(4-9) The Quantile Regression Analysis Result of Exchange Return for Japan Japan OLS Intercept (c) 0.262092 (0.5157) Slope Basic Interest Rate Index of Consumer Sentiment Discount Rate Industrial Production Index Temperature -0.169902 (0.0449)** Trade Remaining 0.000962 (0.8663) -0.133649 (0.0317)** 0.007611 (0.4356) 0.060424 (0.5264) -6.77E-05 (0.9899) QT 0.1 0.000862 (0.9987) -0.15772 (0.1622) 0.2 0.718813 (0.3115) -0.201776 (0.0697)*** 0.021434 (0.8309) 0.006696 (0.5623) 0.014093 (0.9145) -0.04415 (0.6683) 0.002864 (0.5904) 0.000874 (0.9022) 0.031455 (0.4686) -0.000826 (0.8784) 0.015326 (0.2875) -0.14311 (0.4194) 0.006889 (0.3342) 0.3 0.365584 (0.5072) 0.128427 (0.2607) 0.067188 (0.567) 0.007483 (0.5305) 0.129618 (0.4003) 0.4 0.111969 (0.852) 0.6 -0.07661 (0.8875) 0.7 0.152735 (0.8117) 0.8 0.319675 (0.7068) 0.145908 (0.2269) 0.102219 (0.4102) 0.008839 (0.5094) 0.041855 (0.7984) 0.5 0.169907 (0.7567) 0.106191 (0.3967) 0.105101 (0.4078) -0.00108 (0.9277) 0.110306 (0.4317) 0.117632 (0.3313) -0.128 (0.2824) -0.173263 (0.1415) -0.00018 (0.9877) 0.120038 (0.338) 0.004132 (0.7329) 0.183254 (0.0992)*** 0.104101 (0.405) 0.104986 (0.3364) 0.009837 (0.4405) 0.080847 (0.5695) 0.000885 (0.8725) 0.001005 (0.8906) 0.000357 (0.9507) 0.003122 (0.6646) 0.000871 (0.8805) 0.003567 (0.6325) 0.000808 (0.8883) -0.002205 (0.8052) 0.002648 (0.7955) 0.00431 (0.558) 0.005134 (0.6152) -0.229785 (0.0317)** 0.001513 (0.8881) Turnover 0.014268 0.054558 0.027651 0.04936 0.029527 0.006798 -0.034124 Rate (0.7025) (0.2031) (0.5123) (0.2726) (0.5443) (0.8889) (0.6044) 0.092375 (0.2192) Remark : For all P values in the quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means significant at 10% level. 0.9 0.184172 (0.9646) -0.09992 (0.7955) 0.122082 (0.7634) 0.002765 (0.9498) 0.157568 (0.7908) -0.01232 (0.9069) 0.006714 (0.7985) 0.037528 (0.9133) P value is Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table(4-10) The Quantile Regression Analysis Result of Exchange Return for South Korea South Korea OLS Intercept (c) 0.220826 (0.8923) 0.002987 (0.9749) 0.072742 (0.7935) 0.018583 (0.4795) 0.015552 (0.6446) 0.027275 (0.8247) Slope Basic Interest Rate Index of Consumer Sentiment Inflation Rate Discount Rate Industrial Production Index Temperature 0.000224 (0.9821) Trade -0.00598 Remaining (0.5382) Turnover Rate 0.004519 (0.9204) Remark : For all P values in the quote, significant at 10% level. QT 0.1 -0.98129 (0.6795) -0.00592 (0.9745) 0.144757 (0.7888) 0.2 0.602735 (0.7933) -0.0663 (0.6489) -0.09249 (0.8277) 0.3 -0.13445 (0.9404) -0.02501 (0.8066) 0.126574 (0.6799) 0.4 0.09167 (0.9728) -0.03261 (0.7718) 0.089128 (0.8409) 0.5 -0.51799 (0.8552) 0.038416 (0.6989) 0.155876 (0.7383) 0.6 -0.28434 (0.9104) 0.044478 (0.6313) 0.155876 (0.7383) 0.7 0.384955 (0.8769) -0.02046 (0.8381) -0.20985 (0.4419) 0.8 0.824216 (0.7204) -0.0143 (0.8797) -0.19075 (0.4131) 0.9 1.693522 (0.2669) -0.01533 (0.8742) -0.21852 (0.3899) -0.01807 (0.6445) 0.017975 (0.7879) 0.090303 (0.4966) -0.00963 (0.8472) 0.030652 (0.5671) 0.000836 (0.9964) 0.010062 (0.8094) -0.01658 (0.6928) -0.02774 (0.8789) 0.01324 (0.8383) -0.00257 (0.9592) -0.07603 (0.7696) 0.014889 (0.8286) -0.0018 (0.971) -0.03581 (0.894) 0.013225 (0.8437) 0.009184 (0.8401) 0.057865 (0.8445) 0.020503 (0.7648) 0.02895 (0.5795) 0.084845 (0.8046) 0.045286 (0.5348) 0.00173 (0.9734) -0.01543 (0.9635) 0.084752 (0.019)** -0.03301 (0.3147) -0.15701 (0.2615) 0.021397 (0.3134) 0.001062 (0.9477) 0.003049 (0.7439) -0.00296 (0.7659) -0.00404 (0.6712) 0.000386 (0.964) 0.003858 (0.6732) 0.000848 (0.9155) -0.00261 (0.7687) -0.01315 (0.1663) -0.03315 (0.7651) 0.004246 (0.7657) -0.04973 (0.4086) -0.00799 (0.4284) -0.08264 (0.1535) -0.00072 (0.9541) -0.0301 (0.6962) -0.00233 (0.8462) -0.02956 (0.7191) -0.00633 (0.5558) 0.02532 (0.7075) -0.00499 (0.687) 0.072587 (0.2447) -0.00144 (0.9091) 0.044538 (0.4507) 0.001656 (0.8683) 0.012965 (0.8242) *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means P value is Table (4-11) The Quantile Regression Analysis Result of Exchange Return for Hong Kong Hong Kong OLS QT Intercept (c) 0.029278 (0.0618)*** 0.1 0.070782 (0.0011)* 0.2 0.041632 (0.0546)*** Slope -0.004917 (0.4012) -0.005173 (0.8985) -0.022684 (0.5203) Basic Interest Rate Inflation Rate Discount Rate Industrial Production Index Temperature 0.3 0.020482 (0.2466) 0.4 0.005778 (0.7363) 0.5 0.003887 (0.8309) 0.6 -0.004372 (0.7936) 0.7 0.012497 (0.4487) 0.012372 (0.0038)* 0.000287 (0.151) 0.012288 (0.0036)* 0.002351 (0.4495) 0.8 -0.02064 (0.2598) -0.00771 -0.010629 0.002655 0.006855 (0.1219) (0.0178)** 0.013562 (0.6044) (0.1262) (0.0021)* 0.000404 0.000938 0.000711 0.000144 0.000177 0.000312 0.000255 0.000346 (0.1704) (0.2469) (0.3606) (0.6307) (0.4035) (0.1821) (0.1865) (0.087)*** 0.005093 0.005763 0.023071 0.002788 0.00697 0.007806 0.010742 0.013243 (0.3826) (0.8874) (0.515) (0.5834) (0.1187) (0.1133) (0.0153)** (0.002)* -0.004861 -0.012048 -0.006949 0.000746 0.004345 (0.1163) (0.004)* (0.0489)** 0.003297 0.001332 0.000732 (0.8082) (0.2205) (0.2958) (0.6798) (0.8248) -0.001839 -0.003279 -0.002857 -0.000404 -3.75E-0.00018 (0.0216)** (0.0705)*** (0.167) 0.001961 0.000291 0.000591 (0.7215) 05 (0.8642) (0.1738) (0.7436) (0.6446) (0.9741) Turnover -0.000827 -0.004576 -0.001406 9.21E-05 0.000592 0.000705 0.001391 0.001384 0.001268 Rate (0.3624) (0.012)** (0.474) (0.9375) (0.5828) (0.5193) (0.1522) (0.2209) (0.2326) Remark : For all P values in the quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means significant at 10% level. 0.9 -0.016175 (0.4687) -0.013823 (0.0025)* 0.000488 (0.0316)** 0.01345 (0.0024)* 0.003761 (0.396) -0.00018 (0.8642) 0.000529 (0.6478) P value is Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table (4-12) The Quantile Regression Analysis Result of Exchange Return for Singapore Singapore OLS QT 0.1 0.239539 (0.762) 0.4 0.5 0.6 0.7 0.8 0.9 0.24407 0.62033 0.6793 0.5495 0.26206 6 0.45130 7 7 21 8 (0.7707) 4 (0.5871) (0.3705 (0.468) (0.7395) (0.5887) ) Slop Basic 0.01932 0.119298 0.007282 0.5395 0.5385 0.39396 0.08204 0.34692 0.06758 e Interest 3 0.075641 (0.7933) (0.988) 94 39 4 7 8 1 Rate (0.959) (0.876) (0.2471 (0.2359 (0.3808) (0.8574) (0.4726) (0.8931) ) ) Inflation -0.00389 -5.37E0.00417 Rate 0.00107 0.006496 (0.0588)* 0.003633 0.0021 0.0015 0.00083 0.00083 05 5 8 (0.0802)* ** (0.0958)* 92 75 6 7 (0.9824) (0.1775) (0.6067) ** ** (0.2998 (0.451) (0.7097) (0.7069) ) Temperat ure 0.03864 0.036565 0.055685 0.037268 0.0365 0.0715 0.07287 0.06956 0.00323 0.17268 1 (0.5181) (0.3117) (0.548) 67 54 9 7 9 2 (0.4489) (0.4816 (0.162) (0.2027) (0.3149) (0.9456) (0.4311) ) Trade Remainin 0.01193 0.001429 0.014731 0.012146 0.0139 0.0151 0.01996 0.01899 0.01456 0.01859 g 9 (0.9306) (0.132) (0.2416) 3 66 6 8 (0.0048) 2 (0.0054) (0.0989 (0.0541 (0.0002) (0.0005) * (0.0025) * )*** )*** * * * Remark : For all P values in the quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means P value is significant at 10% level. Intercept (c) 0.18583 3 (0.7692) 0.2 0.087969 (0.8978) 0.3 0.196163 (0.7889) Table (4-13) The Quantile Regression Analysis Result of Exchange Return for China China OLS Intercept(C) 0.225097 (0.0217)* * Slope Index of Consumer Sentiment Inflation Rate -0.00459 (0.6603) Discount Rate QT 0.1 0.390893 (0.0073)* 0.2 0.182571 (0.3158) 0.017872 (0.2917) 0.001995 (0.0469)* * 0.003115 (0.7347) -0.00171 (0.0534)* ** 0.006303 (0.1487) 0.008217 (0.222) 0.013599 (0.0976)* ** Industrial Production Rate -0.03932 (0.0518)* ** -0.06012 (0.0296)* * 0.030283 (0.4194) Temperature -4.85E05 (0.9383) 0.001168 (0.2332) 0.000361 (0.69) 0.000616 (0.5784) -0.00195 (0.0358)* * -0.00135 (0.0592)* ** Trade Remaining 0.001345 (0.1789) 0.3 0.18011 6 (0.0267) ** -0.00259 (0.7456) 0.00196 1 (0.0194) ** 0.01557 9 (0.0093) * 0.03077 3 (0.0793) *** 0.00068 3 (0.4931) 0.00073 9 (0.2083) 0.4 0.153323 (0.0258)* * 0.5 0.143494 (0.0352)* * 0.6 0.218258 (0.0155)* * 0.7 0.203405 (0.015)** 0.8 0.194939 (0.0076)* 0.9 0.126701 (0.1824) 0.008591 (0.1819) 0.001093 (0.1444) 0.006337 (0.2825) 0.001114 (0.1253) 0.006337 (0.2825) 0.000777 (0.2631) 0.004543 (0.4641) 0.000841 (0.1827) -0.004728 (0.3693) -0.00101 (0.8771) -0.00077 (0.1595) -0.000125 (0.8601) 0.009196 (0.0982)* ** 0.007723 (0.1509) -0.00362 (0.3765) 0.003287 (0.3581) -0.003548 (0.2335) -0.002294 (0.4641) 0.020765 (0.1419) 0.020653 (0.1462) 0.038769 (0.0408)* * 0.036054 (0.04)** -0.034227 (0.0246)** -0.025059 (0.1504) 0.000298 (0.6044) -0.0005 (0.4261) 0.000316 (0.5652) 0.000762 (0.2047) 0.000596 (0.2141) -0.00074 (0.295) 0.000498 (0.2448) 0.000639 (0.3104) -0.00045 (0.2169) -0.000221 (0.5358) -0.000546 (0.3109) 7.85E-05 (0.8937) Note : For all P values in the quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means P value is significant at 10% level. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table (4-14) The Quantile Regression Analysis Result of Exchange Return for Indonesia Indonesia OLS Intercept(C) 0.972 824 (0.409 3) S lo p e 0.001 168 (0.233 2) 0.077 83 (0.451 4) Inflation Rate Discount Rate QT 0.1 0.16056 (0.1804) 0.2 -0.16056 (0.1804) -0.004193 (0.7173) 0.006022 (0.5015) -0.032794 (0.1611) 0.026143 (0.1814) 0.3 0.0027 92 (0.962 5) 2.02E05 (0.998 3) 0.0179 47 (0.371 8) 0.0036 66 (0.631 7) 0.4 0.00806 4 (0.9016) 0.5 0.0132 85 (0.8597 ) 0.6 0.073 524 (0.363 6) 0.7 0.071642 (0.3731) 0.8 0.074256 (0.4403) 0.9 0.112004 (0.2792) 0.00025 9 (0.9774) 0.0064 36 (0.5246 ) 0.009 176 (0.394 3) 0.010801 (0.3267) 0.015964 (0.1968) 0.016986 (0.2101) 0.01006 4 (0.5733) 0.004277 0.020931 0.04794 0.0083 0.010 (0.8352) (0.414) (0.0184) 27 427 (0.6426 (0.565 ) 3) Trade 0.013 0.026743 0.010001 0.00268 Remaining 285 (0.0919)*** (0.3282) 3 0.0011 0.008 0.011657 0.016585 0.027723 (0.053 (0.7503) 21 306 (0.2398) (0.1566) (0.0175) 9)*** (0.9078 (0.408 ) 8) Remark : For all P values in the quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means P value is significant at 10% level. Table(4-15) The Quantile Regression Analysis Result of Exchange Return for Malaysia Malaysia OLS 0.063726 (0.6354) QT 0.1 0.250959 (0.1481) Intercept (C) 0.2 0.200348 (0.1978) 0.3 0.24939 8 (0.0342) ** 0.4 0.14742 9 (0.1655) 0.5 9.99E-16 (1) S Basic Interest l Rate o p e Inflation Rate 0.007267 (0.7513) -0.008294 (0.7705) 0.011309 (0.6926) 0.03264 1 (0.1424) -2.91E-16 (1) 0.005349 (0.0501)* ** 0.001509 (0.8469) -0.000284 (0.955) 0.04089 8 (0.0497) ** 0.00166 4 (0.5602) 0.00138 9 (0.3554) -1.08E-18 (1) Industrial Production Index 0.022044 (0.1578) -0.022044 (0.1578) -0.034352 (0.0225)** -0.02182 (0.0282) ** Temperature 0.003167 (0.914) -0.00092 (0.9842) -0.015138 (0.6995) 0.01695 7 (0.4268) 0.01433 7 (0.1259) 0.00444 (0.7499) Trade Remaining 0.000959 (0.8536) -0.007623 (0.0925)*** -0.003229 (0.4993) 0.00323 6 (0.2454) Remark : For all P values in the quote, *** means P value is significant at significant at 10% level. 0.00141 5 (0.5505) 1% level, 0.6 0.0033 69 (0.9782 ) 0.0011 97 (0.9625 ) 0.7 0.061885 (0.6638) 0.8 -0.205604 (0.1252) 0.9 -0.307331 (0.1067) 0.016245 (0.5478) 0.0162 45 (0.5478) 0.042352 (0.2406) 0.000767 (0.721) 0.006767 (0.0493)** 0.008332 (0.5268) 0.014617 (0.3632) 0.019993 (0.3254) 0.033915 0.4444) 0.003972 (0.2833) 0.007395 (0.0658)*** 5.37E0.000194 05 (0.9237) (0.9765 ) -2.10E-16 0.0004 0.00274 (1) 74 (0.8293) (0.9676 ) 1.34E-16 0.002322 (1) 0.0003 (0.9044) 82 (0.9817 ) 9.54E-18 4.80E4.80E-05 (1) 05 (0.9869) (0.9869 ) ** means P value is significant at 5% level, * means P value is Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table(4-16) The Quantile Regression Analysis Result of Exchange Return for Philippines Philippines OLS QT 0.1 0.2 0.3 Intercept 0.0693 0.068202 0.009857 (C) 0.021148 86 (0.6115) (0.9477) (0.9175) (0.7164 ) S Basic -0.05482 l Interest 0.060026 0.0243 0.054557 (0.1322) o Rate (0.1142) 7 (0.0733)* p (0.4849 ** e ) Inflation -0.01121 Rate 0.013409 0.0168 (0.0523)* 0.011689 (0.1868) 78 ** (0.0868)* (0.0874 ** )*** Discou 0.04274 0.0311 0.033265 0.033265 nt Rate (0.0355)* 34 (0.0251)* (0.0251)* * (0.1013 * * ) Temper 0.032432 0.005938 0.022834 ature (0.5787) 0.0104 (0.8705) (0.5753) 53 (0.8383 ) Trade Remain 0.000475 0.0047 0.002318 0.001898 ing (0.8491) 59 (0.1515) (0.2994) (0.007) * Remark : For all P values in the quote, *** means P value means P value is significant at 10% level. 0.4 0.076163 (0.6103) 0.5 0.017934 (0.9044) 0.6 0.066875 (0.6618) 0.7 0.148806 (0.3269) 0.8 0.041724 (0.8701) 0.9 0.07175 2 (0.7231) 0.07426 7 (0.1177) 0.065428 (0.0897)* ** 0.069049 (0.0861)* ** 0.046639 (0.3001) 0.075347 (0.1476) 0.092921 (0.0844)* ** 0.005339 (0.4378) 0.005695 (0.4064) 0.005057 (0.4964) -0.00632 (0.4378) 0.016426 (0.2389) 0.01902 4 (0.1348) 0.030882 (0.0684)* ** 0.037848 (0.0301)* * 0.023712 (0.183) 0.035371 (0.0514)* ** 0.048536 (0.0568)* ** 0.03962 (0.1103) 0.009394 (0.8145) 0.026209 (0.5137) .003382 (0.9328) 0.007784 (0.836) 0.033074 (0.6532) 0.06005 1 (0.3537) 0.000928 (0.624) 0.000957 (0.6) 0.000443 (0.8179) 0.000544 (0.7741) 0.002772 (0.2355) 0.00443 2 (0.0842)* ** is significant at 1% level, ** means P value is significant at 5% level, * Table(4-17) The Quantile Regression Analysis Result of Exchange Return for India India OLS Intercept (C) 0.18450 6 (0.8625) S Basic Interest l Rate o p e Inflation Rate 0.01875 5 (0.3699) 0.00267 6 (0.8136) 0.00388 (0.8533) -0.009641 (0.5405) Discount Rate 0.02838 7 (0.6706) 0.17487 5 (0.5334) 0.222644 (0.3915) Industrial Production Index 0.00741 3 (0.7816) 0.01862 (0.5204) 0.03531 (0.4163) -0.003121 (0.92) 0.01829 1 (0.6446) -0.018218 (0.5779) Temperature QT 0.1 0.27024 6 (0.6787) 0.02483 2 (0.6813) 0.2 -0.397468 (0.4798) 0.032441 (0.5032) 0.3 0.29806 6 (0.6505) 0.01180 1 (0.7621) 0.4 0.21058 1 (0.7655) 0.00503 3 (0.9129) 0.00841 8 (0.4879) 0.10116 8 (0.7836) 0.5 0.38290 9 (0.592) 0.00552 7 (0.8979) 0.01356 2 (0.2355) 0.10795 6 (0.7727) 0.6 0.34076 3 (0.6285) 0.00172 4 (0.9613) 0.01150 3 (0.3099) 0.06828 1 (0.8503) 0.00426 7 (0.8729) 0.00923 (0.7581) 0.02688 4 (0.3576) 0.01821 8 (0.5779) 5.78E05 (0.9985) 0.01532 2 (0.631) 0.01177 4 (0.3648) 0.13760 3 (0.6783) 0.8 0.217836 (0.7867) 0.9 0.51514 5 (0.6877) -0.026839 (0.2843) 0.02348 8 (0.5689) -0.003887 (0.7998) 0.00199 9 (0.9354) -0.312513 (0.4345) 0.03047 4 (0.2786) 0.7 0.03692 5 (0.9583) 0.01136 6 (0.6672) 0.00880 8 (0.475) 0.14300 6 (0.6896) 0.03066 1 (0.2708) 0.61337 9 (0.2547 0.02838 7 (0.6706) 0.02316 1 (0.4916) 0.05332 1 (0.1717) 0.083025 (0.0523)** * 0.027874 (0.4205) 0.11833 6 (0.001)* Remark : For all P values in the quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means P value is significant at 10% level. Proceedings of Annual Spain Business Research Conference 14 - 15 September 2015, Novotel Barcelona City Hotel, Barcelona, Spain ISBN: 978-1-922069-84-9 Table (4-18) the Quantile Regression Analysis Result of Exchange Return for Taiwan Taiwan OLS Intercept (C) 0.668518 (0.0878)** * -0.027801 (0.1422) S l o p e Basic Interest Rate Index of Consumer Sentiment Inflation Rate Money Supply QT 0.1 1.169362 (0.1076) 0.2 0.467291 (0.4053) 0.3 0.60018 (0.3177) 0.4 1.09089 (0.0377)** 0.5 1.271351 (0.0101)** 0.6 0.985412 (0.0362)** 0.7 0.652877 (0.1571) 0.8 0.670867 (0.1933) 0.9 0.954214 (0.1848) -0.073131 (0.0342)** -0.033813 (0.2122) -0.019993 (0.3976) -0.043136 (0.043)* -0.026591 (0.1935) -0.017529 (0.3935) -0.016664 (0.5016) -0.027256 (0.4667) -0.036692 (0.0195)** -0.07037 (0.0046)* -0.052343 (0.0051)* -0.050811 (0.0192)** -0.03881 (0.0781)** * -0.041528 (0.0374)** -0.032018 (0.106) -0.044736 (0.0241)** -0.040398 (0.0364)** -0.033815 (0.1106) -0.015187 (0.6079) 0.000668 (0.7584) -0.031733 (0.1672) 0.003298 (0.3512) -0.056799 (0.2017) 0.003116 (0.4738) -0.014444 (0.6842) 0.001427 (0.6092) -0.024344 (0.5204) -7.95E-05 (0.9819) -0.049591 (0.0838)** * 0.016781 (0.0267)** 0.00299 (0.3247) -0.029237 (0.2958) -0.002142 (0.5953) -0.030501 (0.3183) -0.00579 (0.1808) -0.050473 (0.2158) 0.011166 (0.1639) 0.014153 (0.1043) 0.019282 (0.0417)** 0.001102 0.001111 (0.6993) (0.6982) -0.055776 -0.069089 (0.0865)** (0.0227)** * Temperatu 0.018542 0.030326 0.017331 0.017692 0.017285 0.015003 re (0.002)* (0.0314)** (0.0698)** (0.0702)** (0.0527)** (0.0588)** * * * * Turnover -0.011766 0.007898 -0.015662 -0.013036 -0.012833 -0.009937 Rate (0.1204) (0.6703) (0.1434) (0.1478) (0.1516) (0.2491) Remark: For all P values in the quote, *** means P value is significant at 1% level, ** means P significant at 10% level. -0.007685 -0.009216 -0.021567 -0.037133 (0.3532) (0.3054) (0.1208) (0.0223)** value is significant at 5% level, * means P value is Table(4-19) The Quantile Regression Analysis Result of Exchange Return for Thailand Thailand Intercept (C) OLS 0.04761 5 (0.648) s Basic Interest l Rate 0.00796 o 1 p (0.6632) e Inflation Rate 0.00418 3 (0.2839) Discount Rate 0.00328 9 (0.5818) Temperature 0.01740 9 (0.5346) Remark : For all P values in the significant at 10% level. QT 0.1 -0.336167 (0.5052) 0.2 -0.025911 (0.8016) 0.3 0.4 0.5 0.6 0.7 0.8 -0.03676 -0.076119 -0.19122 0.01806 (0.6466) 0.10009 0.03893 (0.4868) (0.1599) 1 7 3 (0.8283) (0.2779) (0.7101) -0.057899 -0.015788 0.00038 -0.018077 (0.0557)** (0.3653) 0.01228 0.00134 2 0.01768 (0.3485) 0.006854 * 5 8 (0.9835) 5 (0.7575) (0.4799) (0.9393) (0.3672) -0.008666 0.0031 0.00514 0.00274 0.00122 0.00461 0.007258 0.00249 (0.1784) (0.4493) 9 5 2 5 (0.0718)*** (0.5905) (0.1957) (0.4618) (0.7875) (0.2803) -0.005 -0.009441 0.00169 0.000285 0.005578 (0.7213) (0.0829)** 0.00770 0.00478 0.00098 9 (0.959) (0.4042) * 6 1 5 (0.7528) (0.1177) (0.3325) (0.8556) 0.12846 0.015124 0.01063 0.01058 0.02868 0.01976 0.031303 0.060054 (0.4167) (0.6402) 5 8 8 7 (0.2205) (0.0478)* (0.6628) (0.6411) (0.2329) (0.4366) * quote, *** means P value is significant at 1% level, ** means P value is significant at 5% level, * means 0.9 0.23367 3 (0.2243) 0.02358 2 (0.3413) 0.00492 4 (0.3201) 0.00922 2 (0.5118) 0.05605 9 (0.2389) P value is