Proceedings of 7th Asia-Pacific Business Research Conference

advertisement

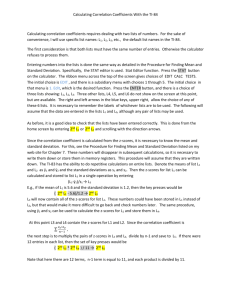

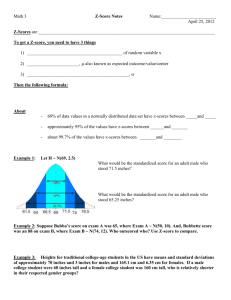

Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Correlation between Bankruptcy Score and Market Performance: Developing Altman’s Z-Score Model Rifa Intania* and Anggoro Budi Nugroho** Financial distress is used to indicate a condition where a company fails or has difficulty to pay off its financial obligations to creditors. If financial distress cannot be relieved, it can lead to bankruptcy. For investors, especially long-term investor, it is prominent to be sure that a corporate will withstand and not suffer from bankruptcy. The Altman’s Z-score is an empirical model for credit-strength test that predicts the probability of corporate bankruptcy. However, the emergence of large, public service companies prompted him to develop a second Z-Score model for non-manufacturing companies, which is used in this research. The formula is essentially the same as before; it just excludes the last component (sales / total assets) because Altman wanted to minimize the effects of manufacturing-intensive asset turnover. This study will aim to find the correlation between the bankruptcy probability, depicted by Z-scores, and market performance, which depicted by trading volume, share price and share return, of the company using the correlation analysis. The results of this study shows significant correlations between Z-scores and trading volume of PT Telekomunikasi Indonesia, PT XL Axiata Tbk and PT Inovisi Infracom Tbk; significant correlations between Z-scores and its share price on PT XL Axiata Tbk, PT Inovisi Infracom Tbk and PT Bakrie Telecom Tbk; but show no significant correlations between Z-score and its share return. The Z-score will results from the calculation using Altman’s Z-score equation model for non-manufacturer company while the other variables are gathered from the IDX market activity records. The companies used in this research are Indonesian telecommunication companies listed in Indonesia Stock Exchange from the period January 2009 until March 2014. Keywords: Altman’s Z-Score, Bankruptcy, Market Performance, Market Activity, Financial Distress Field of Research: Finance and Economics 1. Introduction Telecommunication has been one major factor contributing to the growing globalization era. Along with other advance factors, telecommunication has generated further interdependence of economic and cultural activities, also has a significant social impact on modern society. Indonesia’s telecommunication sector is a highly competitive, rapidly changing and dynamic industry that has come to reflect significant shifts in social behavior and interaction. The rise of mobile telephony then transformed the communication landscape across the archipelago by connecting friends, relatives and business users in both major islands and far flung areas of the country. Telecommunication companies and mobile phone manufacturers now face a stiff competition in attracting and retaining users. Today, price considerations are just one of the areas that telecom providers are being measured against by consumers as factors such as call quality and network coverage become increasingly important. Investing in _______________________________________________________________________ *Rifa Intania, School of Business and Management, Institut Teknologi Bandung, Indonesia. Email: rifa.intania@sbm-itb.ac.id **Anggoro Budi Nugroho, School of Business and Management, Institut Teknologi Bandung, Indonesia. Email: anggoro@sbm-itb.ac.id Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 network capacity through telecom towers either through construction or leasing of space from third party providers is therefore proving to be an area of strategic focus for the major telecommunication players as they seek to differentiate their network offerings to consumers. Heavy investment will therefore be required by telecom operators to remain competitive and avoid losing market share. Revenue growth, by all means, is therefore expected; but to make investment the companies also need to draw as much investors as possible. 2. Literature Review Financial distress is esentially difficult to be precisely defined. These are due to the various kinds of events that happen during the financial distress itself. The failure events of a corporate caused by financial distress nearly comes nowhere an end like dividend reduction, corporate lockouts, loss, employee dismissal, management resignation and fall of share price. According to Karen Wruck (1990) in Ross (2005), financial distress is a situation where corporate operation cashflow is insufficient to fulfill corporate’s liabilities (e.g. trade credit or interest cost) and corporate is subjected to do refinement. The definition was expanded by Altman (1999) related to the inability of paying off debt. In his research, Altman has found an equation to find the probability of bankrutpcy of a corporate, which is called The Altman Z-score Model. Altman Z-score is a model developed by Edward Altman in 1968. The formula is used to predict the probability whether or not a firm will go into bankruptcy within the period two until three years thereafter. The Z-score combines five financial ratios and has been proved to be a dependable instrument in forecasting failure in diverse mix of business entities. Later on, Edward Altman has created the revised Z-score model for private, nonmanufacturer and emerging market companies in the further researches. This research, however, using the revised model of Altman’s Z-score equation for the non-manufacturer companies. Z 6.56X1 3.26X 2 6.72X 3 1.05X 4 Equation 3.1 Altman Z-score Developed Model for Non-manufacturer Company Where X1 = Working capital / Total assets X2 = Retained earnings / Total Assets X3 = Earnings before interest and taxes / Total assets X4 = Market value of equity / Book value of total liabilities Z’’ = Overall Index Meanwhile, this research also study the performance of each company studied on the capital market by their market activity. Market performance is the behavior of a security or asset in the marketplace. These variables below are variables that indicate market activity of a stock, therefore could be used as a tool to analyze a stock’s market performance. The variables being used in this research are trading volume which depicts the stock’s liquidity, share price which depicts the present value of its future cashflow and expected return, and share return which depicts the return the investors could gain in the future and also the risk of the investment itself. Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 3. The Methodology and Model This research is following the research design below. Figure 1 Research Design The object of this research is six telecommunication companies listed in Indonesia Stock Exchange (IDX) with the range of study from January 2009 until March 2014. The data needed to conduct this research are gathered from IDX website and each of the company’s financial report. The six telecommunication companies being studied in this research are PT Telekomunikasi Indonesia Tbk, PT XL Axiata Tbk, PT Indosat Tbk, PT Inovisi Infracom Tbk, PT Bakrie Telecom Tbk and PT Smartfren Telecom Tbk. The author then find the Z-score of each company by using the financial report of each company. Then, the Z-scores of each quartal period being studied is correlated with its market performance’s variable such as trading volume, share price and share return to find the relation between each. Therefore, one question has arisen: what could affect the investor’s investing decision regarding the best company to invest in? Investors frequently look at some ratios to help them decide which company to invest in beside look at the market activity of the particular company’s stock as well. These two perspectives investors used are somehow related to the corporate’s financial condition; which they expect to depict the probability of the particular corporate sustain in the business and give them their expected return. The main objective of this research is to find the relation between each of the company’s bankruptcy score and its market performance and compare the result with other companies and determining how to improve the company’s shareholders’ value to increase investors preferences in choosing company to invest in. Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4. The findings Altman Z-score By using the revised Altman model for non-manufacturing company, the author successfully find the Z-score of each company for each quartal period from third quartal of 2009 to the first quartal of 2014. Table 1 Summary of Z-scores of Telecommunication Companies Listed in IDX Within Period January 2009 – March 2014 The average Z-scores then being used to rank the companies position toward each other regarding their bankruptcy score within the studied period. The Z-scores is being classified into three areas called The Zones of Bankruptcy, which are Safe, Grey and Distress zones. Safe Zones is where the Z-score lies above 2.99, the Grey Zones where the Zscore lies between 1.81 and 2.99, and the Distress Zone is where the Z-score lies below 1.81. Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Table 2 Bankruptcy Rank of Telecommunication Companies Listed in IDX Within Studied Period January 2009 – March 2014 The Z-scores will then being further analyzed by correlate them using SPSS with their trading volume, share price and share return to see the correlation between each. Correlation Analysis Correlation Analysis for PT Telekomunikasi Indonesia Table 3 Summary of Correlation Hypotheses Decision of Various Variables of PT Telekomunikasi Indonesia Tbk From the table above we could conclude several analysis: 1. The relation of Z-score and trading volume has a coefficient of correlation equals to 0.524 which means that the relation’s firm of the two variables is categorized as medium. From the hypotesis testing using t-test shows that the t hitung (2,539) > t tabel (2,110). This indicates that Ho is rejected which shows that the Z-scores of Telkom has positive relation with its trading volume. The higher the Z-score, the higher the trading volume as well. The determination coefficient from the calculation is 27.5%. This means that trading volume is being positively affected by Z-scores by 27.5%, whereas the remaining 72.5% is other variable contribution except the Z-scores. 2. The relation of Z-score and share price has a coefficient of correlation equals to 0.187 which means that the relation’s firm of the two variables is categorized as very weak. From the hypotesis testing using t-test shows that the t hitung (-0.786) > -t tabel (-2,110). This indicates that Ho is accepted which shows that the Z-scores of Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Telkom has no relation with its share price. The determination coefficient from the calculation is 3.5%. This means that share price is being negatively affected by Zscores by 3.5%, whereas the remaining 96.5% is other variable contribution except the Z-scores. 3. The relation of Z-score and share return has a coefficient of correlation equals to 0.096 which means that the relation’s firm of the two variables is categorized as very weak. From the hypotesis testing using t-test shows that the t hitung (-0.399) > -t (-2,110). This indicates that Ho is accepted which shows that the Z-scores of Telkom has no relation with its share return. The determination coefficient from the calculation is 0.9%. This means that share return is being negatively affected by Zscores by 0.9%, whereas the remaining 99.1% is other variable contribution except the Z-scores. tabel Correlation Analysis for PT XL Axiata Tbk Table 4 Summary of Correlation Hypotheses Decision of Various Variables of PT XL Axiata Tbk From the table above we could conclude several analysis: 1. The relation of Z-score and trading volume has a coefficient of correlation equals to 0.506 which means that the relation’s firm of the two variables is categorized as medium. From the hypotesis testing using t-test shows that the t hitung (2,417) > t tabel (2,110). This indicates that Ho is rejected which shows that the Z-scores of Telkom has positive relation with its trading volume. The higher the Z-score, the higher the trading volume as well. The determination coefficient from the calculation is 25.6%. This means that trading volume is being positively affected by Z-scores by 25.6%, whereas the remaining 74.4% is other variable contribution except the Z-scores. 2. The relation of Z-score and share price has a coefficient of correlation equals to 0.823 which means that the relation’s firm of the two variables is categorized as very strong. From the hypotesis testing using t-test shows that the t hitung (5.969) > t (2,110). This indicates that Ho is rejected which shows that the Z-scores of XL has positive relation with its share price. The higher the Z-score, the higher the share price as well. The determination coefficient from the calculation is 67.7%. tabel Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 This means that share price is being positively affected by Z-scores by 67.7%, whereas the remaining 32.3% is other variable contribution except the Z-scores. 3. The relation of Z-score and share return has a coefficient of correlation equals to 0.230 which means that the relation’s firm of the two variables is categorized as weak. From the hypotesis testing using t-test shows that the t hitung (-0.976) > -t tabel (2,110). This indicates that Ho is accepted which shows that the Z-scores of XL has no relation with its share return. The determination coefficient from the calculation is 5.3%. This means that share return is being negatively affected by Z-scores by 5.3%, whereas the remaining 94.7% is other variable contribution except the Zscores. Correlation Analysis for PT Indosat Tbk Table 5 Summary of Correlation Hypotheses Decision of Various Variables of PT Indosat Tbk From the table above we could conclude several analysis: 1. The relation of Z-score and trading volume has a coefficient of correlation equals to -0.141 which means that the relation’s firm of the two variables is categorized as very weak. From the hypotesis testing using t-test shows that the t hitung (-0.585) > -t (-2,110). This indicates that Ho is accepted which shows that the Z-scores of Indosat has no relation with its trading volume. The determination coefficient from the calculation is 2.0%. This means that trading volume is being negatively affected by Z-scores by 2.0%, whereas the remaining 98.0% is other variable contribution except the Z-scores. tabel 2. The relation of Z-score and share price has a coefficient of correlation equals to 0.389 which means that the relation’s firm of the two variables is categorized as weak. From the hypotesis testing using t-test shows that the t hitung (-1.740) > -t tabel (2,110). This indicates that Ho is accepted which shows that the Z-scores of Indosat has no relation with its share price. The determination coefficient from the calculation is 15.1%. This means that share price is being negatively affected by Zscores by 15.1%, whereas the remaining 84.9% is other variable contribution except the Z-scores. Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 3. The relation of Z-score and share return has a coefficient of correlation equals to 0.049 which means that the relation’s firm of the two variables is categorized as very weak. From the hypotesis testing using t-test shows that the t hitung (-0.203) > -t (-2,110). This indicates that Ho is accepted which shows that the Z-scores of Indosat has no relation with its share return. The determination coefficient from the calculation is 0.2%. This means that share return is being negatively affected by Zscores by 0.2%, whereas the remaining 99.8% is other variable contribution except the Z-scores. tabel Correlation Analysis for PT Inovisi Infracom Tbk Table 6 Summary of Correlation Hypotheses Decision of Various Variables of PT Inovisi Infracom Tbk From the table above we could conclude several analysis: 1. The relation of Z-score and trading volume has a coefficient of correlation equals to -0.521 which means that the relation’s firm of the two variables is categorized as medium. From the hypotesis testing using t-test shows that the t hitung (-2.520) < -t tabel (-2,110). This indicates that Ho is rejected which shows that the Z-scores of Inovisi has negative relation with its trading volume. The higher the Z-scores, the lower the trading volume as well. The determination coefficient from the calculation is 27.2%. This means that trading volume is being negatively affected by Z-scores by 27.2%, whereas the remaining 72.8% is other variable contribution except the Z-scores. 2. The relation of Z-score and share price has a coefficient of correlation equals to 0.656 which means that the relation’s firm of the two variables is categorized as strong. From the hypotesis testing using t-test shows that the t hitung (3.580) > t tabel (2,110). This indicates that Ho is rejected which shows that the Z-scores of Inovisi has positive relation with its share price. The higher the Z-score, the higher the share price as well. The determination coefficient from the calculation is 43.0%. This means that share price is being positively affected by Z-scores by 43.0%, whereas the remaining 57.0% is other variable contribution except the Z-scores 3. The relation of Z-score and share return has a coefficient of correlation equals to 0.087 which means that the relation’s firm of the two variables is categorized as Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 very weak. From the hypotesis testing using t-test shows that the t hitung (-0.358) > -t (-2,110). This indicates that Ho is accepted which shows that the Z-scores of Inovisi has no relation with its share return. The determination coefficient from the calculation is 0.7%. This means that share return is being negatively affected by Zscores by 0.7%, whereas the remaining 99.3% is other variable contribution except the Z-scores. tabel Correlation Analysis for PT Bakrie Telecom Tbk Table 7 Summary of Correlation Hypotheses Decision of Various Variables of PT Bakrie Telecom Tbk From the table above we could conclude several analysis: 1. The relation of Z-score and trading volume has a coefficient of correlation equals to 0.435 which means that the relation’s firm of the two variables is categorized as medium. From the hypotesis testing using t-test shows that the t hitung (1.994) < t tabel (2.110). This indicates that Ho is accepted which shows that the Z-scores of Bakrie has no relation with its trading volume. The determination coefficient from the calculation is 19.0%. This means that trading volume is being positively affected by Z-scores by 19.0%, whereas the remaining 81.0% is other variable contribution except the Z-scores. 2. The relation of Z-score and share price has a coefficient of correlation equals to 0.612 which means that the relation’s firm of the two variables is categorized as strong. From the hypotesis testing using t-test shows that the t hitung (3.187) > t tabel (2.110). This indicates that Ho is rejected which shows that the Z-scores of Bakrie has positive relation with its share price. The higher the Z-score, the higher the share price as well. The determination coefficient from the calculation is 37.4%. This means that share price is being positively affected by Z-scores by 37.4%, whereas the remaining 62.6% is other variable contribution except the Z-scores 3. The relation of Z-score and share return has a coefficient of correlation equals to 0.247 which means that the relation’s firm of the two variables is categorized as weak. From the hypotesis testing using t-test shows that the t hitung (1.051) < t tabel Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 (2.110). This indicates that Ho is accepted which shows that the Z-scores of Bakrie has no relation with its share return. The determination coefficient from the calculation is 6.1%%. This means that share return is being positively affected by Zscores by 6.1%, whereas the remaining 93.9% is other variable contribution except the Z-scores. Correlation Analysis for PT Smartfren Telecom Tbk Table 8 Summary of Correlation Hypotheses Decision of Various Variables of PT Smartfren Telecom Tbk From the table above we could conclude several analysis: 1. The relation of Z-score and trading volume has a coefficient of correlation equals to -0.072 which means that the relation’s firm of the two variables is categorized as very weak. From the hypotesis testing using t-test shows that the t hitung (-0.298) > -t (-2.110). This indicates that Ho is accepted which shows that the Z-scores of Smartfren has no relation with its trading volume. The determination coefficient from the calculation is 0.5%. This means that trading volume is being negatively affected by Z-scores by 0.5%, whereas the remaining 99.5% is other variable contribution except the Z-scores. tabel 2. The relation of Z-score and share price has a coefficient of correlation equals to 0.230 which means that the relation’s firm of the two variables is categorized as weak. From the hypotesis testing using t-test shows that the t hitung (0.974) < t tabel (2.110). This indicates that Ho is accepted which shows that the Z-scores of Smartfren has no relation with its share price. The determination coefficient from the calculation is 5.3%. This means that share price is being positively affected by Zscores by 5.3%, whereas the remaining 94.7% is other variable contribution except the Z-scores. 3. The relation of Z-score and share return has a coefficient of correlation equals to 0.029 which means that the relation’s firm of the two variables is categorized as very weak. From the hypotesis testing using t-test shows that the t hitung (-0.118) > -t (-2.110). This indicates that Ho is accepted which shows that the Z-scores of Smartfren has no relation with its share return. The determination coefficient from the calculation is 1.1%%. This means that share return is being negatively affected tabel Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 by Z-scores by 1.1%, whereas the remaining 99.9% is other variable contribution except the Z-scores. 5. Summary and Conclusions In the era of globalization, competition between telecommunication companies becoming very tough lately. Every providers in Indonesia try to make their way to be the top notch for ‘The Leading Telecommunication Company in Indonesia’ title. To be entitled with it, telecommunication companies must somehow focusing on how they could attract more investors in order to expand the company. Within the tough competition between the companies, the investors are also looking for the best company they could invest in. The companies could focus on their sustainability in the market first, before increasing their performance in the exact market. To focus on its sustainability, a company must know well the condition of its entity. To know how the company’s condition regarding the sustainable issue, the company could use the bankruptcy probability calculation model by Altman. The author has found that the telecommunication companies rank from the beast to the least in the telecommunication sector in Indonesia Stock Exchange repeatedly are PT Inovisi Infracom Tbk, PT Telekomunikasi Indonesia Tbk, PT Indosat Tbk, PT XL Axiata Tbk, PT Bakrie Telecom Tbk and PT Smartfren Telecom Tbk. This research shows surprising result, however, because the company that is being objected would be ranked number one is PT Telekomunikasi Indonesia. But instead, this research shows that PT Inovisi Infracom Tbk actually performs better than PT Telekomunikasi Indonesia Tbk regarding the bankruptcy issue with the higher average Z-score of the studied period of 27.391 whereas PT Telekomunikasi Indonesia Tbk average Z-score of the studied period is only 5.966. Meanwhile from the correlation studies, the author has found that the correlation between Z-scores and trading volume, share price, and share return, repeatedly, has suggest different results between each of the companies being studied. Below is the summary of correlation gathered from data processing. The summary of correlation and coefficient of correlations (see Appendices) shows that for the correlation analysis of the relation between Z-score and its trading volume, the significant statistical result are only on PT Telekomunikasi Indonesia with the correlation coefficient 0.524, PT XL Axiata Tbk with the correlation coefficient 0.506 and PT Inovisi Infracom Tbk with the correlation coefficient -0.521, whereas the others shows no significant result on the correlation analysis. This means that only for three mentioned companies the Z-scores is being affected by its trading volume as well as the opposite. The higher the Z-scores, the higher the trading volume; except for PT Inovisi Infracom Tbk which has negative correlation which means the higher the Z-score, the lower the trading volume, as well as the opposite. Further more, the bankruptcy score or probability in the future is being affected by the particular company’s stocks liquidity that is depicted by trading volume; as well as the opposite. For the correlation analysis of the relation between Z-score and its share price, the significant statistical result are only on PT XL Axiata Tbk with the correlation coefficient 0.823, PT Inovisi Infracom Tbk with the correlation coefficient 0.661 and PT Bakrie Telecom Tbk with the correlation coefficient 0.612, whereas the others shows no significant result on the correlation analysis. This means that only for three mentioned Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 companies the Z-scores is being positively affected by its share price as well as the opposite, the higher the Z-scores the higher the share price as well. Further more, the bankruptcy score or probability in the future is being affected by the particular company’s future cash flow and expected returns that is depicted by its share price; as well as the opposite. But for the correlation analysis of relation between Z-score and its share return, there are no significant result at all on the studied companies. This shows that the Z-scores of the companies is not being affected by its share return, as well as the opposite. Further more, the bankruptcy score or probability in the future is not being affected at all by the particular company’s stocks return in the future. However this study is limited to the object studied in this research which is only six telecommunication companies that are listed in Indonesia Stock Exchange. The period studied in this research is also only from the third quarter of year 2009 which is September 2009 until the first quarter of year 2014 which is March 2014. Last, the Altman’s Z-score equation used in this research is the developed Altman’s Z-score model for the nonmanufacturing company but the equation is limited to the timeframe it is developed which is in the year of 1968. Therefore, further investigation is required in this object. References Bodie, Z, Kane, A. & Marcus, A. J. (Eds), 2011, Investments and Portfolio Management, New York: McGraw-Hill. Gitman, L. J. & Zutter, C. J. (Eds), 2012, Principles of Managerial Finance, England: Pearson. Elton, E. J., Gruber M. J., Brown, S. J. & Goetzmann, W. N. (Eds), 2007, Modern Portfolio Theory and Investment Analysis, United States: Wiley. Rodoni, A. & Ali, H. (Eds), 2010, Manajemen Keuangan, Jakarta: Mitra Wacana Media. Fahmi, I., 2011, Analisis Laporan Keuangan, Bandung: Alfabeta. Altman, E.I., 1968, Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy, The Journal of Finance, Vol. 23 no. 4 (Sep., 1968): 589-609. . Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Appendix Table 4.x Summary of Correlations Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Table 4.x Summary of Correlations Coefficient