Proceedings of 7th Asia-Pacific Business Research Conference

advertisement

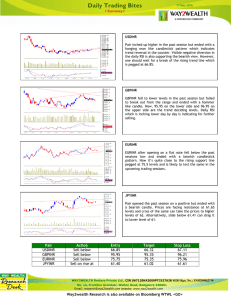

Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 Japanese Candlestick Technical Trading Strategies in Indonesia Capital Market Kevin Alvoti* and Deddy P. Koesindartoto** The Japanese candlestick technical analysis is a short term timing technique to predict future price trends based on the relationships among opening, high, low, and closing prices. Based on those prices candlestick have their own definition to interpret the situation of the stock. Traders can gain a profit by analyzing the signals to buy and sell the stock. This paper aims to find an understanding to use candlestick efficiently through the rate of return stock and the type of candlestick pattern. Moreover to give the exact timing of how to maximize the return this paper will include the ten holding days. Holding days will determine which day that candlestick occurs to give the maximum value. The sample of the data is taken from ten most volatile stocks in LQ 45 stock index 2012, Jakarta Stock Exchange. The Independent variables are the type of candlestick and the holding days. Based on that, Generalized Linear Model used to identify the relationship among them. The t-test are applied to test the profitability of the candlestick and ANOVA used to examine which candlestick will be the most profitable based on their own type. The findings of the research found that candlestick does have a significant value to the return, but not all of the candlestick pattern have the right value for the traders. The information of this study can be used by the traders to understand the right timing on each candlestick patterns after knowing the most significant candlestick type and how long should it be hold. JEL Codes: 1. Introduction Candlestick is the most prevalent analysis tools and nowadays most of technical analysis programs use candlestick as a default mode of their charting programs. This technical analysis developed to identifies the future trend from the past or historical data. Future is something that we predict and evolve with our expectation and uncertainty. This uncertainty makes a lot of possibility can be occurs. Candlestick translate those possibility in many definition trough the patterns. These patterns can help traders to predict future prices of their portfolios. The art of candlestick is located in how users identified those patterns for each stock. There is no absolute answer about how to identify these patterns because it can be look from each of user’s perspective, but not diminishing the framework or rule of the candlestick. These patterns can be very useful for traders to gain profit and immediately cut their loss if the trader is in unfavorable circumstances. Candlestick signals are exploit the emotions of people that not wisely buy and sell their stocks. There are people that panicked sell out at the bottom and there are people that optimist and excited to buy at the top pf price. This can be used to take advantage of the known weakness of the masses people and take a profit from having that knowledge. *Kevin Alvoti, School Of Business & Management Institute Technology Bandung, Indonesia. Email: alvoti_kevin@yahoo.com ** Deddy P. Koesindartoto Ph.D, Head of Magister Science Management Institute Technology Bandung, Indonesia. Email: deddypri@sbm-itb.ac.id 1 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 This study try to identified which candlestick pattern will be valuable for Indonesian traders based on the timing of holding periods because each of candlestick pattern have their own most optimum profitability period. Moreover this study will reveal which patterns that have a significant impact compared with the Jakarta Composite Index. 2. Literature Review 2.1. Candlestick Definition & Pattern Candlestick construction is consisting of “real body” which is built based on the closing and opening price. There are three types of real body which are white body, black body, and horizontal body. White body means that closing price is higher than opening price. Black body means that opening price is higher than closing price. Horizontal body means that the price remains same either on the opening and closing. The size of the body depends on the difference price when closing and opening. Candlestick which has a horizontal body usually called “Doji”. Moreover candlestick also has a tail above and below their body, but this is not exactly always happen in all candlesticks. This tail called “upper shadow” and “lower shadow”. Upper shadow because it is located above the body and give us information of the highest price that occur on the stock in that day. Lower shadow is located below the body and gives the information of the lowest price of the stock in that day. Below is the figure of candlestick construction. Figure 1. Candlestick Construction In Addition to make a stronger prediction we can combine the candlesticks from day by day to know the trend of the candlestick movement. There are two type of candlestick that can help us to understand the trend. Bullish candlestick is a type of candlestick that appears to confirm that there will be an uptrend in the stock movement. Bearish candlestick is a type of candlestick that appears to confirm the downtrend movement of the stock. Moreover the formation of candlestick is affecting the amount of the movement. This study computes two different formations which are single line and reversal patterns. 2.2. Data This research used ten component stocks chosen from LQ 45 index companies from 2012 – 2013. LQ 45 index is known as market that consists of companies that have big capital market, high transaction value, and a good financial condition in Jakarta Stock Exchange Market. The writer choose 16 reversal signal based on the bullish and bearish signal. This 2 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 16 reversal signal is chosen because it is the most candlestick signal that appears in Indonesia Stock Exchange. These are the sixteen reversal signal based on their category and the frequency from 10 stocks in 2012 - 2013: From the candlestick chart of ten stocks there are 488 candlesticks based on 16 different types. 2.3. Previous Research on Japanese Candlestick Technical Analysis Japanese candlestick has been researched by many people since the first invention and popular in trader’s technical analysis. Steve Nison is the researcher that makes Japanese Candlestick becomes popular. The research that has been done mostly is to understand the effectiveness of Japanese Candlestick trading strategies in many different countries. The researcher form Massey University, New Zealand make a study on America market which is Dow Jones Industrial Average (DJIA) for period from 1992 – 2001 which is involved 35 component stocks. Marshall, Young, and Rose found that candlestick technique doesn’t have value for this market because the market itself was not efficient to deliver the information. There is also another research by Prado, Ferneda, Morais, Luiz, And Matsura (2013) Taking 40% of stock from Ibovespa from 2005 to 2009. They applied the same research that has been done by others but implement it in Brazilian stock market. They found some set of candlestick pattern are predictive to forecast the upcoming trend. They also suggest that candlestick should be adapted with the market that intended to be used because every market has their own characteristic and candlestick is not and absolute technique. Another research also taken by GOO, Chen, and Chang (2007) they also find the same result that only some pattern that has a value to the traders in the Taiwan market from 1997 – 2006. Candlestick is a flexible and adaptive technical analysis tools for traders to understand the market. Most of the research that has been done found that there are different patterns from each country that are valuable for the traders. From that point this study try to found the patterns that have a significant impact to the return of the stock. Those patterns can give a good signal for traders to buy or sell the stocks. 3 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 3. The Methodology and Model 3.1. General Linear Model General Linear Model will quantify the relationship between several predictor variables and a criterion variable. The rate of return will be the predictor variable or dependent variable. Candlestick and holding days will be the predictor or independent variable. Here the General Linear Model of the research: The β0 terms for the intercept and 𝞮 is the terms for error or the degree of point that deviate from the equation line. To test the significance of the General Linear Model, the F-test applied in this model. The f-test is to find the equality of variances between the two populations. These are the hypotheses: 3.2. Dummy Variable The dummy variable applied in this research to understand the impact that will shift the outcome or in this case is the rate of return from the data that cannot been defined by a number which called the categorical data. Those sixteen candlestick pattern are the categorical data which impacting the rate of return. Here is the multiple regression model: The Yx1 is the return for the uptrend movement and the Yx2 is the return for the downtrend movement. For α1, 2, 3, 4, 9, 10, 11, 12 are the candlestick patterns from the bullish type and α5, 6, 7, 8, 13, 14, 15, 16 are the candlestick patterns from the bearish type. α 0 is the intercept and 𝞮 is the error. 4 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 3.3. T-test There are two approaches that the writer used to calculate the return. The first approach was taken to find which are the days that will be valuable impacted by the candlestick pattern. The definition of valuable impacted that the signal is matched with the trend of candlestick. To understand which candlestick that will be valuable for the prediction and which date that will be significant, the t-test is used to test the profitability. The hypotheses are: H0 : πxy ≤ 0, H1 : πxy> 0, The πxy define that the return of candlestick with an x type of candlestick and occur on y holding day. There is 16 (X) type of candlestick with 10 (y) holding days. The Second t-test will be comparing each candlestick pattern with the Jakarta composite index. The purpose is to find which candlestick pattern that significantly more valuable than the market movement. The hypotheses are: The πxy define that the return of candlestick with an x type of candlestick and occur on y holding day. There are 16 (X) type of candlestick with 10 (y) holding days. πJSX define the return of Jakarta Stock Exchange (All Composite index) with a same date when the πxy occur 3.4. One Way ANOVA This study also research which candlestick that mostly valuable in their group based on their strategy. There are two different group based on the type of candlestick which are bullish and bearish type. One way ANOVA applied in this study to define the difference or significant means between the candlestick patterns in their own group. After comparing by each of them we will find the candlestick patterns that have a significant movement in their own group, either in bullish or bearish. 4. The findings 4.1. General Linear Model The writer wants to get evidence about variables that affect positively the rate of return. From the test that has been done candlestick appear to be the main effect that significantly influences the rate of return. 5 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 The significance level showed that candlestick is a significant variable, meanwhile others which are holding days and the interaction between them appear not significantly influence the rate of return. Candlestick become the main reason that impact the rate of return then the next step is to define the candlestick pattern that are significantly have impact to the rate of return. 4.2. Dummy Variable The test divided into two groups based on the type of the candlestick which are bullish and bearish. Each of them contains candlestick from single lines and reversal patterns formation. The first table is explaining about the result of Bullish type of candlestick patterns. From the result most of candlestick pattern in bullish type significantly influence the rate of return both for single lines formation and reversal pattern formation, except Morning Star that appear above 0.05 point which is not significant. The cause of Morning Star can be found on the next test. The second table explained about the result from the candlestick pattern with a bearish type. The result of the test found that the entire type of the bearish type candlestick affect the rate of return. The level of significance from the entire candlestick pattern is below the 0.05 point. 6 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 The result of dummy variable explained that both bullish and bearish type of candlestick affecting the rate of return. Significant in this test means that the effect of candlestick does matter to the changes of the return. The next objective is to find that the significance of the candlestick match with their own type and trend movement. 4.3. T-test The t-test will include two different research which are the holding days that will give the traders information about how many days that they should hold and the second research is comparing the rate of return that has been made by the candlestick pattern with the return that the Jakarta Composite index stimulated in the same date that the candlestick pattern occur. 4.3.1. Between the Holding Days The bullish type of candlestick should give trader a signal to sell their stock because the price of the stock that believe will be rise until some point that will be maximum and that point will be translated by the maximum of holding days. Meanwhile the bearish type of candlestick will give a downtrend signal which will indicate the decreasing price of the stock at the maximum. From the result based on the table below we found some candlesticks that don’t have any value to the rate of return in ten holding days. There are three candlesticks that don’t have value to the traders which are Morning Star (C4), Dark Cloud Cover (D1), and Evening Star (D4). These three candlesticks didn’t give a strong signal for traders to hold in ten days. The other results give us a positive signal to the return and have their own holding days which can be used. Form the Bullish type which gives us a selling signal with the highest return are: 1. Hammer : 7 days with 3,95% 2. Inverted Hammer : 5 days with 4,91% 3. Bullish Belt Hold : 3 Days with 1,84% 4. Dragonfly Doji: 5 Days with 3,12 % 5. Piercing : 5 Days with 4,75% 6. Bullish Harami: 4 Days with 2,96% 7 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 7. Bullish Engulfing : 5 days with 2,95% The Bearish type will give traders a signal to buy the stocks at the cheapest price which are: 1. Hanging Man : 3 Days with -3,21% 2. Shooting Star: 9 Days with -3,94% 3. Bearish Belt Hold : 5 days with -2,06% 4. Gravestone Doji: 8 Days with -3,8% 5. Bearish Harami: 10 days with 3,88% Type of Candlestick A1 A2 A3 A4 B1 B2 B3 B4 C1 C2 C3 D2 D3 T-test 1 2 MRR Significance MRR Significance MRR Significance MRR Significance 2.4915% y 2.9721% y 1.2303% y 1.4556% y 3.2908% y 4.0287% y 1.6189% y 2.9825% y MRR Significance MRR Significance MRR Significance MRR Significance -1.9458% y -1.8970% y -0.8555% y -0.3877% - -3.1645% y -2.7656% y -1.3642% y -0.8417% - MRR Significance MRR Significance MRR Significance 1.7319% 1.2988% y 0.3499% - 2.4319% 2.3143% y 1.3767% y MRR -1.4016% Significance y MRR -1.0079% Significance y -2.8627% y -0.9408% y Holding Days 3 4 5 6 Code A : Bullish Single Line 2.8903% 3.0350% 2.9242% 3.5916% y y y y 4.6056% 4.7386% 4.9106% 4.1327% y y y y 1.8364% 1.9467% 1.2033% 1.0908% y 2.8951% 2.4826% 3.1237% 2.7890% y y y Code B : Bearish Single Line -3.2095% -2.8343% -3.0702% -2.7092% y y y y -3.2813% -3.8153% -3.9092% -3.8592% y y y y -1.8211% -1.9633% -2.0589% -1.2531% y y y -1.9851% -1.5572% -3.6480% -3.6775% y y Code C : Bullish Reversal Pattern 3.7728% 4.1895% 4.7531% 4.2865% y 2.7231% 2.9601% 2.6691% 2.6216% y y y y 1.8672% 2.2699% 2.9523% 2.4771% y y y Code A : Bearish Reversal Pattern -3.5287% -3.3506% -2.8786% -3.5475% y y y y -0.8070% -1.0353% -1.2515% -1.3796% - 7 8 9 10 3.9422% y 4.5412% y 1.9333% 2.9669% - 3.6097% y 4.2638% y 1.4637% 2.2784% - 3.5771% y 3.8258% y 1.1142% 0.9028% - 3.7962% y 3.6585% y 1.4879% 0.1539% - -3.1039% y -3.5107% y -0.0652% -3.4010% y -3.1778% y -3.6707% y -0.3667% -3.8028% y -3.1490% y -3.9402% y -0.7631% -3.7049% y -2.8725% y -3.7290% y -1.3782% y -3.2677% - 4.3138% 2.2063% 1.7994% - 3.4531% 1.2360% 2.2048% - 3.1895% 0.5501% 2.2599% - 2.5259% 0.6856% 3.1484% y -2.9295% y -1.2325% - -3.0861% y -2.9585% - -3.6785% y -2.7039% - -3.8793% y -3.1354% - 6. Bearish Engulfing: 1 day with 1% From the result if we divided into their type of candlestick inverted hammer for bullish type and shooting star for bearish type is the most candlesticks that have value for the traders. The frequencies of appearance for both of these candlesticks are also high. If we compare them by the type of formation the single line is more profitable than the reversal pattern on the bullish type, meanwhile in the bearish type the single line and reversal pattern formation give both a high value for the traders. The three days pattern of candlestick didn’t give a valuable signal both from the bearish type and the bullish type. This also due to the lack of frequency that the three days pattern candlesticks are very rare to appear in LQ 45 index of Jakarta Stock Exchange, so there are only small chances to prove the signal strong enough. 8 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.3.2. Comparison with the Jakarta Stock Exchange Composite Index The other t-test is comparing the mean rate of return from each candlestick pattern with the return that been made by the Jakarta stock exchange. After comparing each of candlestick patterns there are three candlestick pattern that not significantly valuable than the JSX movement. Dragonfly Doji (A4), Bearish Belt Hold (B3), and Morning Star (C4) are not significant compare with the JSX. Dragonfly Doji categorized as not significant because the difference with JSX is less than one percent, although it is more valuable than JSX, but still not strong enough. Bearish Belt Hold (B3) Have a positive prediction that the result gives a negative to the rate of return, but compare with the JSX the reduction is not greater enough. On the other Hand evening Star should give an increase price of stock, but from the result it appear to give a negative return which decreasing the price of the stock. This make morning star appear as not a significant candlestick pattern. The result from the previous t-test is different that there are some candlestick which is not profitable in the first test is profitable in the second test compare with JSX and also candlestick that appear profitable in the first is not profitable in the second test compare with JSX. Meanwhile there is one candlestick that appears not profitable in any holding days and also not profitable compare with the JSX which is Evening Star. From overall bearish type is more valuable compare with the JSX because only one candlestick that not significant in spite of bullish type with two candlestick that not significant. 9 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 4.4. One Way ANOVA This study will include one way ANOVA to compare each of candlestick patterns with another in the same group. So it is divided into two groups which bullish candlestick will be compared with bullish type and also bearish candlestick with bearish type. From the test we can found which candlestick that significant to each other and have the highest value in the group. The Significant in this test means that the candlestick should be differ from one to each other and have a highest rate of return for bullish type and lowest rate of return for bearish type. Downtrend Candlestick B2 B3 B4 B1 D1 D2 D3 D4 B1 B3 B4 B2 D1 D2 D3 D4 B1 B2 B4 B3 D1 D2 D3 D4 B1 B2 B3 B4 D1 D2 D3 D4 B1 B2 B3 D1 B4 D2 D3 D4 B1 B2 B3 D2 B4 D1 D3 D4 B1 B2 B3 D3 B4 D1 D2 D4 B1 B2 B3 D4 B4 D1 D2 D3 Candlestick MRR Significance -3.50% -1.14% -2.59% -1.86% -3.09% -1.59% -2.50% -2.90% -1.14% -2.59% -1.86% -3.09% -1.59% -2.50% -2.90% y -3.50% y -2.59% y -1.86% -3.09% y -1.59% -2.50% y -2.90% -3.50% -1.14% -1.86% -3.09% -1.59% -2.50% -2.90% -3.50% y -1.14% -2.59% -3.09% -1.59% -2.50% -2.90% -3.50% -1.14% -2.59% -1.86% -1.59% -2.50% -2.90% -3.50% y -1.14% -2.59% -1.86% -3.09% y -2.50% -2.90% -3.50% -1.14% -2.59% -1.86% -3.09% -1.59% - Uptrend Candlestick Candlestick MRR Significance A2 4.15% A3 1.58% A4 1.69% A1 C1 3.46% C2 1.97% C3 2.11% C4 -0.18% A1 3.29% A3 1.58% A4 1.69% A2 C1 3.46% C2 1.97% C3 2.11% C4 -0.18% A1 3.29% y A2 4.15% y A4 1.69% A3 C1 3.46% y C2 1.97% C3 2.11% C4 -0.18% A1 3.29% A2 4.15% y A3 1.58% A4 C1 3.46% y C2 1.97% C3 2.11% C4 -0.18% A1 3.29% A2 4.15% A3 1.58% C1 A4 1.69% C2 1.97% C3 2.11% C4 -0.18% A1 3.29% A2 4.15% y A3 1.58% C2 A4 1.69% C1 3.46% C3 2.11% C4 -0.18% A1 3.29% A2 4.15% y A3 1.58% C3 A4 1.69% C1 3.46% C2 1.97% C4 -0.18% A1 3.29% y A2 4.15% y A3 1.58% y C4 A4 1.69% y C1 3.46% y C2 1.97% y C3 2.11% y 10 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 From the table above we can see that there is only a few significant sign between each candlestick. This explained that the rates of return between them are not too different both for bullish and bearish type. However there is one candlestick that has all significant sign between the other candlesticks in bullish type which is Morning Star. Morning Star was given a significant sign among all of them because the rate of return that interprets by Morning Star is negative while it should be positive because it is characterized as a bullish type. This makes Morning Star significant in all of other candlesticks because the rate of return that very different between others and the others has a higher rate of return than Morning Star. Divided by two groups the result will help us to identify the candlesticks that have the strongest value in their own type of candlestick. The strongest candlestick should have the highest/lowest rate of return (depend on which group) and the most frequency with significant sign. The highest rate of return from bullish type is Inverted Hammer (A2) with 4,15 % and the lowest rate of return from bearish type is Shooting Star (B2) with -3,5 %. The next step is to checked from the result above which candlestick that have the highest number of significant value. From the bullish type we have some of candlestick with a significant sign which are: 1. 2. 3. 4. 5. 6. 7. 8. A1 – 2 Signal A2 – 5 Signal A3 – 1 Signal A4 – 1 Signal C1 – 3 Signal C2 – 1 Signal C3 – 1 Signal C4 – 1 Signal From the outcome above A2 is the most significant among the others candlestick and also with the highest rate of return which is 4,15%. Inverted Hammer becomes the most profitable value for traders as a strongest signal to sell the stock with the highest price. Moreover the C1 which is Bullish Engulfing can be trusted as a second signal that profitable for traders with 3,46 % rate of return. From the bearish type we have some candlestick with significant sign which are: 1. 2. 3. 4. 5. B1 – 1 Signal B2 – 3 Signal B4 – 1 Signal D2 – 2 Signal D4 – 1 Signal There are five candlestick with significant sign, meanwhile three others are not significant at all which means those three candlestick cannot be trusted as a good signal for traders to buy at the lowest point. The most trusted candlestick pattern in bearish type is B2 which is Shooting Star and also with the lowest rate of return, -3.5%, so traders can buy stocks at the cheapest price after Shooting Star occur. The second signal that also can be trusted is Bearish Harami (D2) with -3.09% rate of return. 11 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 5. Summary and Conclusions Japanese candlestick has been tested in this research from sixteen different candlestick pattern; bullish and bearish type; single line and reversal pattern formation. The outcome of Japanese candlestick is given a positive result which is profitable to be trusted by traders who intend to do the trade in LQ 45 index from Jakarta Stock Exchange. Both bullish type and bearish type of candlestick give a strong evidence in ten component stock of LQ 45 Index from 2012-2013. The first test founded that there is a strong relationship between return and candlestick and because of that the writer try to specify the effect of candlestick. Both bullish and bearish candlestick type are affecting the rate of return. There are 15 candlesticks that approve to impact the rate of return except one candlestick from bullish type which is Morning Star, the three days single line pattern / reversal pattern. This is because in this research Morning Star result a negative rate of return in spite of giving an increase in rate of return due to the category of Morning Star that is a bullish type. The next test was given to understand how many days that traders can trust for each candlestick pattern to hold and giving the best performance and value for traders. For bullish type most of the holding days stop at the middle of the period, which in this case using 10 days period. They are giving their best performance on the 4 th day and 5th day, for example Inverted Hammer, Dragonfly Doji, Piercing, and Bullish Engulfing. On the other hand Bearish type founded in a varied days which founded at the beginning, middle and at the end of the period. Moreover there are candlesticks that don’t have any single of holding days which are Morning Star, Dark Cloud Cover, and Evening Star. This study also compares the rate of return from each candlestick with the Jakarta Stock Exchange composite index. From the result almost all of the candlestick patterns appear to be more valuable than the movement in the composite index only three type that given worse performance than the composite index. Those three candlestick pattern are Dragonfly Doji, Bearish Engulfing, and Morning Star. The last test taken to identify which candlestick that becomes the best performer in their own group. Inverted hammer is the best performer with the most frequent significant value and with the highest rate of return in its own group. On the other hand, Shooting Star is the best performer for bearish group with the most frequent significant value and the lowest return indicate to the lowest point of price. Overall from this study, candlestick pattern with bullish type given a stronger signal than the bearish type because only two bullish candlestick patterns that occur not to be significant which is Morning Star and Dragonfly Doji because Morning Star is not significant value from the dummy variable and doesn’t have any holding days, moreover both Morning Star and Dragonfly Doji not given a better performance than the composite index. Meanwhile in the bearish type there are three candlestick patterns which are Bearish Belt Hold, Dark Cloud Cover, and Evening Star. Bearish Belt hold and Dark Could Cover don’t have any of holding days that can be trusted. If the candlestick divided into the formation the single lines formation is better performer than the reversal pattern it can be found from the holding day test the all of the single line pattern have a maximum value of holding day. Moreover compare with the most significant candlestick from the last test in their own group both for bullish type and bearish type the single line formation is the most profitable. 12 Proceedings of 7th Asia-Pacific Business Research Conference 25 - 26 August 2014, Bayview Hotel, Singapore ISBN: 978-1-922069-58-0 To conclude, Japanese candlestick does have a positive effect for the rate of return and this can be used by traders who trade in LQ 45 index from Jakarta Stock Exchange. From the entire test result that has been done in this study giving strong evidence that candlestick is profitable for Jakarta Stock Exchange Market because the effect of the candlestick is big which is affecting more than four percent for bullish type and more than three percent for bearish type. The findings from Goo, Chen, and Chang (2007) found that also Japanese candlestick have a significant effect to the Taiwan Stock Market. This make the writer believe to research in Jakarta Stock Market to identify the effect of Japanese Candlestick. References CaginalP, G., Laurent, H. (1998)’The Predictive Power of Price Patterns’, Applied Mathematical Finance, Vol. 5, pp. 181 – 205. Marshall, Ben. R., Young, Martin. R., Cahan, Rochester. (2007)’Are Candlestick Technical Trading Strategies Profitable In The Japanese Equity Market?’, Springer Science. Roy, Partha., Sharma, Sanjay., Kowar, M. K., (2012)’Fuzzy Candlestick Approach to Trade S&P CNX NIFTY 50 Index Using Engulfing Patterns’, International Journal of Hybrid Information Technology, Vol. 5, No. 3. Marshall, Ben. R., Young, Martin. R., Rose, Lawrence. C. (2005)’Candlestick Technical Trading Strategies: Can They Create Value for Investor?’, Journal of Banking & Finance, Vol. 30, pp. 2303 – 2323. Shiu, Yung-Ming., Lu, Tsung-Hsum. (2011)’Pinpoint and Synergistic Trading Strategies of Candlesticks’, International Journal of Economics and Finance, Vol.3, No.1. Goo, Yeong-Jia., Chen, Dar-Hsin., Chang, Yi-Wei. (2007)’The application of Japanese Candlestick Trading Strategies In Taiwan’, Investment Management and Financial Innovations, Vol. 4, Issue 4. Lu,Tsung-Hsun., Chen, Jinji. (2013)’Candlestick Charting in European Stock Markets’, The Finsia Journal of Applied Finance, Issue 2. BIgalow, Stepehen W. (2002). Profitable Candlestick Entry and Exit Strategies. Texas: The Candlestick Forum LLC. BIgalow, Stepehen W. (2002). Profitable Candlestick Trading. New York: John Wiley & Sons, Inc. Nison, Steven. (1991). Japanese Candlestick Charting Techniques. New York: New York Institute of Finance, 1991. Bigalow, Stephen W. Futures; Oct 2003; 32, 12; ABI/INFORM Complete pg. 42. Bhandari, Bramesh. Futures; Mar 2014; 43, 2; ABI/INFORM Complete pg. 30. 13