“Perfect Tender in Time” Rule Prepayment if the note/mortgage do not expressly

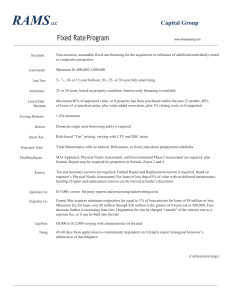

advertisement

• Lambert owns “The Free Market” (a local shopping center) Prepayment – Equitable holds a mortgage on The Free Market, securing repayment of a $10MM loan (8% interest) – Loan is payable in full at end of 10-year term, in a “balloon payment,” in 2020 • 2015: Lambert wants to pay off the mortgage, tenders Equitable $10MM • Why would Equitable refuse this payment? Can they legally do so? “Perfect Tender in Time” Rule • In “remedies” terms, the “perfect tender in time” rules essentially gives the mortgage lender the right to specific performance of the borrower’s promise to repay, in accordance with the terms of the note • Does it make sense to give the lender this right, rather than just an action for damages? “Perfect Tender in Time” Rule • Common law: if the note/mortgage do not expressly permit prepayment, mortgagee can refuse to allow it, and insist that borrower repay at agreed-upon time • Rationale: – Lender should be able to get the benefit of the investment decision it made at time Lender made the loan – E.g., if current interest rates are now below the contracted-for rate, the lender would suffer a “reinvestment loss” due to prepayment “Perfect Tender in Time” Rule • Lender: money damages aren’t an adequate remedy for my potential reinvestment loss because they aren’t certain to make me “whole” – Rationale: lender can’t immediately “cover” (i.e., substitute a new mortgage loan) – Real estate is unique, no other mortgaged parcel is a perfect substitute – Finding a “comparable” replacement mortgage loan takes a great deal of time, expense, due diligence • Restatement of Mortgages § 6.1 rejects the “perfect tender in time” rule altogether • Under the Restatement, if a mortgage is silent, the mortgagor can prepay w/out a fee (i.e., prepayment is not a breach of the agreement) – Fannie/Freddie single-family note form allows prepayment w/out a fee (this has cultivated an incorrect expectation among many laypersons that mortgage loans can be freely prepaid) – Lender that wants to restrict the right to prepayment should bear the burden of imposing a clear contractual restriction • Only two states (PA and MO) accept this view; the rest still apply the “perfect tender in time” rule • Lambert owns “The Free Market” – Equitable’s mortgage note provides for an interest rate = 8% – Note’s prepayment fee = “6% of the amount prepaid” • In 2015, Lambert wants to prepay (balance = $10MM) – In 2015, prevailing interest rates are now 10% • Can Lambert challenge the fee as an invalid penalty? Problem 1 Prepayment Clauses • Mortgage loan documents typically contain one (or more) of three types of prepayment provisions – (1) “Lock-out” provision: prepayment is absolutely prohibited, or is prohibited for a certain period of time – (2) “Flat fee” (borrower can prepay, but must pay a fee based on a percentage of the amount prepaid) – (3) Yield maintenance clause (borrower can prepay, but must pay a fee based on a formula designed to approximate the lender’s actual reinvestment loss, by reference to Treasury index rate) • On these facts, Lambert’s prepayment actually benefits Equitable! – Equitable’s interest collected on existing note = $800K/year – Interest Equitable would earn if it re-loaned $10MM at current 10% market rate = $1MM/year – By reinvestment, Equitable would earn an additional $200,000 in interest per year, each year, for 5 years left on original loan term – Present value of this benefit to Equitable ≈> $750K! • Can Equitable collect a $600K prepayment fee when it not only suffered no loss, but received a ≈$750K benefit? 10-Year, $10MM Loan: What Is Lender’s Reinvestment Loss Due to Prepayment (for Each 1% Decline in the Interest Rate)? Prepayment Fees • Weight of judicial authority: prepayment fee clause is a valid liquidated damages clause, which can be enforced even if lender suffered no actual loss due to the prepayment – Rationale: at time of loan, parties can’t know if rates will go up/down, or by how much (thus, at time of loan, size of possible reinvestment loss can’t be determined with certainty) – Percentage fee is a “reasonable” pre-estimate of damages due to potential reinvestment loss Prepayment Fees • Prof. Whitman has argued that if the mortgage note contains a prepayment fee, then the mortgagor effectively has purchased an “option” to prepay for a price = agreed fee – He argues that this fee should thus be enforceable according to its terms (w/out regard to “penalty” analysis or evaluation under “liquidated damages” standards) • • • • • After Loan Year 1: After Loan Year 2: After Loan Year 3: After Loan Year 4: After Loan Year 5: $625,000 $574,000 $520,000 $462,000 $399,000 • • • • After Loan Year 6: After Loan Year 7: After Loan Year 8: After Loan Year 9: $331,000 $257,000 $178,000 $92,000 Strategery (as George W. Would Say) • Lambert wants to prepay, but doesn’t want to pay $600K fee, so he stops making his mortgage payments • After several months, Equitable declares a default, accelerates the loan and demands that Lambert pay full $10MM principal plus accrued interest and $600K prepayment fee • Lambert tenders full $10MM + accrued interest, but says, “Now that Equitable accelerated, this is ‘payment,’ not ‘prepayment’ — so I don’t have to pay the $600K prepayment fee.” • Is Lambert correct, or not? • Answer: it depends on the language of the clause – Equitable’s reinvestment risk is the same, whether the payoff is voluntary or involuntary (Equitable still has to go out and reinvest the money) – If the loan documents expressly allow mortgagee to impose a prepayment fee if payment occurs following acceleration of the loan, that fee is enforceable [p. 611, note 6(a)] – But, if loan documents don’t define payment of accelerated debt as prepayment, weight of authority treats payment of accelerated balance as ≠ “prepayment” [p. 611, note 6(a)] • One critique: yield maintenance clause tied to Treasury rates “overstates” reinvestment loss – Treasury (risk-free) rates will always trail real estate mortgage note interest rates (which account for risk) by 2-4% – Thus, even if interest rates have not actually increased, yield maintenance clause will result in prepayment fee • Defense: Treasury rate is appropriate b/c lender will reinvest prepaid funds at Treasury rate until it can identify a suitable replacement investment Yield Maintenance Clauses • Parties can’t know future interest rates, but can use a formula that more precisely calculates the lender’s reinvestment loss – Note 2, page 606: prepayment fee = present value of all future P&I payments on the note (discounted at the “reinvestment rate,” which is based on a Treasury rate), minus the outstanding principal balance due on the note at the time of the prepayment • Does this formula accurately reflect the lender’s damages? • If this formula works, why would the mortgagee choose to use a “percentage fee” provision instead? Lopresti v. Wells Fargo Bank (p. 597) • How is the provision in Lopresti different from a yield maintenance clause? – “Breakage Fee” under the clause in Lopresti was based on the difference between Treasury rate at time of loan and Treasury rate at time of prepayment – It thus does not “overcompensate” the lender like a true yield maintenance clause (p. 606, note 2) Usury • Usury laws establish a legal limit on interest rates • Nominally, Missouri has a 10% usury limit [RSMo. § 408.030] • Traditional rule: lender can’t enforce usurious interest rate – Some state laws required disgorgement of all interest collected – Other states required only disgorgement of any interest collected above the legal rate • In the late 1970s, as inflation and interest rates rose, usury laws threatened the solvency of banks and savings & loan associations – 1980: Banks, S&Ls had to pay 14-15% to attract deposits, but usury laws in most states prohibited them from charging borrowers more than 10% (or the applicable state law usury limit) • Potential cost of bailouts prompted federal pre-emption of state usury laws – This allowed federally-regulated lenders to make mortgage loans w/out regard to state law usury limits Default Interest and Late Fees: Westmark • Today, due to federal pre-emption and revision of state usury law in many states, usury law is mostly a “dead letter” – E.g., federally regulated mortgage lenders are not subject to state law limits – E.g., usury rate for payday lenders in Missouri is 1,950% • In Missouri, parties can agree to any interest rate for: – (1) A loan to a corporation, partnership, or LLC; – (2) A business loan of => $5,000; – (3) Loans secured by real estate, unless the real estate is residential and the lender is not a federally regulated lender [Can you spot the usury trap here?] • Westmark Note: “If the unpaid balance hereof is not received by Holder on the Maturity Date, or on the Acceleration Date, such amount shall bear interest at the Note Rate plus two (2%) per annum (the “Default Rate”)....” [Default interest] • Westmark Note: “If any installment under this Note shall not be received by Holder on the date due, Holder may at its option impose a late charge of six percent (6%) of the overdue amount.” [Late fee] Late Fees and Default Interest • Suppose that mortgage note has both default interest and late fee clauses, and that Borrower is in default (> 20 days has passed since last installment date w/out payment) • Lender imposes the default interest rate, and also assesses a “late fee” on late installment • Why isn’t that “double counting” by the Lender (collecting twice for the same harm)? Late Fees • By contrast, the late charge or late fee is “backward”looking; it compensates the lender for: – (1) Administrative expenses and costs incurred in handling a late payment (extra servicing expense), and – (2) Lost interest on the late payment itself (i.e., the lost use value of the late installment); if the borrower had timely paid the installment, the lender would have been able to invest that amount and earn a return on it earlier Default Interest • Default interest is “forward”-looking; it compensates the lender for the lost opportunity cost (i.e., interest) associated with the lender’s investment of the principal – Once borrower defaults, the default rate allows the lender to “adjust” the interest rate to a rate more appropriate (now that borrower has proven itself to be “riskier”) – Parties can agree to whatever rates they wish, subject to usury limits (which typically do not apply to most real estate mortgage loans) Westmark • Consistent with the great weight of case authority, court upheld both the late charge and default interest provisions • Note: state statutes do commonly place maximum limits on late charges [note 7, page 621] – RSMo. § 408.140(1) (“If the contract so provides, a charge for late payment on each installment or minimum payment in default for a period of not less than fifteen days in an amount not to exceed five percent of each installment due ....”) Satisfaction of Mortgage • When the mortgagor pays off the mortgage debt, the lien of the mortgage is extinguished (it is no longer enforceable) • But, if the mortgage/deed of trust still appears on the public record, it is a “cloud” on the mortgagor’s title (as searchers can’t tell whether or not it has been paid off) • Thus, upon receiving full payment, the mortgagee must execute a “release” or “satisfaction” of the mortgage – In many states (including MO), mortgagee must also record it Payoff Letters/Statements • Today, most mortgage notes are prepaid (before their originally scheduled maturity), either when – (1) the mortgagor sells the mortgaged land, or – (2) the mortgagor refinances the mortgage debt • Mortgagor confirms the amount needed to make full payment of mortgage debt by obtaining a “payoff statement” from the lender Missouri Statute [RSMo. § 443.130] • Once mortgage is paid off, mortgagee must record satisfaction within 45 days after request by mortgagor • If mortgagee fails to do so, mortgagee is liable for a statutory penalty of $300 per day, up to a maximum of 10% of the amount of the mortgage, plus court costs and attorney fees • If satisfaction is rejected by the recorder, mortgagee has 60 days (following receipt of notice of rejection) to record a sufficient satisfaction • Common law: lender had no legal duty to provide a “payoff statement” (a confirmation of the balance of debt) – Compare UCC § 9-210 (requires secured party to confirm balance of debt upon written request, with $500 penalty if secured party fails to timely respond) – Restatement of Mortgages § 1.6 recognizes a legal duty to deliver a payoff statement; such a duty is also imposed by statute in a few jurisdictions • In practice, lenders routinely provide payoff letters (sometimes charging a fee unless prohibited by statute) • Prior to sale from Uphoff to Mitchell, Bank gives Uphoff (borrower) a payoff amount of $124K (debt really = $125K) • Uphoff tenders $124K to Bank, deeds land to Mitchell at closing • 1 week later, Bank says “We goofed; payoff letter should’ve said $125K” • Can Bank collect $1,000 from Uphoff? • Can Bank enforce the mortgage against Mitchell if $1,000 isn’t paid? Problem 2 • Bank can still collect the remaining $1,000 from Uphoff in an action on the note, which has not been satisfied (assuming, of course, that Uphoff is personally liable for the debt) • However, Bank probably can’t enforce the mortgage lien vs. Mitchell (due to equitable estoppel) – Mitchell relied on accuracy of payoff amount to complete the purchase, believing he would receive a clear title • Problem: payoff letters often state that they are subject to “correction”; in that case, can Mitchell reasonably rely on the payoff letter?