Due-on-Sale Clauses

Due-on-Sale Clauses

• Most mortgage loans contain “due-on-sale” or “due-ontransfer” provisions that allow the mortgagee to accelerate the debt if a transfer occurs without mortgagee’s consent

• The enforceability of such clauses is clear where the proposed transferee is objectively problematic

– E.g., Buyer is not creditworthy; Buyer plans to operate strip club

• But suppose mortgage lender is motivated by interest rate concerns?

Uphoff owns home

Bank holds 6% mortgage, balance = $120,000,

20 years left on the loan term

Mitchell (M) wants to buy Uphoff’s home

If M must borrow (15%)

Monthly:

Total interest

$1,517.33

(30 years) $426,258.05

If M can assume (6%)

Monthly:

Total interest

$719.46

(30 years) $139,006.67

Annual mortgage payment differential $9,574.44

Present value of savings over 20 years $59,929.59

If M can “take over” the mortgage, Uphoff can command sale premium (up to $59,929.59) on sale of home

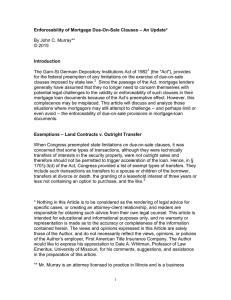

Federally Insured S&Ls

12

11

10

9

8

7

6

197

8

19

79

198

0

19

81

198

2

19

83

Cost of Funds

19

84

19

85

19

86

19

87

Return on Mortgages

• Pre-1982, when mortgagor tried to sell home and allow buyer to assume or “take over” the existing loan, lender would block sale using “due on sale” clause (thus requiring buyer to get new mortgage loan)

• Borrowers began suing, challenging this practice as an unreasonable restraint on Borrower’s right of alienation

– Majority: due-on clause freely enforceable

– Minority (esp. California): lender can object if the transfer would impair the lender’s security or increase the risk of default, but not just b/c interest rate is no longer favorable to lender

1

Garn-St. Germain Act

• Applies to all mortgage loans (whenever made), and to all transfers of mortgaged property made after October 15, 1982

• Garn Act pre-empts any contrary state law (court decision, statute, or regulation) that restricts enforcement of a due-on-sale clause in accordance with its terms

• Garn Act makes due-on-sale clause enforceable according to its terms, as a matter of federal law (except for limited exceptions)

– Note: Lender doesn’t have to accelerate, and can instead choose to allow subject to/assumption transfer [12 U.S.C. § 1701j-3(b)(3)]

• O owns land subject to a mortgage that provides: “If the mortgagor sells the mortgaged land without the prior written consent of mortgagee, mortgagee may accelerate the mortgage debt.”

• O deeds the land to Smith as a birthday gift, without the prior written consent of mortgagee

• Can mortgagee accelerate the loan?

Problem

• Garn Act does not specify what a “due-on” clause must say

• Garn Act only pre-empts contrary state laws that would limit the effectiveness of a “due-on” clause according to its explicit terms

– Thus, the language of the actual clause is critical

– I.e., if the clause is triggered only by a “sale,” many courts will conclude that a non-sale transfer does not trigger the clause

(courts still tend to narrowly construe restraints on alienation)

– Thus, gift to Smith probably would not trigger a due-on clause that by its terms only applies to “sales”

Fannie/Freddie Uniform Instrument

• ¶ 18 [p. 1451]: “If all or any part of the Property or any

Interest in the Property is sold or transferred (or if Borrower is not a natural person and a beneficial interest in Borrower is sold or transferred) without Lender’s prior written consent, Lender may require immediate payment in full of all sums secured by this Security Instrument.”

• Under this provision, mortgagee could accelerate the debt based on mortgagor’s gift deed to Smith

2

• Under Fannie/Freddie Uniform

Instrument due-on clause, could

Bank accelerate if Mortgagor:

– Grants Litton an option to buy the mortgaged land?

– Leases the land to Mitchell?

– Takes out a home equity second mortgage loan?

– Defaults on that loan and the home equity lender later conducts a foreclosure sale?

• Exceptions [p. 507]: Lender can’t exercise “due-on” clause if owner:

– Grants a subordinate lien (e.g., home equity loan)

– Grants a PMSI for household appliances (even if they become fixtures upon installation)

– Transfers on death of joint tenant/entireties tenant

– Leases for < 3 years, w/out purchase option

– Transfers on death to a relative

– Transfers to spouse/children

– Transfers to ex-spouse in marital dissolution

– Transfer to inter vivos trust (if owner is beneficiary and there is no transfer of occupancy)

Note 1, page 511

• Husband and wife own land as joint tenants, on which they operate a grocery store

• Bank holds a mortgage with “due-on-transfer” clause

• Husband dies; wife continues operating grocery store

• Can Bank accelerate?

– Yes; exceptions don’t apply b/c this is business property, not

“residential real property containing less than 5 dwelling units”

• Note: Garn Act exceptions apply only to mortgages on residential land (< 5 dwelling units)

• Originally, the exceptions applied to exceptions to all mortgages

• In 1983, Congress amended the Garn Act to limit the residential mortgages only (< 5 units)

– Rationale: commercial lenders objected to being barred from acceleration, if borrower had obtained a subordinate mortgage loan, w/out first mortgagee’s consent

– Congress didn’t want to limit ability of homeowners to obtain home equity loans

3

Note 2, page 511

• Husband and wife own farmland as joint tenants

• Bank holds a mortgage on the land which contains a due-on-transfer clause

• Husband dies

• Can Bank accelerate the mortgage loan over objection of widow?

Note 2, page 511

• Application of statute in this situation is not clear

– If the purpose of the loan was to finance the farming operation, Bank may expect to be able to accelerate (Bank may view this as a “business” loan)

– But, if H and W lived on the farm, the court may treat the farm as “residential real property” (and thus treat the loan as being covered by the Garn Act exceptions for intra-family transfers on death)

• How should Bank structure the loan differently to address this ambiguity?

– Bank could make two separate loans:

• (1) Loan A, secured only by the farm house and curtilage

• (2) Loan B, secured by the rest of the farmland (and financing farm operations)

– In the event of transfer-on-death, Bank could accelerate Loan

B (the commercial mortgage financing the farm operation), but not Loan A (the residential mortgage)

• Suppose Buyer wants to take over

Seller’s existing mortgage (which bears favorable interest rate)

– Bank, which holds mortgage, is almost certain to refuse (rates are now 3-4% higher)

• Can Buyer go through with the transaction and simply conceal it from Bank? What risks would be involved?

Question

4