Problem 3 Present Title Covenants (Warranty Deeds)

advertisement

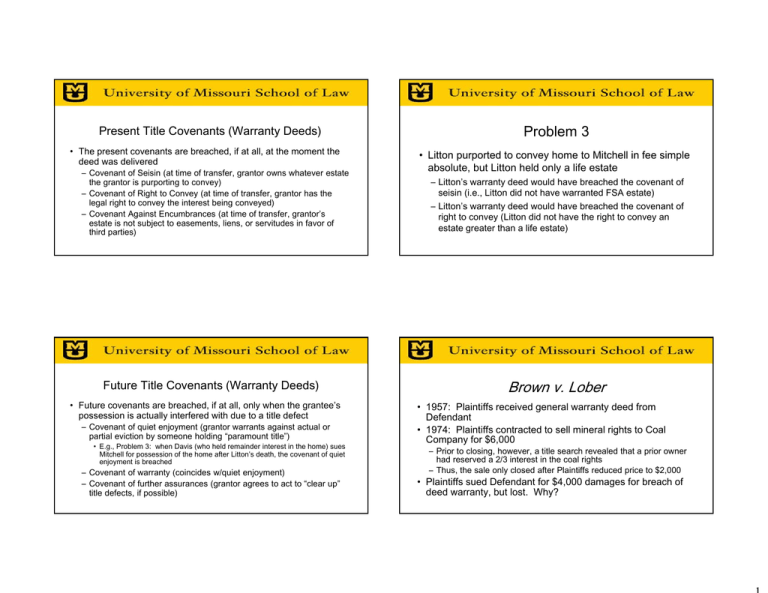

Present Title Covenants (Warranty Deeds) • The present covenants are breached, if at all, at the moment the deed was delivered – Covenant of Seisin (at time of transfer, grantor owns whatever estate the grantor is purporting to convey) – Covenant of Right to Convey (at time of transfer, grantor has the legal right to convey the interest being conveyed) – Covenant Against Encumbrances (at time of transfer, grantor’s estate is not subject to easements, liens, or servitudes in favor of third parties) Future Title Covenants (Warranty Deeds) • Future covenants are breached, if at all, only when the grantee’s possession is actually interfered with due to a title defect – Covenant of quiet enjoyment (grantor warrants against actual or partial eviction by someone holding “paramount title”) • E.g., Problem 3: when Davis (who held remainder interest in the home) sues Mitchell for possession of the home after Litton’s death, the covenant of quiet enjoyment is breached – Covenant of warranty (coincides w/quiet enjoyment) – Covenant of further assurances (grantor agrees to act to “clear up” title defects, if possible) Problem 3 • Litton purported to convey home to Mitchell in fee simple absolute, but Litton held only a life estate – Litton’s warranty deed would have breached the covenant of seisin (i.e., Litton did not have warranted FSA estate) – Litton’s warranty deed would have breached the covenant of right to convey (Litton did not have the right to convey an estate greater than a life estate) Brown v. Lober • 1957: Plaintiffs received general warranty deed from Defendant • 1974: Plaintiffs contracted to sell mineral rights to Coal Company for $6,000 – Prior to closing, however, a title search revealed that a prior owner had reserved a 2/3 interest in the coal rights – Thus, the sale only closed after Plaintiffs reduced price to $2,000 • Plaintiffs sued Defendant for $4,000 damages for breach of deed warranty, but lost. Why? • Held: Plaintiffs couldn’t recover for breach of present covenant of seisin or covenant against encumbrances – 10 year statute of limitations began to run in 1957, upon delivery of deed (which is when breach occurred)! – No discovery rule! • Held: Plaintiffs couldn’t recover for breach of future covenant of quiet enjoyment – Problem: owner of coal rights hadn’t yet asserted those rights (thus, no actual or partial eviction of Plaintiff had occurred) – Plaintiff should’ve reached settlement w/ prior owner first Problem 2 • 1995: Your father buys a farm from Jones for $100,000, receiving a general warranty deed (without exceptions) • 2010: You inherit the farm from your father • 2015: You have an agreement to sell farm to Developer for $500,000, but deal falls apart when title search reveals a “agricultural use only” covenant in favor of neighboring parcel • If neighbor will not release covenant, your economic loss is $300,000 ($500,000 - $200,000 FMV for agricultural use), but you can recover only $100,000 from Jones (price he received). Why? Brown — The Limited Utility of Deed Covenants • Title defects are often “latent” – By the time the defect is discovered/arises, much time may have passed, and thus the statute of limitations may have run for breach of the present deed covenants – While eviction may still permit an action for breach of future deed covenants, passage of time can also affect the utility of that cause of action — grantor that made warranties may be dead, not findable, bankrupt, or judgment-proof Limitation of Damages? • Rationale 1: Jones’s title was defective at the time deed was delivered, so liability should be based on the value of land at that time (as reflected by price received by Jones) • Rationale 2: Jones can’t meaningfully protect himself against the risk of economic loss due to future market appreciation of the land (or appreciation b/c you made improvements to the land) Limitation of Damages • How can grantee protect against losing the benefit of future appreciation due to a latent title defect? • Only through title insurance – (1) Owner should purchase an owner’s policy of title insurance; and – (2) Owner should make sure that the policy amount of that title insurance policy is increased if the land is later improved or appreciates in value due to market conditions Gifts by Deed • Note: cap on damages means that where grantee receives land by general warranty deed as a gift, grantee cannot recover damages from donor/grantor! – Smith citation (note 3, p. 219) is misleading – In Smith, the court allowed a donee to recover damages from a remote seller/grantor, not the immediate donor/grantor – For this reason, title insurance should play an important role in gift transactions, too Legal/Practical Considerations for Grantor/Warrantor • First: if your title is defective at time you convey the property by general warranty deed, you can be held liable to a “remote” grantee – Future covenants are covenants that “run with the land” – Owner’s policy of title insurance will indemnify you for this liability (even after you no longer own the land) • Second: if your title is subject to an encumbrance of which you are aware and cannot remove, you must “except” that encumbrance from any title covenants you make – E.g., “subject, however, to the following interests which Grantor does not warrant against: [list any easements, restrictions, or covenants that are of record or are known to Grantor] • Suppose that in Problem 2, you get sued by neighboring owner, who obtains an injunction against your planned residential development (based upon the recorded “ag use only” restrictive covenant) • You sue Jones (from whom your father purchased the land) for breach of covenant of quiet enjoyment, as Jones’s general warranty deed did not “except” the ag use covenant • Jones argues: covenant wasn’t breached b/c the land was obviously farmland and thus your father (the grantee) implicitly agreed to take title subject to the agricultural use • Should Jones prevail on this argument? Why or why not? • If grantor breaches a deed warranty, the grantee can also recover the costs of defending the grantee’s title, including attorney fees [Note 7, pages 220-221] – This liability is not “capped” by the amount received by the grantor at the time grantor made the warranty in question • If grantee litigates title with an adverse claimant and wins, grantor did not breach deed warranty and thus is not liable to grantee for grantee’s costs of defense! • Problem 4: How can grantee protect against the costs of incurring a successful defense of its title? • Some courts have held that a warranty deed impliedly excepts coverage for an encumbrance that was obvious at the time the grantee accepted title – E.g., covenant against encumbrances did not warrant against a visible driveway easement in favor of neighboring parcel owner (rationale: parties would have factored the existence of that easement into the agreed price for the land) • Does that result make good sense? – Warranties are typically strictly construed (grantor should’ve taken exception for known encumbrance, even if it is obvious) – Also, in Problem 3, a visible agricultural use would not signal the existence of an “agricultural use only” covenant