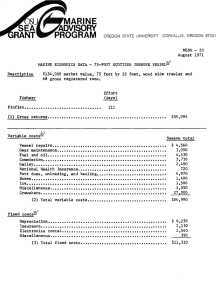

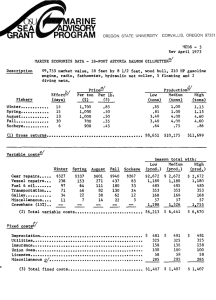

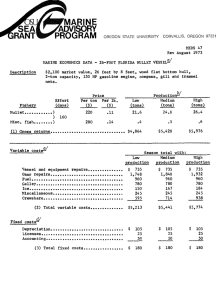

MARINE "GRANT PROG RAM ADVISORY

advertisement

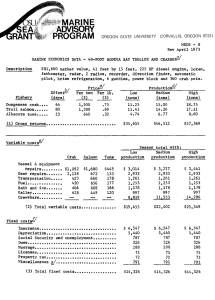

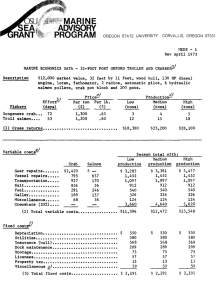

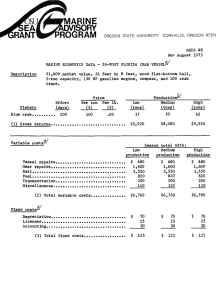

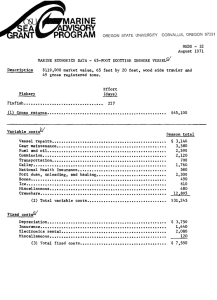

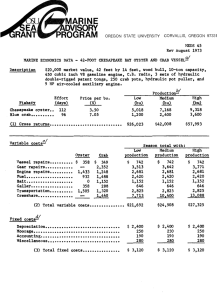

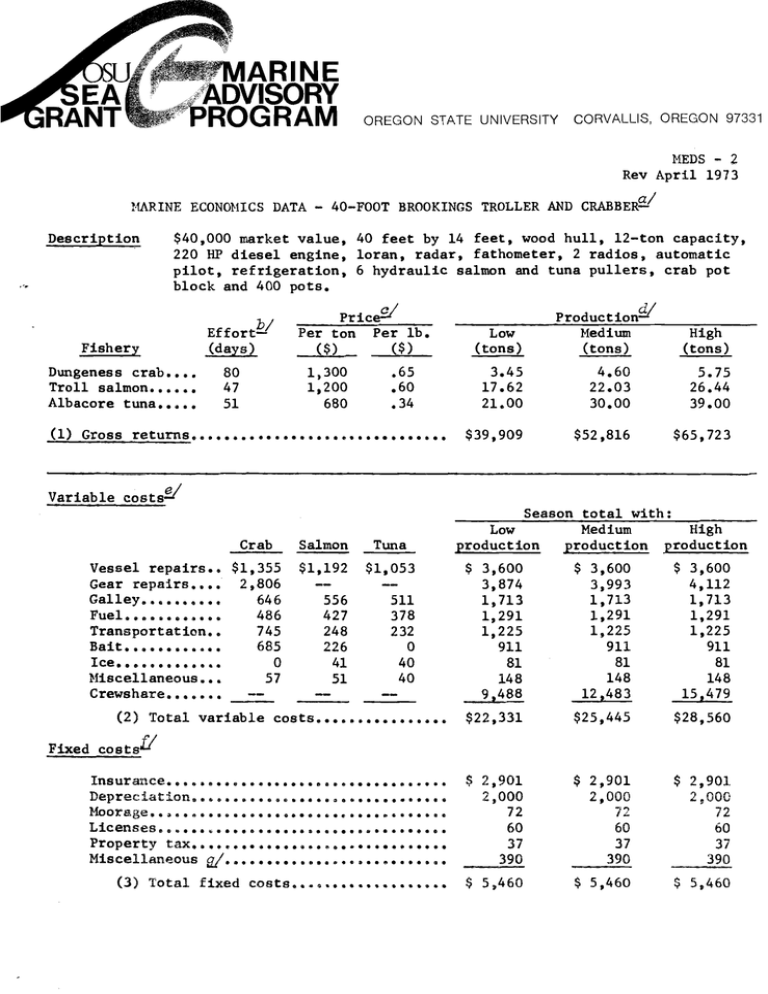

MARINE SU ADVISORY PROG RAM "GRANT OREGON STATE UNIVERSITY CORVALLIS, OREGON 97331 MEDS Rev April 1973 2 MARINE ECONOMICS DATA - 40-FOOT BROOKINGS TROLLER AND CRABBERDescription $40,000 market value, 40 feet by 14 feet, wood hull, 12-ton capacity, 220 HP diesel engine, loran, radar, fathometer, 2 radios, automatic pilot, refrigeration, 6 hydraulic salmon and tuna pullers, crab pot block and 400 pots. Price" Effort-" (days) Fishery Dungeness crab Troll salmon Albacore tuna 80 47 51 Low Production Medium Per ton Per lb. ($) ($) (tons) (tons) (tons) 1,300 1,200 680 .65 .60 .34 3.45 17.62 21.00 4.60 22.03 30.00 5.75 26.44 39.00 $39,909 $52,816 $65,723 (1) Gross returns High Variable costs7 Vessel repairs Gear repairs Galley Fuel......,.., Transportation Bait Ice Miscellaneous.. Season total with: Low Medium High production production production Crab Salmon Tuna $1,355 2,806 646 486 745 $1,192 $1,053 556 427 248 226 511 378 232 41 51 40 40 685 0 57 $ 3,600 3,874 1,713 1,291 1,225 911 0 Crewshare.. . (2) Total variable costs $ 3,600 3,993 1,713 1,291 1,225 911 $ 3,600 4,112 1,713 1,291 1,225 911 81 81 148 9,488 148 12,483 81 148 15,479 $22,331 $25,445 $28,560 $ 2,901 2,000 $ 2,901 2,000 $ 2,901. 72 60 37 72 60 37 72 60 37 390 390 390 $5,460 $ 5,460 $ 5,460 Fixed Insurance................,., Moorage. . a. ø. . U S SS CC CSSSCS CSS Licenses. . .......... ..... . Property tax.............,........., Miscellaneous .. . . .. . . . . .. . . . . . /. CS . ..... . (3) Total fixed costs...5........, 2,000 Opportunity cos Low production Medium production High production $11,973 $15,845 $19,717 (5) Operator's management (10% of gross) 3,991 5,282 6,572 (6) Total investment ($40,000 @ 9%) 3,600 3,600 3,600 $12,118 $21,911 $31,703 8,518 18,311 28,103 -3,846 784 5,414 (4) Operator's labor (30% of gross) Summary Return to labor, management, and investment (1 less 2 and 3) Return to labor and management (1 less 2, 3, and 6) Return to investment (1 less 2, 3, 4, and 5) Original data developed by selected Brookings fishermen, April 1969, in cooperation with Oregon State University Marine Advisory Program. Costs, landings, and price have been adjusted to reflect changes since the original data was developed, and is representative of above-average operators for this port. Fishing days at sea. 2/ Prevailing prices for this port during the 1972 season. Low and high are 25% below and above medium for crab, 20% below and above medium for salmon, and 30¼ below and above medium for tuna. Costs that vary with fishing effort. May include unpaid crew, operator, and family labor. Some costs, such as gear repair and crewahare, also vary with production. Costs that do not vary with fishing effort. Utilities, accounting, etc. Opportunity cost of labor is the estimated value of this operator's time, or what could have been earned working for someone else, Opportunity cost of management is the estimated value of this operator's management (decision-making and risk), or what could have been earned managing another similar business. Opportunity cost of investment is the estimated fair return to total investment in the business, regardless of the actual amount of debt.