RANTVPROG RAM SEA&V /ADVISORY MARINE U

advertisement

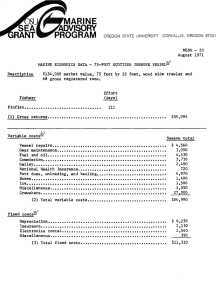

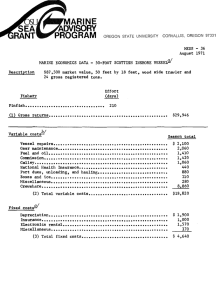

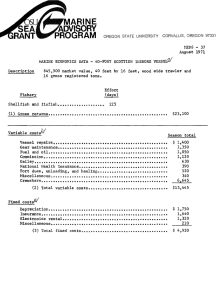

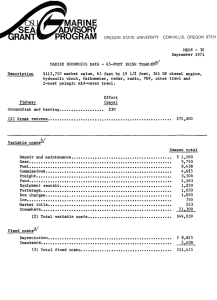

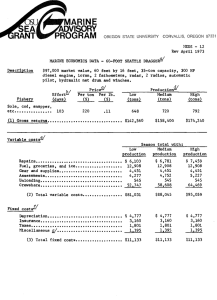

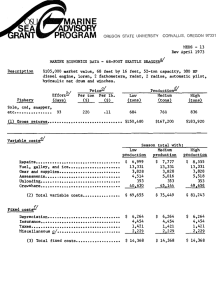

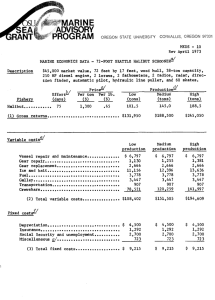

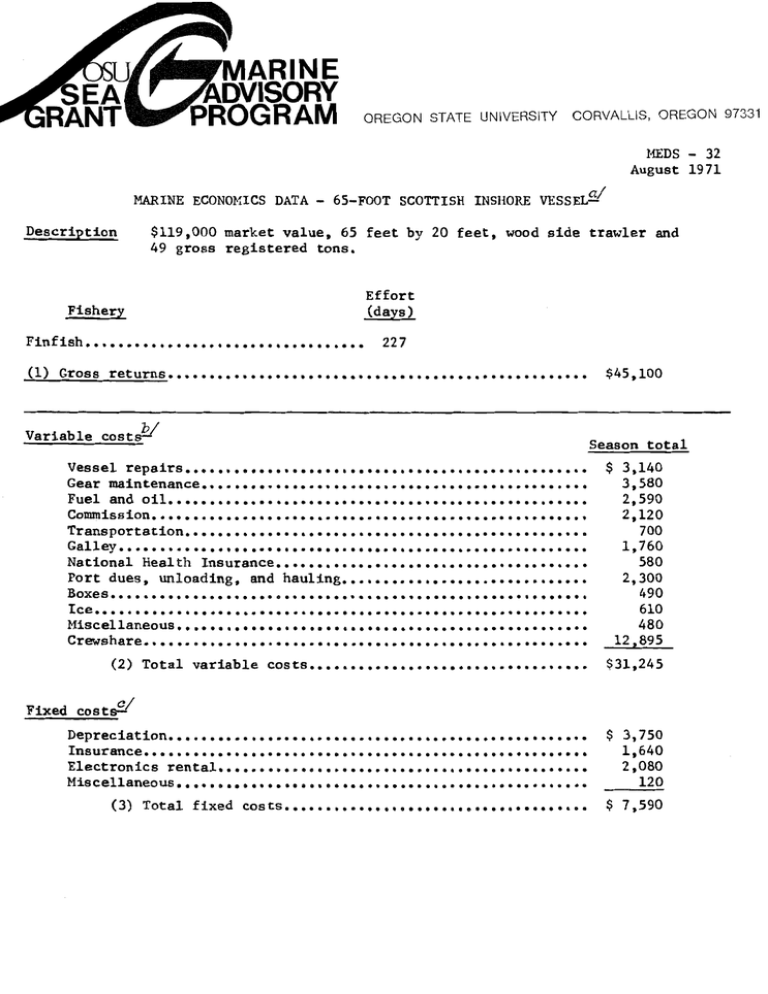

MARINE SEA&V /ADVISORY U RANTVPROG RAM OREGON STATE UNIVERSITY CORVALLIS, OREGON 97331 MEDS - 32 August 1971 MARINE ECONOMICS DATA - 65-FOOT SCOTTISH INSHORE VESSEL7 Description $119,000 market value, 65 feet by 20 feet, wood side trawler and 49 gross registered tons. Effort Fishery Finfjsh (days) 227 (1) Gross returns $45,100 Variable costs" Season total Vessel repairs Gear maintenance Fuel and oil Commission Transportation Galley National Health Insurance Port dues, unloading, and hauling Boxes Ice Miscellaneous Crewshare (2) Total variable costs $ 3,140 3,580 2,590 2,120 700 1,760 580 2,300 490 610 480 12,895 $31,245 Fixed Depreciation Insurance Electronics rental Miscellaneous (3) Total fixed costs $ 3,750 1,640 2,080 120 $ 7,590 Opportunity costs Season total (4) Operator's labor (5) Operator's management (10% of boat share) (6) Total investment ($119,000 @ 10%) $ 2,865 2,124 11,900 Summary Return to labor, management, and investment (1 less 2 and 3) Return to labor and management (1 less 2, 3, and 6) Return to investment (1 less 2, 3, 4, and 5) 6,265 -5,635 1,276 Developed by the British White Fish Authority in cooperation with the Oregon State University Marine Advisory Program, in Edinburgh, Scotland. W Costs that vary with fishing effort. 2/ Costs that do not vary with fishing effort. Opportunity cost of labor is the estimated value of this operator's time, or what could have been earned working for someone else. Opportunity cost of management is the estimated value of this operator's management (decision-making and risk), or what could have been earned managing another similar business. Opportunity cost of investment is the estimated fair return to total investment in the business, regardless of the actual amount of debt.