Departmental Performance Report 2014–15

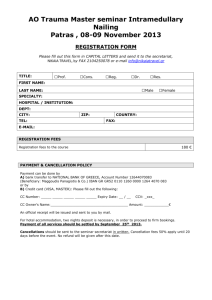

advertisement