Seychelles Country Report Competitiveness Strategies For Small States Malta, 23-31 May 2011

advertisement

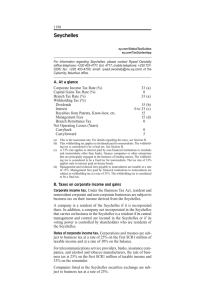

Seychelles Country Report Competitiveness Strategies For Small States Malta, 23-31 May 2011 Jayant Mayadas – Trade Consultant, Ministry of Finance & Trade Davis Laporte – Economist, Central Bank of Seychelles Key Facts Location – (see map) – 115 islands Time Zone – GMT +4 Population – 89,000 Land Area – 455 sq km Ocean EEZ area – 1.4 million sq.km Form of Govt – Sovereign Democratic Republic Languages – English, French, Creole Currency – Seychelles Rupee Other Indicators Life Expectancy : 73 yrs Literacy : 96% UN Human Development Index : last assessed 51 of 176 WB Ease of Doing Business: 95 of 183 GDP per capita: $ 10,600 Legal Framework for Trade • The Constitution • Laws – Business Tax Act – Companies Act – Trades Tax Act… soon to be replaced by Customs Magmt Act – Food Act – Goods and Services Tax Act…. VAT act – Licenses Act – Seychelles International Business Authority Act – International Trade Zone Act – Companies (Special Licenses) Act • International Agreements – Regional agreements – Bilateral Agreements Trade Framework • WTO – in accession process. Observer status. • IEPA – the Interim Economic Partnership Agreement with the European Union. • Free Trade Agreement (FTA) since 2008 with the Common Market for Eastern and Southern Africa (COMESA). • Rejoined the Southern Africa Development Community (SADC) in 2008 and pursuing FTA with them. • Pursuing the Tripartite Initiative – COMESA/SADC/EAC • Double Taxation Avoidance Agreements (DTAs) and Bilateral Investment Promotion and Protection Agreement (BIPPAs) with various countries. • Other International Agreements –IOC (Indian Ocean Commission) member since ‘84 –Vienna Convention – Montreal Protocol on Substances depleting the Ozone Layer – CITES (trade in endangered species) –Convention on Biodiversity Market Access Import Tariffs based on HS 2002 classification. In transition to HS 2007. 94% of the tariff lines are at 0% duty Duty mostly concentrated on 4 main revenue sensitive items Fuel Alcohol Tobacco Motor vehicles Environmental Levy – due to fragile & important resource Vehicles Plastic bottles Plastic bags Metal cans Main Industries Tourism Fisheries Financial Services Lesser industries – construction, domestic manufacture, livestock farming… Tourism Share of GDP : 25% Share of Workforce: 15% Profile of Activities within the Sector.. Hotel, restaurant, car hire, diving & water borne activities, tour operators, airline agents etc. Strengths Image.. Exclusive, privacy Natural environment protection Pollution free Peaceful Outside cyclone belt Tourism Constraints Remote – distance from market.. Access Costs of operation & import dependence Infrastructure – water.. HR & service productivity ICT Piracy – cruise ships.. Aldabra.. game fishing .. Tsunami / drought risk Sustainable / eco practices Fisheries Share of GDP : 10% Share of Visible Exports : 92% Strengths Product Quality Resource Management Labour relations / unions Potential for value chain growth Govt incentives & support Fisheries Constraints Diversification – markets & products – preference erosion Water supply for large processing HR & productivity issues Support services – ICT, R&D, Labs, port infrastructure Piracy Sustainable management of resource risks Financial Services Structure of Financial System: Central Bank of Seychelles (CBS) Domestic commercial banks (6) Offshore banks (2) Seychelles Credit Union Development Bank of Seychelles Housing Finance Company Banks: Governed By Financial Institutions Act 2004 Must be locally incorporated Prescribed minimum capital – USD 2 million Financial Services cont… Domestic V/S Offshore Banks Offshore banks Conduct transactions solely with non-residents and in foreign currency Exempted from tax Domestic banks Conducts both onshore and offshore banking business (i.e. with residents and non-residents and in all currencies) Financial Services cont… Objective of the Seychelles Authorities is to encourage entry of more foreign reputable banks, both domestic and offshore. New foreign banks would be expected to Increase competition Introduce new products and open up new frontiers for domestic sector Transfer knowledge and skills Introduce new technology Create employment Financial Services cont… From 1994 Seychelles ventured into incorporation of offshore companies These companies are regulated through the Seychelles International business Authority (SIBA) To date Seychelles has incorporated around 90,000 IBCs, 200 CSLs and 300 Trusts. SIBA is also an active player behind the setting-up of the country’s 1st Stock exchange – Expected to be operational by 2012 STRATEGIES - Aggressive marketing in international forums/internet - Lower tax rates - Confidentiality – However, to remain on OECD’s White List a certain degree of disclosure is required - Benefit through Double Taxation Avoidance agreements of the country Development Strategies History – NDPs… 2007 – Strategy 2017 – govt vision for 23 sectors 2008 – world financial crisis & impact From Nov 2008 – with IMF – macroeconomic and structural reforms program. MEFP 2009-2012. Results so far & medium term strategy ahead Currency float & liberalization of FX regime Fiscal tightening State assets sale and decreased public sector Elements of the ongoing Macroeconomic Reform Program IMF-supported reform programme since November, 2008 Objective: To promote macroeconomic stability and sustainable growth. Main components: Monetary policy framework- market determined interest rates, reserve money targeting Foreign exchange policy- free floating exchange rate regime Fiscal policy – primary balance surplus Sustainable public debt Sustainable balance of payments position Public sector reforms – downsizing of public sector, increase efficiency Structural reforms – privatisation of several public entities Cross-cutting Constraints to Competitiveness Regulatory & Legal framework Tax Policy & Admin – ambitious reform ongoing – revenue neutral, but equity & simplicity target. HR Skill Building – institutions & access GOP policies – balance of expatriate skills access Incentives Regime - distorting Backward Linkages of Main Industries Communication – better awareness for buy-in Development Strategies..contd Will remain an open economy, so must compete on that basis MTNDS – Med Term Nat Dev Strategy Cycles of growth & decline – due external vulnerability Dependence on tourism & 90% imported consumpn Narrow economic base to be strengthened & widened; food security & basics to be assured; renewable energy, better HR, ICT and infrastructure to give a sustainable platform to all other endeavours. Some Policy Suggestions for Action Oil exploration – regulated Specialized niche tourism Eco Medical Elderly Accelerated HR development & education Global supply chain Host education services Careful accession strategy to WTO and RTAs “The winner is the chef who takes the same ingredients as everyone else and produces the best results” - Edward de Bono Thank You