By Selma Valentin Financial Services Supervision Division Central Bank of Seychelles

advertisement

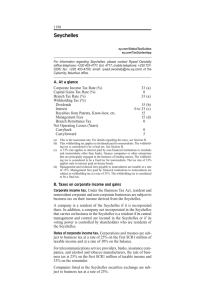

By Selma Valentin Financial Services Supervision Division Central Bank of Seychelles Introduction General facts on Seychelles Role of the Central Bank of Seychelles Seychelles economy before the economic reform program Changes brought about by the economic reform program Current challenges Seychelles Facts Population: 89, 770 (2010 figure) Area: 455 sq km Number of Islands: 115 Official languages: Creole, English and French Capital City: Victoria GDP: $1,084 million (2011) Economic sectors: Tourism, Fishing, Agriculture, Financial Services Major trade partners for exports: United Kingdom, France, Italy, United States, and Germany Major trade partners for imports: United Arab Emirates, Spain, South Africa, France, and Singapore 2 World Heritage Sites Central Bank of Seychelles Autonomous under the CBS Act 2004 Regulatory body for banking and non-banking financial services Supervises the financial sector via: The Financial Institution Act 2004 The Insurance Act 2008 Financial Institutions (application of Act) Order 2009 Objectives The main objectives of Central Bank of Seychelles are: a) to promote price stability; b) to maintain sound financial system The CBS also advises the Government on banking, monetary and financial matters and in particular on the monetary implications of proposed fiscal policies or operations of the Government FUNCTIONS promoting and developing Seychelles as a centre for carrying on of financial services; to monitor, supervise and co-ordinate the conduct of the financial services from within Seychelles; providing, and within the framework of local legislation and laws, appropriate supervision and regulation of the conduct of banking non banking financial services; formulating appropriate policies, and providing advice and assistance on the regulation of banking non banking financial services; to regulate and administer the insurance Divisions of Central Bank of Seychelles Administration Division Research and Statistics Division Banking Services Banking Public debt Payment Systems Financial Markets Division Financial Services Supervision Division Licensing and regulating and supervision of Financial Institutions, which include commercial banks , bureaux de change, insurance businesses as well as other microfinance institution. Supervision Division FSSD Banking Supervision and Foreign Exchange section Banks Bureaux de Change Credit Union Insurance section Housing Finance Insurers Intermediaries Financial Services Supervision Division Setup of the Division: Head of Division Director Financial Services Analyst (12) Financial Services analyst Assistants (8) Secretary Institutions Supervised by BS & FX Section Domestic Banks Offshore Banks Microfinance Institutions Bureaux de change Other Non deposit taking Institutions Activities of the FSSD Licensing , regulation and supervised of Financial Institutions On-site and off-site supervision Administration of prudential requirements for the banking sector Complaints handling Drafting of Regulations Analysis of Financial Institutions on demand Insurance Section Supervised Insurance companies and intermediaries • • through the Insurance Act 2008 Two Domestic Insurers SACL, Harry Savy Insurance Two offshore Insurers One offshore Captive 9 Brokers 47 Agents SIBA An autonomous corporate Body established in 1995 under the Seychelles International Business authority Act, 1994. Objectives of SIBA To monitor, supervised and co-ordinate the conduct of international business within Seychelles Promote and help develop seychelles as a Centre for carrying on of financial services Provide advice and assistance to government on matters relating to international business Responsibilities Administration of: International Business Companies Act,1994 International Trust Act,1994 Companies Special License Act,2003 Limited Partnerships Act, 2003 Licensing and regulation of Corporate Service Providers Management of seychelles International Trade Zone Act,1994. And Recently Mutual & Hedge Fund act 2008 Securities Act 2007 Seychelles economy pre-economic reform program Fixed exchange rate policy Overvalued Seychelles Rupee Limited foreign currency Parallel markets Restrictive foreign exchange controls Low external reserves Low predetermined interest rates Changes brought about by the economic reform Floating exchange rate New regulations on foreign currency exposure risk However High interest rate High liquidity Current challenges Human capacity building Setting up adequate policies and regulation Keeping abreast with supervisory development Financial literacy Corporate governance Lack of competition Increasing access to credit Financial Literacy Financial Tribunal Challenges (cont) High lending rates State-owned institutions (DBS and HFC)