Banking & Finance in Small States: Issues and Policies

advertisement

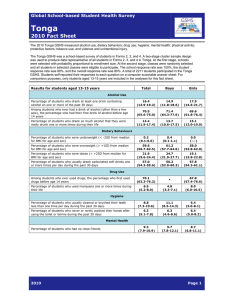

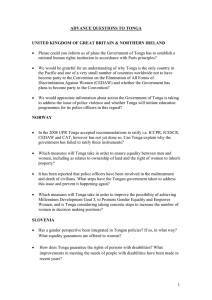

Banking & Finance in Small States: Issues and Policies Malta Workshop 11-19 April 2011 by Mr. Kaho o vailahi ‘Ofa Disclaimer This presentation is the sole views and opinions of the author and does not reflect the views and opinion of the Retirement Fund Board of Tonga. Outline Tonga in Brief Institutional Set-Up Main Strengths and Weaknesses Possible Opportunities and Areas for Reform Tonga in Brief 1 176 Islands (Divided into 3 Major Groups) Total Land Area: 748 Square Kilometers Population (Est. 2009): 104,000 Exchange Rate: USD 1 : TOP 2 GDP per capita (Est. 2010): USD 6,300 per head Real GDP Growth (Est. 2010/2011): 1.25% Annual Average Inflation (Est. Jun 11): 6% Tonga in Brief 2 Weighted Average Term Deposit Rate: 3.95% (Feb 11) Weighted Average Lending Rate: 11.40% (Feb 11) Banking System Liquidity: $77.7 million (Feb 11) Retirement Fund Board: $66.6 million (86% Feb 11) Institutional Set-Up Reserve Bank of Tonga (Monetary Policy & Regulator) Banks (3 Commercial Banks & 1 Development Bank) Retirement Funds Insurance Finance Companies Micro-Finance Credit Unions Regulator Reserve Bank Reserve Bank of Tonga Act RBT Regulations Currency Regulations Financial Institutions Act Foreign Exchange Control Act Money Laundering and Proceeds of Crime Act Prudential Supervision Statements Retirement Fund Retirement Fund Board Act & Regulations Credit Union Credit Union Act Main Strengths and Weaknesses Strengths Close coordination between institution Weaknesses Limited Investment Opportunity due to Weak Economy Est. growth of 1.25%, -9.4% Private Sector Credit Growth Non-performing Loans to Total Loans 15.3% as of June 2010 Limited Regulatory Coverage/Development Still with Basel I Possible Opportunities and Areas for Reform Huge opportunities to learn from other small states and develop the current financial system Widen the coverage of the regulator to include; Retirement Funds Insurance Securities Commission Consumer Complaints Commission Concluding Remarks Important to strengthen the Small States Network to; Promote Malta’s resilient attitude to other small states. Foster close network linkages between small states regulatory & financial staffs. Provide a united forum for discussion and lobby of small states issues. For less developed small states to learn, revise and adopt financial developments from leading small states instead of trying to reinvent the wheel. Thank You