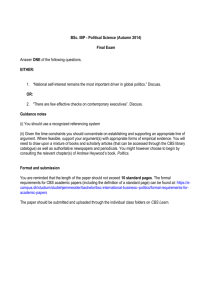

Document 13277342

advertisement

Presented by: Ruth T. Penaia BASIC INFORMATION ON SAMOA OVERVIEW OF FINANCIAL SECTOR CENTRAL BANK OF SAMOA FUNCTIONS CBS SUPERVISION & REGULATION COMMERCIAL BANKS IN SAMOA ECONOMIC UPDATE MACROMACRO-ECONOMICS FORECAST 2010/11 CHALLENGES & OPPORTUNITIES Oceania, group of islands in the South Pacific Ocean, about half way between Hawaii and New Zealand. First Polynesian nation to gain independence in 1962. Population :180,741 Population growth : 0.30.9% p.a over 1971 – 2007 Climate – Tropical Language : English/Samoa Land Area: 2,820 km2 EEZ : 98,500 km2 GDP per capita: $7,802 Currency: Tala USD$1:SAT$2.45 EURO$1:SAT$3.45 Vulnerable to devastating storms Dependent aid, remittances, tourism, agriculture & fishing Since 1998, financial sector reforms included: Removing all credit ceilings and interest rate controls ◦ banks free to set their own interest rates; ◦ credit growth controlled through open market operations of Central bank instruments strengthen the capacity of CBS to manage liquidity and undertake prudential supervision, and of the NPF and DBS Financial sector reforms increased opportunities for financing small businesses Gaps remained in terms of financing available ◦ Commercial banks remained constraint in ability to provide longer term debt financing to small businesses due to short term nature of deposit products. Due to the nature of the land tenure system in Samoa, where over 80 percent of land is customary land, commercial banks have problem obtaining satisfactory security. Acts as a banker to the government and the commercial banks. ACTS ◦ ◦ ◦ ◦ Central Bank of Samoa Act 1984 Financial Institutions ACT 1996 Money Laundering Prevention Act 2009 Insurance Act 2007 OBJECTIVES ◦ Promote Sustainable Real Economic growth by: maintaining price stability, international Reserves Viability and Sound Financial System. Undertakes formulation & implementation of monetary policy & related measures Manage rate Samoa’s Tala is exchanged with currencies of other countries & administers foreign exchange control measures. Custody role & management of Samoa’s reserves Design & issue of currency notes and coins Issues own CB securities to the commercial banks & non bank public & maintains a registry service, rediscount & repurchase facilities Provides facility for the clearing &settlement of inter-bank payments Custodian of commercial banks’ statutory minimum deposit reserves Financial Institutions Act 1996, issues licenses to financial institutions and undertakes prudential supervisions Amendments 2001, supervisory roles extended to NBFI: SNPF, DBS, & IC Money Laundering Act mandates CBS as MLPA– Financial Intelligence Unit est. in the CB. Collect STR Insurance act 2007 appoints Governor as Insurance Commissioner, empowering CBS to license insurance entities & supervise industry. i. Expand the statutory functions of the Bank to supervise & regulate ii. Establish business relations with selected non-bank financial institutions • • Allow institutions to establish accounts with the Bank and qualify them to borrow funds at concessional rates Extend term for granting advances from 182 days to 5 years iii. Control of margins provide flexibility for CBS to intervene as necessary when fees & charges are inappropriately excessive iv. Promoting financial inclusion & financial literacy Reaffirms the Bank’s commitment to reach out to people who have little/no access to formal financial services (unbanked) Aims to promote public confidence in banks & maintain health & stability of the financial system Assess performance through offsite/onsite surveillance activities : Attention to capital & liquidity adequacy, asset concentration & risk exposure, asset quality & adequacy of provisions for loses & interest suspension Collect & evaluate periodic reports from banks On site frequency, scope & techniques vary & depends on condition and level of sophistication of bank Banking system activities quarter ended 31 Mar 2010 reflected negative growth in total assets despite an upward trend in liquidity level over previous quarters. Commercial Banks maintained strong capital adequacy level with ratios comfortably above CB minimum requirement of 15%. Source: CBS Bullentin June Qtr 2010 Overall level NPL reduced 11.4% ($6.8m) to $53.0m in qtr. As compared to prior year. It registered decrease of 7.7% ($4.4m) respectively. Total provision for bad & doubtful debts of $33.9m provides a 64.0% buffer against possible loan losses as a result of NPLs. In proportion to total loans & advances, total provision stood at 4.6% respectively. Close monitoring ongoing. Source: CBS Bulletin June Qtr 2010 SOURCE: CBS MONETARY SURVEY JAN 2011 SOURCE: CBS MONETARY SURVEY JAN 2011 •2006 20062006-2008: strong growth in loans and advances dominated by construction construction sector • SPG Games in 2007 • low system liquidity Source: CBS 2011 • 2005 – 2008: strong profitability performance. •Average Average from 98 to 09 of: total income - $76.6 million; and total expenses - $49.9 million. •WBS 2001. 1. WBS changed its financial year from December to September in 200 •SCB SCB came into operation in April 2003. Source: CBS CBS 2011 •2006 2006 to 2008 – strong interest income growth (approx. 70.6 percent of total) •Non NonNon-interest income – include fees & charges, foreign exchange profit, other income. •Average Average from 98 to 09 of: interest income - $49.6 million; and nonnon-interest income - $27.1 million. SOURCE: CBS 2011 2011 SOURCE: CBS 2011 Gov’t net position: fell 8 percent to $181.1m, representing a $16.5 m cash deficit. SOURCE:CBS 2011 •Intention: Easing Stance Excess Reserves fell $9.8 million to $151.2 million in Oct’10 SOURCE:CBS 2011 COMMERCIAL BANKS’ TOTAL LIQUIDITY Tala Million ($m) Oct 2009 June 2010 Sept 2010 Oct 2010 Vault Cash 9.20 8.87 10.4 4 10.5 9 CBS Securiti es 27.50 27.5 0 27.5 0 27.5 0 Excess Reserve s 105.26 129. 14 161. 06 151. 24 TOTAL ($m) 141.96 165. 51 199. 00 189. 33 SOURCE: CBS 2011 SOURCE:CBS 2011 COMMERCIAL BANK INTEREST RATES * At their lowest so far since financial system deregulation in Jan’98: W/Avg. deposit rate – fell 6 basis points to 2.38% W/Avg. lending rate – fell 7 basis points to 10.26% Int. Spread (narrowed 1 bp to 7.88% in Oct’10) SOURCE: CBS 2011 26 700 600 500 400 Level (Lefthand) Annual Average Percent Change (Righthand) Ann Avg Target Pt-to-Pt 300 200 100 20 18 16 14 12 10 8 6 4 2 0 Percent Change, % “Professional and business services” (+$10.5m) “trade” (+$6.7m), “building & construction” (+$2.7m), and “transport & commn” (+$0.1m) “Manufacturing” (-$8.5m), “other activities” (-$0.7m),“agriculture and fisheries” (-$0.2m) and “electricity & water” (-$0.02m). Commercial Bank Loans Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Comm. Banks Credit to Private Sector & Public Institutions (up $10.5m or +1 percent to $736.8m in Oct 2010) Amount, Tala Million Annual average credit growth rose to 4.4% from 4.2% at end September 2010 SOURCE: CBS 2011 27 Exports (fell $168k or -7% to $2.2m in Oct‘10) Beer (-$0.2m), f/fish (-$0.1m), re-export (-$52k), taro (-$40k), spring water (-$36k), cigarettes (-$9k), banana (-$2k) Absent from export scene after shipment in Sept10: coconut cream, handicraft and Samoan cocoa nonu juice (+$0.2m), coconut oil (+$32k), coconuts (+$31k), nonu fruit (+$22k) soft drinks (+$6k) and copra meal (+$4k), SOURCE:CBS 2011 28 Oct-10 Sep-10 Aug-10 Gov't Jul-10 Jun-10 May-10 Apr-10 Non-petroleum (-$4.9m to $38.7m) Petroleum Mar-10 ~ reflecting increased volume Feb-10 Petroleum (+$0.2m to $12.6m) Jan-10 MOF and more medical equipment and supplies for NHS Dec-09 ~ reflecting materials consigned to Non-petroleum Nov-09 Government (+$7.4m to $14.7) 100 90 80 70 60 50 40 30 20 10 0 Oct-09 Imports (rose 4% or +$2.7m to $66.0m in Oct’10) Amount, Tala Million SOURCE:CBS 2011 29 Tourism earnings (-$5.8m or -20% to $23.3m in Oct’10) Remittances (-$0.8m or -3% to $27.3m in Oct’10) SOURCE:CBS 2011 30 Forecast 2009/10 2010/11 Exports (000) Total % change Imports (mn) Total Value % change Earnings Tourism (mn) % change Remit. BOP Total % change Surplus Gross reserves 30,366 26,457 8.0% -12.9% 650.1 668.5 3.8% 2.8% 300.70 293.04 -6.6% -2.5% 346.80 325.08 -5.3% -6.3% -151.41 -11.66 410.7 • Total exports expected to decline by 13% in 2010/11. • Total imports is expected to increase by 3% in 2010/11. • Total arrivals in 10/11 expected to decline by 4%. • Total earnings is estimated to drop by 2.5%. • Gross remittances expected to decline by 6%. • The balance of payments is expected to record another surplus pushing up reserves to 8.0 months of cover. 422.4 SOURCE: CBS 2011 Forecast 2009/10 2010/11 1,071 1,105 1.0% 3.2% Other Manufacturing 89.4 95.0 Construction 129.3 131.5 Public Administration 95.1 102.7 Finance & Business 110.6 114.2 Overall Budget deficit (mn) 160.8 140.5 Real GDP (mn) % change The world economy is expected to rebound by 4.5% while inflation is expected to pick up slightly. On the domestic side, the Samoan economy is expected to grow strongly on the back of expansionary Govt. Budget. Real GDP is expected to rise by 3.2% in 10/11. SOURCE: CBS 2011 Forecast 2009/10 2010/11 Headline Inflation (%) inflation rate -0.2% 3.0% Underlying inflation rate 1.1% 2.4% • Inflation is expected to increase but within the target of 3.0 percent • Due to expected recovery in imported inflation as world prices start to recover from weak demand in past 2 years. • Domestic inflation is also expected to rebound due to recovery in the economy and consumer demand. SOURCE: CBS 2011 Despite the strong expected recovery, real GDP is still expected to be lower than in the fiscal years before 2009/10. With inflation falling and international reserves at a record level, the environment is ideal for ‘boosting and maintaining an upward momentum for economic growth. Growth is expected to be driven largely by the Govt. Budget whereas the tourism, exports and private remittances are expected to remain depressed in 2010/11. SOURCE: CBS 2011 CHALLENGES ACTIONS •Weak property rights, lack of a collateral framework, difficulty in collecting debts and poor credit history of borrowers • Finalize Personal Property Security Act and design/establish the PPs registry to improve collateral framework, including debt collection. •Further growth in bank lending. •Lack of credit information available & cost of loan recovery high •Establish credit bureau & debt collection agency to facilitate better information provision. •Enter into agreements with credit bureaus in Australia/NZ to extend availability of credit on a regional basis. •Very limited economic use of customary land because proprietary rights cannot be mortgaged, •Finalize review & start dialogue with banks on leases as collateral for securing loans CHALLENGES ACTIONS •The lack of resolution of key sector issues (such as the role of the public sector) and the resulting underinvestment by the public and the private sectors in agriculture over the past decade. •Samoa to develop more efficient farmer support services (including a demandand market-driven research and extension system to facilitate the adoption of improved technologies). Encourage Public-private policy dialogue and industry coordination •Samoa is remote and transport costs are •Encourage Agricultural farming for high because of distance to markets and commercialisation from subsistence. small cargo volumes •Import substitution •Government to subsidize •Vulnerability to natural disasters •Develop disaster plan and off site premises for back up system CHALLENGES ACTIONS Changes in regulation & legislation •Review and update policies and procedures. •Increase staff awareness on changes & importance of roles & responsibilities. •Management to take the lead •Maintain regular dialogue with regulators on issues of importance and regular reporting. •Product development & expansion •Rapid changes in information technology •Develop/Review processes/ procedures to mitigate the risks. •Invest in staff training and development. •Invest in research and development. •Service Standards & Building customer relationships •Design a sign a system to make service fail safe. •Customer satisfaction surveys Bureaucracy in Govt payment system •Raise issue with appropriate Ministry to ensure timely payments to reduce cashflow stress on clients. CHALLENGES ACTIONS Management of risk: Liquidity risk Credit risk Interest rate risk Operational risks •Invest in information gathering/monitoring. •Insist on collateral •Credit rationing •Develop long term relationships with customers •Monitor borrowers behaviour with proceeds. •Loan covenants Increase in impaired loans •Establish special assets committee •Close monitoring and be alert on warning signs. •Strengthen staff capacity in loan appraisal •Align behaviour of every individual in loan organisation with management priorities •Banks survival & ability to compete depends on ability to maintain a healthy loan portfolio. •Enhance Supervision & Regulatory Framework NO VIABLE POTENTIAL PROJECTS. STILL PROBLEM WITH ADEQUATE SECURITIES COST OF PRODUCTION HIGH/SMALL ECONOMIES OF SCALE HUGE COMPETITION FROM AGRICULTURAL SECTOR – HUGE DECLINE IN COCOAL AND CORPRA COMPARED TO 20 YEARS AGO ASIA/ECUADOR FUNGAL DISEASE – 1966 AFTER CYCLONE BANANA LEAFDISEASE. EARLY 1990 TARO PLIGHT IMPORTED CHEMICALS TO CONTROL BUT WAS EXPENSIVE. GOVT USED TO SUBSIDIZE BUT NOT ANYMORE 1960S HAD COCO AND COPRA BOARD, BUT NOW ABOLISH OR MADE DEFUNCT NEED A MARKETING AUTHORITY – MARKET IN NZ IMPORT SUBSTITUTION ENCOURAGE IN TERMS OF LIVESTOCK, EGG FACTORY, HAM TWISTIES, SAUSAGE AND MANUFACTURING COCONUT OIL HUGE MARKET FOR EXPORT/ SUBSTITUTE FOR DIESEL Samoa is remote and transport costs are high because of distance to markets and small cargo volumes Samoa is susceptible to natural disasters, periodic droughts and exp cyclones The sector is vulnerable to natural disasters (the country has been hit by 3 major cyclones since 1990), pests and diseases (e.g. the taro blight which wiped out taro exports in the mid-1990s, or currently the rhino beetle for coconut) and the environmental basse is fragile;