ZIMBABWE

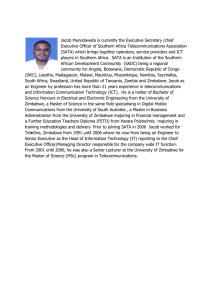

advertisement