Document 13263826

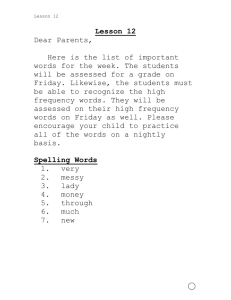

advertisement

1978 October 78 EM 27 discrimination. without p.ople, all to equally them offers and programs it. in participation invitas Extension counties. Oregon and Agriculture, 01 D.partmani S. U. the University, State Oregon of program coop.retive a I. work Extnsion 1914. 30, Jun. and May of Congr.aa of Act, th. of furth.rance in dietributsd and duced pro- was publication This dir.ctor. Wadsworth, A. H.nry Corvallis, Univ.raity, Stat. Or.aon S.rvic., Ext.n.ion I SERVICE EXTENSION OREGON UNIVERSITY STATE homesteads. farm on taxes of half pay would state that except tem, sys- present from change No year. per cent per- 2 plus value market 1975 b) or value use farm a) of lesser at assessed be would farmland assessed Specially value. assessed times bonds, existing for amounts plus value, assessed of $1000 per $15 to limited taxes Property value. use farm at assessed lands farm- Certain value. assessed times rate tax to equal Taxes FARMERS HARRP. in change for provision No taxes. for paid rent of portion the of one-half to equivalent fund re- a renters pay would State $1500. of payment maximum a to up residences principal occupied owner on levied taxes the of half pay would state the Generally, HARRP. in change for provision No relief. direct additional No value. assessed duced re- usually the times bonds, existing for amounts plus value, assessed of $1000 per $15 to limited taxes Property $16,000. than less of incomes with renters to fund re- $328 to up provides HARRP taxes. pay to landlord by used rent of Portion taxes. ty proper- direct no pay Renters $16,000. than less of comes in- with homeowners to refund $655 to up provides (HARRP) Program Relief Renters and Homeowners property. of value assessed times rate tax mined deter- locally to equal Taxes RENTERS HOMEOWNERS SYSTEM PRESENT MEASURE 6 11 MEASURE PAYMENTS TAX PROPERTY 1. SYSTEM TAX OREGON'S AND 11 MEASURE 6, MEASURE University. State Oregon Economics, Resource and Agricultural of Department Assistant, Research Savage, John and Economist, Extension Weber, Bruce by Prepared nues. reve- state unspent return to provision specific no is There biennium. next the into carryover would surplus this of None payments0 tax income their to proportion in taxpayers to refunded be would funds surplus of amount total the more, or percent 2 by appropriations exceed revenues operating general state When loans. new of issuance the slow would That loans0 state for available be would money less base, 1975 a to back rolled be would value assessed Because 1980. during slowed be would loans new of issuance base, 1979 a at frozen be would 1980 in value assessed Because Oregon. in value sessed astotal the of percentage a to limited generally is loans Farm and Home Veterans the as loans such issue to ability its therefore, and, capacity bonding state's The nues. reve- state unspent return to provision specific no is There BONDS SURPLUS programs. state existing for funding reduce could and grams pro- new for spending duce re- probably would 11 Measure relief. tax property as renters and homeowners to revenues tax income personal state return to constitution state the by mandated be would state The limit0 this from exempt be would governments local by reimbursements and service, debt relief, renter and homeowner Mandated years. 2 previous the in Oregon in income personal of rate growth the to limited be would spending fund general State permitted. be would increases tax "automatic" system, present the under As approval. of vote two-thirds a without biennium previous spending. on limit overall No prohibited. be would perty pro- of value or transfer on taxes New system. present under as permitted, be would increases tax "Automatic" revenues. in receives it than more spend not may state The spending. on limit overall No SPENDING legislation. additional without increase, lation popu- and income personal as "automatically" increase can taxes state other and taxes income from revenue total The MEASURE 6 MEASURE 11 Property taxes limited to $15 per $1000 of assessed value, plus amounts for existing bonds, times the usually reduced assessed value. No change from present sysNo direct relief protem. vided by state. Property would be assessed at 1975 values plus 2 percent per year. Newly constructed, purchased or transferred property would be assessed at market value at time of change. In 1980, the assessed value of property would be frozen at 1979 levels. Otherwise, it is the same as the present system. Property taxes would be shared on the basis of 1975 market value and length of ownership. Taxes would continue to be apportioned among property owners on the basis of the current market value of property, except during 1980 when it would be apportioned on the basis of 1979 market values. PRESENT SYSTEM BUSINESS! INDUSTRY Taxes equal to tax rate times assessed value. 2. ASSESSMENT SYSTEM ASSESSMENT OF PROPERTY APPORTIONMENT OF TAXES With certain exceptions, property in Oregon is now assessed at its true cash value, the price a willing buyer would pay a willing seller. Property taxes are generally shared among the property owners in direct proportion to the current market value of their holdings. Owners of recently constructed, purchased, or transferred property would pay a higher share of taxes than owners of similar properties that had not been recently constructed, purchased or transferred. The 1979 legislature would "review, study, and revise as neces 5ary" existing assessment laws and practices0 3. LOCAL GOVERNMENT REVENUES For local governments with voter approved tax bases, the tax levy may increase 6 percent each year without Tax levies voter approval. outside the 6 percent limitation must be approved by the voters. For local governments without tax bases, all property tax levies must be approved by voters. SPENDING BONDS No overall limit on local spending. Local governments cannot spend more than they receive in revenues0 Voters approve most local bond measures. Local governments can guarantee repayment of certain bonds through their power to levy taxes on property0 In addition to limits in the present system, 3 new restrictions would be placed on local taxing power: (1) Because of the 1.5 percent limitation, maximum local tax rates for individual governments would probably be determined by the state government. This would limit property tax revenues. Voters could not approve property tax levies above that limit. (2) New taxes based on the value or sale of property would be prohibited. (3) Special taxes may be created only with approval of two-thirds of qualified voters0 In addition to limits in the present system, expenditures funded by property taxes could not grow faster than the rate of population growth, adjusted by a price change index. Voters could approve taxes beyond this limit. This limit could not be less than that allowed under the 6 percent limitation. No overall spending limit. No overall spending limit. The reduction in property taxes would result in a reduction in local spending and services, or some increase in local non-property tax revenues unless the state or Federal government increased their funding to local governments. The effect on local spending would depend on the response of local governments and voters to the new limit on expenditures funded by property Local governments could not make the same guarantee of repayment of bonds under the The 1.5 percent limitation. capacity of local governments to sell bonds would be im- No direct effect. The state generally would not share payment of the additional property taxes beyond these limits, even if voters approved such taxes. The effect on local revenues would depend on the response of local governments and voters to this new limit. taxes0 paired. 4. STATE GOVERNMENT REVENUES Generally, a simple majority vote of the Oregon legislature is needed to enact any law increasing existing state taxes or creating any new state tax. A two-thirds vote of the Oregon legislature would be needed to enact any law increasing existing state taxes as sources of revenue. The state legislature could not enact any tax measure increasing revenues from a tax category (such as income tax, cigarette tax) by 5 percent or more from the pre- SPENDING The total revenue from income taxes and other state taxes can increase "automatically" as personal income and population increase, without additional legislation. "Automatic" tax increases would be permitted, as under present system. New taxes on transfer or value of property would be prohibited. previous biennium without a two-thirds vote of approval. No overall limit on spending. The state may not spend more than it receives in revenues. No overall limit on spending. State general fund spending would be limited to the growth rate of personal income in Oregon in the previous 2 years. Mandated homeowner and renter relief, debt service, and reimbursements by local governments would be exempt from this limit0 As under the present system, "automatic" tax increases would be permitted. The state would be mandated by the state constitution to return state personal income tax revenues to homeowners and renters as property tax relief. Measure 11 would probably reduce spending for new programs and could reduce funding for existing state programs. SURPLUS BONDS There is no specific provision to return unspent state reve- There is no specific provision to return unspent state reve- nues. nues. The state's bonding capacity and, therefore, its ability to issue such loans as the Veterans Home and Farm loans is generally limited to a percentage of the total assessed value in Oregon. Because assessed value would be rolled back to a 1975 base, less money would be available for state loans0 That would slow the issuance of new loans. When state general operating revenues exceed appropriations by 2 percent or more, the total amount of surplus funds would be refunded to taxpayers in proportion to their income tax payments0 None of this surplus would carryover into the next biennium. Because assessed value in 1980 would be frozen at a 1979 base, issuance of new loans would be slowed during 1980. Prepared by Bruce Weber, Extension Economist, and John Savage, Research Assistant, Department of Agricultural and Resource Economics, Oregon State University. MEASURE 6, MEASURE 11 AND OREGON'S TAX SYSTEM 1. PROPERTY TAX PAYMENTS MEASURE 11 PRESENT SYSTEM MEASURE 6 HOMEOWNERS Taxes equal to locally determined tax rate times assessed value of property. Homeowners and Renters Relief Program (HARRP) provides up to $655 refund to homeowners with incomes of less than $16,000. Property taxes limited to $15 per $1000 of assessed value, plus amounts for existing bonds, times the usually reduced assessed value. Generally, the state would pay half of the taxes levied on ownr occupied principal residences up to a maximum payment of $1500. RENTERS Renters pay no direct properPortion of rent ty taxes. used by landlord to pay taxes. }IARRP provides up to $328 refund to renters with incomes of less than $16,000. No additional direct relief. State would pay renters a refund equivalent to one-half of the portion of rent paid for taxes. No provision for change in HARRP. No provision for change in HARRP. FARMERS Taxes equal to tax rate times assessed value. Certain farmlands assessed at farm use value. Property taxes limited to $15 per $1000 of assessed value, plus amounts for existing bonds, times assessed value. Specially assessed farmland would be assessed at lesser of a) farm use value or b) 1975 market value plus 2 percent per year. No change from present system, except that state would pay half of taxes on farm homesteads. OREGON STATE UNIVERSITY EXrENSIOI1 LJ SERVICE Extension S.rvic., Oregon Stat. University, Corvallis, H.nry A. Wadsworth, director. ThIs publication was produced and distributed in furth.rance of the Act, of Congress of May S and Jun. 30, 1914. Extension work I. a cooperative program of Oregon State University, the U. S. Department of Agriculture, and Oregon counties. Extension invite, participation in its programs and offers them equally to stl p.opl., wIthout discriminatIon. EN 78: 27 October 1978