I Exit Planning and the Changing of

advertisement

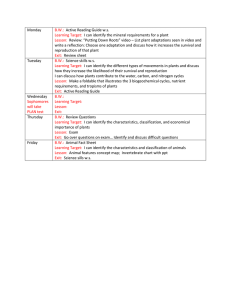

24 BRAND STORY P R O D U C E D BY T H E O R E G O N B U S I N E S S M A R K E T I N G D E PA R T M E N T Exit Planning and the Changing of the Guard: A Value Proposition I t’s happening whether anyone’s ready or not. Businesses here in Oregon and across the U.S. are already experiencing the effects of the largest generational shift in recent history, and these changing tides will impact every level of the workplace — from a company’s executive leadership to its cultural core. In the U.S., those born between 1979 and 1997 are expected to make up the largest percentage of the workforce within a decade. And while many have addressed the impact this shift has on the way business is conducted, fewer have broached the subject of exit planning and how these changing demographics impact the ownership of a company. These generational changes underscore the need for effective exit planning to capture the value owners have invested in their business and to exit on their own terms. Expert exit planners bring methodology and the personal motivation necessary to help business leaders strategically navigate the exit-planning process. “An effective plan ensures you’re always ready and that difficult circumstances won’t adversely impact how you exit,” says Ben Lenhart, an attorney at Lane Powell. He explains that each of the likely types of exits (e.g., sale of the company to a financial or strategic buyer, transfer of ownership within company — either to senior management or the employees, or the sale/transfer of the company to family member[s]) have different consequences and results, and that the business owner’s goals and circumstances drive the process. “Still, in almost every case, significant value is lost without effective exit/transition planning,” he says. “Most people have a fear of the unknown,” admits Jeff Bird, an attorney at Lane Powell, “and that’s one reason this subject is the elephant in the room no one wants to talk about.” But given the facts he cites, more business leaders need to. For one, many business owners have over 90% of their net worth tied up in their business, but only 25% have started an exit plan. “The manner in which a business is transitioned will have a huge impact on retirement and financial independence,” Bird says. Business owners have to accept and address the fact that many transfers happen for reasons beyond the owner’s control. For example, over the next decade, one out of every two businesses will experience a change of ownership. Half of these transfers will be due to circumstances like death, disability, divorce or financial distress. “This transfer of wealth is at a level we’ve not seen in our society,” Bird says. “And leaders need a transition plan to ensure they capture the value they’ve invested in their businesses.” But successfully navigating this process requires careful planning and a multidisciplinary approach. But what does effective exit planning look like? Bird and Lenhart explain that the best plans should draw on a team of diverse experts to consider all contingencies, meaning that an ideal team would include a business/M&A attorney, financial advisor/ wealth manager, tax specialist, accountant, BRAND STORY 25 Lane Powell attorneys Jeff Bird (left) and Ben Lenhart estate-planning attorney and, in certain cases, an investment banking firm. Most importantly, an experienced exit planning advisor should be at the helm guiding the process. “Going through the process with engaged exit-planning advisors will maximize value,” says Lenhart, who received his Certified Exit Planning Advisor (CEPA) designation in 2014 from the Exit Planning Institute, a widely accepted and endorsed professional exit-and succession-planning program. Bird, who received his CEPA certification in 2012, and Lenhart are two of the six total CEPAs in Oregon. They are among an elite group of business advisors who are uniquely qualified to help business owners navigate each stage of the process. But they possess more than just technical understanding. “The advantage that certified advisors offer is that we’ve seen it all and done it all,” says Bird. “We bring experience and valuable relationships to the table in addition to our understanding of the pitfalls and dangers that can derail the process.” Both attorneys sought the designation The best plans should draw on a team of diverse experts to consider all contingencies. for personal reasons, giving them a passion for helping each client. Lenhart decided to go through the intensive CEPA process because of his experience observing businesses close through the recession. “For me, this was a very personal decision,” he explains, “since I saw a number of quality businesses go under that, had they engaged in appropriate exit/transition planning, likely would have survived.” For his part, Bird was drawn to working as an exit-planning advisor due to an innate desire to help clients leave a legacy that they can be proud of. that will fulfill family needs and align their business with their future goals and objectives. “There’s nothing more satisfying than sitting at the table with a business owner and helping them accomplish their goals,” he says. “I like to help people, and this is one of the most valuable things I can do for a business.” And in an ever-changing business environment, many business owners will likely need to rely on Bird and Lenhart’s expertise to help with careful and strategic exit planning. “The need for exit planning seems so basic,” Lenhart concludes. “Everyone really should do this; we help them accomplish the difficult part so they can take peace of mind in knowing that they are prepared for the future and able to maximize the value of their business.” n For more information on exit planning, contact Jeff Bird or Ben Lenhart at 503.778.2100, or email birdj@lanepowell.com or lenhartb@lanepowell.com