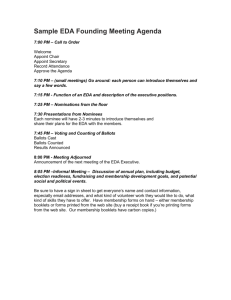

establishing the Fort Monmouth Economic Revitalization Authority, supplementing CHAPTER

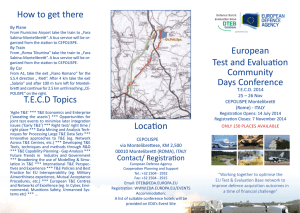

advertisement