D&O Liability

advertisement

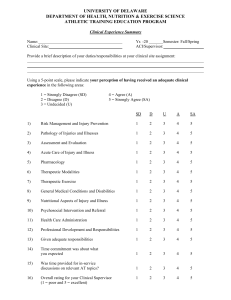

American Conference Institute’s 19th Forum on D&O Liability Coverage, Underwriting, and Claims Strategies for Managing Liability Risks Through Market Changes and Increased Scrutiny Inquire about special rates for government, academia, insurers, brokers & risk managers September 17–18, 2015 • The Carlton Hotel on Madison Avenue • New York, NY Distinguished Co-Chairs Diane M. Parker, Esq. VP, North American Claims Group Allied World Insurance Company Douglas W. Greene Shareholder Lane Powell PC Federal and state enforcement and regulatory initiatives and their impact on D&O liability, led by: David Woodcock Chair, Financial Reporting and Audit Task Force Regional Director, Fort Worth Regional Office U.S. Securities and Exchange Commission Simona Suh Senior Counsel, Division of Enforcement U.S. Securities and Exchange Commission You know the risks facing Directors and Officers today. IN RESPONSE BE A PART OF THE NATION’S PREMIER D&O FORUM! Revamped Sessions for This Year Include: • Federal and State Enforcement and Regulatory Initiatives and Their Impact on D&O Liability Led by speakers from: OppenheimerFunds AIG Willis Hartford Financial • New Developments/Trends in the D&O Marketplace with Respect to the Latest Products, Coverage, Claims, and Underwriting, and a Look at the Evolution of D&O Insurance, its Breadth of Coverage, and the Role of Predictive Modeling Berkshire Hathaway Specialty • Developments in Delaware Law that Impact the D&O Liability Landscape and M&A Litigation ARC Excess & Surplus • Dealing with Globalization of Claims against Directors and Officers: Developments Abroad, International Coverage, and Ensuring that Coverage is Adequate Across Multiple Jurisdictions Travelers • Private Company D&O and D&O Coverage for Non-Profits: Claims Frequency, Unique and Evolving Claims that Arise, as well as Underwriting Issues Aspen Insurance • Impact of Legal Developments of Key Securities Class Actions, Corporate Governance and D&O Claims, Including IPO Litigation U.S. Risk Brokers, Inc. • Shareholder Derivative Litigation, Including M&A Litigation brought Derivatively, and the Increasing Importance of Side A • Getting Past Data Breaches and Focusing on Cyber Issues at the Board Level, Ensuring Adequacy of a Company’s Cybersecurity Measures, and a Look at the Derivative and Class Action Suits Stemming out of Cyber Breaches Gen Re Navigators Claims QBE North America Western World Insurance Allianz Global Beecher Carlson Endurance Insurance USI Richard K. Hayes Deputy Chief, Civil Division, E.D.N.Y DOJ • Strategies for Effectively Participating in a Securities Class Action Mediation • Getting Deals Closed with Representations & Warranties Insurance: Trends, Challenges and What’s Next Alliant Joseph P. Borg Director Alabama Securities Commission • D&O for Private Equity and Hedge Funds Zurich North America • D&O and Financial Institutions Markel Earn CLE Credits Aon Everest National Earn CPE Credits Allied World Media Partner: And many others Register Now | 888-224-2480 | www.AmericanConference.com/DandO Register Now • 888-224-2480 • www.AmericanConference.com/DandO 1 ACI’s D&O Liability forum continues to stand out as the premier event for leading brokers, underwriters, claims professionals and attorneys to benchmark coverage, underwriting, and claims strategies. No other event can match the practical and detailed analysis of the entire D&O landscape, including the impact of litigation, regulatory action, and market conditions in today’s tumultuous environment. ATTENTION D&O PROFESSIONAL: The dynamics have changed in the industry, with: recent activity in Delaware regarding forum selection and restraints on litigation; cyber and its impact on D&O insurance; new issues surrounding private equity companies, hedge funds, and privately owned companies; shareholder derivative action suits; M&A litigation and its impact on coverage, and more. It is thus imperative that the players involved understand the key areas which expose directors & officers to liability and the obligations which arise under D&O policies, whether representing the insurer or the insured. That is why you cannot afford to miss American Conference Institute’s 19th D&O Liability Summit. In addition to unparalleled networking opportunities, this conference will provide attendees with the latest insights and expert advice from our exceptional faculty on: • Federal and State Enforcement and Regulatory Initiatives and their Impact on D&O Liability • New Developments/Trends in the D&O Marketplace with Respect to the Latest Products, Coverage, Claims, and Underwriting, and a Look at the Evolution of D&O Insurance, its Breadth of Coverage, and the Role of Predictive Modeling • Developments in Delaware Law that Impact D&O Liability Landscape and M&A Litigation • Dealing with Globalization of Claims against Directors and Officers: Developments Abroad, International Coverage, and Ensuring that Coverage is Adequate Across Multiple Jurisdictions • Private Company D&O and D&O Coverage for Non-Profits: Claims Frequency, Unique and Evolving Claims that Arise, as well as Underwriting Issues • Impact of Legal Developments of Key Securities Class Actions, Corporate Governance and D&O Claims, Including IPO Litigation • Shareholder Derivative Litigation, Including M&A Litigation brought Derivatively, and the Increasing Importance of Side A • Getting Past Data Breaches and Focusing on Cyber Issues at the Board Level, Ensuring Adequacy of a Company’s Cybersecurity Measures, and a Look at the Derivative and Class Action Suits Stemming out of Cyber Breaches • Strategies for Effectively Participating in a Securities Class Action Mediation • Getting Deals Closed with Representations & Warranties Insurance: Trends, Challenges and What’s Next • D&O for Private Equity and Hedge Funds • D&O and Financial Institutions Register by calling 1-888-224-2480, faxing your registration form to 1-877-927-1563, or online at www.AmericanConference.com/DandO Here are just some of the organizations already booked on to attend: SEC DOJ Alabama Securities Commission AHT Insurance AIG Alliant Insurance Services Allianz Global Corporate & Specialty Allied World Insurance Company Aon ARC Excess & Surplus, LLC Aspen Insurance Beecher Carlson Berkshire Hathaway Specialty Insurance Endurance Insurance Everest National Gen Re Granof International Group LLC Hartford Financial Products Innovation Insurance Group Integro Insurance Brokers Lockton Companies, LLC Markel Navigators Claims OppenheimerFunds Phillips ADR QBE North America Sperber Dispute Resolution Starr Adjustment Services, Inc. Tipping Point Insurance Travelers U.S. Risk Brokers, Inc. USI Western World Insurance Group Willis Zurich North America Morvillo, Abramowitz, Grand, Iason & Anello, P.C. Goodwin Procter LLP Richards, Layton & Finger Bernstein Litowitz Berger & Grossmann LLP Clyde & Co US LLP Cozen O’Connor Bruch Hanna LLP Lane Powell PC Sedgwick LLP Bass, Berry & Sims PLC Berkowitz Oliver Williams Shaw & Eisenbrandt Jenner & Block Holland & Knight Gilbert LLP White and Williams LLP Mintz Levin Cohn Ferris Glovsky and Popeo PC Ropes & Gray LLP Wiley Rein LLP Bowditch & Dewey, LLP Proskauer Rose LLP among others WHO YOU WILL MEET • Underwriters • Product Leaders • Claims Managers • Corporate Counsel/ Risk Managers • Brokers • Attorneys specializing in: D&O Insurance; Securities Litigation & Enforcement; White Collar Crime CONTINUING PROFESSIONAL EDUCATION CREDITS CONTINUING LEGAL EDUCATION CREDITS American Conference Institute (ACI) will apply for Continuing Professional Education credits for all conference attendees who request credit. There are no pre-requisites and advance preparation is not required to attend this conference. Course objective: Coverage for D&O and its relationship to the business of insurance. Recommended CPE Credit: 16.0 hours. ACI is registered with the National Association of State Boards ofAccountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417 or by visiting the web site: www.nasba.org Accreditation will be sought in those jurisdictions requested by the registrants which have continuing education requirements. This course is identified as nontransitional for the purposes of CLE accreditation.. ACI certifies that the activity has been approved for CLE credit by the New York State Continuing Legal Education Board. ACI certifies that this activity has been approved for CLE credit by the State Bar of California. ACI has a dedicated team which processes requests for state approval. Please note that event accreditation varies by state and ACI will make every effort to process your request. 2 Join the Conversation CLE Credits ACI: Reinsurance/Insurance: Legal, Regulatory, and Compliance Experts Group @Insurance_ACI / #DandO DAY ONE – Thursday, September 17, 2015 7:15 Registration & Continental Breakfast 8:00 Co-Chairs’ Welcome Remarks 9:55 Diane M. Parker, Esq. Vice President, North American Claims Group Allied World Insurance Company David F. Allen, RPLU Vice President Gen Re Douglas W. Greene Shareholder Lane Powell PC 8:10 Heather Fox Chief Brokerage Officer ARC Excess & Surplus, LLC Federal and State Enforcement and Regulatory Initiatives and Their Impact on D&O Liability Michael Tomasulo Principal & Management Liability Practice Leader AHT Insurance David Woodcock Chair, Financial Reporting and Audit Task Force Regional Director, Fort Worth Regional Office U.S. Securities and Exchange Commission Ty Sagalow President Innovation Insurance Group Moderator: Simona Suh Senior Counsel, Division of Enforcement U.S. Securities & Exchange Commission Carl E. Metzger Partner Goodwin Procter LLP Richard K. Hayes Deputy Chief, Civil Division, E.D.N.Y U.S. Department of Justice • • • • • Joseph P. Borg Director Alabama Securities Commission • Todd M. Greeley, Esq. Vice President, Executive & Professional Lines Claims Berkshire Hathaway Specialty Insurance • • Vincent G. Caracciolo Managing Principal Integro Insurance Brokers • Moderator: Jonathan S. Sack Partner Morvillo, Abramowitz, Grand, Iason & Anello, P.C. 9:40 New Developments/Trends in the D&O Marketplace with Respect to the Latest Products, Coverage, Claims, and Underwriting, and a Look at the Evolution of D&O Insurance, its Breadth of Coverage, and the Role of Predictive Modeling Morning Break 11:10 What’s new in the D&O marketplace? What’s new with D&O insurance policies? What are the current underwriting trends? Aligning the policy to match risk profile of the company The claims issues that never go away: notice, choice of counsel, allocation, consent to settlement How do you talk to your client/broker/insurer about D&O insurance? The evolution of D&O: Can D&O be a service, not just an insurance product? Is D&O a “Form too Far” in terms of the breadth of coverage? The role of predictive modeling in D&O insurance Developments in Delaware Law that Impact D&O Liability Landscape and M&A Litigation David J. Murray Head of D&O Claims, Claims Division Starr Adjustment Services, Inc. Shanda Davis D&O Product Manager, Bond & Specialty Insurance Travelers Register Now | 888-224-2480 | www.AmericanConference.com/DandO 3 • Cover-holder status: Will this effectively change how insurance will be bought? • Insolvency issues as they relate to D&O liability around the world • What’s the forecast for the future? What can we expect as the next big thing in international cooperation? Steven Carabases SVP, Management Liability Claims Navigators Claims Steven L. White Senior Vice President, Management Liability Claims Aspen Insurance Anne Foster Director Richards, Layton & Finger 2:50 Jeroen van Kwawegen Partner Bernstein Litowitz Berger & Grossmann LLP • • • • • • David S. Perkins, RPLU Executive Vice President U.S. Risk Brokers, Inc. Forum selection and fee shifting issues Bylaws requiring mandatory arbitration Minimum stake and interest claim Possible effects of these developments on strike suits Other key developments in Delaware law and practice A look at the increasing severity of the M&A suits rather than volume of these cases 12:40 Networking Luncheon for Speakers and Delegates 1:40 Dealing with Globalization of Claims against Directors and Officers: Developments Abroad, International Coverage, and Ensuring that Coverage is Adequate Across Multiple Jurisdictions Gregg C. Rentko, CPCU, AU, MSIM Second Vice President Western World Insurance Group Paul Schiavone Regional Head Financial Lines North America Allianz Global Corporate & Specialty Steven H. Anderson CEO and Founder Tipping Point Insurance Moderator: Angelo G. Savino Chair, Professional Liability Practice Group Cozen O’Connor • Claims frequency in the private sector • Unique and evolving claims and underwriting issues? o Different venues o Which industry sectors have been appearing? Thomas Sheffield Vice President, Specialty Claims QBE North America Kim West Partner Clyde & Co US LLP Perry S. Granof, Esq. Managing Director Granof International Group LLC • When abroad, what do Directors and Officers have to be concerned about? • How to effectively place business internationally given that U.S. policies aren’t necessarily written with claims in mind that are increasing in frequency around the world o What to think about when considering getting insurance coverage with local companies - Admitted vs. non-admitted companies o Indemnification issues • Emergence of “cross-border class actions” 4 Join the Conversation Private Company D&O and D&O Coverage for Non-Profits: Claims Frequency, Unique and Evolving Claims that Arise, as well as Underwriting Issues 4:05 Afternoon Break 4:15 Impact of Legal Developments of Key Securities Class Actions, Corporate Governance and D&O Claims, Including IPO Litigation Jeffrey R. Lattmann Executive Managing Director, National Executive Liability Practice Beecher Carlson John C. Minett SVP and Counsel – Professional Liability Claims Manager Endurance Insurance ACI: Reinsurance/Insurance: Legal, Regulatory, and Compliance Experts Group @Insurance_ACI / #DandO Kara Altenbaumer-Price, Esq. Vice President, Management & Professional Liability Counsel USI Moderator: John W. Shaw Partner Berkowitz Oliver Williams Shaw & Eisenbrandt LLP Gregory S. Bruch Partner Bruch Hanna LLP • Have we seen an increase in shareholder derivative litigation? • Are shareholder suits unrelated to a securities class action on the rise? • Characteristics of M&A litigation brought derivatively versus brought as a class action • Impact of derivative suits on Side A • Novel strategies to settle derivative suits and the D&O insurance implications • Cybersecurity derivative suits John E. Failla Partner Proskauer Rose LLP Moderator: Douglas W. Greene Shareholder Lane Powell PC • Year’s highlights • Decisions and trends • Increasing regulatory environment and its impact on securities litigation • Key coverage issues • Surge in IPO-related securities litigation 6:00 Conference Adjourns DAY TWO – Friday, September 18, 2015 7:30 Continental Breakfast 8:05 Shareholder Derivative Litigation, Including M&A Litigation brought Derivatively, and the Increasing Importance of Side A Diane M. Parker, Esq. Vice President, North American Claims Group Allied World Insurance Company Steve Levine, Esq. First Vice President, Claims Attorney Executive and Cyber Risk Practice Alliant Insurance Services Will Fahey Senior Vice President Zurich North America Eric C. Scheiner Partner Sedgwick LLP Shayne R. Clinton Member Bass, Berry & Sims PLC 9:35 Morning Break 9:45 Getting Past Data Breaches and Focusing on Cyber Issues at the Board Level, Ensuring Adequacy of a Company’s Cybersecurity Measures, and a Look at the Derivative and Class Action Suits Stemming out of Cyber Breaches Michael Sternhell Senior Vice President, Senior Counsel OppenheimerFunds David T. Vanalek, Esq. Manager, Global Management Liability Markel Cynthia K. Tortolani Vice President, Account Executive Lockton Companies, LLC Jacqueline Waters Urban, Esq. Managing Director & Practice Leader Aon Matthew L. Jacobs Partner Jenner & Block Moderator: Thomas Bentz Partner Holland & Knight • Handling cyber business interruption and cyber operational risks o Understanding at the board level what those operational risks are o Management procedures for preventing and addressing consequences when it does happen Register Now | 888-224-2480 | www.AmericanConference.com/DandO 5 • Ensuring adequacy of a company’s cybersecurity measures o What is the board’s role in cybersecurity o Tracing the evolution of board oversight o Where are we today? o What does board preparedness mean for D&O underwriting and claims? • Predicting where the issues may arise and helping clients understand where the risks are o What types of cover are out there? o What are the limits of liability? o Which policy responds and how? • The potential for a significant wave of derivative and class action suits stemming out of cyber breaches • SEC‘s focus on cybersecurity and cybersecurity disclosures 11:10 12:30 Networking Luncheon for Speakers and Delegates 1:30 Getting Deals Closed with Reps. & Warranties Insurance: Trends, Challenges and What’s Next Jay J. Rittberg Senior Vice President and Americas M&A Manager AIG William M. Monat SVP – Transactional Solutions Leader Willis Nancy D. Adams Member Mintz Levin Cohn Ferris Glovsky and Popeo PC Strategies for Effectively Participating in a Securities Class Action Mediation Jeffrey Cowhey President Ambridge Partners LLC Patrick McGinley Vice President Everest National • Key drivers for the development of R&W insurance • Key issues to address, including process and structure • Current market: opportunities and challenges with growth of the product • Claims: is the product responding? • What’s next: thoughts on the future Jill Sperber Sperber Dispute Resolution Michelle Yoshida Mediator/Arbitrator Phillips ADR Darren J. Robbins Partner Robbins Geller Rudman & Dowd LLP 2:20 Robbyn S. Reichman, Esq. Managing Director and Practice Leader Aon Scott D. Gilbert Partner Gilbert LLP Steve Boughal, CFA, FRM Vice President, Chief Underwriting Officer Hartford Financial Products Moderator: John F. McCarrick Partner White and Williams LLP • Setting the table: pre-mediation calls and briefing to identify issues likely to impact your negotiating position • Showing up prepared: the advantages of being able to accurately articulate your counterparties’ arguments to show you understand their case • Managing expectations: when to posture and when to show your cards • Listening skills: how to draw out the issues and outcome needs that will drive mediation outcome; listening for unspoken signaling from the other parties to the mediation • Keeping the faith: maintaining trust and confidence through your discussions with the mediators and counterparties • Defining a successful outcome: how to build consensus towards an outcome everyone can accept 6 Join the Conversation D&O for Private Equity and Hedge Funds Cecelia A. Lockner Counsel Ropes & Gray LLP • Coverage considerations and strategies • Developing claim trends and underwriting issues • Hedge fund D&O 3:10 D&O and Financial Institutions Frank J. Ecker AVP, Regional Underwriting Officer Zurich North America Raymond T. Hannan, Jr. SVP – U.S. Underwriting Manager Aspen Insurance ACI: Reinsurance/Insurance: Legal, Regulatory, and Compliance Experts Group @Insurance_ACI / #DandO Kimberly M. Melvin Partner Wiley Rein LLP SAVE THE DATES: Insurance Allocation Moderator: June 25–26, Chicago Mary-Pat Cormier Partner Bowditch & Dewey, LLP Bad Faith Claims and Litigation July 27–28, Chicago • 6 years later: has the insurance landscape changed, or are we going back to a pre-crisis type coverage? • How the onslaught of litigation brought about by the financial crisis has affected FI’s risk management scheme • Impact of recent changes and developments in policy wordings • Evaluating current D&O exposures in the post-financial crisis climate • Are exposures from whistleblower bounties on the rise? • What types of financial-crisis claims remain? • What have we learned about underwriting? • What have we learned about claims management? • What have we learned about the defense of claims? 4:15 July 29–30, New York City Cyber & Data Risk Insurance September 30–October 1, New York City Visit www.americanconference.com/blog and navigate to the ACI Expert Jobs link. Is your organization recruiting specialists with expertise in this area? Many of our speakers and delegates use our conferences to recruit for new, expert talent to fill open positions at their firms. Because ACI provides many niche conferences annually, our events are a great way to discover a rich pool of highly qualified talent. Global Sponsorship Opportunities It’s quick, easy and free for you, your in-house recruiters, or anyone in your firm to post current open positions and take advantage of our exclusive community of experts. The newly posted jobs will appear on the relevant sections of www.americanconference.com and our partner sites, ensuring that your free job listing is visible to a large number of targeted individuals. American Conference Institute: With more than 300 conferences in the United States, Europe, Asia Pacific, and Latin America, American Conference Institute (ACI) provides a diverse portfolio devoted to providing business intelligence to senior decision makers who need to respond to challenges spanning various industries in the US and around the world. As a member of our sponsorship faculty, your organization will be deemed as a partner. We will work closely with your organization to create the perfect business development solution catered exclusively to the needs of your practice group, business line or corporation. For more information about this program or our global portfolio of events, please contact: Tel: 212-352-3220 x5242 w.tyler@AmericanConference.com Insurance Regulation Announcing the ACI Job Board Conference Ends Wendy Tyler Director of Sales, American Conference Institute EPLI July 27–28, New York City The leading networking and information resource for counsel and senior executives. Each year more than 15,000 in-house counsel, attorneys in private practice and other senior executives participate in ACI events – and the numbers keep growing. Guaranteed Value Based on Comprehensive Research ACI’s highly trained team of attorney-producers are dedicated, full-time, to developing the content and scope of our conferences based on comprehensive research with you and others facing similar challenges. We speak your language, ensuring that our programs provide strategic, cutting edge guidance on practical issues. Unparalleled Learning and Networking ACI understands that gaining perspectives from – and building relationships with – your fellow delegates during the breaks can be just as valuable as the structured conference sessions. ACI strives to make both the formal and informal aspects of your conference as productive as possible. © American Conference Institute, 2015 Register Now | 888-224-2480 | www.AmericanConference.com/DandO 7 American Conference Institute’s 19th Forum on D&O Liability Inquire about special rates for government, academia, insurers, brokers & risk managers Coverage, Underwriting, and Claims Strategies for Managing Liability Risks Through Market Changes and Increased Scrutiny September 17–18, 2015 • The Carlton Hotel on Madison Avenue • New York, NY 5 Easy Ways to Register MAIL American Conference Institute 45 West 25th Street, 11th Floor New York, NY 10010 PHONE 888-224-2480 FAX 877-927-1563 ONLINE www.AmericanConference.com/ DandO R E G I S T R AT I O N F O R M EMAIL CustomerService@ AmericanConference.com Payment Policy Payment must be received in full by the conference date. All discounts will be applied to the Conference Only fee (excluding add-ons), cannot be combined with any other offer, and must be paid in full at time of order. Group discounts available to individuals employed by the same organization. REGISTRATION CODE 807I16.S Cancellation and Refund Policy You must notify us by email at least 48 hrs in advance if you wish to send a substitute participant. Delegates may not “share” a pass between multiple attendees without prior authorization. If you are unable to find a substitute, please notify American Conference Institute (ACI) in writing up to 10 days prior to the conference date and a credit voucher valid for 1 year will be issued to you for the full amount paid, redeemable against any other ACI conference. If you prefer, you may request a refund of fees paid less a 25% service charge. No credits or refunds will be given for cancellations received after 10 days prior to the conference date. ACI reserves the right to cancel any conference it deems necessary and will not be responsible for airfare‚ hotel or other costs incurred by registrants. No liability is assumed by ACI for changes in program date‚ content‚ speakers‚ or venue. ATTENTION MAILROOM: If undeliverable to addressee, please forward to: D&O Underwriter/Product Manager/Claims/Counsel Hotel Information CONFERENCE CODE: 807I16-NYC American Conference Institute is pleased to offer our delegates a limited number of hotel rooms at a preferential rate. Please contact the hotel directly and mention code A53A53B or “ACI D&O Liability” to receive this rate. Venue: The Carlton Hotel Address: 88 Madison Avenue, New York, NY 10016 Reservations: 800-601-8500 or 212-532-4100 YES! Please register the following delegate for D & O Liability CONTACT DETAILS NAME JOB TITLE APPROVING MANAGER Registration Fee ORGANIZATION The fee includes the conference‚ all program materials‚ continental breakfasts‚ lunches and refreshments. ADDRESS CITY STATE TELEPHONE FAX EMAIL TYPE OF BUSINESS Incorrect Mailing Information ZIP CODE If you would like us to change any of your details please fax the label on this brochure to our Database Administrator at 1-877-927-1563, or email data@AmericanConference.com. ACI reserves the right to deny admission to anyone, at any time, for any reason. Missed A Conference – Order The Conference Materials Now! I would like to receive CLE accreditation for the following states: ___________________. See CLE details inside. FEE PER DELEGATE Advance Pricing On or Before August 6, 2015 Standard Pricing After August 6, 2015 $1895 $2095 Conference If you missed the chance to attend an ACI event, you can still benefit from the conference presentation materials. To order the Conference Materials, please call +1-888-224-2480 or visit: www.americanconference.com/conference_papers GROUP PRICING I would like to add __ copies of the conference materials on CD-ROM to my order - $299 each I cannot attend but would like information regarding conference publications PAYMENT NUMBER EXP. DATE CARDHOLDER I have enclosed my check for $_______ made payable to American Conference Institute (T.I.N.—98-0116207) ✃ Please charge my VISA MasterCard AMEX Discover Card Please invoice me ACH Payment ($USD) Please quote the name of the attendee(s) and the event code 807I16 as a reference. For US registrants: Bank Name: HSBC USA Address: 800 6th Avenue, New York, NY 10001 Account Name: American Conference Institute UPIC Routing and Transit Number: 021-05205-3 UPIC Account Number: 74952405 Non-US residents please contact Customer Service for Wire Payment information 1-2 No Discount 3-4 10% Discount 5-6 15% Discount 7 20% Discount More than 7 Call 888-224-2480 Special Discount We offer special pricing for groups and government employees. Please email or call for details. Promotional discounts may not be combined. ACI offers financial scholarships for government employees, judges, law students, nonprofit entities and others. For more information, please email or call customer service.