The Employer Adviser

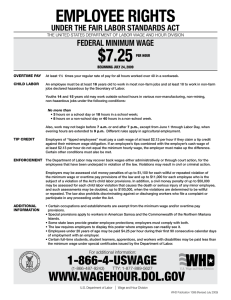

advertisement

The Employer Adviser Hot Sheet -Breaking Developments in Labor and Employment Law 03.22.06 New Washington Law Outlines Standards, Deadlines, and Procedures That Apply to Department of Labor & Industries’ Wage and Hour Investigations, Provides Authority for L&I to Issue Citations, Authorizes Civil Penalties, and Provides Employers With Protections and Safeguards On March 17, 2006, Washington Governor Christine Gregoire signed Substitute House Bill (“SHB”) 3185 into law. SHB 3185 adds several new sections to Chapter 49.48 RCW, and will go into effect on June 15, 2006. As an overview, SHB 3185 provides (for the first time) specific standards, deadlines, and procedures that apply to the Washington Department of Labor & Industries’ (“L&I”) investigations and determinations concerning employer compliance with various specific state wage requirements under Washington law. The provisions of the Bill address both L&I investigations and determinations that result from employee wage complaints and those that result from L&I’s independent agency authority. The Bill provides L&I with authority to investigate and issue citations and notices of assessment to employers that have failed to comply with certain specific state wage payment requirements. The Bill also authorizes L&I to assess civil penalties against employers who have committed willful violations of one of the specified wage payment requirements. New Law Limits L&I’s Administrative Enforcement to Specific “Wage Payment Requirements” SHB 3185 specifically limits the scope of administrative enforcement authorized by the new law (including the assessment of civil penalties) to the following “wage payment requirements”: (a) RCW 49.46.020 (minimum wage); (b) RCW 49.46.130 (overtime); (c) RCW 49.48.010 (final wages for terminating employees); (d) RCW 49.52.050 (willful violations); and (e) RCW 49.52.060 (deductions from wages). The Bill does not apply to all possible statutory wage payment requirements, such as those contained in Chapter 49.12 RCW or its regulations (for example, meal and rest break wage requirements). Likewise, administrative enforcement of private employment contract provisions, such as “agreed wage rates” (i.e., wage rates above minimum wage agreed to by an employer and employee), is not included in the scope of the Bill. New Law Clarifies Procedures for L&I Investigations, Decisions and Appeals Under SHB 3185, an employee may file a complaint with L&I when the employee believes that the employer has violated one or more of the wage payment requirements listed above. Employee wage complaints must be in writing. The wage claim accrues from the date when the wages are due (not from some other date, such as the date when the employee first discovers 1 wages might be owing). In response, L&I must investigate and issue a written decision within 60 days of receiving the wage complaint. L&I must either issue a citation/notice of assessment in favor of the employee, or a determination of compliance in favor of the employer confirming the applicable wage payment requirements have not been violated. L&I may extend this 60 day deadline “for good cause.” L&I may only take action on wage complaints that have not expired as a result of the Washington three year statute of limitations. L&I is required to send a copy of its determination to both the employee and the employer via certified mail or service of process. The Bill permits an employee or employer to initiate an administrative appeal within 30 days from issuance of a citation/notice of assessment or determination of compliance, using the standard appeal procedures and deadlines under the Washington Administrative Procedures Act (“APA”). New Law Provides L&I Authority to Assess Civil Penalties for Violations of “Wage Payment Requirements” SHB 3185 permits L&I to require any employer that has violated one or more of the designated wage payment requirements to pay all wages owed to the affected employee plus interest at a rate of one percent for each month that the wages have remained unpaid. In addition, SHB 3185 allows L&I to assess civil penalties in cases where the employer has committed a willful violation of a wage payment requirement. The Bill’s definition of “willful” expressly incorporates the definition of “willful” as applied in determining a violation of RCW 49.52.050(2) (willful nonpayment of wages), and includes an express reference to the “bona fide dispute” defense. In cases where L&I determines that a violation is “willful,” the Bill allows L&I to impose civil penalties equal to the greater of $500 or ten percent of the amount of the unpaid wages, up to a maximum civil penalty of $20,000. The Bill also provides mechanisms for L&I to collect on a citation/notice of assessment or civil penalty against an employer. New Law Includes Specific Protections and Safeguards for Employers Who Make Reasonable Efforts to Comply With State Wage Payment Requirements SHB 3185 provides specific protections and safeguards for employers who make reasonable efforts to comply with the wage payment requirements. For example, the Bill includes a “safe harbor” provision that immunizes employers from civil penalties if the employer “reasonably relied” on L&I regulations, L&I administrative policies, or any written L&I “order, ruling, approval, opinion, advice, determination or interpretation.” L&I is required to maintain a “complete and accurate record” of such agency statements to ensure that employers are not denied immunity from civil penalties due to incomplete agency records. The Bill also includes a “window of correction” provision that immunizes employers from civil penalties if the employer “provides payment” of all assessed wages and interest to an employee within ten business days of receiving the citation and notice of assessment (whether or not the employee actually accepts such payment). In the event the employer makes such payment after the ten day deadline, L&I retains discretion to waive any civil penalties. New Law Contains Election of Remedies Provision That Will Protect Employers From “Double Dipping” by Complainants SHB 3185 also provides protections for employers in cases where an employee files an administrative wage complaint with L&I, but later withdraws the administrative complaint in order to pursue a private court action. The Bill requires employees to make such an “election of remedies” by providing written notice to L&I within ten business days after receiving a copy of a citation/notice of assessment. If the employee does not provide such written notice within the required ten day time period, the employee may not pursue a new action in court and is limited to administrative relief (including the right to pursue an administrative appeal). 2 If the employee elects to pursue a private court action within the required time period: (a) L&I must immediately terminate the administrative action; (b) L&I must vacate any citation/notice of assessment that has been issued; and (c) the employee, L&I, or any other person or agency cannot admit into evidence in any court, judicial, or administrative action the following: (i) the citation/notice of assessment, (ii) any related findings of fact and conclusions of law issued by L&I, and (iii) the fact of any payment or offer of payment by the employer to the employee of the wages and interest assessed by L&I in its citation and notice of assessment. The intent of this provision is to “wipe the slate clean” and return the employer to its former position before the employee filed his or her wage complaint. New Law Brings Finality to L&I Wage Disputes The Bill brings finality to wage disputes by providing that payment of all wages and interest assessed in an L&I citation/notice of assessment constitutes full and complete satisfaction by the employer of all wage payments at issue. It also ensures finality by barring the employee who either accepts payment from the employer, or who elects to take his or her complaint through the administrative appeal process, from bringing any additional claims in any court action or other judicial or administrative proceeding based on the same wage complaint. What This Means for Employers in Washington SHB 3185 gives L&I authority to (1) investigate certain types of wage payment complaints, (2) issue a citation/notice of assessment against an employer for violations, or issue a determination of compliance to the employer who is following Washington law, and (3) assess civil penalties for willful violations. The Bill sets forth the procedures to be followed by L&I and provides much-needed information for employers about what to expect during an L&I investigation. The new procedures potentially offer a faster avenue for resolving wage disputes by requiring that L&I must investigate and issue its determination within 60 days, absent good cause. The Bill also provides an administrative appeal process for both employers and employees consistent with the Washington APA. As with the investigation process, an administrative appeal may prove faster for employers and employees than proceeding with wage claims through court actions. Employers should be aware that SHB 3185 does not appear to limit L&I investigations to those raised by written employee wage complaints. L&I will be authorized to issue citations/notices of assessment and civil penalties as a result of investigations and determinations arising under L&I’s independent agency authority (i.e., in the absence of any employee wage complaint). The Bill does, however, limit L&I to issuing such citations, assessments, and civil penalties to violations of the specific statutory wage payment requirements set forth above. SHB 3185 also provides Washington employers with a number of new safeguards and protections during an L&I investigation of a wage payment complaint under Washington law, including: • Employers can receive written determinations in their favor where the employers have complied with the Washington statutory wage requirements in dispute; • Employers will have a “safe harbor” and be immune from civil penalties under the new statute where the employer has reasonably relied on L&I regulations, administrative policies, or any written L&I “order, ruling, approval, opinion, advice, determination or interpretation”; • L&I will now be required to keep “complete and accurate records” of such orders, rulings, approvals, opinions, advices, determinations or interpretations for purposes of determining whether an employer is immune from civil penalties; 3 • Employers will have a “window of correction” and be immune from civil penalties if the employer pays all wages and interest assessed by L&I within ten business days of the employer’s receipt of a citation and notice of assessment; • Employers may possibly be found immune from civil penalties if they pay the wages and interest assessed by L&I later than the ten-day “window of correction” time period, and L&I decides to waive the penalties; • Employees must elect between the remedies provided by SHB 3185 or by a court action, and cannot pursue both; • Employers have protections if the employee elects to withdraw an administrative complaint in order to pursue a private court action, whereby the citation, findings, conclusions, and other information from the administrative action cannot be used against the employer in any court or other administrative action; and • Employers will have finality for wage disputes processed through L&I. Given the fairly short time frames and deadlines provided under the Bill, employers will want to be vigilant in the event of a citation/notice of assessment, so they can take advantage of the ten day “window of correction” and 30 day administrative appeal provisions, where appropriate. Likewise, employers may want to review their record-keeping practices so that they can support a “safe harbor” defense by showing through their records that they reasonably relied upon L&I regulations, administrative policies, or any written L&I “order, ruling, approval, opinion, advice, determination or interpretation.” One practice that employers should follow in light of the new “safe harbor” defense is to request and obtain written confirmation from L&I of any specific advice received from L&I representatives concerning wage payment requirements and compliance issues. SHB 3185 is the product of successful multi-year negotiations between L&I, the business community, the labor community and other interested “stakeholders.” The final Bill is a tremendous improvement over earlier drafts of civil penalty bills that were introduced in prior legislative sessions. Our many thanks to one of our colleagues at Lane Powell, Douglas E. Smith, who played an active and substantial role in the negotiation and drafting process of this Bill. Doug is pictured below, with other stakeholder representatives, as Governor Gregoire signed SHB 3185 last Friday. From left to right: Mark Johnson (Washington Retail Association Director for Governmental Relations), Kris Tefft, Senator Jean Kohl-Welles, Bruce Neas, Rich Ervin (L&I Employment Standards Manager), Doug Smith, Representative John McCoy (prime supporter of the bill), and Cli Finch (Washington Food Industry, Vice President for Governmental Affairs). 4 For more information, please contact the Labor and Employment Law Practice Group at Lane Powell: 206.223.7000 Seattle 503.778.2100 Portland employlaw@lanepowell.com www.lanepowell.com We provide The Employer Adviser Hot Sheet as a service to our clients, colleagues and friends. It is intended to be a source of general information, not an opinion or legal advice on any specific situation, and does not create an attorney-client relationship with our readers. If you would like more information regarding whether we may assist you in any particular matter, please contact one of our lawyers, using care not to provide us any confidential information until we have notified you in writing that there are no conflicts of interest and that we have agreed to represent you on the specific matter that is the subject of your inquiry. © 2006 Lane Powell PC Seattle - Portland - Anchorage - Olympia - London Lawyers for Employers ™ 5