Master of Finance

advertisement

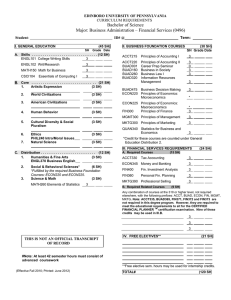

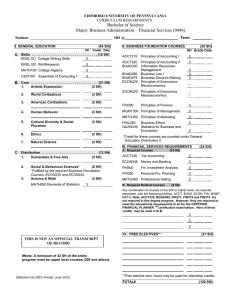

PLAN OF STUDY: Master of Finance The Master of Finance will be awarded upon successful completion of the program and any other conditions as required by the University. Completion of the SARI (Scholarship and Research Integrity) program is required of all students prior to graduation. It is recommended that you contact your faculty adviser once a year, and also at the time you file your “Intent to Graduate”. Pre-Program Requirements One or more courses may be required based on application review. Some pre-program courses may be taken concurrently with core courses. Students should consult with their adviser. Course # BUSAD 501 BUSAD 523 FIN 531 Course Title Met Statistical Analysis for Managerial Decision Making _______ Prices and Markets _______ Financial Management _______ Term/Yr.Taken Grade ___________ ___________ ___________ _____ _____ _____ Core Courses Students are required to meet all necessary course prerequisites prior to enrolling in any given course. (Check prerequisites listed on following page before enrolling in course work.) Course # Course Title Term/Yr.Taken Grade BUSAD 525 Quantitative Methods in Finance ___________ _____ ACCTG 512 Financial Accounting Theory and Reporting Problems ___________ _____ BUSAD 526 Current Issues in Corporate Finance; Advanced Corporate Finance ___________ _____ FIN 508 Analysis of Financial Markets ___________ _____ FIN 513 Speculative Markets: Financial Derivatives & Risk Management ___________ _____ FIN 505 Multinational Managerial Finance ___________ _____ Term/Yr.Taken Grade Elective Courses (Select three courses) Course # Course Title ACCTG 524 Managerial Accounting _____________ _____ BUSAD 527 Fixed Income Securities _____________ _____ BUSAD 528 Mergers and Acquisitions _____________ _____ FIN 506 Portfolio Theory and Policy _____________ _____ FIN 532 Financial Decision Processes: Real Options and Capital Budgeting Under Uncertainty _____________ _____ ______ 597 Approved Special Topics in FIN/ACCTG/BUSAD: _____________ _____ _____________ _____ Course Title: _____________________________ Capstone Course BUSAD 585 Research in Security Valuation □ Completion of SARI Module 10/2/14 _____________ PLAN OF STUDY: Master of Finance Master of Finance Course Descriptions and Prerequisites ACCTG 512 - Financial Accounting Theory and Reporting Problems Introduction to financial accounting and the external users of accounting information focusing on principles underlying financial accounting and specific applications of those principles through interpretation, evaluation, and use of accounting information for decision-making. ACCTG 524 - Managerial Accounting Prerequisite: ACCTG 512. Introduction to the variety of ways in which managerial accounting information is used to support an organization’s strategic business objectives. The role of managerial accounting has been expanded to collect and analyze measure of financial performance, customer knowledge, internal business processes, and organizational learning and growth. BUSAD 525 - Quantitative Methods in Finance Spreadsheet-based financial modeling including capital budgeting, basic statistics, and forecasting. BUSAD 526 - Advanced Corporate Finance and Financial Modeling Prerequisites: BUSAD 525, ACCTG 512. Finance topics involving strategic financial decisions, including capital structure and cost of capital, financial forecasting, valuation, and corporate control. BUSAD 527 - Fixed Income Securities Prerequisite: FIN 513. This course covers analysis and valuation of fixed income securities and interest rate derivatives. BUSAD 528 – Mergers and Acquisitions Prerequisite: BUSAD 526. Surveys the drivers of success in mergers and acquisitions (M&A) and develops skills in the design and evaluation of these transactions. BUSAD 585 (Capstone) - Research in Security Valuation Prerequisite: Completion of all Core Courses. Focuses on the analysis and valuation of a firm’s equity securities in the financial market using a fundamental analysis method. Course research includes financial analysis of a publicly traded company through historical analysis of financial statements and a projection using pro forma financial statements. The analysis includes valuation of the firm and its equity, based on financial theories, models, and techniques developed in the program. The capstone ensures a culminating experience that requires students to demonstrate evidence of analytical ability and synthesis of the knowledge acquired in the program. FIN 505 - Multinational Managerial Finance Financial management topics crucial to multinational companies subject to foreign exchange risk exposure and different tax regulations in foreign countries. FIN 506 - Portfolio Theory and Policy An advanced finance course in investment/portfolio management. The primary focus is on the design of stock portfolios, rather than the details of the pricing of financial instruments or identification of arbitrage opportunities. The course provides a framework that enables you to view investment management in a changing investment environment. FIN 508 - Analysis of Financial Markets Prerequisite: FIN 531 or approved equivalent. An overview of financial markets and institutions. Topics include determinants of interest rates; bond pricing and bond portfolio management; the term structure of interest rates; financial derivatives including options, futures, and swaps; and the Fed and financial markets. FIN 513 - Speculative Markets Prerequisite: FIN 508. Financial Derivatives and Risk Management: Analysis of derivative securities covering options, forwards, futures, OTC derivatives; topics include valuation, trading, hedging. FIN 532 - Real Options and Capital Budgeting Prerequisite: FIN 513. Capital investment analysis with dynamically uncertain cash flows and managerial flexibilities. Topics include discounted cash flow analysis, decision trees, and real options method in capital investment. FIN/ACCTG/BUSAD 597 - Special Topics: Selection of courses from current and evolving issues. Designed to assist in developing expertise in a selected area, such as behavioral finance, financial fraud analysis, transfer pricing, topics on corporate income tax, Sarbanes-Oxley Act and financial reporting, or treasury management. 10/2/14