@ Research Smith 2

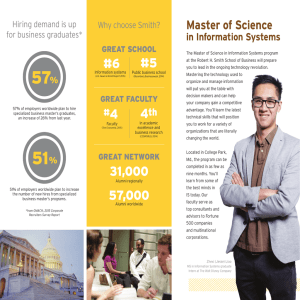

advertisement

Research@Smith Fall 2012 | VOL 13 | NO 2 2 International Business Capitalism as Crime Prevention 4 Customer Service To Be or Not to Be…More Productive 6 Management Hostile Customer Encounters 8 Management Room for Equity? Fall 2012 VOL 13 | NO 2 Research@Smith summarizes research conducted by the faculty of the Robert H. Smith School of Business at the University of Maryland. Dean G. Anandalingam ASSOCIATE DEAN OF FACULTY & Research Michael Ball Editor Rebecca Winner Contributing Writers Carrie Handwerker, Gregory Muraski PHOTOGRAPHY Tony Richards Design Lori Newman Research@Smith is published two times a year by the Robert H. Smith School of Business University of Maryland 3570 Van Munching Hall College Park, MD 20742 www.rhsmith.umd.edu We’d like to put Research@Smith directly into the hands of academics, executives, policymakers, and others who are interested in learning about the latest research conducted by Smith School faculty. To request a copy of this publication or make an address correction, contact Rebecca Winner via e-mail, editor@rhsmith.umd.edu, or phone, 301.405.9465. Learn more about Smith research: www.rhsmith.umd.edu/smithresearch Dean’s column The research program at the Smith School of Business is excellent across many different fields. This issue of Research@Smith deals with topics as disparate as healthcare management, capital controls and enhancing service productivity. While there may not seem to be a theme in content, what is true across these pieces is the level of rigorous research and analysis coupled with close attention to an important issue affecting an industrial sector today. The Smith School faculty has always been ranked in the top-10 in research by Financial Times (No. 8 in 2012), Business Week (No. 2 in 2010) and the UT-Dallas productivity ranking (better than No. 10 in each and every field!). What is even more impressive about the faculty is that they are all working on important global issues such as the financial crisis, healthcare cost and management, sustainability, and cybersecurity. Our faculty frequently appear as experts in the media as well. In just the last two months Smith professors have been quoted in outlets such as CNN, CNBC, and ABC News, as well as the New York Times, The Washington Post, The Wall Street Journal, the Financial Times, Bloomberg BusinessWeek, CNN Money/Fortune, and many more. They are also available to leaders in the business community, whether through formal consulting projects, thought leadership events around the region or research projects with our Centers of Excellence. If you are interested in learning more about partnership opportunities, please contact Greg Hanifee, our assistant dean of executive programs, for more information. G. “Anand” Anandalingam Dean, Robert H. Smith School of Business University of Maryland Research@Smith page 2 page 8 Capitalism as Crime Prevention Room for Equity? Research by Kislaya Prasad Capital controls spur black markets and murder rates. Research by Liu Yang High-level female leadership can neutralize the gender wage disparity. page 4 To Be or Not to Be…More Productive Research by Roland Rust Lower customer service productivity can often lead to a better bottom line. page 6 Hostile Customer Encounters Research by Rellie Derfler-Rozin Managers can mitigate the effects that verbally abusive customers have on employees. page 10 Research Briefs Featured Researchers page 12 Executive Profile: Rick Clinton, Verizon Wireless Mobile fALL2012 INTERNATIONAL BUSINESS economic growth up Capital controls spur black markets and murder rates. Research by Kislaya Prasad Capitalism as Crime Prevention Policymakers around the world have responded to the recent global financial crisis by implementing new economic measures that reverse a four-decade-old liberalization trend. This new permissiveness toward economic controls that measure capital and currency restrictions, capping interest rates, and imposing import and export licenses, are finding their way back into the policy toolkit. Though occasionally effective, these measures can be overused. And aside from economic arguments against restrictions, history shows a seamy side effect to governments manipulating the free flow of currency and goods — black market violence. homicide down Kislaya Prasad, professor and director of the Smith School’s Center for International Business Education and Research, investigated this phenomenon through India’s recent history. His findings link a declining rate in homicides to that government’s 1991 transition to a free market economy that involved a dramatic loosening of controls on trade, manufacturing and currency. Prasad analyzed India’s intentional homicide rate and its dependence on the differential between the Mumbai and London price of gold. Prior to 1991 the import of gold into India was heavily restricted, creating a divergence between Indian and international gold prices. This differential — a measure of the attractiveness of smuggling — is found to predict changes in the homicide rate. Liberalization caused the gold price differential to decline and this dramatically affected the homicide rate. After rising steadily through the 1980s, the murder rate declined sharply after the initiation of reforms. “A variety of social institutions — courts of law for instance — have been devised to manage conflict between agents engaged in trade,” Prasad explains. “When a transaction becomes illegal, people lose access to such institutions and end up resolving conflicts through violence. Rationing leads to black markets, tariffs lead to smuggling, and disputes among black marketers and smugglers are settled — often violently — outside the courts. Liberalization in India had the effect of putting a lot of black marketers and smugglers out of business.” Prasad expanded the study to 100-plus countries. Analyzing two decades of data, he shows restrictions on trade — measured in a variety of ways, including using the black market exchange premium — are associated with a lower homicide rate across those countries. Prasad says his research was inspired by Edward Luce’s “In Spite of the Gods: The Strange Rise of Modern India” (Doubleday, 2007), which tells the story of India’s free market transformation from “license Raj”— a system in which “you couldn’t hire, fire, change the size of your labor force or build an extension to a plant without first securing a government license,” he says. The controls extended to imports and exports, which made it very lucrative to smuggle not just precious metal, but also alcohol, electronics, and industrial inputs like polyester filament yarn. These factors created an 2 FALL 2012 : VOLUME 13 : NUMBER 2 environment in India analogous to the alcohol prohibition era in U.S. history. “Similar to Al Capone’s notoriety in American folklore of that era, the likes of Haji Mustan and Chhota Rajan became wealthy and infamous as Indian gangsters, largely through gold smuggling.” Manipulating the flow The organized crime culture is discussed in Luce’s book, which includes remarks by an Indian police officer that provided the spark for Prasad’s study: “The mafia dons were making most of their money from smuggling gold and electronic goods. Since the 1990s restrictions have been lifted so there is much less money to be made in smuggling. They still have protection rackets and prostitution rings, but these are not as lucrative. Ten years ago we would have two or three gang killings every day. Now it is a few each month.” Prasad says lessons of his research for policymakers will be apparent. “Criminalizing transactions that people seek to engage in is rarely a good idea, especially now as governments around the world are tempted to institute new economic controls.” economies. The takeaway for executives is more subtle, he adds. Any business transaction potentially brings disagreement and conflict. But unlike smaller and perhaps homegrown companies in developing markets, foreign companies tend to be insulated from black market crime. Firms with sufficient capital can access “an emergent and thriving dispute resolution industry of third-party mediators and private, judicial arbitrators in countries with weak public legal infrastructures,” says Prasad. These companies still must prepare to use these private sector dispute resolution mechanisms, just as they would the public court system, to better manage contract disputes. Prasad’s findings could also generate further investigation into the relationship between other forms of control and violent crime. “Mexico’s tightened control on the drug trade has coincided, and likely correlates with, a striking rise in crime in the last three-to-five years,” he says. “But whether to lift controls on an addictive commodity is a much more difficult and complex question compared to loosening restrictions on trade.” “Economic Liberalization and Violent Crime,” is forthcoming in the Journal of Law and Economics. For more information, contact kprasad@rhsmith.umd.edu. ■ RESEARCH@SMITH 3 of capital can lead to the mafia culture expanding and contaminating their customer service when United Airlines improved its labor productivity 32 Percent Passenger revenues declined 17 Percent Lower productivity can often lead to a better bottom line. Research by Roland Rust To Be or Not to Be… More Productive Automating customer service functions has become a popular strategy to improve service productivity and cut costs. But too much service productivity can actually cut into a company’s revenue, according to recent research from Roland Rust, Distinguished University Professor, David Bruce Smith Chair in Marketing, and executive director of the Smith School’s Center for Excellence in Service, and Ming-Hui Huang, Distinguished Faculty Fellow at the Center. Consider Alaska Airline’s automated check-in system at Anchorage Airport. Though passengers were initially wary, by 2008, 73 percent of passengers were choosing to check in using the automated kiosks on the airline’s website. That improved Alaska Airline’s productivity by 18 percent. It also saved money: it costs the airline $3.02 to use an agent to perform each passenger check-in, while self-service costs between 14 and 32 cents per check-in. The airline was able to reduce its workforce by 10 percent and increase its earnings by 25 percent. But for every success story there is a corresponding cautionary tale. United Airlines improved its labor productivity by 32 percent, and then received the lowest customer satisfaction scores in the airline industry for the next three years running. Its passenger revenues declined 17 percent over the same period, the worst decline of any US airline. Rust, with co-author Huang, National Taiwan University, gathered data from more than 700 other companies in two time periods across a variety of industries, including wholesale and retail, information and technical services, finance and insurance, education and healthcare, and food and recreation. They found that when prices and profit margins are higher, the most profitable service productivity levels tend to be lower. Firms in highly competitive industries, with high prices and profit margins and relatively low wages, should provide higher levels of “high-touch” service, even at the expense of productivity. In industries where wages are high, prices and margins are low, and the market isn’t very competitive, higher productivity — with its correspondingly lower cost — results in a better bottom line. Each firm’s optimal level of productivity is based on those variables, and when productivity is too high or too low, profitability suffers. The tradeoff between service quality and productivity should be considered in the same light as any strategic variable, says Rust: “Productivity is a strategic decision. Companies tend to think about the cost side exclusively — “the lower our costs are, the better our bottom line.” But that ignores the revenue side — customer satisfaction has a very large impact on revenue.” Managers should be able to use the model Rust and his co-author created to examine the effectiveness of their own firms’ productivity levels. All the data from the study’s empirical analysis are in the public domain, so any firm could replicate it. By inserting their firm’s own data into the author’s empirical equation, managers can get a better idea about whether they are over- or under-productive. 4 FALL 2012 : VOLUME 13 : NUMBER 2 $ Firms of all sizes, across all industries, should carefully consider the strategic trade-offs between service productivity and quality, the authors find. But small companies may need to be even more careful about their productivity strategy than large companies. Small companies don’t enjoy the same economies of scale as big firms, so it is difficult for them to compete on cost and price. High-quality customer service to a niche market can help a smaller business out-compete larger firms that have a cost advantage. The results of the study lead to some straightforward recommendations for firms’ productivity strategy. “If you have a small number of customers you have to treat them really well,” says Rust. “Any defense contractor serving the federal government understands that. Also, the more money you’re making from each customer, the more important it is to treat them well. To treat customers well, you place less emphasis on productivity.” “All other things being equal, productivity is good. The problem is, all other things are not equal. Companies want to show productivity gains, but that is not always a good strategy. As technology improves, a higher level of productivity is justified, but at a given level of technology higher productivity can be counter-productive.” Large companies have the hardest time finding the optimal level of productivity, according to Rust and Huang’s research. They have found that on average, large companies are about 9 percent too productive. Most of these companies, Rust and Huang conclude, would actually make more money if they were less productive. A side societal benefit is that decreasing service productivity would also put more people to work, leading to better economic conditions, which would in turn benefit the society. “Optimizing Service Productivity” was published in the Journal of Marketing. For more information about this research, contact rrust@rhsmith.umd.edu. ■ RESEARCH@SMITH 5 All other things being equal, productivity is good. The problem is, all other things are not equal. Companies want to show productivity gains, but that is not always a good strategy. MANAGEMENT customer hostility employee gets anxious employee makes mistakes more customer hostility Managers can mitigate the effects that verbally abusive customers have on employees Research by Rellie Derfler-Rozin Eliminating Service Errors from Hostile Customer Encounters “The customer is always right” and “service with a smile” is the commonly accepted wisdom when it comes to keeping customers happy. But this mantra perpetuates a dark side — a power imbalance between the customer and front-line worker in crowded retail stores, fast food restaurants, 24/7 call centers and other settings in the service sector. When a dissatisfied, verbally-abusive patron exploits this upper hand, the frontline worker absorbs the heat and the business suffers as well. Previous studies have measured the broader implications of this dynamic, including worker burnout and loss of customers. But the real-time dynamics of the conflict and immediate fall-out from a hostile-costumer encounter are just as crucial because they affect the way an employee actually deals with the task at hand, according to new research from Rellie Derfler-Rozin, assistant professor of management. Derfler-Rozin found that a customer service worker under duress from a verbally abusive customer is prone to error in the heat of the moment. This compounds the customer’s frustration and creates a vicious cycle of dysfunction. “It’s worse if the encounter involves a high-status customer and you factor in the worker’s fear of losing his or her job — especially in this economy slowed by recession,” she says. Derfler-Rozin and her co-authors subjected university students in Israel and England to simulated customer requests that ranged from aggressive to neutral in tone. She then measured cognitive performance, memory recall and overall functioning of the students handling those customer requests. Students who encountered several aggressive customers in a row performed had much worse performance on those tasks. Even brief encounters with an angry, hostile customer impaired memory, general cognitive performance and task performance. Verbal abuse can distract the person on the receiving end into making errors, says Derfler-Rozin, and this has serious implications for customer service workers, who need to be efficient at multitasking. “The employee has to talk with the customer and instantly appear empathetic and able to understand the problem and its solution, all while executing a complex computer 6 FALL 2012 : VOLUME 13 : NUMBER 2 task,” says Derfler-Rozin. “Hostility from the customer interferes with the worker’s ability to recall information and likely disrupts the thinking processes that are needed to meet the complexity of the given task.” So when customers aggressively confront workers get their problems resolved, they may actually be creating a climate that results in less-effective service. It creates a lose-lose situation for the customer, the employee, and ultimately the firm that risks losing the customer’s business. Companies can mitigate the problem by preparing their front-line service employees to deal with hostile customers, says Derfler-Rozin. Role-plays that simulate an angry encounter give employees the chance to practice listening with empathy to the complaint while simultaneously working through the complex computer task necessary to find the appropriate service solution. Practicing those skills in a safe environment can help employees be more effective in an actual hostile situation. However, managers should also take care to protect their service employees from the unreasonable and irrational, when a customer’s legitimate frustrations can result in a verbal assault on the employee. In those instances, managers should act to protect employees from abusive customers. Allow employees to terminate calls from difficult customers, or to stop interacting altogether with someone who is repeatedly offensive, says Derfler-Rozin. This signals that management cares about employees, and the resulting boost in morale and motivation will improve the service environment overall. “When customers exhibit verbal aggression, employees pay cognitive costs,” was published in the September 2012 Journal of Applied Psychology and co-authored by Amir Erez, University of Florida; Ravit Rozilio, Haifa University; and Anat Rafaeli, Shy Ravid and Dorit Efrat Treister from Technion Institute of Technology, Israel. For more information, contact rderfler@rhsmith.umd.edu. ■ RESEARCH@SMITH 7 Managers of customer service workers can mitigate employee error induced by stress from verbally abusive customers by simulating hostile-customer encounters during task training exercises and by eliminating employee exposure to repetitively abusive customers. MANAGEMENT Female corporate leadership can neutralize the gender wage disparity Research by Liu Yang women’s pay lags behind men by about 80 Percent women hold only 6 Percent of all CEO and top executive positions. Room for Equity? Despite incremental gains the past several decades in America, pay for full-time working women lags behind that for men. The median disparity — about 80 percent — ranges from near neutral in low-paying service sectors to approaching 60 percent among high-level professionals, including the women holding just 6 percent of all CEO and top executive positions. However, this small, under compensated fraction of America’s business leaders are creating a culture of change in companies they lead, according to recent research from Liu Yang, assistant professor of finance. “When women hold senior leadership positions, they cultivate more female-friendly cultures inside their firms, and subsequently improve career prospects for those women,” says Yang. Yang examined data recently made available by the U.S. Census Bureau’s Longitudinal Employer Household Dynamics program. She identified and tracked separate sets of workers laid off from the same firm and subsequently employed by another. The data included 461,449 workers in 9,244 closing plants across 23 states between 1993 and 2006. Yang looked at the differences in outcomes for groups of laid-off workers re-employed into the same firms, under male or female managers. Yang and co-author Geoffrey Tate, University of North Carolina, measured changes in wages according to gender in the transition between employers. When women went to work for male managers, they started at their new firms with an average wage disparity of five percent. “However, the gap was cut in half in a female-managed company,” Yang says. “The results, at a minimum, suggest that women in leadership are necessary to implement a shift toward egalitarian hiring and compensation policies.” It is often suggested that the gender-wage gap is a result of the female worker’s tendency to prioritize family ahead of career, limiting work hours or not devoting extra personal time in order “to get ahead.” Women are less productive and less competitive than men, goes the argument; hence, they make less money. But Yang’s research suggests that wage disparities are generated through management and depend on the leader’s gender. Male-led firms paid women less than men in every wage group, Yang found, including workers over 55, for whom the constraints of family are less likely to differ by gender. Yang notes that even in women-led firms, pay for women ages 25-35 lags behind that for other female age groups, perhaps indicating that women of child-bearing age tend to focus more on family. However, “managers and shareholders appear to unfairly project such a quality to all women, in effect penalizing those in other age groups,” she adds. Women in the highest wage brackets working in male-led firms had the highest wage disparity when compared to their male counterparts. “This further erodes the notion 8 FALL 2012 : VOLUME 13 : NUMBER 2 $ $ that gender wage disparity is driven by women sacrificing career advancement in favor of family,” she says. “Managerial bias, rather than lack of qualifications, fuels the gender wage gap.” Yang says the study adds to the growing literature on the way “CEO style” and managerial policies affect corporate outcomes. Female leadership creates an environment that is more conducive to the advancement of other women within the organization. Female leadership also appears to create a gender-equal culture in which more workers feel treated fairly and more incentivized and loyal toward the firm. “Shareholders of male-led firms should take note of these implications,” she says. “Female Leadership and Gender Equity: Evidence from Plant Closure” is under review from the Journal of Financial Economics. For more information, contact lyang@rhsmith.umd.edu. ■ Creating Wage Equity in Your Firm How can company leaders maximize productivity through ensuring both female and male employees are treated fairly with equal growth and advancement opportunity? ■ Regularly review salaries, promotions and benefit increases to identify potential gender-based inequity ■ Ensure resources, such as work space and equipment, are allocated regardless of gender ■ Ensure deserving women are appointed to vital policymaking or leadership committees ■ Look for, and guard against, invisible gender biases in job performance reviews RESEARCH@SMITH 9 Firms can take advantage of capable women leaders and position them to nurture a culture of gender equity and subsequent broader base of incentivized workers that feel treated fairly. research briefs Another Repatriation Tax Holiday? U.S. law makers should avoid, or at least restructure, giving American firms another tax holiday in attempts to get them to reinvest their foreign earnings domestically, according to research by Mike Faulkender, associate professor of finance. His findings show the reinvestment from tax holiday created by the 2004 American Jobs Creation Act (AJCA) — which cut the tax rate from 35 to 5 percent — was marginal and primarily from smaller companies. Big firms applied very little repatriated funds to new investment. With the highest corporate income tax rate among industrialized nations, U.S. companies are keeping more than $1 trillion in foreign subsidiaries to delay paying federal taxes. Faulkender advocates creating a more competitive tax rate to create incentives for long-term domestic investment. “Investment and Capital Constraints: Repatriations Under the American Jobs Creation Act,” is forthcoming in Review of Financial Studies. Managing Your Emotions to Manage Better A person’s ability to manage their feelings translates to better job performance for managers, according to a study by Myeong-gu Seo, associate professor of management and organization. Seo found managers with high emotional intelligence (EI) were better at dealing with stress and emotions triggered by the demands of managing diverse teams, functions and lines of business, with multiple stakeholders and competing agendas. Seo surveyed 346 part-time Smith MBA students and their work supervisors. He found that people with high EI understand and interpret emotional cues and use that information to guide and inform their decision making. He also had teams of MBA students evaluate each other’s teamwork and found students with high emotional intelligence were seen as contributing more to the group. This effect was even stronger in diverse teams. “Emotional Intelligence, Teamwork Effectiveness, and Job Performance: The Moderating Role of Job Context,” was published in the March 2012 Journal of Applied Psychology. When Silence Isn’t Golden Products with no online reviews are likely of low quality because consumers with bad experiences tend to refrain from posting a review, according to research from Ritu Agarwal, Robert H. Smith Dean’s Chair Professor of Information Systems, and Guodong “Gordon” Gao, assistant professor in the Department of Decision, Operations and Information Technologies. The researchers compared online ratings of physicians from RateMDs.com with reviews from a patient survey to find doctors who rated low in the survey were less likely to be rated online. They also found that online ratings skewed excessively high or low because patients who have extreme experiences are more likely to rate online, and consumers who are overwhelmingly happy or upset to tend to exaggerate their experiences. “The medical community is so worried that ratings websites will become a channel for disgruntled patients to vent and ruin their reputations, but we find just the opposite,” Gao said. “It’s more likely that patients are recommending their doctors rather than ‘naming and shaming.’” “A Changing Landscape of Physician Quality Reporting: Analysis of Patients’ Online Ratings of Their Physicians Over a 5-Year Period”, was published in the Journal of Medical Internet Research. Uncovering Risks in Emerging Markets Entering any new market can be risky for a company, but political prowess and mastery of new analytic tools can improve the chances for success, says Bennet Zelner, associate professor in the logistics, business and public policy department. He studied businesses entering emerging markets to come up with best practices for managing interactions with political, social and economic institutions. Zelner says companies should use data-mining and language-parsing technology to monitor news and conversations online and in the media. Companies can learn a lot about a region’s social norms and values and use that information to assess risk, identify critical stakeholders and develop an influence strategy. Zelner says the strategy also helps when crafting a communications strategy and creating a long-term presence in the new market. “The Hidden Risks in Emerging Markets,” appeared in the April 2010 issue of Harvard Business Review. 10 FALL 2012 : VOLUME 13 : NUMBER 2 Air Passengers Drive to Save Money In a year, nearly 4.7 million travelers saved $480 million by flying to U.S. airports, then driving over the border to their Canadian destination, according to research by Martin Dresner, professor and chair of logistics, business and public policy, and Smith coauthors Robert Windle, professor of economics, and doctoral student Omar Sherif Elwakil. The frugal travelers saved an average of 28 percent over the cost of Canada-based arrivals and departures, but cost Canadian airports $1.3 billion in missed revenue in 2008. Transborder fares are two to three times higher than those for flights between U.S. cities despite the 2005 U.S.-Canada “Open Skies” agreement. Elwakil says more open competition would help right the problem. “Transborder Demand Leakage and the U.S.- Canadian Air Passenger Market” is accepted for publication in Transportation Research Part E: Logistics and Transportation Review. RESEARCH@SMITH 11 featured researchers Rellie Derfler-Rozin assistant professor of management and organization, received her PhD in organizational behavior from London Business School. She focuses her research on how behaviors and decisions at the workplace are affected by psychological anxieties that relate to threats to fundamental needs, such as the need to maintain status in a group and the need to belong to a group. Her recent work examines employees’ responses to discretionary-versus-rule-based allocation systems, behaviors of employees that are at risk of being socially excluded at the workplace, and the relationship between task variety and ethical behavior. Kislaya Prasad is a research professor of decision, operations and information technology whose principal research focus is on the computability and complexity of individual decisions and economic equilibrium, innovation and diffusion of technology, and social influences on economic behavior. He is also the director of the Smith School’s Center for International Business Education and Research. Recent projects include medical treatment variations and diffusion of technologies in medicine, complexity of choice under uncertainty, and experimental tests of contract theory. His research is currently funded by a grant from the National Science Foundation. Prasad is also a guest scholar at the Center on Social and Economic Dynamics, The Brookings Institution, Washington, D.C. Roland T. Rust is Distinguished University Professor and David Bruce Smith Chair in Marketing and founder and executive director of two research centers: the Center for Excellence in Service and the Center for Complexity in Business. He is also visiting chair in marketing science at Erasmus University (Netherlands), International Research Fellow of Oxford University’s Center for Corporate Reputation (UK) and International Fellow at the CTF Service Research Center at Karlstad University (Sweden). He was chair of the department of marketing at Maryland for eight years, during which he presided over a dramatic improvement in the marketing faculty — in his last year as chair the department ranked number one in the world in number of publications in the top four marketing journals. Liu Yang, assistant professor of finance, focuses her research on theoretical and empirical corporate finance in the areas of mergers and acquisitions, corporate restructuring, corporate governance, labor economics and financial institutions. Her recent work on merger waves examines how and why public and private firms act differently during merger waves. She also uses corporate restructuring events to compare the quality of human capital in focused and conglomerate firms and to investigate how female leadership affects the gender wage gap for workers. Executive Profile Rick Clinton Rick Clinton, associate director of knowledge management for Verizon Wireless, has a big job. And he’s part of a big team — over 1,000 people manage the business of customer service, building tools and offering content that supports call centers on the company’s 800 line and technical support line, as well as on Verizon’s website. “After I finished my EMBA, I went from a team of 9 to a team of 35. The value to the business I deliver is significantly higher.” Like many companies, Verizon Wireless has put increased focus on knowledge management, says Clinton. The company’s ongoing challenges and opportunities arise from the dramatic evolution in wireless technology: smart phones now function as portable computers, and have been widely adopted — 95 percent of people in the U.S. carry some kind of cell phone. “Now people are in the process of going from lines of service to points of connectivity,” says Clinton. “The average family will have over 100 points of connectivity in their house. That is how Verizon manages customers now — it’s not really about lines of service, it’s about connection and data consumption.” That business model change has also brought a change in the company’s value proposition, which has shifted to providing data for everything that needs network connectivity. Competition in this space is fierce. Companies with the biggest throughput will be the ones to attract and retain customers, says Clinton, which is why Verizon “doubled down” on FIOS and towers and its 4G network. Verizon also aims to compete on customer service, which is why Clinton’s role is so important. “What I’m trying to figure out these days is how do we become the best in customer service without the customer having to call us?” says Clinton. “When we create tools and content, we’re shifting the focus to making everything available to customers directly, so that customers can do exactly what they want, when they want. People don’t want to pick up a phone, wait in line and talk to us. They want to solve their problems at their own pace, in their own time.” Clinton has been with Verizon since 1995, when it was still Bell Atlantic Mobile. He started by running a store in Frederick, Md.; went on to became an account executive in corporate sales, then moved into marketing to expand his understanding of the industry. He went on to be a product development manager, then an associate director managing flash services. Clinton transitioned to his current role earlier this year, due in part to the skills he gained in the Smith School’s Executive MBA program. “After I finished my EMBA, I went from a team of 9 to a team of 35. The value to the business I deliver is significantly higher,” says Clinton. Clinton says he chose Smith because of the focus on leadership and entrepreneurship. “Although I work for a big company, I consider myself an intrapreneur,” says Clinton. “That’s what appealed to me, having the skills to build something that is enduring and will survive.” Learn more about the Smith School’s executive MBA, custom and open executive education programs online, www.rhsmith.umd.edu/execed. 12 FALL 2012 : VOLUME 13 : NUMBER 2 www.umd.edu Research at Smith The Smith School is consistently ranked in the top 10 for research worldwide by publications such as the Financial Times and Bloomberg Business Week. Smith faculty research explores topics that matter to business leaders, policy makers and academics. Their work is highly regarded and widely cited, and their expertise is sought after by major media outlets and top corporations alike. Keep up-to-date with the latest research topics on our website, www.rhsmith.umd.edu. University of Maryland The University of Maryland, College Park, is one of the nation’s top 20 public research universities. In 2007, the University of Maryland received approximately $407 million in sponsored research and outreach activities. The university is located on a 1,250-acre suburban campus, eight miles outside Washington, D.C., and 35 miles from Baltimore. Robert H. Smith School of Business The Robert H. Smith School of Business is an internationally recognized leader in management education and research. One of 12 colleges and schools at the University of Maryland, College Park, the Smith School offers undergraduate, full-time and part-time MBA, executive MBA, MS, PhD, and executive education programs, as well as outreach services to the corporate community. The school offers its degree, custom and certification programs in learning locations in North America and Asia. More information about the Robert H. Smith School of Business can be found at www.rhsmith.umd.edu. Nonprofit Org. U.S. Postage PAID Permit No. 1 Baltimore, MD 3570 Van Munching Hall University of Maryland College Park, MD 20742-1815 Address Service Requested Research@Smith In this issue No Time to Read? ■ Capitalism as Crime Prevention Download this issue’s featured research articles in audio format directly ■ To Be or Not to Be…More Productive to your iPod or other mobile device, and listen to it at your convenience. ■ Hostile Customer Encounters These audio and video clips can also be accessed via the Web. To subscribe ■ Room for Equity? to Smith Podcasts or learn more visit www.rhsmith.umd.edu/podcast.