Mutual Fund Directors Forum Alternative Investments: What are They?

Mutual Fund Directors Forum

Alternative Investments: What are They?

November 28, 2012

Devin McCune, Head of Board Reporting and Compliance, Thomson Reuters

Laurie Thomsen, Independent Trustee, MFS Funds

Elizabeth Reza, Ropes & Gray LLP

Increasing Interest

• Both investors and sponsors have shown increased interest in registered “alternative” investment products

• Reasons

– Interest by retail investors in hedge funds and other alternative strategies

– Interest by institutions in transparency and liquidity

– Focus on absolute returns/uncorrelated returns

– Regulatory developments

2

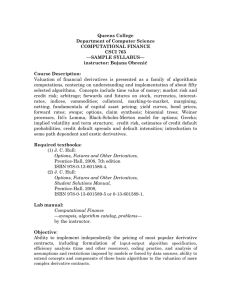

Alternative Fund Launches in Past Year

Alternative

Classification

Absolute Return

Long Short Equity

Managed Futures

Specialty Fixed

Income

Commodities

Extended US Large

Cap Core

Equity Market

Neutral

Dedicated Short

Bias

Currency

Equity Leveraged

New Launches

11/01/11-10/31/12

77

39

39

14

29

11

10

8

8

7

3

Total Number of

Funds

258

192

71

88

42

55

100

157

70

177

Percentage

Increase

30%

20%

55%

16%

145%

20%

10%

5%

11%

4%

Source: Lipper

Examples of Alternative Products

• Absolute Return Funds

– Typically seek positive returns (generally above inflation) over a certain period/market cycle

– Generally has flexibility to “go anywhere”

Absolute Return Funds

Commodities

Precious Metals

Market Neutral

Indexing

Event

Driven

Currencies

Foreign

Securities

Hedging

REITs

Arbitrage

Dedicated Short Bias

Derivatives

Short Sale

Convertibles

Emerging

Markets

MLPs

4

Leverage

Managed Futures

Long/Short

Source: Lipper

Examples of Alternative Products (cont.)

• Long/Short Funds

– Typically achieve long and short exposure through short sales and/or derivative positions

– 130/30 funds use short sales to increase long exposure

Long Short Equity

Commodities Market Neutral

Indexing

Currencies

Hedging

Event Driven

Foreign Securities

Arbitrage

Dedicated Short Bias

Managed Futures

Derivatives

Leverage

Short Sale

Long/Short

Convertibles

Emerging Markets

Source: Lipper

5

Examples of Alternative Products (cont.)

• Managed Futures Funds

– Aim to provide low correlation to stock and bond investments through investments in futures

– Focus of CFTC/NFA regulatory initiatives

Managed Futures Funds

Commodities

Indexing

Foreign Securities

Managed

Futures

Currencies

Leverage

Derivatives

Long/Short

Short Sale

Source: Lipper

MLPs

6

Emerging Markets

Examples of Alternative Products (cont.)

• Commodity Funds

– Capitalize on inflation fears and lower correlation to securities portfolios

– Regulatory Developments

• Amendments regarding registration

• Treatment of commodity subsidiaries

Commodities

Market Neutral

Precious Metals

Derivatives

Long/Short

Leverage

7 Arbitrage

Indexing

Source: Lipper

Examples of Alternative Products (cont.)

• Market Neutral Funds

– Use long and short exposure to seek to eliminate correlation to broad market movements

Equity Market Neutral Funds

Infrastructure

Derivatives

Market

Neutral

Short Sale

Event Driven

Foreign Securities

Hedging

Dedicated Short Bias

Managed

Futures

Convertibles

8

MLPs

Leverage

Long/Short

Source: Lipper

Examples of Alternative Products (cont.)

• Multi-Strategy Funds (or “Manager of Manager” Funds)

– Allocation of “sleeves” to multiple portfolio management teams

– Managers often seek to implement hedge fund/alternative strategies, subject to regulatory restrictions

• Registered Fund of Hedge Funds

– Permits access for less than the minimum investment level, making diversification easier to achieve

– Regulators have imposed eligibility requirements notwithstanding

1933 and 1940 Act registration

9

Challenges for Board

• Understanding strategy and the fund’s role

– How will the alternative product behave on its own and in tandem with other portfolio holdings and/or products?

• Appropriate expertise (portfolio management and operational)

– Does the adviser possess the necessary expertise for this alternative product?

• Lack of track record may make evaluation difficult

• Track record may have been developed in a non-1940 Act product

• Compliance considerations (liquidity, valuation, leverage, etc.)

• Accounting

• Tax

10

Challenges for Board (cont.)

• How should the board measure success?

– Understand the aim/goal of the alternative product

– Define how success should be measured

• Prior to launch, if possible

• Complexity may make peer analysis and benchmark comparison “best available”

11

Challenges for Board (cont.)

• How should the board measure success (cont.)?

– Performance benchmarking

• Provide blended indexes by strategy, if possible

• Hurdle rate analysis of returns

• Performance by investment sleeve

• Provide risk measures for analysis

– Expense benchmarking

• Multiple techniques cause expenses to vary

• Benchmark against cost to manage traditional assets

• Look for peer groups comprised of funds with similar investment techniques and weightings, if possible

• Be wary of “outliers” within peer group

12

Challenges for Board (cont.)

• Risk Management

– Does management have a process for identifying and managing risk?

– Has strategy been tested in times of market stress?

• Managing the sales process

– Will wholesalers/brokers be able to properly sell product?

• Conflicts issues

13

Process

• No “one size fits all” solution

• Consider executive session pre-meetings

• Consider 2-step process – conceptual proposal then specific approvals

• Consider providing a template with specific questions the

Board wants answered in connection with new fund launches

• Consider forming a special committee to oversee alternative products

– ad hoc or permanent

14

This summary should not be construed as legal advice or a legal opinion on any specific facts or circumstances and is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. The contents are intended for general informational purposes only, and you are urged to consult your attorney concerning any particular situation and any specific legal question you may have. © 2012

Ropes & Gray LLP

15