Departmental Performance Report 2013–14

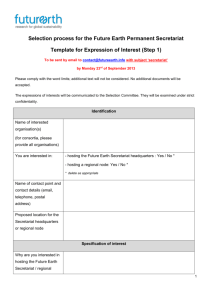

advertisement