The Rise of Britain’s Fiscal- Military State

advertisement

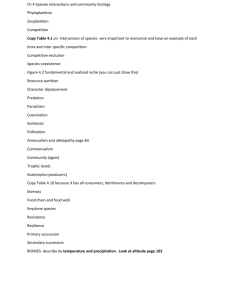

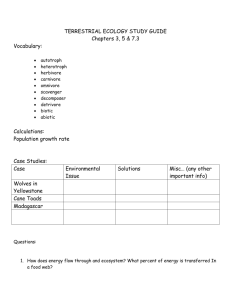

The Rise of Britain’s FiscalMilitary State Towards the study of Britain as an imperial power • We have been discussing the forging of a British identity • Colley argued that war was instrumental in this process • In the coming weeks we shall examine the relationship between Britain and its European and colonial rivals, and the impact such conflicts had on the British state 1721 What is a state? The centralised model • Penguin Dictionary of Sociology: ‘A state is a set of institutions governing a particular territory, with a capacity to make laws regulating the conduct of the people within that territory, supported by revenue deriving from taxation and reliant on a monopoly of legitimate force’ A different model: the participatory, self-governing state • A coordinated and territorially bounded network of agents exercising political power • State is distinguished by kind of power exercised rather than the form of agencies • Political power is distinctive in being territorially based, functionally limited and backed by threat of legitimate physical force A different model: the participatory, self-governing state • Mike Braddick: where are such institutions located? Who runs them? The state starts to look rather different: dispersed authority; negotiated via local office-holders all locally chosen, unpaid; legitimacy dependent on consent; self-governing communities • Was this type of state under threat? A fiscal-military state • • • • • • • A state capable of funding and fighting large scale warfare England had preferred to focus on navy. In 1578 England had 24 ships with 6290 men; in 1688 it had 173 ships with 41,900 men. But there had been a movement in the direction of a fiscal-military state before 1689, especially during the civil wars of the 1640s 1647-60 armed men numbered 11-47,000 Pressure to raise money. In 1590s Eliz’s total income was £500,000; a century later it was 10 times that. Increase well above inflation and population growth. Financing the state. 1550-1640 ad hoc measures. Problem of underassessments. Types of tax were therefore a problem. Ship money. Forced loans. 1640s saw a double transformation: scale of govt revenues increased dramatically and proportion of total income from parliamentary sources increased dramatically. New forms: the monthly assessment and excise. Direct taxation increased from £192,000 pa 1560-1602 to 1.43m pa 16481653 Accelerating pace of change • GB was at war more frequently and on a wider scale than ever before: • 1689-1697 (Nine Years War), 1702-1713 (War of Spanish Succession), • 1718-20 (War of the Quadruple Alliance) • 1739-48 (War of Jenkin’s Ear; War of Austrian Succession), • 1756-63 (7 Years War), • 1775-83 (War of American Independence), • 1793-1801 (War with Revolutionary France), 1803-1815 (Napoleonic Wars). Different type of war • Periods of peace were not truly pacific. • war on new scale: American war posed huge logistic problems eg supply lines over 3000m. • Acquisition of empire also placed strain on British state. The effects • Expansion of army and navy. In first half of C18th peacetime army was 35000; after 1763 it was 45,000 (most stationed in Ireland). • Armed forced intruded into civilian life. • After 1689 they comprised 10-15% of the House of Commons (more than no of lawyers). • Troops could be used as policemen esp. 1715, 1745, 1780 Gordon Riots. • GB army dependent on foreign manpower. Much money spent subsidising other countries eg £7m in war of Sp succession; £17.5m 1739-63; over 32,000 Germans fought for GB vs American colonies. £46m was spent on loans and subsidies to foreign states during the wars against France 1793-1814. The cost of war • • • • War was hugely expensive Over 60% of govt income in 1689-1697. How was this financed? Revolution in tax collection. 1660-1784 tax revenue grew 6 fold. Why? 1670-1810 tax receipts outstripped economic growth. Therefore economic growth was a factor but not the only one. What were others? The Treasury became very powerful in this period. Imposition of new taxes and higher levels of existing taxes. Switch from direct to indirect taxation. Growth of state • Why? Need to cloth, feed, arm troops and supply navy. Growing number of tax officials and govt administrators and victuallers and contractors. • Growing no of office-holders. Greatest increase was in revenue depts esp. excise. • Growth of bureaucracy. Separation of politics and bureaucracy. 9 of Lowndes family served in the Treasury 1674-1798. Establishment of rules and routines. Reform in the 1780s Financial Revolution: the creation of a public debt • • • • • Annuities National Debt Bank of England 1694 Paper money State-sponsored joint-stock companies eg East India Company • State lotteries Creation of a National Debt: 50-60 of income on servicing; 66% at end of American war. 1797 The Lottery Contrast c.1780s The Modern Promethesius or downfall of Tyranny 1814 How successful? • Infrequent tax riots though 1725 in Scotland vs Malt Tax. 1720 South Sea Bubble (fear of speculation and its effects on morality). 1733 excise crisis. • Hostility to tax • Fear of encroachment on British liberties and destruction of the consensual, dispersed state 1790 1790 1721 1791 1789 1795 1787 Conclusion • A fiscal-military dimension to the state did grow – some of it was planned but mostly the necessary and even unintended consequences of war • An ambiguous reaction to this development: suspicion and even opposition to this process as much as patriotic celebration of the military capacity of the British state