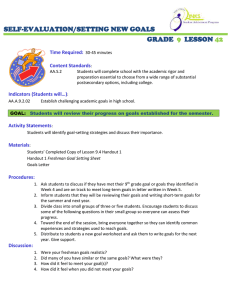

What They Did in their Previous Lives:

advertisement