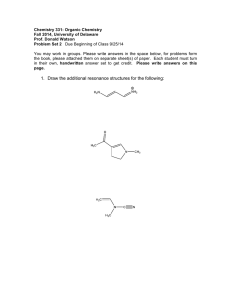

S B F V

advertisement