Outlook for the Nebraska Economy

advertisement

Outlook for the Nebraska Economy

WESTERN REGIONAL SCIENCE ASSOCIATION

4 9 TH A N N U A L M E E T I N G

SEDONA, ARIZONA

FEBRUARY 22, 2010

ERIC THOMPSON, DIRECTOR

BUREAU OF BUSINESS RESEARCH

UNIVERSITY OF NEBRASKA – LINCOLN

ETHOMPSON2@UNL.EDU

Outline

2

y Nebraska entered the recession late, and left on

ony

y

y

y

time (or perhaps even early)

Employment

p y

g

growth anticipated

p

for 2010

Opportunities/challenges related to the recession

Long-term

g

opportunities

pp

in manufacturing

g

Regional conditions within the State

UNL Bureau of Business Research

Reasons for Shallow Recession in Nebraska

Relative Strength of Key Industries

3

Major

j Nebraska Industries

Agriculture

Insurance

Manufacturing Related To Agriculture

The first two are p

performing

g relativelyy well in current

recession

UNL Bureau of Business Research

Reasons for Shallow Recession in Nebraska

Agriculture

4

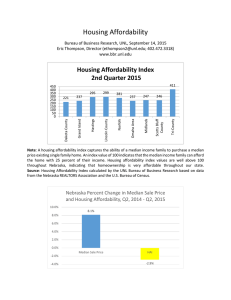

y Farm Income

{ There has been a big drop in farm income in 2009 and

livestock producers are suffering.

{ However,

However while farm incomes in 2009 are down from record

levels in 2007 and 2008, incomes remain above the 10-year

average

y Therefore, in agriculture, 2009 is not a good year,

but it is (overall) not a disastrous year either

UNL Bureau of Business Research

Reasons for Shallow Recession in Nebraska

Strength of Insurance

Carriers

Industry

5

Insurance Carriers

33

33

32

32

31

31

30

UNL Bureau of Business Research

2010.4

2010.3

2010.2

2010.1

2009.4

2009.3

2009.2

2009.1

2008.4

2008.3

2008.2

2008.1

2007.4

2007.3

2007.2

2007.1

30

UNL Bureau of Business Research

2010.4

2010.3

2010.2

2010.1

2009.4

2009.3

2009.2

2009.1

2008.4

2008.3

2008.2

2008.1

2007.4

2007.3

2007.2

2007.1

Significant Losses in Manufacturing

6

Manufacturing

105

100

95

90

85

80

Shallow Recession in NE–Smaller Decline in

Property Values Means

Stronger

Consumer

7

y Nebraska never had a significant

g

bubble in housing

g

prices, so it also never had a drastic decline

y Further, during 2008, there was even a substantial

run-up in farm-land prices

y So, there was no dramatic decrease in household

property

t wealth

lth iin N

Nebraska

b k d

during

i th

the 2008-2009

8

period, as in other parts of the country

y Of course

course, one potential concern for 2010 is a

collapse in the price of farm land (this did not

pp in 2009)

9)

happen

UNL Bureau of Business Research

Recovery Gains Steam Throughout 2010

8

y Incomes are g

growing

g again

g

in Nebraska

{ This has spurred growth in consumer spending

y A relatively weak dollar also has aided Nebraska’s

export-oriented industries in agriculture,

manufacturing, and services

y As

A the

th year continues,

ti

growing

i consumer spending

di

and exports will support business investment

UNL Bureau of Business Research

Employment Trends and Outlook

Non-Farm Employment

9

Non-Farm Employment

970

965

960

955

950

945

940

UNL Bureau of Business Research

2010.4

4

2010.3

3

2010.2

2

2010.1

1

2009.4

4

2009.3

3

2009.2

2

2009.1

1

2008.4

4

2008.3

3

2008.2

2

2008.1

1

2007.4

4

2007.3

3

2007.2

2

2007.1

1

935

Employment Outlook (pro-cyclical sector)

Construction Employment

10

Construction

52

51

50

49

48

47

UNL Bureau of Business Research

2010.4

2010.3

2010.2

2010.1

2009.4

2009.3

2009.2

2009.1

2008.4

2008.3

2008.2

2008.1

2007.4

2007.3

2007.2

2007.1

46

Employment Outlook (pro-cyclical sectors)

Business and Professional Services

11

Bus & Professional Services

108

106

104

102

100

98

96

UNL Bureau of Business Research

20

010.4

20

010.3

20

010.2

20

010.1

20

009.4

20

009.3

20

009.2

20

009.1

20

008.4

20

008.3

20

008.2

20

008.1

20

007.4

20

007.3

20

007.2

20

007.1

94

Employment Growth By Industry

2009 and 2010

12

Industry

y

Total Non-Farm

Construction

Manufacturing

p

Transportation

Wholesale Trade

Retail Trade

Growth 2009

9

-1.6%

-3.0%

3

-8.4%

-2.0%

-1.5%

-1.8%

UNL Bureau of Business Research

Growth 2010

+1.0%

+1.0%

-2.1%

+1.3%

3

+0.2%

+0.1%

Employment Growth By Industry

2009 and

2010

13

Industry

y

Growth 2009

9

Information

-5.5%

Financial Activities

-0.2%

Services

-1.2%

5

Federal Government

+2.5%

State & Local Gov’t

+2.5%

UNL Bureau of Business Research

Growth 2010

-1.7%

+1.3%

3

+2.2%

+2.4%

4

+0.8%

Other Measures of Growth

2009 and 2010

14

Measure

Nominal Income

Taxable Sales

Population

Growth 2009

9

-0.5%

-3.2%

3

+0.8%

Unemployment

p y

Rate

2009

4.8%

4

UNL Bureau of Business Research

Growth 2010

+4.1%

+3.5%

35

+0.8%

2010

4.8%

4

Unemployment Rate Trends and Outlook

15

Unemployment Rate

5 0%

5.0%

4.5%

4.0%

3.5%

3.0%

2.5%

UNL Bureau of Business Research

20

010.4

20

010.3

20

010.2

20

010.1

20

009.4

20

009.3

20

009.2

20

009.1

20

008.4

20

008.3

20

008.2

20

008.1

20

007.4

20

007.3

20

007.2

20

007.1

2.0%

Risks For Nebraska Economy–

A Lost Cost Advantage

16

y In the latter half of this decade,, an exaggerated

gg

cost

of living made many areas on the West and East

Coasts less competitive.

{

Climate,

l

access to oceans h

have amenity value,

l

b

but property

prices had risen far in excess of those amenity values on the

East and West Coasts

y This problem has now been addressed

{ Property prices have declined, more in line with the real value

off amenities

iti

y As a result, Nebraska has lost a competitive

advantage that it held in the 2005

2005-2008

2008 period

UNL Bureau of Business Research

Opportunities For Nebraska Economy–

Temporary Spike in Population Growth?

17

Year

2005

5

2006

7

2007

2008

2009

9

Nebraska Population

p

Growth Rate

0.6%

0.5%

0.6%

0.8%

0.8%

UNL Bureau of Business Research

Opportunities for the Nebraska Economy–

Strength and Decentralization of Manufacturing

18

Average

g Annual Growth Rate

Manufacturing Value-Added 1972 to 2002

United States:

p

Areas:

Metropolitan

Non-Metropolitan Areas:

3.1%

3.0%

3

3.9%

Source: Hammond and Thompson (2009)

UNL Bureau of Business Research

Decentralization of Manufacturing

19

Component

p

of Growth 1972-2002

97

Metro

Labor Hours

-0.6

Capital Stock

1.3

2.3

3

Productivityy

Total

3.0

3

Source: Hammond and Thompson (2009)

UNL Bureau of Business Research

Non-Metro

0.1

1.6

2.2

3.9

3

9

Nebraska – A Leading Indicator for the United

States and The West?

20

y Nebraska’s recent strengths

g

and emerging

g g

advantages will carry it through the next few years

y But, more generally, he strength of the entire “Upper

Midwest” may provide a roadmap for national

recovery.

{

Stabilization of household wealth and a recovery in household

income

Ù

{

Both portend solid, steady growth in consumer spending

An economy with a larger export sector and a smaller housing

and real estate sector

UNL Bureau of Business Research